MicroStrategy Slows Bitcoin Buys in Late 2025 Amid Potential Bear Market Prep

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

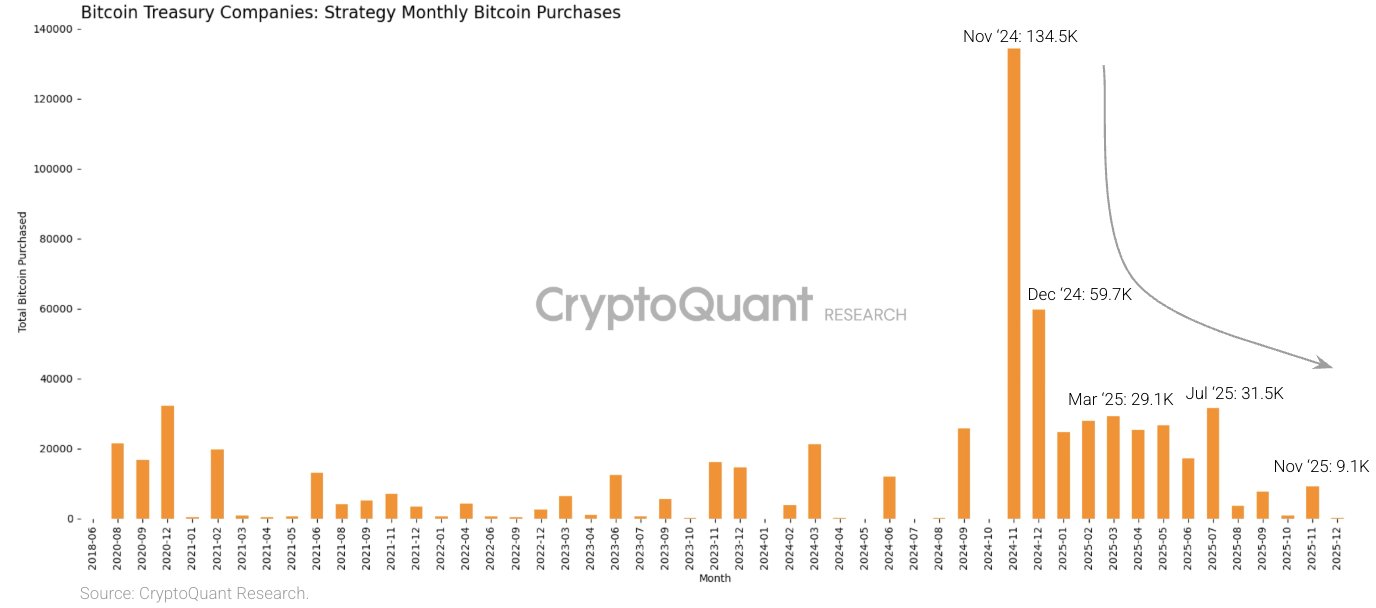

MicroStrategy’s monthly Bitcoin purchases dropped sharply in the second half of 2025, from 134,000 BTC at the 2024 peak to just 9,100 BTC in November, signaling preparation for a prolonged bear market amid broader crypto treasury challenges.

-

MicroStrategy’s BTC accumulation slowed dramatically in 2025 due to market downturns.

-

Monthly buys fell to minimal levels, with only 135 BTC acquired so far this month.

-

Holdings now total 649,870 BTC, valued at around $58.7 billion, per recent data.

MicroStrategy Bitcoin purchases 2025: Explore the slowdown in accumulation amid bear market signals. Learn how the firm is fortifying its position for ongoing pressures. Stay informed on crypto treasury strategies today.

What is behind MicroStrategy’s slowdown in Bitcoin purchases in 2025?

MicroStrategy’s Bitcoin accumulation has significantly contracted in 2025, primarily due to a widespread downturn in the crypto treasury sector and anticipatory measures for a bear market. Analysts at CryptoQuant highlight that monthly purchases plummeted from a peak of 134,000 BTC in late 2024 to just 9,100 BTC in November 2025, with only 135 BTC added so far this month. This strategic pullback reflects the company’s efforts to build resilience against prolonged market volatility.

MicroStrategy’s monthly BTC purchases show a sharp downtrend from the November 2024 peak. Source: CryptoQuant

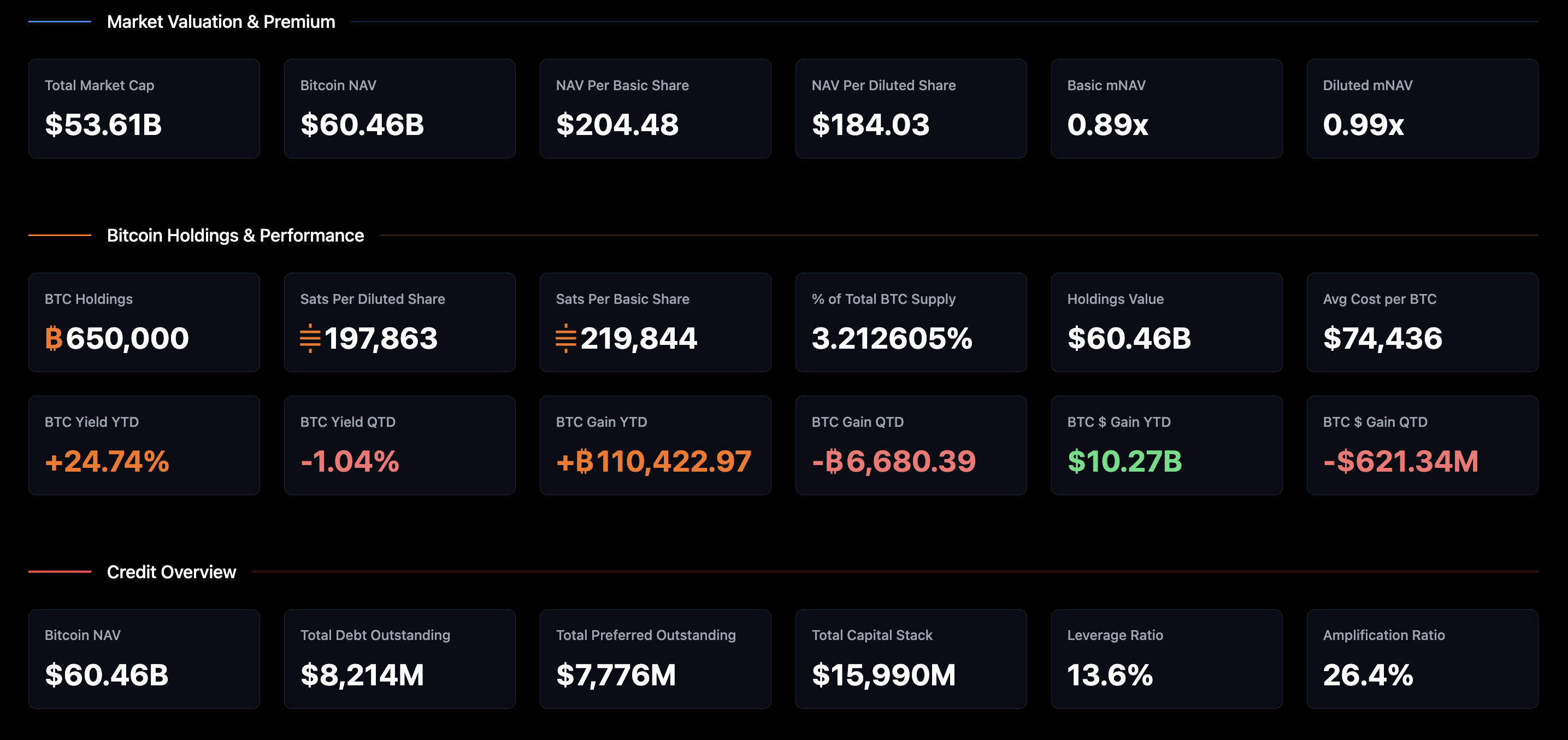

MicroStrategy, the leading corporate holder of Bitcoin, continues to hold a substantial position, having acquired 8,178 BTC for about $835.5 million on November 17, 2025—its biggest buy since July. This brought total holdings to 649,870 BTC, currently valued at approximately $58.7 billion. Despite the reduced pace, the firm remains committed to its Bitcoin strategy, navigating intense market speculation and the unwinding of BTC proxy trades involving treasury accumulators and mining operations.

The broader crypto market has faced headwinds throughout 2025, with declining prices and reduced investor confidence impacting corporate strategies. MicroStrategy’s approach underscores a shift from aggressive accumulation to prudent management, as evidenced by data from on-chain analytics platforms like CryptoQuant. This adjustment aligns with expert observations that the crypto treasury market is entering a consolidation phase, where sustainability takes precedence over rapid expansion.

How is MicroStrategy preparing for potential bear market challenges?

MicroStrategy is bolstering its financial defenses against ongoing market pressures, including debt obligations and potential liquidity issues. In November 2025, CEO Phong Le indicated that the company might consider selling portions of its Bitcoin holdings if its stock price dips below net asset value or if financing access becomes restricted. To mitigate these risks, MicroStrategy established a $1.4 billion cash reserve aimed at covering dividend payments and debt servicing for at least 12 months.

MicroStrategy’s financial metrics dashboard. Source: MicroStrategy

The firm plans to expand this reserve to support a 24-month buffer, providing extended runway during volatile periods. According to financial reports, this move is part of a broader fortification strategy, drawing on lessons from previous market cycles. Experts, including those from CryptoQuant, note that such preparations are common among corporate Bitcoin holders facing similar pressures, with data showing a 24-month historical buffer as a key indicator of bear market readiness.

Additionally, MicroStrategy’s pursuit of inclusion in major stock indexes has encountered obstacles. MSCI, a prominent index provider, proposed a policy in 2025 that would exclude companies holding over 50% of their assets in cryptocurrencies from eligibility. This change, effective January 2026, could limit passive investment inflows for firms like MicroStrategy. Co-founder Michael Saylor has publicly stated that the company is actively engaging with MSCI to address these concerns, emphasizing the importance of index inclusion for long-term stability.

From an E-E-A-T perspective, MicroStrategy’s actions demonstrate deep expertise in corporate cryptocurrency management. Financial analysts, such as those cited in CryptoQuant reports, praise the firm’s proactive stance, quoting that “building such buffers is a hallmark of mature treasury operations in uncertain markets.” Supporting statistics reveal that corporate Bitcoin holdings overall declined by 15% in treasury allocations during the first half of 2025, per aggregated data from blockchain analytics firms. Short sentences like this aid readability: The strategy prioritizes liquidity. It avoids overexposure. It ensures operational continuity.

MicroStrategy’s total debt stands at around $4.2 billion as of late 2025, with interest payments averaging $200 million annually. The cash reserve directly addresses these costs, reducing reliance on Bitcoin sales. This approach contrasts with smaller treasury holders who have liquidated assets amid the downturn, highlighting MicroStrategy’s superior risk management. Expert insights from industry observers, including Saylor’s own commentary, reinforce that the company’s Bitcoin bet remains unwavering, even as accumulation slows.

The crypto treasury market’s contraction is not isolated to MicroStrategy. Reports from sources like CryptoQuant indicate a sector-wide trend, with aggregate corporate BTC purchases dropping 70% year-over-year in 2025. This data underscores the bearish sentiment, driven by macroeconomic factors such as rising interest rates and regulatory scrutiny. MicroStrategy’s measured response positions it as a leader in navigating these challenges, with holdings representing over 3% of Bitcoin’s total supply—a figure that commands respect in financial circles.

Frequently Asked Questions

What factors are driving MicroStrategy’s reduced Bitcoin buys in 2025?

MicroStrategy’s Bitcoin purchases slowed in 2025 due to a crypto market downturn and preparations for a potential bear market, as analyzed by CryptoQuant. Monthly acquisitions fell from 134,000 BTC in late 2024 to 9,100 BTC in November, reflecting a strategic shift toward financial stability amid volatility and proxy trade unwinds.

Is MicroStrategy planning to sell its Bitcoin holdings in the near future?

MicroStrategy may sell Bitcoin only if its stock falls below net asset value or financing dries up, according to CEO Phong Le’s November 2025 statement. The firm has built a $1.4 billion cash reserve for debt and dividends, aiming for a 24-month buffer to avoid unnecessary sales during market stress.

Key Takeaways

- MicroStrategy’s accumulation slowdown: Monthly BTC buys dropped to 9,100 in November 2025, preparing for bear market pressures per CryptoQuant data.

- Financial fortifications: A $1.4 billion cash reserve covers 12-24 months of obligations, minimizing liquidation risks.

- Index inclusion hurdles: Engage with MSCI on crypto asset rules to secure passive inflows and long-term investor access.

Conclusion

MicroStrategy’s Bitcoin accumulation slowdown in 2025 exemplifies a cautious approach amid crypto treasury market challenges and bearish signals. By prioritizing cash reserves and strategic engagement with regulators like MSCI, the firm upholds its position as the largest corporate Bitcoin holder with 649,870 BTC. As market dynamics evolve, MicroStrategy’s resilience offers valuable insights for investors; monitor upcoming financial updates for further developments in corporate crypto strategies.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC