NEAR Shows Signs of Potential Recovery Amid Recent Downtrend and Easing Selling Pressure

NEAR/USDT

$121,640,641.86

$1.106 / $1.053

Change: $0.0530 (5.03%)

-0.0057%

Shorts pay

Contents

-

NEAR Protocol faces downward market pressure, yet potential signs of a recovery could emerge amid fluctuating trading activity.

-

The crypto asset has recently endured significant losses, prompting analysts to explore the underlying reasons for its bearish trend.

-

According to COINOTAG, “Selling pressure on NEAR has intensified, particularly among derivative traders,” indicating a cautious market sentiment.

NEAR Protocol shows signs of bearish activity with declining addresses and heightened selling pressure, though predictions suggest a potential recovery ahead.

Declining Interest Signals Market Caution for NEAR

The NEAR network’s recent performance highlights a troubling trend as the Daily Active Addresses (DAA) have dropped remarkably, reflecting a waning user engagement reported by Artemis. The relationship between DAAs and a token’s market performance is crucial; when active engagement diminishes, it often correlates with a decline in value.

Currently, NEAR is grappling with a stark decrease in DAAs, which fell from 4.4 million to 3.9 million in just four days. This downward trajectory aligns with NEAR’s price, currently trading at around $5.11, per CoinMarketCap data.

Source: Artemis

COINOTAG has also noted the unsettling trend of increasing selling pressure, driven chiefly by derivative traders, which has further compounded NEAR’s struggles to stabilize in the market.

Bearish Sentiment Amplified by Derivative Market Trends

The sentiment surrounding NEAR is further exacerbated by the rise in short positions among traders, as indicated by Coinglass’s long-to-short ratio reading of 0.8793. This trend reveals a significant shift towards bearish expectations, with traders predominantly betting against NEAR’s price increasing.

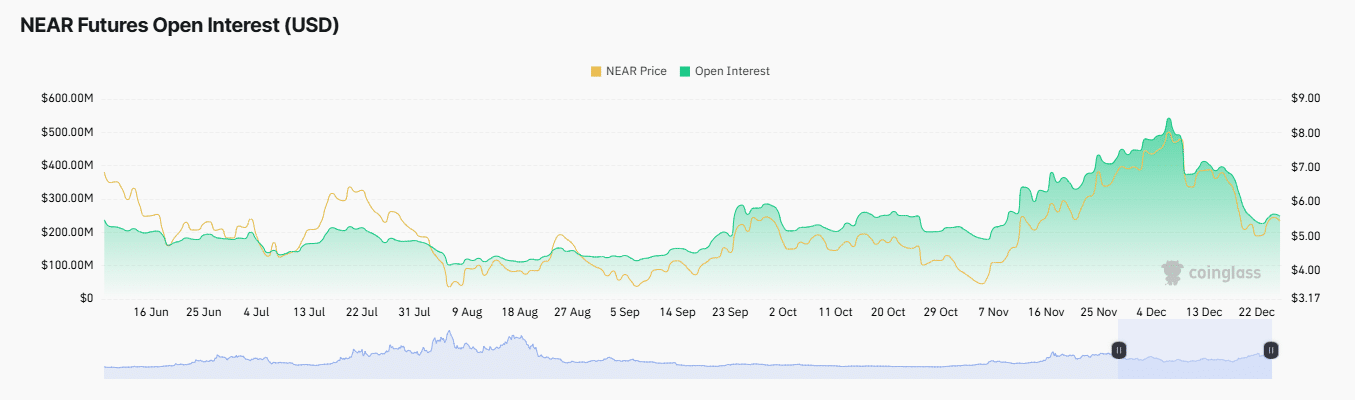

Moreover, NEAR’s Open Interest witnessed a steep decline of 6.86% in just 24 hours, underscoring the market’s deterioration in confidence, dropping to a value of $237.39 million.

Source: Coinglass

Additionally, liquidation data signals a further increase in bearish sentiment, with approximately $901,510 liquidated from long traders who faced losses. This pattern reinforces the ongoing challenges NEAR encounters amid a turbulent market.

Nonetheless, several technical indicators suggest that the extent of the bearish pressure may be starting to wane.

The Average Directional Index (ADX) currently shows a reading of 17.85, hinting at a weakening of the downward momentum, potentially indicating that selling activity may soon slow. If the downward trend continues to ease, it could pave the way for NEAR to experience a price rebound.

Source: Trading View

Future Prospects for NEAR Protocol

As observed on the weekly charts, NEAR appears to be consolidating within a symmetrical triangle pattern. Such formations are often viewed as preludes to significant price movements, with historical data suggesting that they may precede upward breakouts.

However, continued selling pressure may test NEAR’s resilience, potentially pushing the cryptocurrency down to a support level around $4.625, or lower, which will be crucial in the current market context.

Source: Trading View

This downward movement may represent the final phase of NEAR’s current downtrend, after which a rebound could see the asset striving to recuperate towards the $10 price point, thus entering a period of potential recovery.