Mt. Gox Transfers $1B in Bitcoin Spark Selling Fears, Potential Year-End Recovery Looms

SPK/USDT

$5,969,853.79

$0.020535 / $0.01808

Change: $0.002455 (13.58%)

+0.0050%

Longs pay

Contents

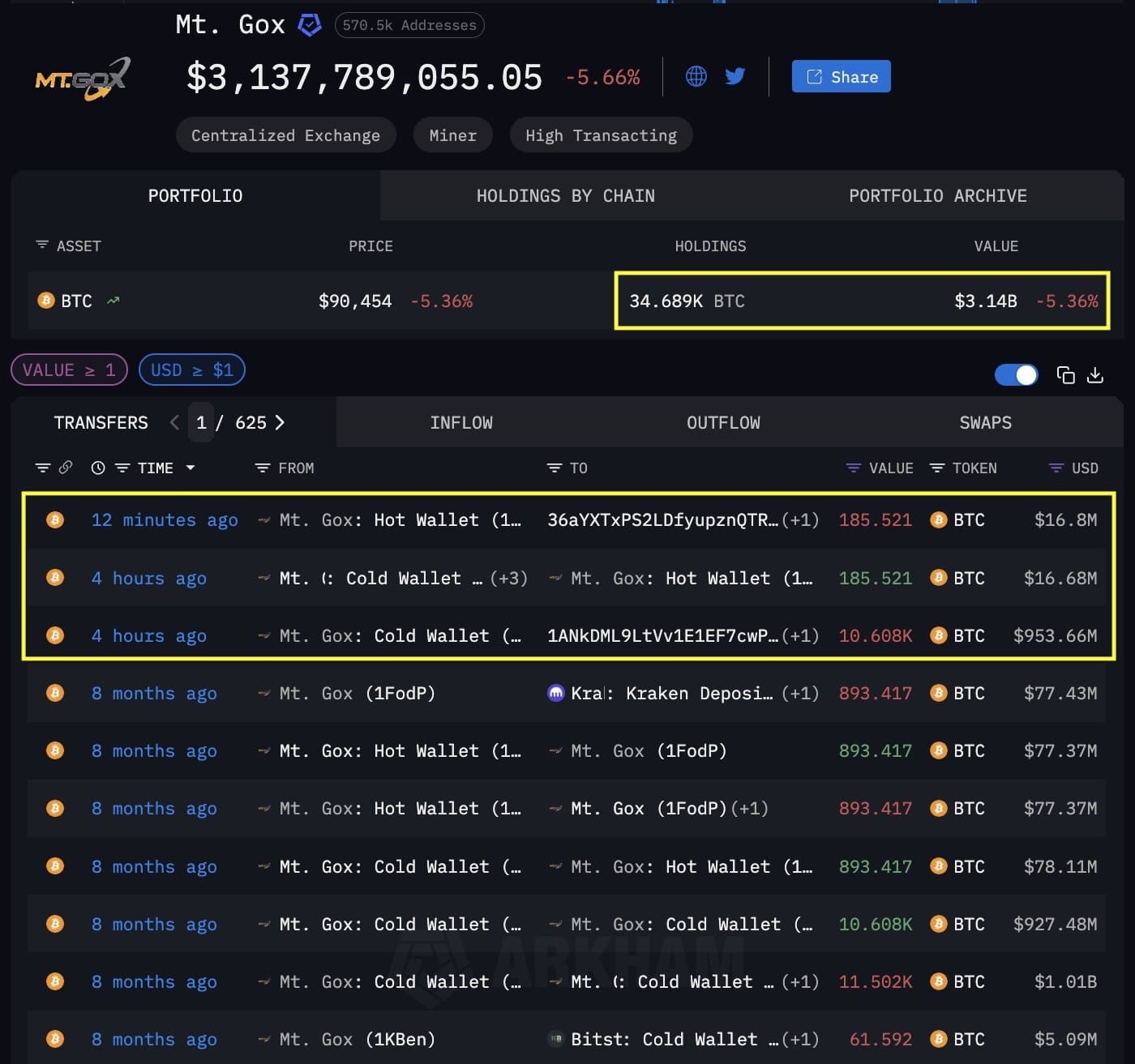

The Mt. Gox estate recently transferred over $1 billion in Bitcoin, moving 10,600 BTC valued at $953 million to a new wallet and selling 185.5 BTC for $16.8 million on Kraken. This activity has heightened fears of additional selling pressure amid Bitcoin’s 29% decline since October.

-

Mt. Gox Bitcoin transfers involve shifting funds from dormant cold wallets, potentially signaling preparations for creditor repayments extended to October 2026.

-

Only a small portion, 185.5 BTC worth $16.8 million, was sold via Kraken, while the bulk remains in new addresses.

-

The estate now holds 34,600 BTC valued at $3.14 billion, down from 142,000 BTC at the start of repayments in July 2024, according to on-chain analytics.

Mt. Gox Bitcoin transfers spark market concerns: $1B moved, including sales on Kraken. Explore implications for BTC price amid 29% drop. Stay informed on crypto repayments and recovery outlook. Read now for expert insights.

What Are the Latest Mt. Gox Bitcoin Transfers?

Mt. Gox Bitcoin transfers refer to the recent movements of significant Bitcoin holdings by the estate of the defunct exchange, which collapsed in 2014. In a development that has stirred the cryptocurrency market, the estate shifted 10,600 BTC—equivalent to approximately $953 million at current prices—from a long-dormant cold wallet to a new address. Additionally, 185.5 BTC worth $16.8 million was liquidated through the Kraken exchange. These actions come as the estate continues its creditor repayment process, which began in July 2024 and has been extended to October 31, 2026, due to ongoing challenges in distributing funds to affected users.

Will These Mt. Gox Bitcoin Transfers Lead to More Selling Pressure?

The transfers mark the first major activity from this wallet in eight months, prompting speculation about the estate’s intentions. On-chain data indicates the movement from cold storage (address 1DcoA) to a potentially more accessible hot wallet (1ANkD), which often precedes sales in similar scenarios. However, it could also represent a precautionary shift to enhanced security measures. The Mt. Gox estate originally held around 142,000 BTC when repayments commenced, but through progressive liquidations, its reserves have dwindled to 34,600 BTC, currently valued at $3.14 billion based on prevailing market rates from sources like TradingView.

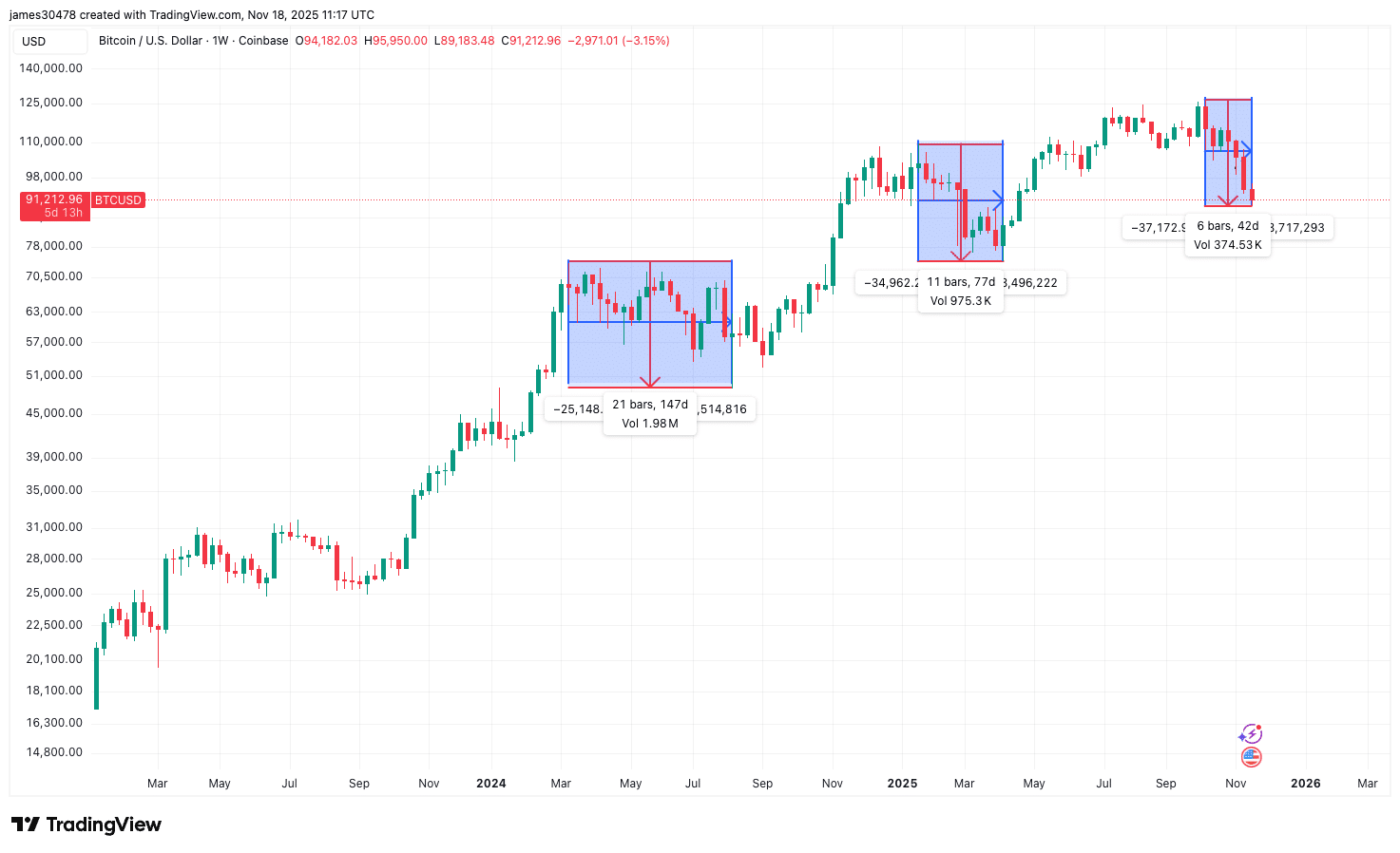

Market observers note that while the $16.8 million sale is minor compared to the total holdings, any large-scale dumping could exacerbate Bitcoin’s recent downturn. Since October, Bitcoin has fallen 29%, retreating from a high of $126,000 to around $89,200. This pullback represents the third 30% correction in the current bull cycle and aligns with historical patterns during upward trends. Despite breaching key support levels such as the 365-day moving average, technical analysts view this as a transient liquidity crunch rather than a fundamental reversal.

Expert opinions underscore potential relief ahead. Dirk Willer, Head of Macro Strategy at Citibank, anticipates an easing of liquidity pressures. “Going forward, the liquidity squeeze for Bitcoin should improve between now and year-end,” Willer stated in recent commentary. This perspective echoes sentiments from BitMEX co-founder Arthur Hayes, who forecasts a short-term dip to $80,000-$85,000 before a rebound toward $200,000, driven by broader macroeconomic improvements. Such insights highlight the resilience of Bitcoin’s market structure even amid estate-related uncertainties.

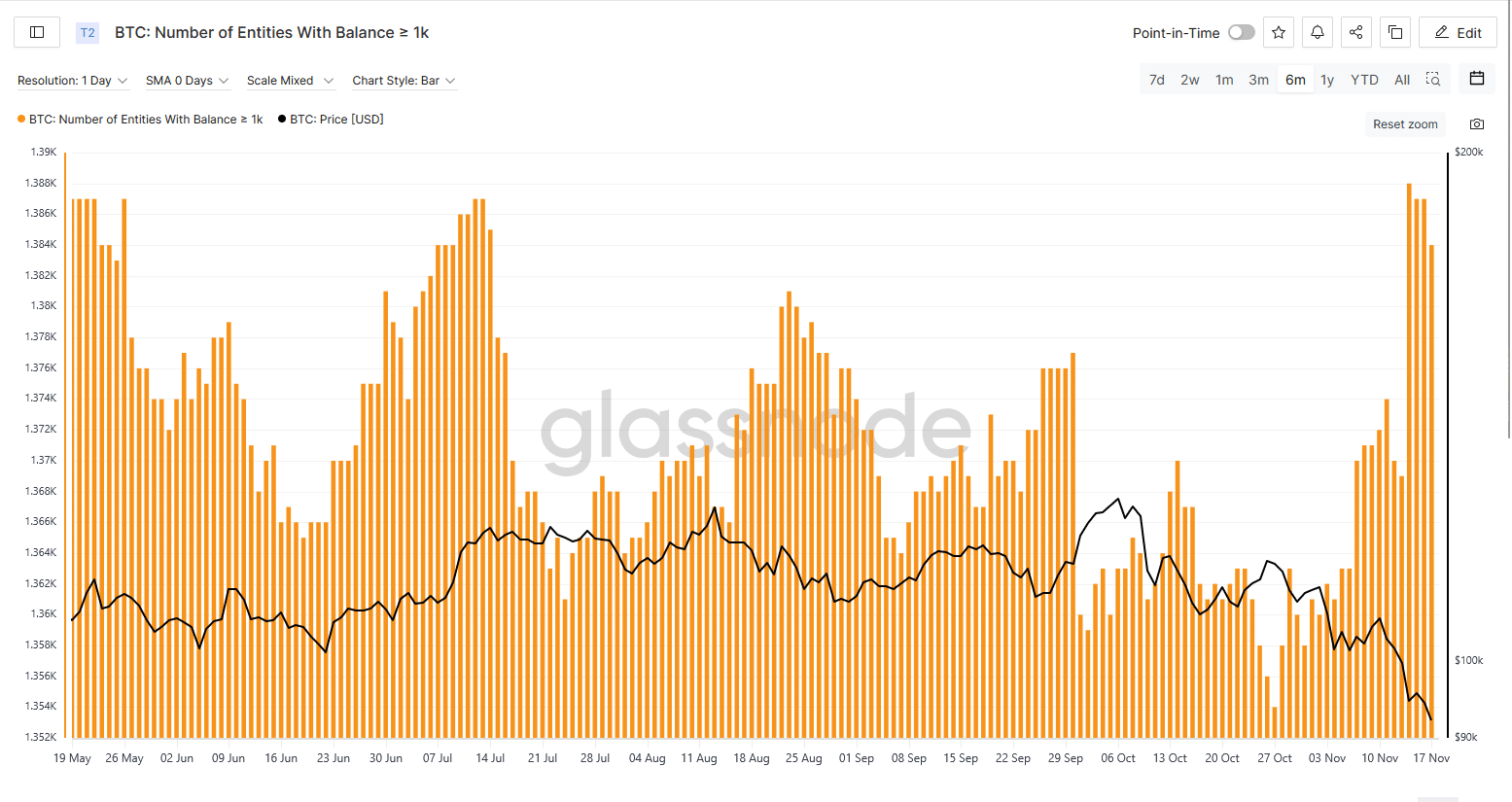

Adding to the bullish undercurrents, large-scale investors—known as whales holding over 1,000 BTC—have ramped up accumulation during the dip. Data shows increased buying activity when prices fell below $110,000, with intensified purchases following the breach of $100,000. This behavior suggests that savvy market participants are treating the correction as a buying opportunity, potentially stabilizing prices against further Mt. Gox-induced volatility.

Source: X

Source: BTC/USD, TradingView

Source: Glassnode

Frequently Asked Questions

What Is the Current Status of Mt. Gox Creditor Repayments?

The Mt. Gox repayment process, which distributes Bitcoin and fiat to creditors affected by the 2014 hack, started in July 2024. The deadline has been pushed to October 31, 2026, to address verification and distribution hurdles. At launch, the estate controlled 142,000 BTC; ongoing transfers and sales have reduced this to 34,600 BTC today.

How Might Mt. Gox Bitcoin Transfers Affect Bitcoin’s Price Recovery?

Mt. Gox Bitcoin transfers could introduce short-term selling pressure, contributing to recent volatility, but experts like Citibank’s Dirk Willer predict liquidity improvements by year-end that may support recovery. Arthur Hayes of BitMEX suggests a dip to $80,000-$85,000 before climbing to $200,000, bolstered by whale accumulations signaling long-term confidence.

Key Takeaways

- Mt. Gox’s $1 Billion Bitcoin Movement: The estate transferred 10,600 BTC worth $953 million and sold 185.5 BTC for $16.8 million, part of ongoing creditor repayments extended to 2026.

- Market Impact and Whale Activity: Amid a 29% Bitcoin drop since October, large holders have increased positions below $100,000, viewing the pullback as a discount opportunity per Glassnode data.

- Recovery Outlook: Analysts from Citibank and BitMEX foresee liquidity easing, potentially driving Bitcoin toward $200,000 after a near-term low, despite estate-related uncertainties.

Conclusion

The recent Mt. Gox Bitcoin transfers underscore the lingering effects of the exchange’s collapse on the broader cryptocurrency ecosystem, with over $1 billion in movements amplifying concerns about selling pressure during Bitcoin’s correction phase. As the estate navigates its extended repayment timeline, holding 34,600 BTC valued at $3.14 billion, market participants remain vigilant for signs of stabilization. With expert forecasts pointing to improved liquidity conditions by year-end, Bitcoin’s trajectory appears poised for resilience, encouraging investors to monitor on-chain developments closely for strategic positioning in the evolving digital asset landscape.

Comments

Other Articles

BTC Has Turned into Risky Assets: Grayscale Report

February 13, 2026 at 09:06 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC