LDO Downtrend May Deepen After Whale Deposits 6.2M Tokens Amid Key Support Break

LDO/USDT

$35,125,965.16

$0.3035 / $0.2809

Change: $0.0226 (8.05%)

-0.0056%

Shorts pay

Contents

A dormant Lido DAO whale recently transferred 6.2 million LDO tokens to Binance, incurring significant losses and heightening sell-side pressure on the LDO price. This move coincides with LDO’s ongoing downtrend, breaking key support levels and signaling potential further declines toward the $0.4560 demand zone.

-

LDO whale deposit triggers market concerns amid weakening structural support.

-

Taker Buy CVD shows buyer absorption over 90 days, yet seller dominance persists.

-

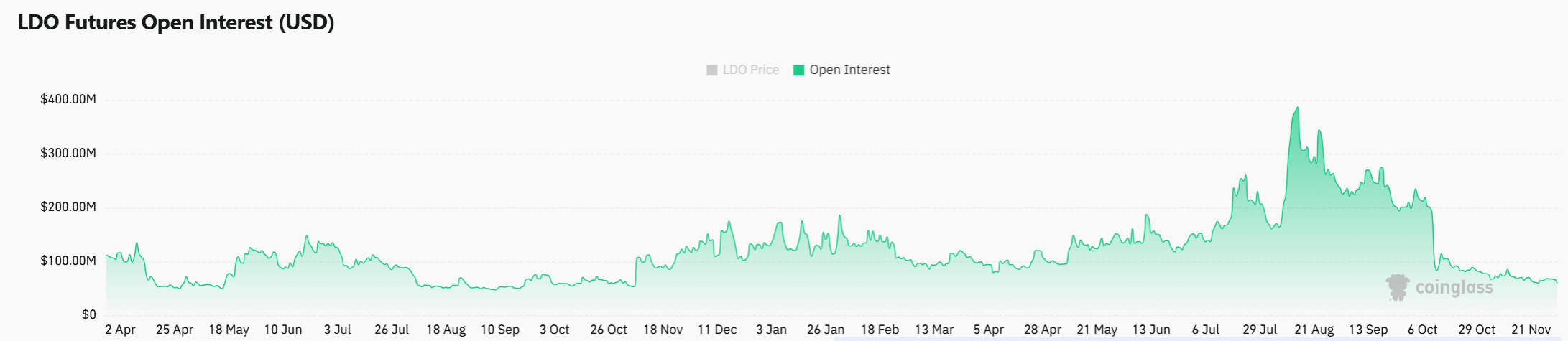

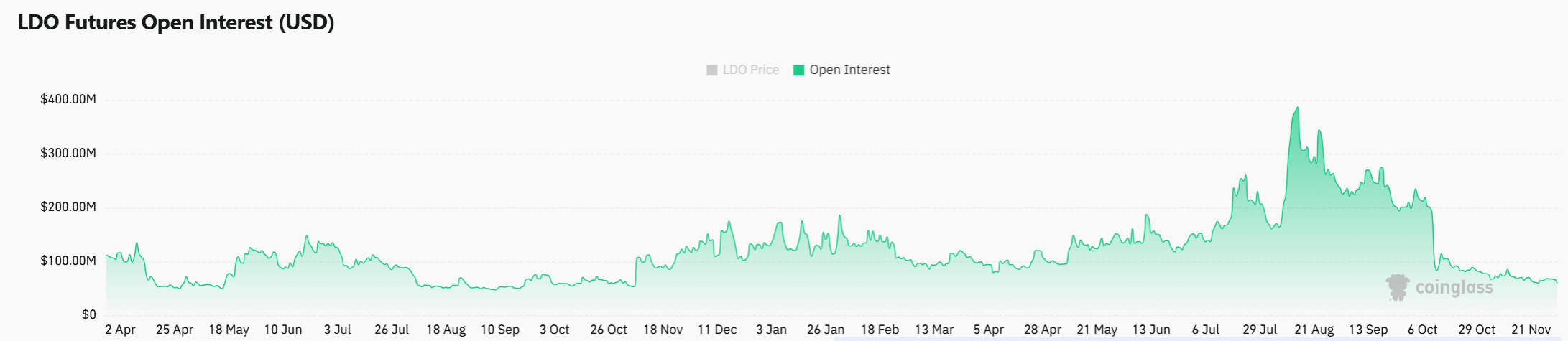

Open Interest dropped 4.16% to $60.07 million, reflecting reduced speculative interest and bearish positioning with shorts at 57.61%.

LDO price faces intensified pressure after a major whale deposit to Binance amid downtrend. Discover key indicators, support levels, and market positioning in this analysis. Stay informed on Lido DAO developments—monitor closely for recovery signals now.

What is causing the recent LDO price decline?

LDO price decline stems primarily from a dormant whale’s transfer of 6.2 million LDO tokens to Binance at a substantial loss, amplifying fears of renewed selling pressure. This event occurred as Lido DAO continued to erode structural support, making the token more susceptible to downside momentum. Despite some buyer absorption indicated by Taker Buy CVD over the past 90 days, the overall market setup favors sellers, with liquidity shifting aggressively between buyers and sellers.

How has the LDO whale movement impacted market dynamics?

The whale’s deposit intensified bearish sentiment during LDO’s fragile phase, where the token was already losing key technical levels. According to data from on-chain analytics platforms, such large transfers often signal profit-taking or repositioning, which can exacerbate declines in liquid staking tokens like LDO. In this case, the move aligned with a broader risk-off environment in the crypto market, where traders are cautious amid regulatory uncertainties and macroeconomic headwinds. Market experts note that while individual whale actions don’t dictate long-term trends, they can accelerate short-term volatility, as seen with LDO’s Relative Strength Index (RSI) dipping to 30.28, indicating oversold conditions without immediate reversal signs. Supporting statistics from derivatives platforms show open interest contracting by 4.16% to $60.07 million, underscoring fading speculative appetite and reinforcing the downward trajectory.

A dormant whale moved 6.2 million LDO into Binance at a steep loss, intensifying fears of renewed sell-side pressure returning to the market. Moreover, the deposit arrived during a period when Lido DAO [LDO] was continuing to lose structural support, which increased the influence of such a large transfer. However, Taker Buy CVD still favored buyers, indicating consistent absorption across the past 90 days despite heavier distribution pressure.

That created an unusual setup: aggressive offloading from a major holder while buying activity resisted downward momentum.

Liquidity continued shifting between both sides as each attempted to control direction. That left LDO vulnerable if buyer absorption weakened at the next demand zone.

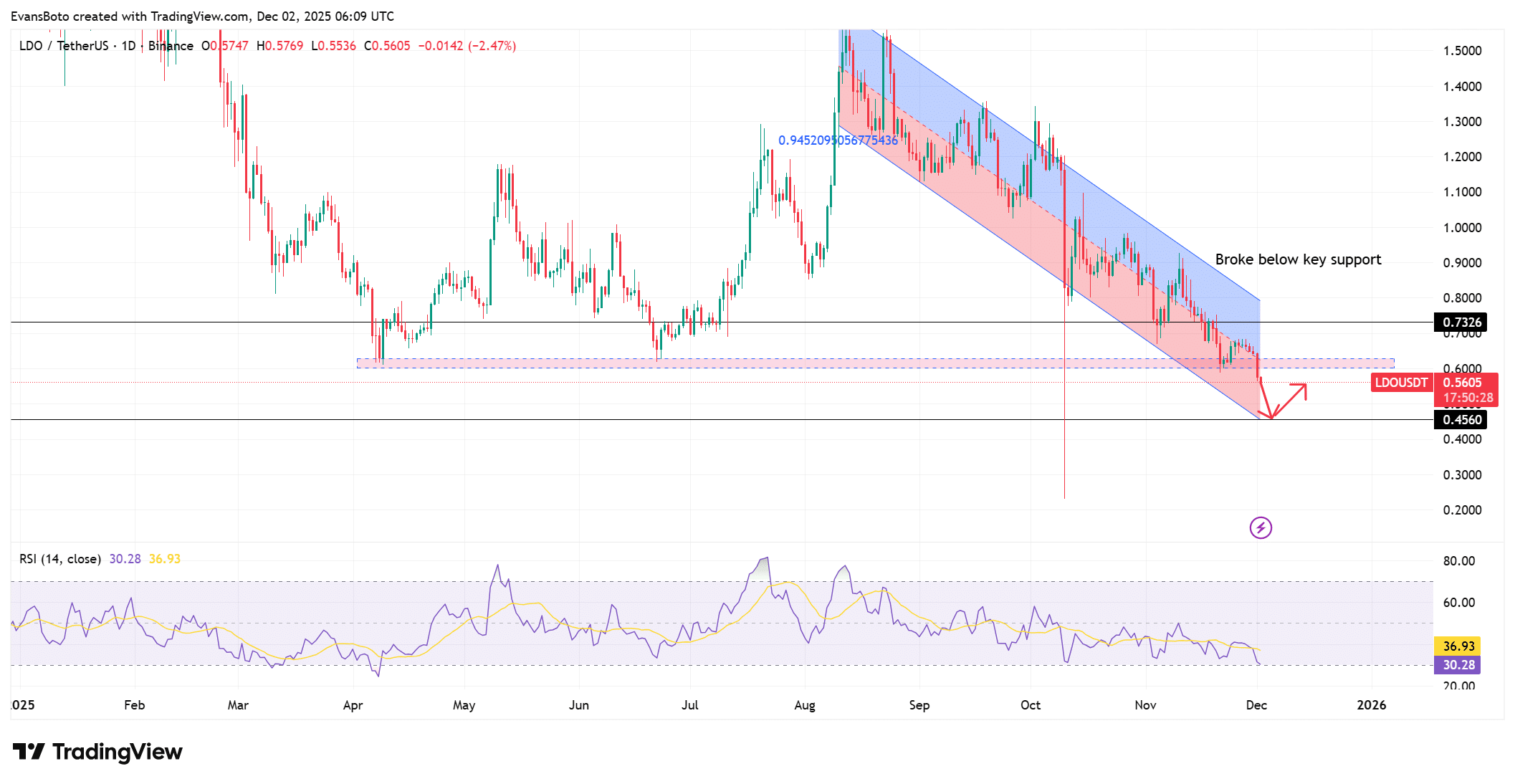

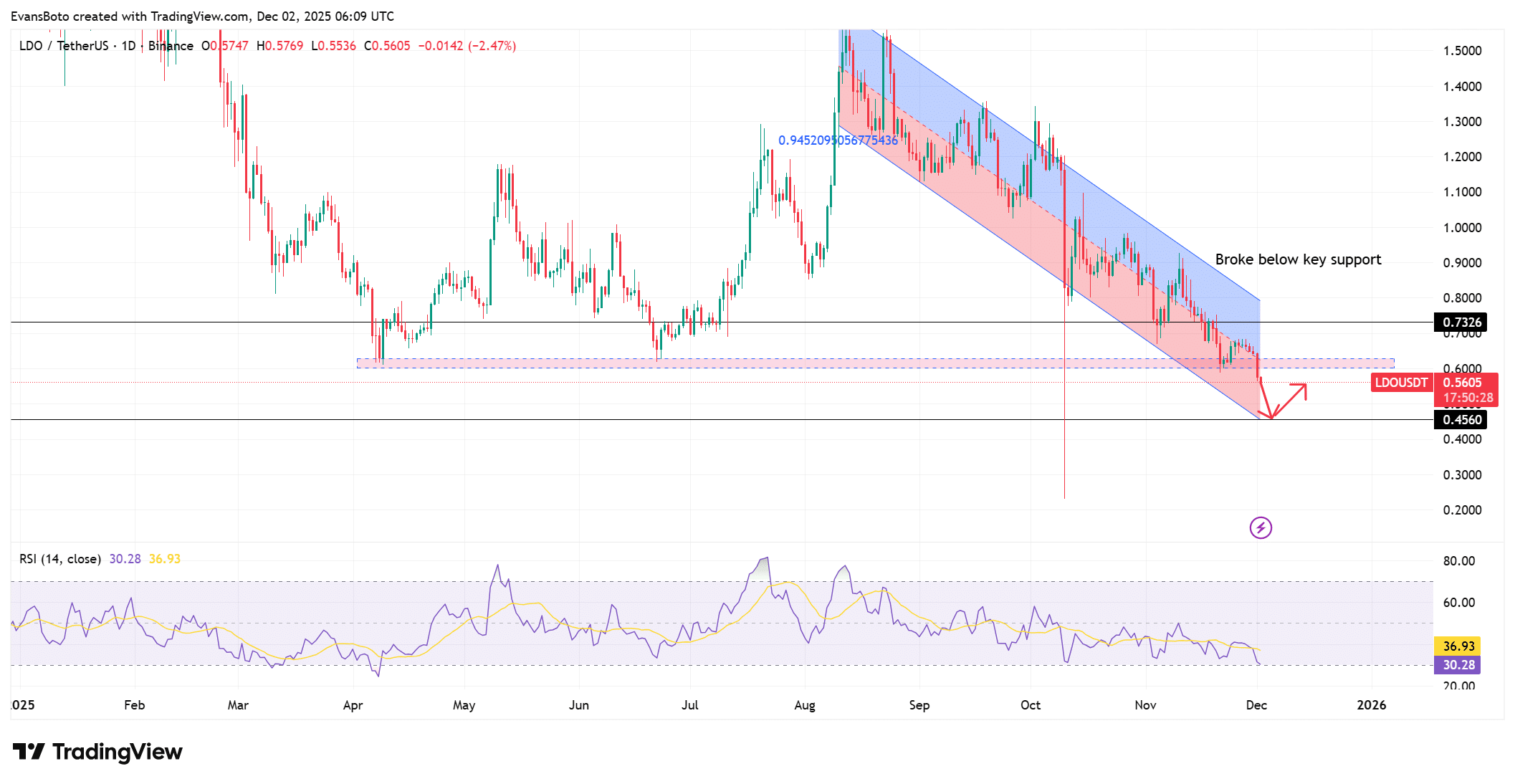

Downtrend intensifies as LDO breaks key support

LDO traded inside a steep descending regression channel, and the repeated lower highs confirmed seller control. The slope of the channel signaled accelerating downside momentum, reducing the odds of a clean recovery.

On top of that, the break below the $0.7326 support removed an important structure level that previously held during earlier declines.

Losing that level shifted focus toward the $0.4560 demand zone, where buyers might attempt a reaction.

RSI printed 30.28, while its signal line sat at 36.93, reflecting weakness with no clear reversal signals. Every upward attempt lost momentum quickly, proving sellers dominated until buyers reclaimed levels above the broken support.

Source: TradingView

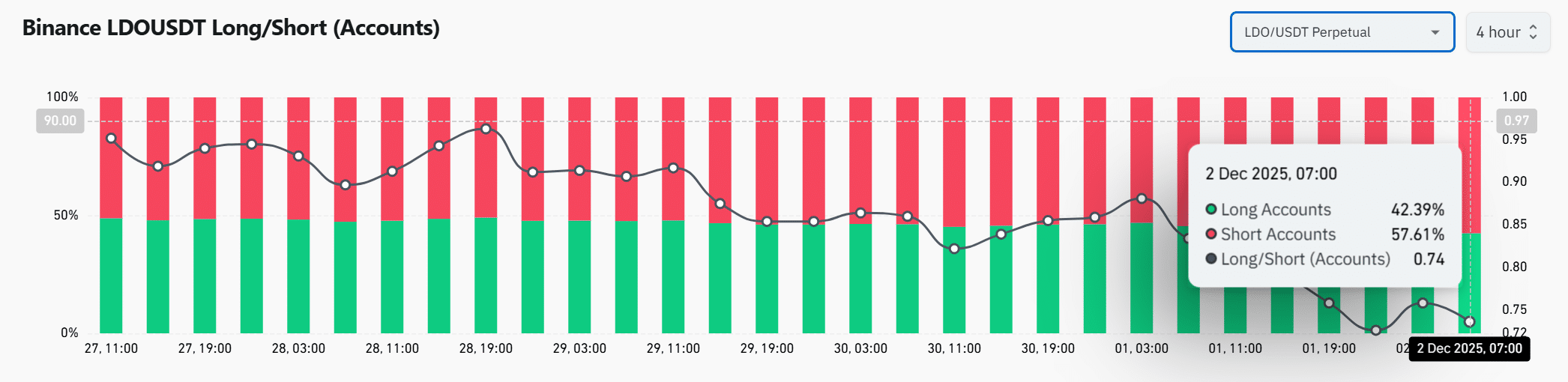

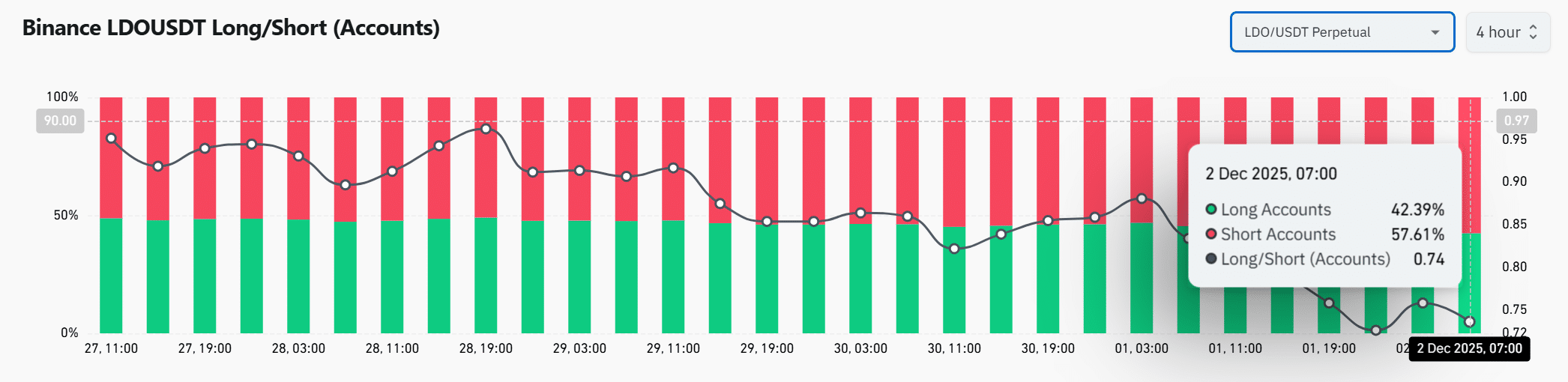

Short sellers grow more aggressive as positioning tilts

Bearish momentum strengthened as short accounts increased to 57.61%, creating a clear imbalance that favored sellers. Moreover, this shift showed growing conviction among traders who expect continued downside rather than a recovery. The positioning also aligned with LDO’s broader weakness, which reinforces seller confidence.

By contrast, long accounts held 42.39%, showing buyers hesitated to add exposure while conditions remained fragile.

That imbalance increased pressure on bulls, who needed both structural improvement and reduced short interest to shift momentum. Market positioning continued leaning toward extended downside unless a strong catalyst interrupted the trend.

Source: CoinGlass

Open Interest drop reveals fading speculative appetite

Open Interest falling 4.16% to $60.07 million at press time reflected shrinking speculative participation as traders reduce exposure during LDO’s weakening phase. Moreover, the drop supported the broader risk-off tone, since traders favored caution over aggressive positioning.

At the same time, lower Open Interest limited short-term volatility potential, because fewer open positions reduced the chance of sharp price swings. The combination of falling Open Interest and rising short dominance strengthened the bearish backdrop across derivatives markets.

Additionally, this contraction signals a market still searching for stability, as traders avoid building meaningful new positions until LDO reaches clearer demand zones or forms stronger reversal signals.

Source: CoinGlass

Conclusively, LDO continued facing strong downside pressure as the descending regression trend, the bearish Long/Short Ratio, and declining Open Interest all aligned toward further losses. Despite buyer absorption appearing through Taker Buy CVD, the broader setup lacks the strength needed to disrupt dominant selling momentum.

The aforementioned conditions supported a move toward the $0.4560 demand zone, which stands as the next logical target before any rebound attempt. If buyers defend that level with confidence, stabilization becomes possible, but the market must first complete this downside move that every major signal currently confirms.

Frequently Asked Questions

What does the LDO whale transfer to Binance mean for investors?

The transfer of 6.2 million LDO by a dormant whale to Binance at a loss highlights potential sell-side pressure in the short term. Investors should watch for increased volatility around key support levels like $0.4560, as this could delay recovery in Lido DAO’s token price. On-chain data suggests such moves often precede further corrections unless countered by positive ecosystem developments.

Is LDO poised for a rebound after breaking support?

While LDO’s break below $0.7326 support intensifies the downtrend, the $0.4560 demand zone could provide a buying opportunity if volume picks up. Current indicators like low RSI and contracting open interest point to caution, but a strong defense at this level might signal stabilization for voice-activated queries on crypto trends.

Key Takeaways

- LDO whale movement: The 6.2 million token deposit to Binance underscores heightened selling risks amid Lido DAO’s structural weakness.

- Bearish positioning: Shorts dominate at 57.61%, with open interest declining 4.16%, limiting upside potential without a catalyst.

- Next support test: Focus on $0.4560 demand zone; successful defense could pave the way for stabilization and potential recovery.

Conclusion

The LDO price decline driven by the recent whale deposit and persistent downtrend highlights ongoing challenges for Lido DAO in a competitive staking landscape. With bearish signals from technical indicators, derivatives data, and market positioning aligning toward the $0.4560 zone, traders remain vigilant for any shifts. As the crypto market evolves, monitoring whale activities and support levels will be crucial—consider positioning accordingly to navigate potential opportunities ahead.