NEAR Protocol’s On-Chain Surge Hints at Potential Reversal Despite Recent 14% Dip

NEAR/USDT

$178,823,904.18

$1.10 / $1.028

Change: $0.0720 (7.00%)

+0.0056%

Longs pay

Contents

NEAR Protocol’s on-chain activity shows robust growth with 41.8 million active users and $5 billion in processed volume via NEAR Intent, despite a 14% price drop in the last 24 hours, signaling potential for a market reversal amid rising adoption.

-

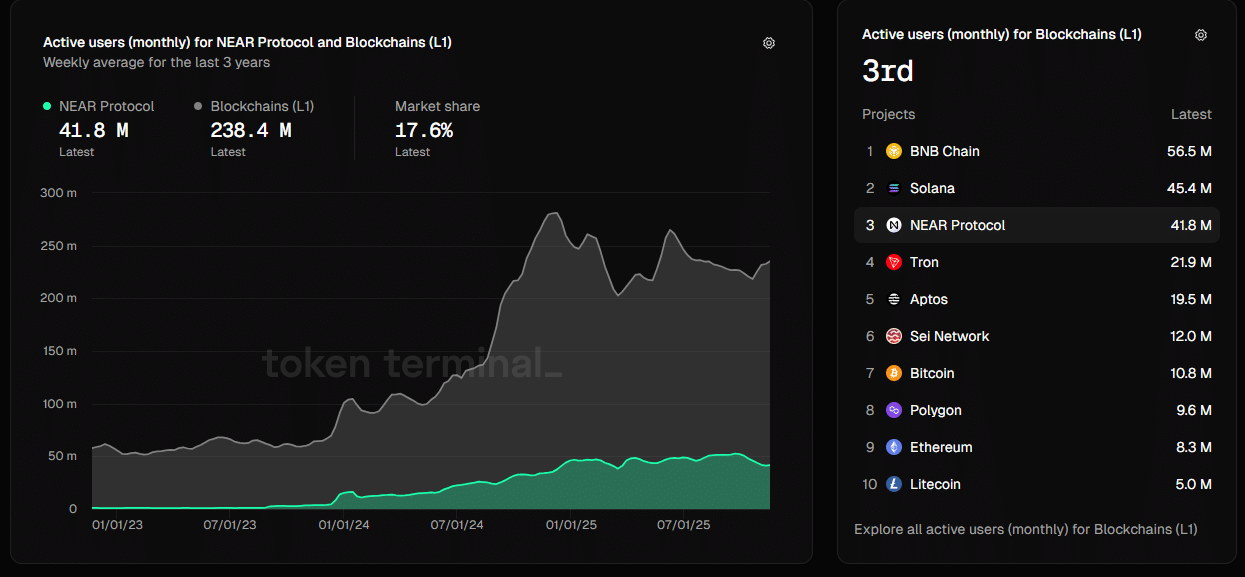

NEAR Protocol on-chain activity surges as monthly active users reach 41.8 million, capturing 17% of all Layer-1 blockchain users.

-

NEAR Intent achieves $5 billion in all-time processed volume, highlighting strong ecosystem engagement.

-

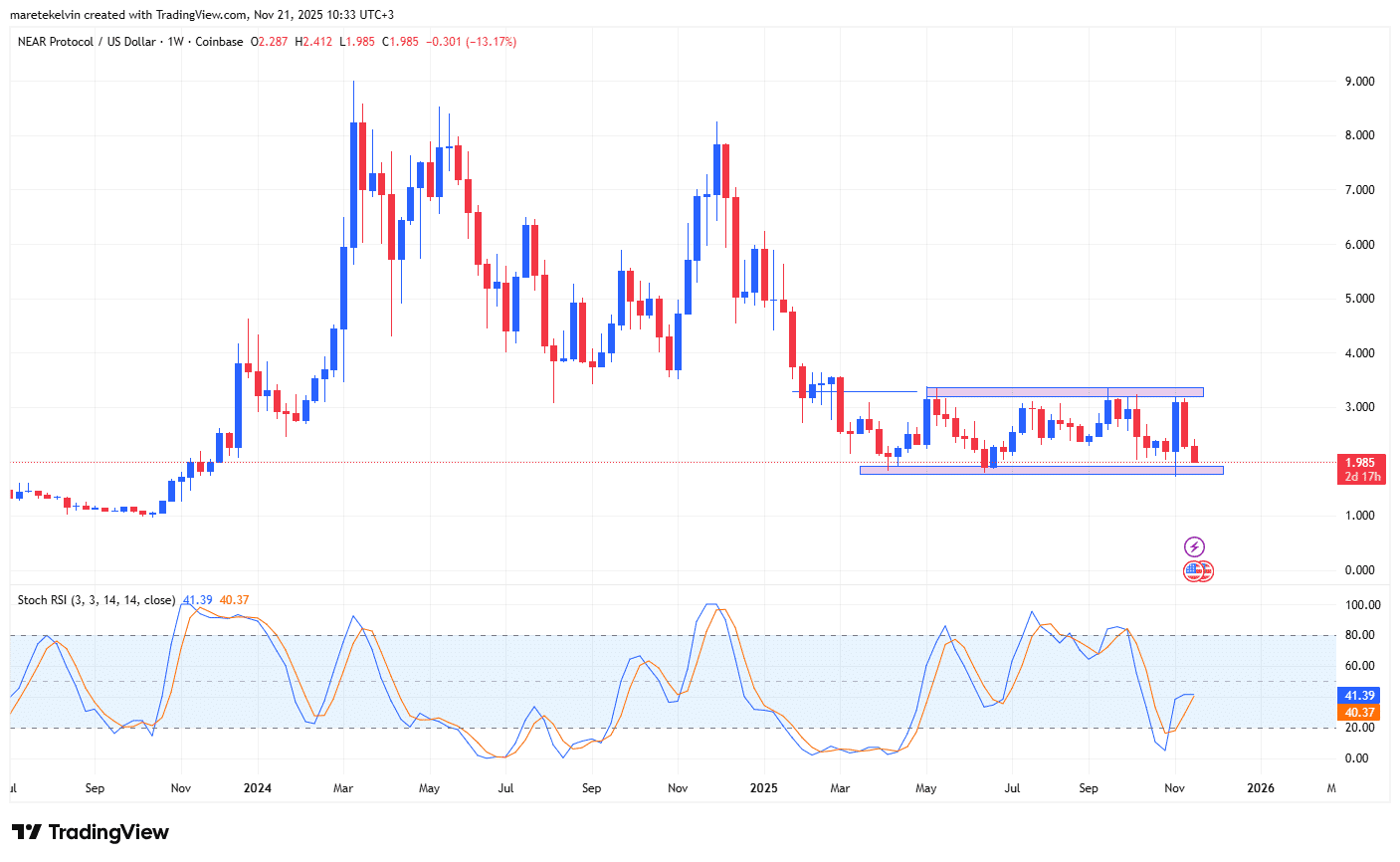

Price consolidates between $1.82 and $3.20 support levels, with on-chain metrics suggesting resilience against broader market volatility.

Discover how NEAR Protocol’s on-chain activity defies its recent 14% price decline, with 41.8M users and $5B volume. Explore growth signals and reversal potential—stay ahead in crypto trends today!

What is driving NEAR Protocol’s on-chain growth despite price pressures?

NEAR Protocol’s on-chain activity is experiencing significant expansion, fueled by innovative features like NEAR Intent, which recently hit $5 billion in all-time processed volume. This milestone underscores robust ecosystem usage and developer engagement, even as the token’s price has declined 14% in the past 24 hours due to heightened market volatility. Monthly active users on the network have climbed to 41.8 million, positioning NEAR as a leader among Layer-1 blockchains and indicating sustained adoption in a cautious market environment.

The protocol’s sharding technology and user-friendly design continue to attract developers and users, contributing to this on-chain momentum. Data from Token Terminal reveals that NEAR now holds nearly 17% of all Layer-1 active users, a sharp rise that reflects growing demand for its scalable infrastructure. This disconnect between on-chain vitality and short-term price action highlights the protocol’s underlying strength, potentially setting the stage for future price appreciation as market sentiment stabilizes.

How does NEAR Protocol’s user base compare to other Layer-1 blockchains?

NEAR Protocol ranks third in Layer-1 active users, trailing only BNB Chain with 56.5 million and Solana with 45.4 million, according to recent analytics from Token Terminal. This positions NEAR as a competitive force in the Layer-1 space, where its 41.8 million users represent a substantial 17% market share. The growth in active users points to increasing adoption of NEAR’s fast transaction speeds and low fees, which appeal to decentralized application builders.

Supporting this, NEAR’s ecosystem has seen a surge in monthly active users across its network, outpacing many peers in user retention metrics. Experts note that such on-chain developments often precede price recoveries, as they demonstrate real-world utility. For instance, the protocol’s focus on nightshade sharding enables parallel processing, handling thousands of transactions per second efficiently. This technical edge, combined with community-driven initiatives, has bolstered its user base amid broader crypto market fluctuations.

In comparison, while Solana benefits from high-speed performance and BNB from its exchange integration, NEAR’s emphasis on accessibility—through tools like account abstraction—has driven organic growth. Recent data indicates a 20% increase in daily active addresses over the past month, further solidifying its position. This user expansion not only enhances network security through greater decentralization but also signals long-term viability, as more participants contribute to transaction validation and governance.

The protocol’s development team has emphasized sustainable growth, with updates aimed at improving interoperability with other chains. Such enhancements could further elevate NEAR’s standing, potentially capturing more market share from established players. Overall, these metrics illustrate NEAR’s resilience, providing a foundation for investors monitoring Layer-1 performance in 2025.

Source: Token Terminal

Frequently Asked Questions

What caused NEAR Protocol’s recent 14% price drop?

NEAR Protocol’s price fell 14% in the last 24 hours due to intensified market volatility across cryptocurrencies, prompting risk-off trading. Sellers dominated short-term movements, but underlying on-chain growth remains strong, suggesting the dip may be temporary amid broader sentiment shifts.

Is NEAR Protocol’s on-chain activity a sign of future price recovery?

Yes, NEAR Protocol’s on-chain activity, including 41.8 million active users and $5 billion in NEAR Intent volume, indicates rising demand that could support a price reversal. As adoption grows, this fundamental strength may outweigh current bearish pressures, much like past cycles where metrics led market upturns.

Key Takeaways

- Robust On-Chain Metrics: NEAR Protocol boasts 41.8 million active users, securing 17% of the Layer-1 market and demonstrating ecosystem vitality.

- Milestone Achievement: NEAR Intent processed $5 billion in volume, reflecting high engagement despite price declines.

- Price Resilience: With support at $1.82 and consolidation since March, on-chain positives could drive a reversal—monitor for breakout signals.

Long-term price structure hints at potential reversal

On the contrary, the token’s short-term price reaction seemed to highlight a clear disconnect. NEAR’s strong on-chain traction has not translated into short-term price action. In fact, sellers seem to still be in dominance.

The steep daily decline could be a sign that traders may be prioritizing risk-off moves rather than fundamentals. Especially as market liquidity thins and volatility spikes.

On the weekly chart, NEAR prices have been tied in consolidation phase since March this year. The altcoin’s price has been fluctuating within the $1.82 and $3.20 price levels for long.

At the time of writing, the same was approaching the $1.82 support zone after the latest bearish run. However, the support level is more likely to stand given the favorable on-chain sentiments.

Source: TradingView

Conclusion

NEAR Protocol’s on-chain activity continues to thrive with 41.8 million users and key milestones like $5 billion in NEAR Intent volume, even as its price faces short-term bearish pressure from market volatility. This divergence underscores the protocol’s solid fundamentals and growing adoption in the Layer-1 landscape. As 2025 unfolds, investors should watch for alignment between on-chain growth and price action, potentially leading to renewed bullish momentum—consider tracking these metrics for informed decisions.