Michael Saylor Stays Bullish on Bitcoin Despite 29% Drawdown and MicroStrategy Purchase

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

Michael Saylor remains optimistic about Bitcoin despite its 29% drawdown from $126,000 to $90,000 in late 2025, viewing it as a healthy market correction that removes weak holders and positions the asset for a new all-time high.

-

Bitcoin’s resilience: The cryptocurrency has endured 15 major drawdowns over 15 years, always recovering to surpass previous highs.

-

Market reset benefits: Pullbacks like this flush out excess leverage and short-term speculators, strengthening the foundation for future growth.

-

MicroStrategy’s strategy: The firm added 8,178 BTC worth $835 million in November 2025, maintaining holdings of 649,870 BTC amid volatility.

Discover Michael Saylor’s bullish outlook on Bitcoin’s 2025 drawdown and MicroStrategy’s bold purchase strategy. Learn why this correction could signal the next rally—stay informed on crypto market trends today.

What is Michael Saylor’s View on the Current Bitcoin Drawdown?

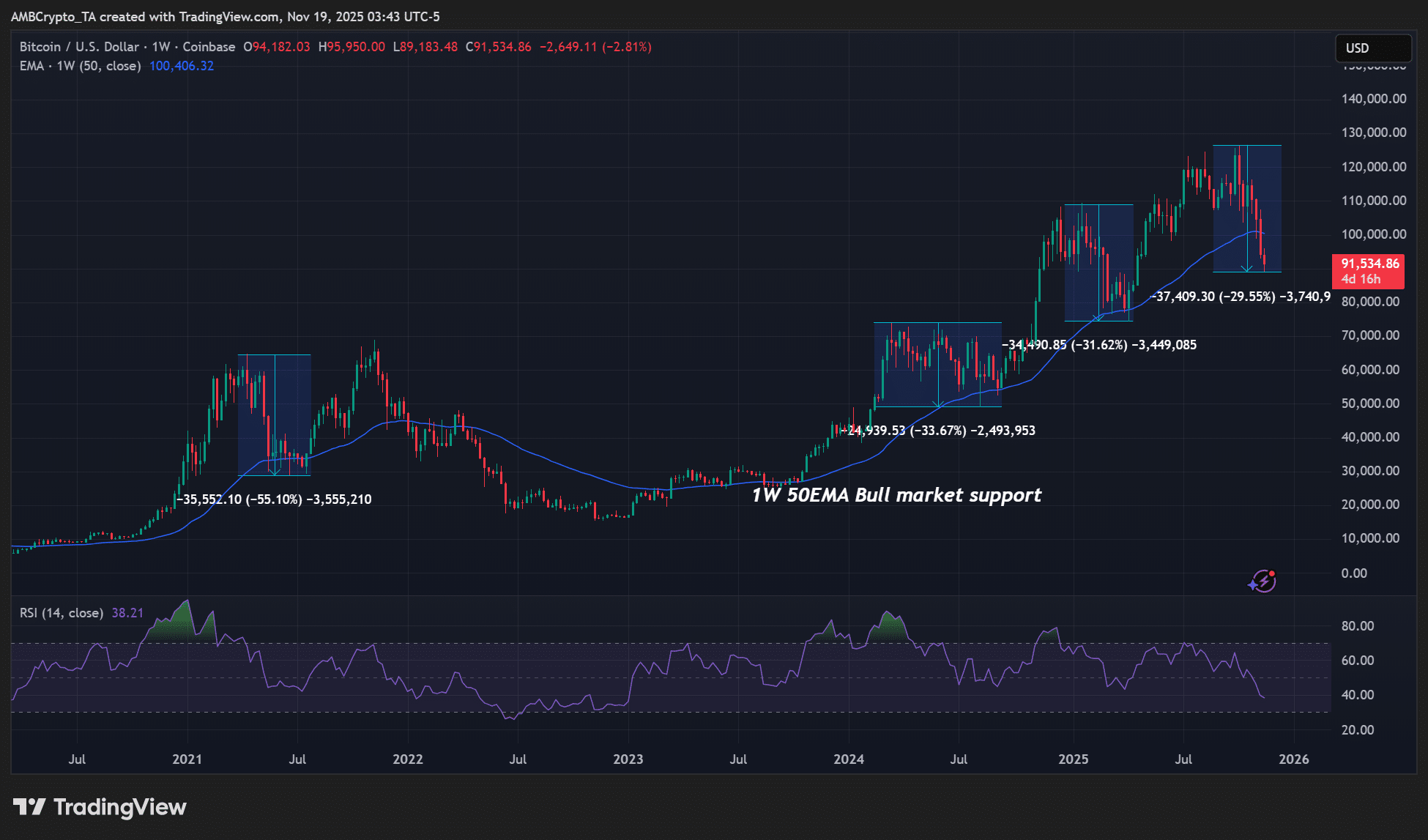

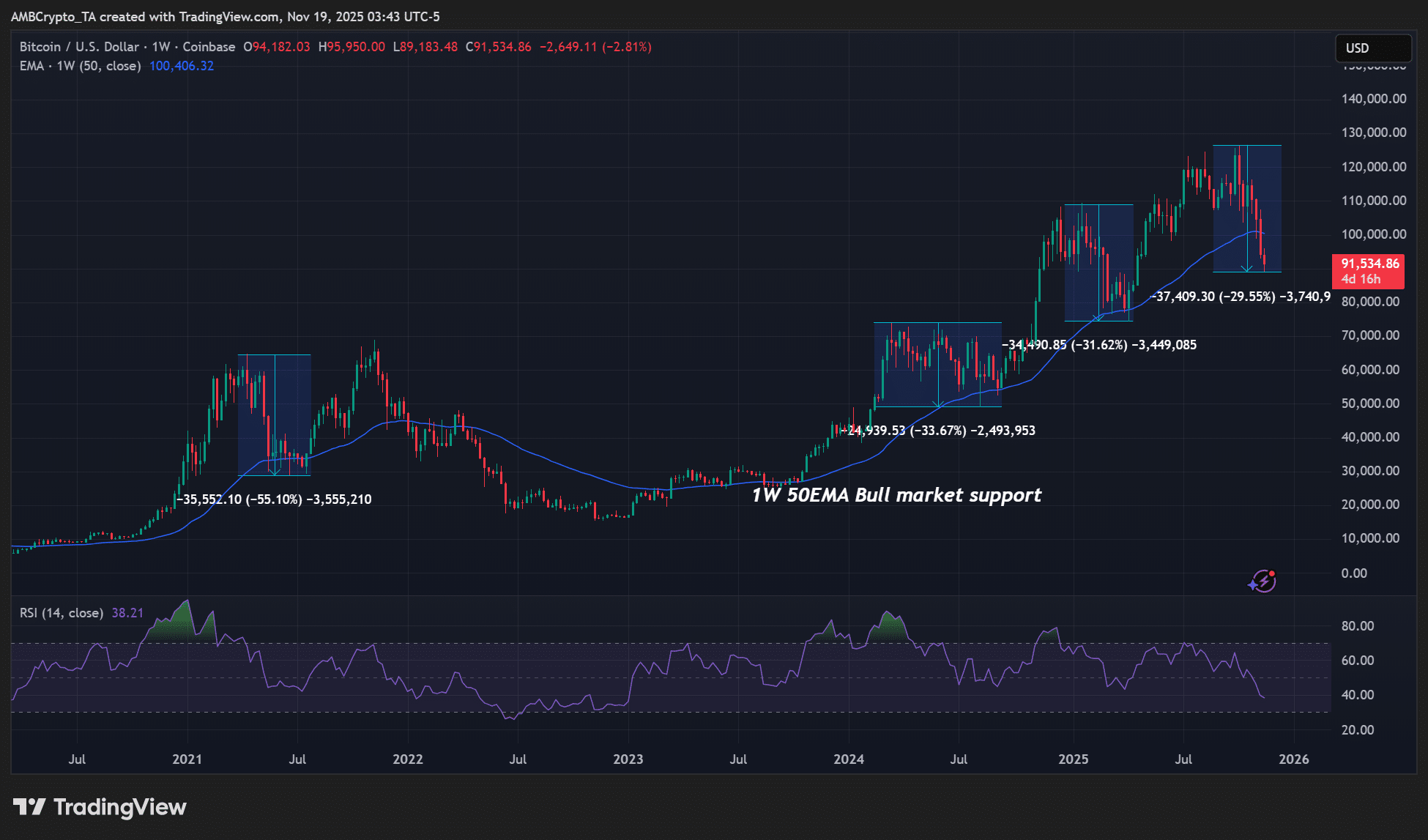

Bitcoin drawdown in late 2025 has erased significant yearly gains, with the price falling 29% from $126,000 to around $90,000. Michael Saylor, executive chairman of MicroStrategy, describes this as a normal phase in the evolution of Bitcoin as an emerging asset class. In a Fox Business interview, he emphasized that such corrections are essential for long-term health, clearing out temporary participants and excess leverage to pave the way for stronger rebounds.

Saylor highlighted Bitcoin’s historical pattern, noting it has survived 15 major drawdowns since its inception and consistently reached new peaks afterward. This perspective underscores his unwavering confidence in the asset’s value proposition, even as market structures like the 50-week exponential moving average face pressure from the sell-off.

How Is MicroStrategy Responding to Bitcoin’s Price Decline?

MicroStrategy continues its aggressive Bitcoin accumulation strategy despite the ongoing price dip. On November 17, 2025, the company purchased 8,178 BTC for approximately $835.6 million, funded primarily through the sale of convertible preferred stock. This brought its total holdings to 649,870 BTC, demonstrating a commitment to holding through volatility.

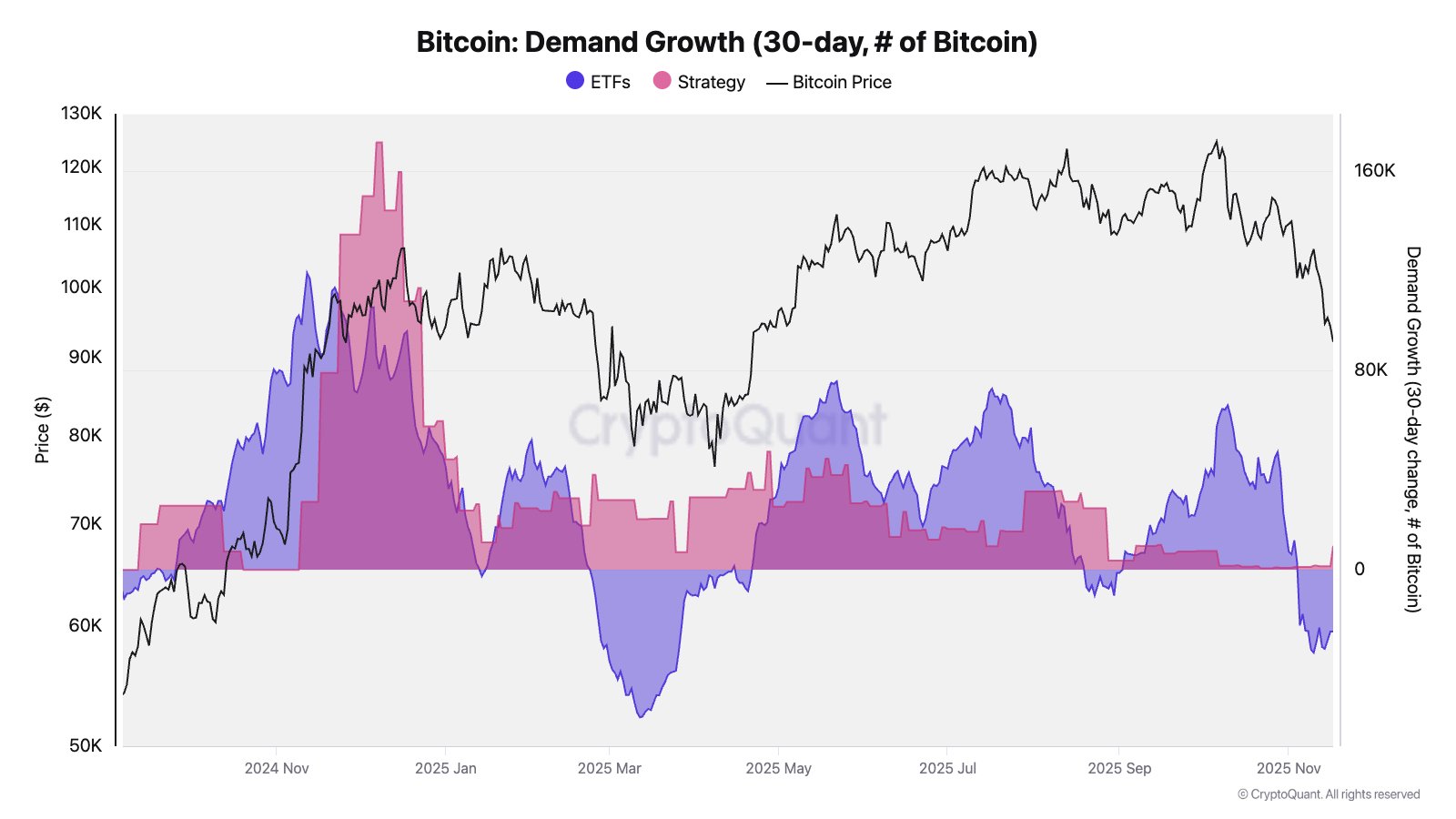

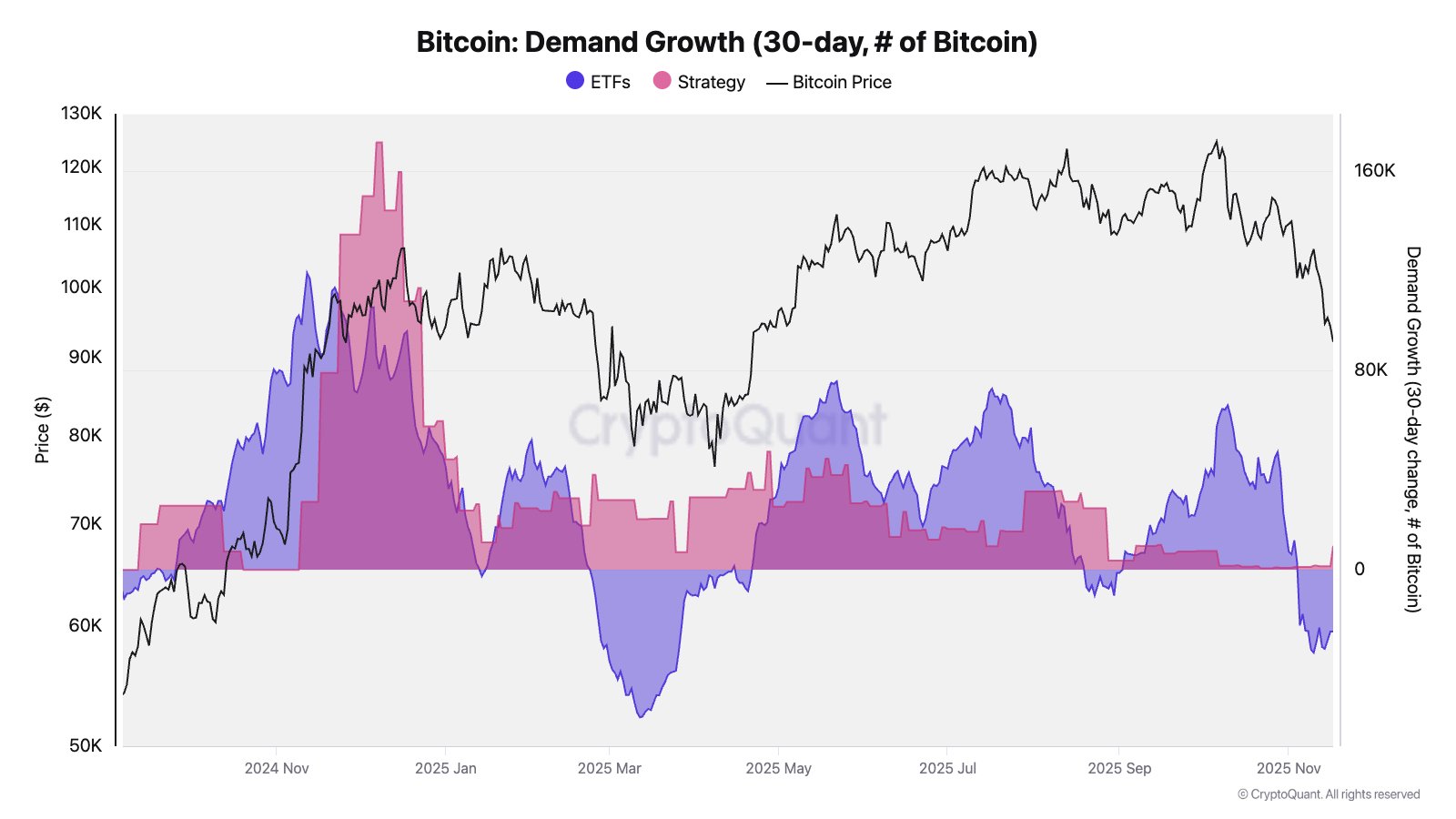

According to an SEC filing, the firm’s unrealized profits on these holdings have dipped from $31 billion (67%) to about $11 billion (23%) due to the decline, yet Saylor asserts MicroStrategy could weather an additional 80-90% drop. Analysts from CryptoQuant point out that this purchase, while notable, represents a relatively modest inflow compared to broader selling from exchange-traded funds (ETFs) and long-term holders, which has sustained downward pressure. Data from TradingView illustrates the sharp drop, with Bitcoin shedding over $35,000 in value in recent weeks.

Source: BTC/USD, TradingView

The decline remains within typical 30% bull market pullbacks, but the breach of key technical levels signals heightened caution among traders. Saylor’s stance contrasts with critics like Peter Schiff, who mocked the firm’s recent buy as insufficient against ongoing losses, stating it showed little progress after years of accumulation.

Broader market dynamics, including net selling from Bitcoin ETFs over the past few weeks, have overshadowed MicroStrategy’s efforts. Julio Moreno, Head of Research at CryptoQuant, noted that the $835 million acquisition was too small to counter the selling pressure from institutional outflows and seasoned investors.

Source: CryptoQuant

Looking ahead, potential recovery catalysts include a Federal Reserve interest rate cut in December 2025, with more insight expected from the November 20 jobs report. As of the latest data, MicroStrategy’s stock has climbed back above $200, while Bitcoin holds near $90,000—both down 28% and 2% year-to-date, respectively.

MicroStrategy’s approach echoes its resilience during previous crypto winters, where it retained Bitcoin holdings without liquidation. This steadfast strategy positions the firm—and by extension, the broader Bitcoin ecosystem—as a model for institutional adoption amid economic uncertainty.

Frequently Asked Questions

Why does Michael Saylor believe the Bitcoin drawdown in 2025 is beneficial?

Michael Saylor views the 2025 Bitcoin drawdown as a healthy correction that eliminates excess leverage, weak investors, and short-term speculators. He argues this process strengthens the market, setting the stage for Bitcoin to rebound to new all-time highs, consistent with its 15-year history of recoveries.

What role does MicroStrategy’s recent Bitcoin purchase play in the current market?

MicroStrategy’s $835 million Bitcoin purchase in November 2025 adds to its substantial holdings, signaling confidence in the asset’s long-term value. However, experts note it has not significantly offset selling pressure from ETFs, though it exemplifies corporate treasury strategies in volatile conditions.

Key Takeaways

- Historical Resilience: Bitcoin has navigated 15 drawdowns over 15 years, each followed by new highs, reinforcing its durability as an asset class.

- Market Health: The current 29% pullback clears out leverage and tourists, creating a solid base for the next upward rally, per Saylor’s analysis.

- Strategic Accumulation: MicroStrategy’s ongoing BTC buys, like the recent 8,178 coins, demonstrate commitment, though they face criticism amid unrealized losses—consider monitoring Fed policies for recovery signals.

Conclusion

The 2025 Bitcoin drawdown highlights the asset’s cyclical nature, with Michael Saylor’s optimism underscoring its transformative potential despite short-term pressures. MicroStrategy’s persistent buying strategy further illustrates institutional faith in Bitcoin’s recovery trajectory. As markets await key economic indicators like the jobs report and potential rate cuts, investors should focus on long-term fundamentals for informed decisions in this evolving landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC