NEAR Protocol May Target $3.8–$4.0 Amid Record Volume and Whale Accumulation

NEAR/USDT

$178,823,904.18

$1.10 / $1.028

Change: $0.0720 (7.00%)

+0.0056%

Longs pay

Contents

NEAR Protocol has experienced a significant surge, rising over 12% in the last 24 hours before a minor 4% retracement, driven by record trading volume of $626 million weekly, whale accumulation, and strong buyer dominance in derivatives markets.

-

Record trading volume highlights growing investor interest in NEAR Protocol’s ecosystem developments.

-

Whale accumulation via large spot orders signals confidence in sustained price momentum.

-

Buyer dominance in futures markets, with a 90-day CVD surge, supports a potential breakout above $3.2 resistance, targeting $3.8–$4.0.

Discover the factors behind NEAR Protocol’s recent price surge, including record volumes and whale activity. Stay ahead in crypto investments—explore NEAR’s bullish outlook today.

What is driving NEAR Protocol’s recent surge?

NEAR Protocol‘s surge is primarily fueled by unprecedented trading volume reaching $626 million weekly, as reported by Token Terminal, alongside active whale accumulation and robust buyer control in derivatives. This momentum reflects heightened enthusiasm for NEAR’s expanding ecosystem, including recent integrations like Thorwallet post-halving. At press time, the token trades near $3.2 after a 12% gain, testing key resistance levels.

How are whales influencing NEAR Protocol’s price action?

Analysis from CryptoQuant shows NEAR whales placing substantial spot average orders, coinciding with the volume spike, indicating strategic buying during the rally. This accumulation bolsters support at lower levels and could propel further gains if sustained. Developer growth and transaction throughput on NEAR’s network, as noted in recent blockchain metrics, add fundamental strength. Experts like those from Token Terminal emphasize that such on-chain activity often precedes extended bull runs in layer-1 protocols.

Frequently Asked Questions

What causes NEAR Protocol’s trading volume to hit all-time highs?

NEAR Protocol’s trading volume surged to $626 million weekly due to ecosystem expansions, such as the Thorwallet integration following its halving event, attracting more developers and users. This increased activity has drawn institutional interest, boosting liquidity across exchanges and reinforcing the token’s position in the altcoin market.

Will NEAR Protocol continue its bullish trend if resistance breaks?

Yes, a decisive break above $3.2 could transform it into support, targeting $3.8 to $4.0, based on current buyer dominance and Stochastic RSI signals. However, overbought conditions suggest monitoring for short-term corrections, while fundamentals like rising throughput support long-term growth—ideal for voice searches on crypto forecasts.

Key Takeaways

- Record Trading Volume: NEAR Protocol’s weekly volume hit $626 million, per Token Terminal, underscoring investor enthusiasm amid ecosystem advancements.

- Whale Accumulation: Large spot orders from whales, as analyzed by CryptoQuant, align with price surges and signal strong conviction in NEAR’s future.

- Buyer Dominance: A sharp rise in 90-day futures CVD reflects aggressive buying, potentially driving NEAR past $3.2 resistance toward higher targets—consider positioning accordingly.

Conclusion

NEAR Protocol’s recent surge, marked by record trading volumes, whale accumulation, and buyer dominance, positions it for potential continued bullish momentum if it clears the $3.2 resistance. Fundamentals like developer expansion and integrations further enhance its appeal in the competitive blockchain space. As the crypto market evolves, investors should track these indicators closely for opportunities in NEAR Protocol’s ongoing rally.

Key Takeaways

What’s driving NEAR Protocol’s recent surge and bullish momentum?

Record trading volume, whale accumulation, and strong buyer dominance across markets are fueling the rally.

Could NEAR break past its resistance and extend gains?

Yes, if buying pressure and ecosystem growth persist, NEAR could target the $3.8–$4.0 range.

NEAR Protocol [NEAR] is breaking down barriers once again. Over the last 24 hours alone, the token has surged significantly by over 12%, before retracing 4%, at the time of writing.

That’s not all, the token trading volume has also skyrocketed to an all-time high. According to the recent Token Terminal’s reports, the token recorded a weekly trading volume of $626 million.

This sequential surge highlights growing enthusiasm around NEAR’s ongoing ecosystem developments.

Source: Token Terminal

NEAR whales are making moves

In addition to the surge in trading volume, COINOTAG’s analysis of Spot Average Order Size data reveals that NEAR whales are actively accumulating large orders.

This accumulation appears to be strategically timed, coinciding with the recent spike in trading activity.

Source: CryptoQuant

Buyers regain control

On the derivative markets, Futures 90-day Taker CVD data indicates a significant surge in the token’s buyers’ dominance. The surge reflects a renewed accumulation across spot and derivatives markets.

Buyer dominance is reinforcing NEAR’s current bullish technical setup.

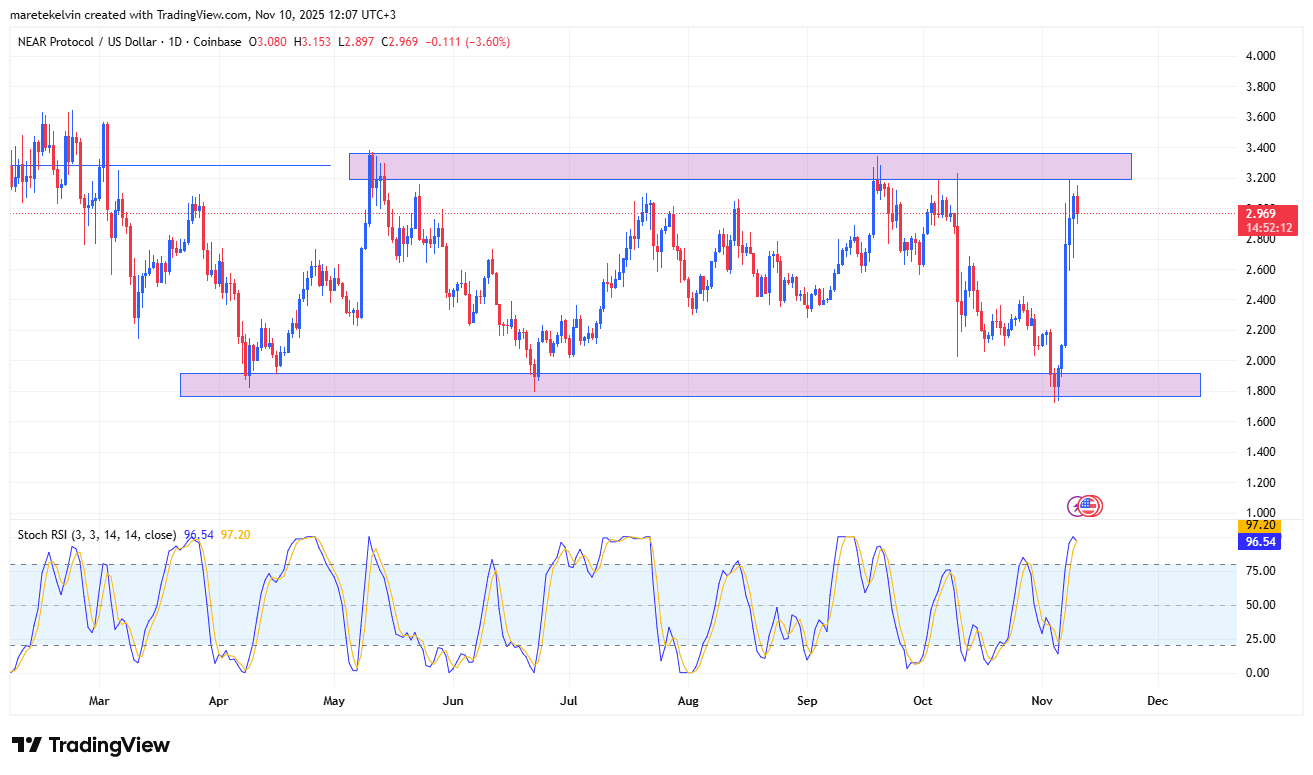

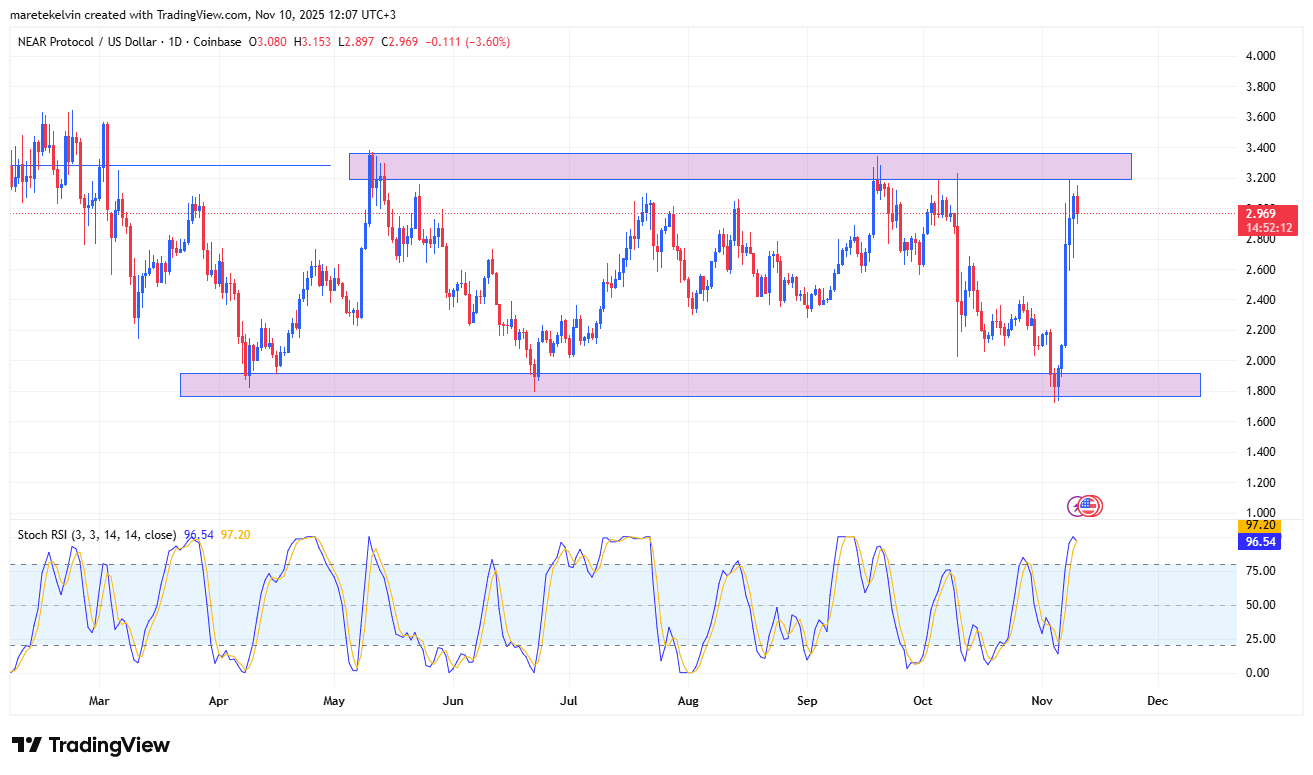

At the time of writing, the token was testing the $3.2 resistance level, a barrier that has repeatedly halted upward moves in recent weeks.

If buying momentum continues at this pace, NEAR could break through and turn this resistance into a support level, paving the way for a sustained rally.

Source: CryptoQuant

Positive fundamentals add to the bullish outlook

Beyond the technical setup, NEAR’s fundamentals continue to impress. Its growing ecosystem activity, developer expansion, and rising transaction throughput have boosted investor sentiment in recent weeks.

Just recently, the token was integrated with Thorwallet, just a week after its halving event. The after-development tremors are still visible on the altcoin price action.

Still, investors should watch for volatility near the $3.2 resistance level. The key liquidity zone has witnessed several rejections in the past.

Also, NEAR’s Sochastic RSI was in an overbought region, at press time, hinting at a potential short-term price correction ahead. However, a clean break above the resistance zone could open the door for a move toward the next major target around $3.8–$4.0

Source: TradingView

Also, NEAR’s momentum looks far from over.

The token’s Trading Volume was at record highs, and buyers are regaining control. If bullish sentiment holds, the coming days could mark a decisive turning point for the token’s next major rally phase.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

COINOTAG: CME FedWatch Reveals 26.6% Chance of January 25bps Rate Cut, 73.4% Hold

December 18, 2025 at 05:04 PM UTC

Moon Pursuit Capital Debuts $100M Market-Neutral Crypto Fund Targeting Bitcoin Cycle-Timing and Altcoin Momentum

December 17, 2025 at 01:10 PM UTC