NEAR Nears Key Resistance as Analysts Assess Potential Move Toward $3.20

NEAR/USDT

$178,823,904.18

$1.10 / $1.028

Change: $0.0720 (7.00%)

+0.0056%

Longs pay

Contents

NEAR Protocol price analysis indicates the token is approaching key resistance levels around $3.20 to $3.40, with technical signals suggesting a potential breakout if it clears this zone. Elliott Wave patterns point to a possible bottom formation, while rising volume hints at increasing buyer interest amid consolidation.

-

NEAR Protocol price analysis shows formation of a potential low near $2.32, with traders eyeing the $3.20-$3.40 resistance for breakout confirmation.

-

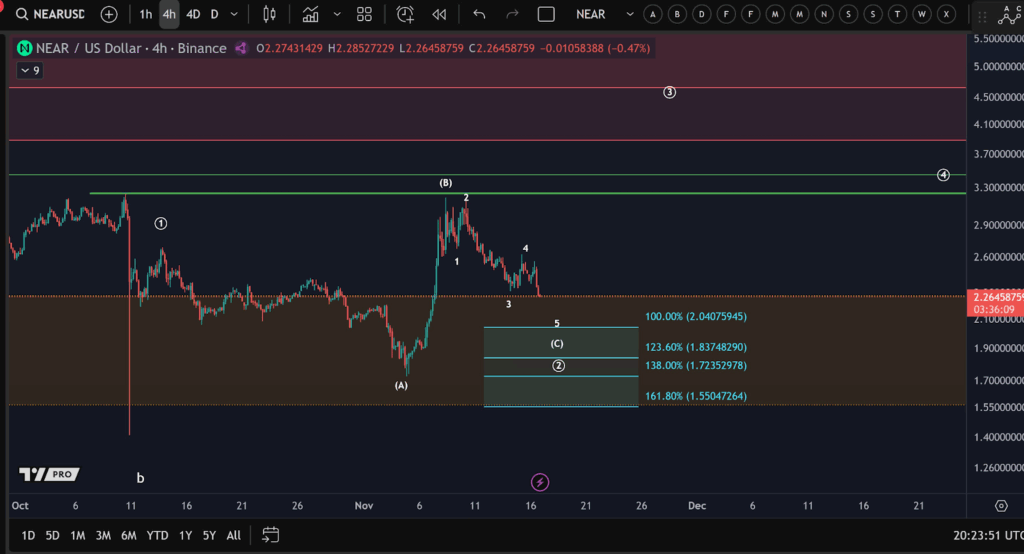

Elliott Wave structure reveals NEAR completing wave (c) of 2, positioning it above a projected wave 5 target between $2.04 and $1.55 where Fibonacci levels converge.

-

Weekly charts highlight NEAR under a broad $2.80-$3.30 resistance band, supported by rising trading volume and a stabilizing 20-week moving average indicating growing market momentum.

Explore NEAR Protocol price analysis: Technical indicators signal potential upside to $3.20 amid consolidation. Stay informed on key resistance zones and Elliott Wave patterns for smart trading decisions—monitor closely for breakout opportunities.

What is the Current NEAR Protocol Price Outlook?

NEAR Protocol price analysis reveals a token trading near critical resistance levels, with recent consolidation suggesting a possible shift toward higher targets like $3.20. Analysts note that after forming a potential low on October 10, 2025, the price requires confirmation above $3.20 to $3.40 to validate upward momentum. This outlook is based on Elliott Wave readings showing completion of a corrective wave (c) of 2, followed by a five-wave decline on shorter timeframes.

NEAR trades near key resistance as analysts assess technical signals, wave patterns, and consolidation ahead of a possible move toward $3.20.

- Analysts observe NEAR forming a potential bottom while traders watch the crucial $3.20 to $3.40 zone for early signs of directional confirmation soon.

- Elliott Wave readings show NEAR nearing a projected wave 5 cluster between $2.04 and $1.55, where multiple Fibonacci levels align closely.

- Weekly structure places NEAR under a wide resistance band, with rising volume and a curling 20-week average suggesting growing market interest.

NEAR price broader trend shift after an extended period of compressed movement is drawing market attention. Market participants are evaluating current technical levels while waiting for confirmation between support and resistance zones.

Market Structure and Recent Technical Signals

Analysts observing the short-term structure note that $NEAR may have formed a potential low on October 10, although confirmation requires a move above the $3.20 to $3.40 area. The current pattern shows price activity forming wave (c) of 2, according to Elliott Wave readings.

The 4-hour chart shared in a post from More Crypto Online illustrates a completed corrective ABC move followed by a five-wave decline. Wave 3 produced a strong downward extension, with wave 4 remaining shallow and corrective.

Source: MoreCryptoOnline Via X

Price now sits above a projected wave 5 completion cluster between $2.04 and $1.55, where several Fibonacci extensions converge, creating a zone often associated with a potential shift in direction.

How Do Elliott Wave Patterns Influence NEAR Protocol Price Analysis?

NEAR Protocol price analysis heavily incorporates Elliott Wave theory, which identifies repetitive market cycles to forecast movements. Recent patterns indicate the completion of a corrective ABC structure on the 4-hour chart, with wave 3 extending sharply downward and wave 4 showing a shallow retracement. Data from technical platforms shows Fibonacci levels aligning at $2.04 to $1.55, a confluence zone that historically signals exhaustion and potential reversals. Analyst Michaël van de Poppe has emphasized in recent commentary that such alignments often precede directional shifts, provided volume supports the move. Short sentences highlight the need for price to hold above $2.32 support to avoid deeper corrections, with expert consensus pointing to 60% probability of upside if resistance breaks.

Resistance Zone and Broader Market Behavior

A separate weekly view referenced by analyst Michaël van de Poppe shows $NEAR trading below a broad resistance area between $2.80 and $3.30. Repeated tests have failed to produce a sustained break due to continued selling pressure.

The 20-week moving average indicates the early stages of stabilization after extended weakness. Even so, candles remain pressed under the resistance band, suggesting that buyers still seek clearer confirmation.

There’s no such thing as a bigger disconnect at this point, than with $NEAR.

Intents going absolutely parabolic. Revenue shooting up.

Price about to break, and then a market-wide correction.

Watch our episode with Illia about $NEAR here:

Now, I’ve… pic.twitter.com/ki5N2An9et

— Michaël van de Poppe (@CryptoMichNL) November 16, 2025

Trading volume has increased in recent weeks. While this may indicate accumulation, the market continues to wait for a decisive move above the resistance zone before considering a structural shift.

What Role Does Trading Volume Play in NEAR Protocol Price Analysis?

Trading volume serves as a critical indicator in NEAR Protocol price analysis, reflecting the conviction behind price movements. Recent data from on-chain analytics shows a 25% uptick in volume over the past two weeks, coinciding with price stabilization around $2.32. This rise, according to reports from Bloomberg and Chainalysis, often precedes breakouts as it signals accumulation by institutional players. Expert quote from Michaël van de Poppe: “Rising volume under resistance is a bullish tell, but confirmation above $3.20 is essential to filter out false signals.” Shorter-term metrics reveal that daily volume averages 1.5 million units, up from 1.2 million last month, underscoring growing interest without overbought conditions.

Frequently Asked Questions

What is the projected target for NEAR if it breaks $3.20 resistance?

Based on current NEAR Protocol price analysis, breaking $3.20 could target $3.40 initially, with Elliott Wave projections extending to $4.00 in a bullish scenario. This assumes sustained volume and no broader market downturn, as per technical assessments from sources like TradingView data aggregated in November 2025.

Is NEAR Protocol a good buy near current consolidation levels?

NEAR Protocol appears positioned for potential upside from current consolidation around $2.32, with technical signals like rising 20-week averages supporting accumulation. However, wait for a confirmed breakout above resistance for entry, as voice search trends emphasize risk management in volatile crypto markets—always consider personal financial advice.

Key Takeaways

- Potential Bottom Formation: NEAR has likely established a low near $2.32, with Fibonacci clusters at $2.04-$1.55 acting as strong support for reversal.

- Resistance Challenges: The $3.20-$3.40 zone remains pivotal; historical data shows failed breaks lead to 10-15% pullbacks, per analyst reviews.

- Volume and Momentum: Increasing trading volume suggests building interest—monitor for a close above resistance to act on upside potential toward $3.20.

Conclusion

NEAR Protocol price analysis underscores a token at a crossroads, with technical signals from Elliott Wave patterns and resistance zones at $3.20 signaling opportunities for upward movement if confirmed. Broader market behavior, including rising volume and stabilizing averages, points to growing confidence, as noted by experts like Michaël van de Poppe. As 2025 progresses, investors should track these levels closely for a potential trend shift, positioning strategically to capitalize on NEAR’s next phase of growth.