MicroStrategy Risks MSCI Exclusion Due to Bitcoin-Heavy Balance Sheet, Potential $2.8B Outflows

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

MicroStrategy faces potential exclusion from MSCI indexes due to its dominant Bitcoin holdings, which exceed 25% of total assets under new guidelines. This risk, highlighted by JP Morgan analysts, could trigger up to $2.8 billion in passive outflows if enacted in January 2025, pressuring the stock further amid market volatility.

-

MicroStrategy’s Bitcoin exposure: The company holds 649,870 BTC, representing over 80% of its balance sheet.

-

New MSCI rules classify firms with crypto assets dominating their finances as Digital Asset Thematic companies, limiting index inclusion.

-

Potential impact includes $2.8 billion from MSCI alone, escalating to $8.8 billion if other providers like FTSE follow suit, per JP Morgan estimates.

Explore MicroStrategy MSCI exclusion risks: Bitcoin-heavy balance sheets threaten index removal, sparking massive outflows. Stay informed on MSTR’s volatility and safeguard your investments today.

What is the MicroStrategy MSCI Exclusion Risk?

MicroStrategy MSCI exclusion risk refers to the potential removal of the company’s stock from major global indexes managed by MSCI due to its substantial Bitcoin holdings dominating its balance sheet. Under updated MSCI guidelines effective in 2025, companies classified as Digital Asset Thematic entities—those with crypto assets comprising more than 25% of total assets—face restrictions or outright exclusion from standard equity indexes. This development, flagged by analysts at JP Morgan, could force passive investment funds to divest, amplifying downward pressure on MicroStrategy’s shares, which have already declined nearly 70% in recent quarters.

MicroStrategy’s strategy of accumulating Bitcoin has positioned it as a proxy for cryptocurrency exposure in traditional markets, but the evolving regulatory landscape for indexes is now challenging that status. As Bitcoin prices fluctuate, the company’s net asset value tied to its holdings becomes a vulnerability, potentially leading to reclassification and the associated financial repercussions.

How Do MSTR’s Bitcoin Holdings Impact Its Index Eligibility?

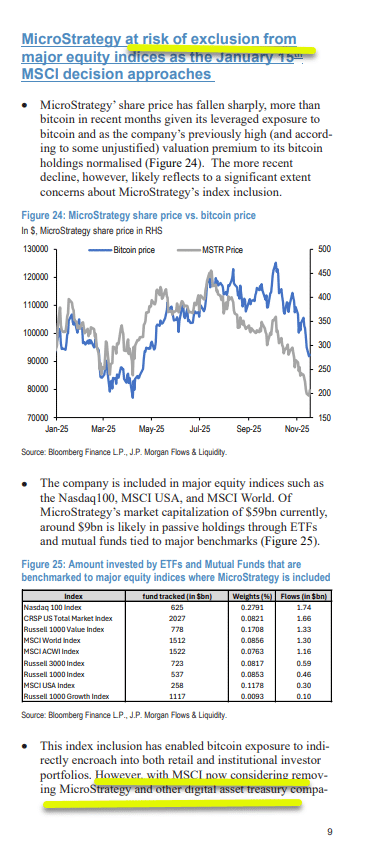

MicroStrategy’s Bitcoin holdings, totaling 649,870 coins acquired at an average price of $74,433 each, represent a significant portion of its assets, far exceeding the 25% threshold set by MSCI for Digital Asset Thematic classification. This reclassification means the company could be barred from broad market indexes like the MSCI World or USA Index, which are tracked by trillions in passive funds. According to MSCI’s methodology updates announced in late 2024, firms with such concentrated crypto exposure must demonstrate diversified revenue streams to maintain eligibility; MicroStrategy’s software business generates only a fraction of its value compared to its digital assets.

Supporting data from Bloomberg indicates that this shift could disrupt the flow of institutional capital, with JP Morgan estimating initial outflows of $2.8 billion from MSCI-linked ETFs alone. Expert analysis from VanEck’s Head of Digital Assets Research, Matthew Sigel, notes on social media platforms that “Bitcoin’s volatility directly correlates with MSTR’s premium erosion,” highlighting how a mere 8% drop in Bitcoin’s price from current levels could push the company’s position into unrealized losses. Short sentences underscore the urgency: Index exclusion accelerates selling. Passive funds must comply. Stock prices suffer immediate hits.

Frequently Asked Questions

What Triggers MSCI Exclusion for Companies Like MicroStrategy?

MSCI exclusion for MicroStrategy would be triggered by its Bitcoin holdings surpassing 25% of total assets, classifying it as a Digital Asset Thematic company under 2025 rules. This prevents inclusion in core indexes to avoid overexposure to volatile crypto in diversified portfolios. JP Morgan reports confirm this threshold was breached months ago, with holdings now over 80% of balance sheet value.

Will MicroStrategy’s Stock Recover If Bitcoin Rises After Exclusion?

If Bitcoin rises following a potential exclusion, MicroStrategy’s stock could see partial recovery through its direct BTC correlation, but forced outflows would create short-term headwinds. Analysts suggest the premium to net asset value, currently near zero, might rebuild slowly as active investors reassess. This natural progression aligns with historical patterns where crypto proxies rebound amid bull markets.

Key Takeaways

- MicroStrategy’s Bitcoin Dominance: With 649,870 BTC on its books, the company’s balance sheet is heavily skewed, directly violating MSCI’s new 25% asset threshold and inviting exclusion.

- Outflow Projections: JP Morgan forecasts $2.8 billion in sales from MSCI funds, potentially ballooning to $8.8 billion if FTSE and others align, eroding shareholder value overnight.

- Strategic Implications: The broken premium cycle halts further BTC buys via equity raises; investors should monitor January’s review for rebalancing opportunities.

Conclusion

In summary, the MicroStrategy MSCI exclusion risk stems from its outsized Bitcoin holdings impact, pushing the firm toward Digital Asset Thematic status and potential index removal in January 2025. As passive flows threaten billions in divestments, the company’s valuation loop faces unprecedented strain amid Bitcoin’s Q4 volatility. Looking ahead, MicroStrategy may need to diversify beyond crypto to regain stability, offering savvy investors a chance to evaluate long-term resilience in an evolving financial landscape.

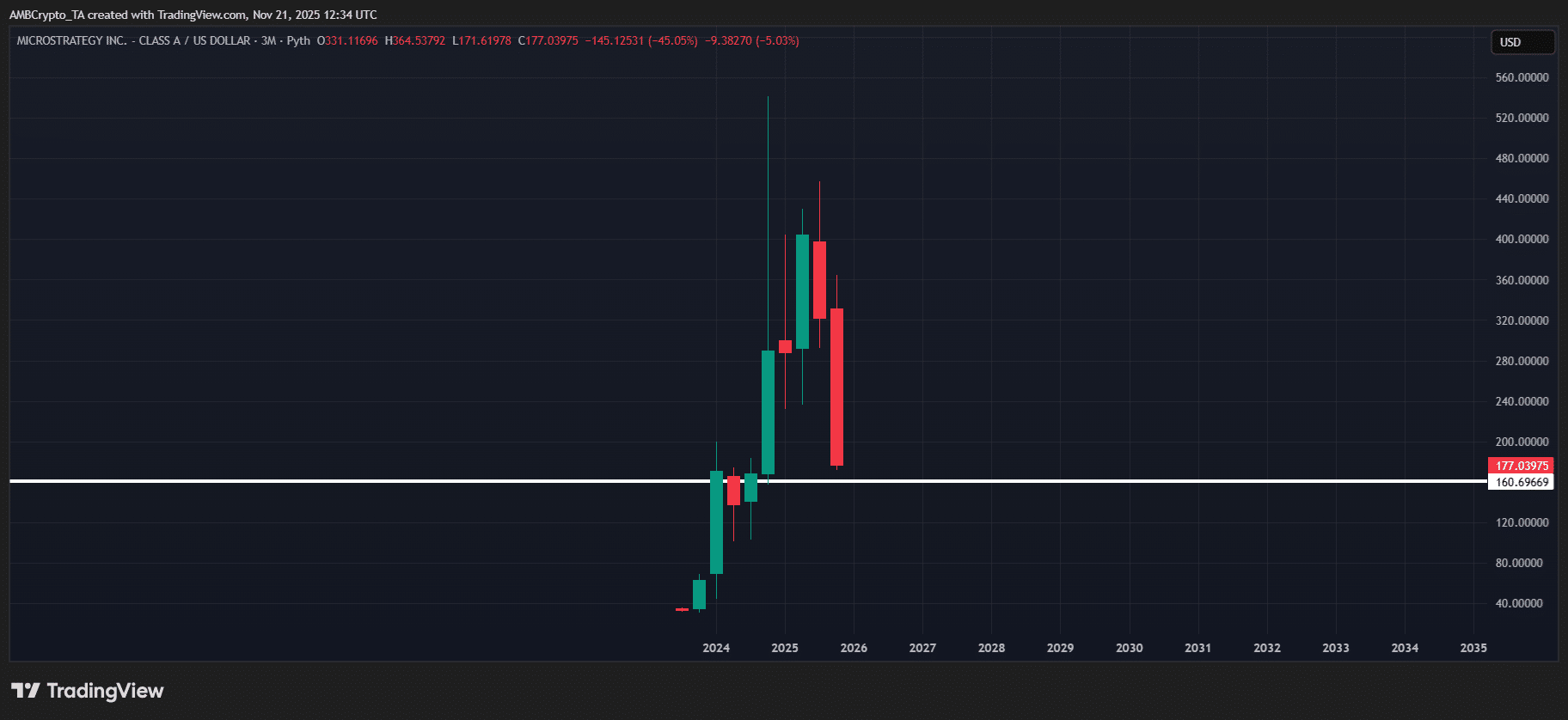

MSTR’s Valuation Loop Falters at the Worst Possible Time

MicroStrategy’s underlying engine is starting to show cracks. From a technical standpoint, the stock has lost 40% in just the last month and is down 68% from its all-time high. The company currently holds 649,870 Bitcoin at an average cost of $74,433 per coin—a massive exposure that ties its fate closely to cryptocurrency fluctuations.

Technically, that means if Bitcoin drops another 8% from the $80,000 level, the company’s position would move fully into the red. This pressure has already hit the stock and its premium hard, establishing $160 as a potential support floor for MSTR.

Source: TradingView (MSTR/USDT)

Notably, this is exactly why JP Morgan’s thesis matters. MicroStrategy’s old playbook was simple: raise money from the stock, buy Bitcoin, watch the stock rise, and repeat. However, that loop is now broken. When the stock trades near its Bitcoin value, there’s no premium left to fund additional purchases.

For example, if MSTR’s Bitcoin per share is worth $150 and the stock trades at $300, the company can issue shares to buy more Bitcoin. But if the stock hovers closer to $150, the premium evaporates, halting the cycle. With this in mind, MicroStrategy’s possible exclusion from MSCI feels far from hypothetical, especially with the decision less than two months away. Analysts are closely watching this high-risk event for its broader implications on corporate crypto strategies.

Massive Outflows Loom as MicroStrategy Faces Index Risk

MSCI’s new criteria for Digital Asset Thematic companies put MicroStrategy directly in the spotlight. MSCI has indicated that firms whose Bitcoin holdings dominate their balance sheets could be reclassified. In a more severe scenario, they could even be removed from major indexes altogether.

The market is already pricing this in. MicroStrategy’s valuation premium has shrunk rapidly, adding to investor concerns and keeping the stock at risk of declining toward the $160 level.

Source: X (Matthew Sigel)

The bigger issue? Bloomberg reported that JP Morgan estimates $2.8 billion in passive flows would be forced to sell if MSCI removes MicroStrategy. If other indexes mirror this move, total outflows could climb beyond $8.8 billion.

In short, MicroStrategy is at a real inflection point. The company continues adding Bitcoin using debt financing. However, in a risk-off market, this strategy appears increasingly exposed. A full MSCI exclusion in January is no longer just a headline—it’s a legitimate risk that could reshape the company’s market position and influence how other firms approach cryptocurrency integration.

The Treasury market’s volatility since the start of Q4 has amplified these concerns, with algorithms failing to predict movements and leaving investors underwater. MicroStrategy has not escaped this pain, with its stock down nearly 70% to $177—back to Q4 2024 levels—while Bitcoin has only declined about 21% over the same period. JP Morgan analysts’ warning about the upcoming MSCI review underscores a classic “sell-the-news” scenario, where anticipation of negative outcomes drives preemptive selling.

Despite these challenges, MicroStrategy’s pivot to Bitcoin as a treasury asset has garnered praise from proponents of digital currency adoption. Executives, including Chairman Michael Saylor, have long advocated for this approach, arguing it hedges against inflation better than traditional reserves. Yet, as index providers like MSCI tighten criteria to reflect investor preferences for balanced portfolios, the strategy’s viability is under scrutiny. Data from company filings shows Bitcoin now constitutes over 80% of assets, a figure that has grown steadily since 2020 acquisitions began.

Looking at historical precedents, companies with concentrated exposures—such as those in niche tech sectors—have faced similar reclassifications, leading to temporary stock dips followed by stabilization. For MicroStrategy, the January review will serve as a critical test. If exclusion occurs, the immediate forced selling from index-tracking funds could exacerbate the current 68% drawdown from highs. Conversely, any mitigation through asset diversification might preserve eligibility, though current trajectories suggest limited room for adjustment before the deadline.

Investor sentiment, as gauged by market data, remains cautious. Trading volumes have surged in recent sessions, indicative of positioning ahead of the announcement. The $160 level, mentioned earlier, aligns with technical support from moving averages and prior consolidation zones. Breaking below could signal further downside, potentially testing $140 if Bitcoin weakens concurrently.

Beyond the immediate risks, this situation highlights broader tensions in the convergence of traditional finance and cryptocurrencies. MSCI’s guidelines, developed in consultation with institutional clients, aim to maintain index integrity by curbing undue volatility from single-asset dependencies. For MicroStrategy, navigating this requires balancing its core Bitcoin thesis with signals from authoritative bodies like MSCI and analysts at firms such as JP Morgan.

In the context of 2025’s market dynamics, where Bitcoin has shown resilience despite macro headwinds, MicroStrategy’s plight serves as a cautionary tale. Stakeholders must weigh the rewards of high-conviction crypto plays against the regulatory and indexing hurdles that accompany them. As the review approaches, all eyes will be on how this unfolds and its ripple effects across the sector.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC