Peter Schiff Warns: Bitcoin Shift to Weak Hands Could Amplify Future Drawdowns

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The transfer of Bitcoin from long-term holders to weak hands is intensifying market volatility, as new investors lack conviction and sell during downturns. According to economist Peter Schiff, this shift increases the float and amplifies future selloffs, potentially leading to deeper Bitcoin price drawdowns amid ongoing whale activity.

-

Long-term Bitcoin holders, or OGs, are cashing out over 400,000 BTC in recent months, adding significant selling pressure.

-

Weak hands among retail investors may dump holdings at the first sign of trouble, exacerbating market declines.

-

Bitcoin exchange inflows remain elevated, with data from CryptoQuant showing persistent whale transfers contributing to prices dipping below $85,000.

Bitcoin long-term holders selling to weak hands signals deeper drawdowns ahead. Explore Peter Schiff’s warnings and expert insights on market volatility in this analysis. Stay informed on BTC trends for smarter investing decisions.

What Is the Impact of Bitcoin Long-Term Holders Selling to Weak Hands?

The transfer of Bitcoin long-term holders selling to newer, less committed investors—often called weak hands—is reshaping market dynamics and heightening volatility. Economist and gold investor Peter Schiff highlighted that Bitcoin is experiencing its “IPO moment,” with sufficient liquidity enabling original holders to exit positions. This shift not only expands the available supply but also introduces fragility, as weak hands are prone to panic selling during corrections, potentially worsening drawdowns in the Bitcoin market.

Source: Peter Schiff

Schiff emphasized on a recent update that the movement of substantial Bitcoin volumes from strong to weak hands amplifies the float, meaning more coins are readily available for trading. This can lead to sharper price drops in selloffs, as the influx of less resilient holders dilutes overall market conviction. Historical patterns show that such transitions often precede periods of increased turbulence, particularly when combined with broader economic uncertainties.

In October alone, whales and other long-term Bitcoin holders offloaded over 400,000 BTC, exerting heavy selling pressure that drove prices below $85,000. This activity underscores a pivotal change in Bitcoin’s holder base, where early adopters are realizing gains after years of accumulation. As these coins move to retail and institutional players with shorter horizons, the market’s resilience is tested, raising questions about sustained upward momentum.

How Are Elevated Bitcoin Exchange Inflows Affecting Market Sentiment?

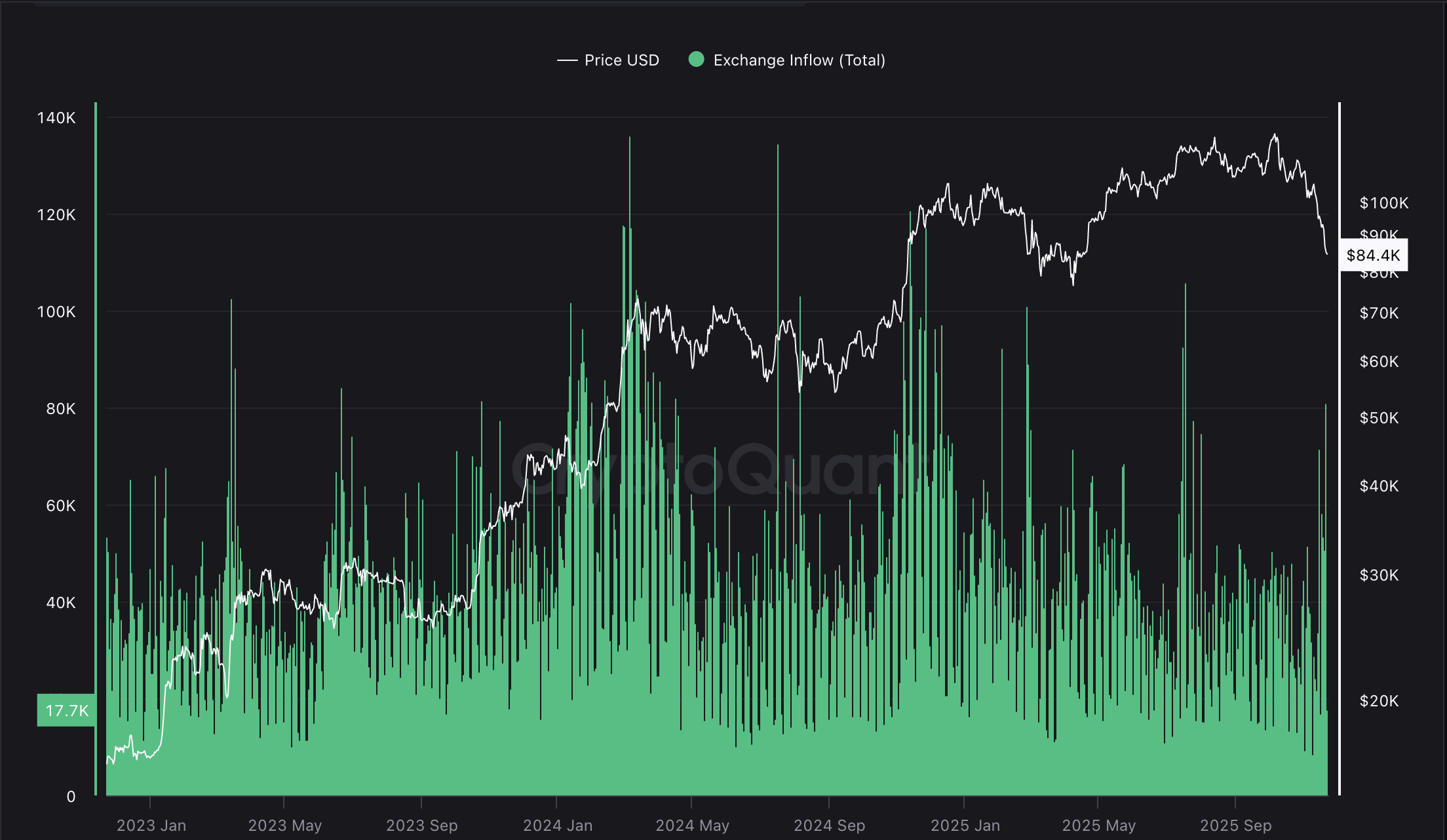

Elevated Bitcoin exchange inflows, which track coins sent to platforms for potential selling, indicate ongoing caution among holders and contribute to bearish sentiment. Data from CryptoQuant reveals that these inflows have stayed high, correlating with the recent price crash and signaling persistent distribution by large players. This trend, observed amid a broader crypto downturn, divides analysts on whether the bull run will rebound with improved liquidity or evolve into a prolonged bear phase.

The Bitcoin exchange inflow, which tracks the number of BTC sent to exchanges for selling, remains elevated. Source: CryptoQuant

Supporting this, on-chain metrics show a spike in transfers from cold wallets to exchanges, often a precursor to liquidation events. Experts note that while institutional adoption continues—bolstered by Bitcoin’s strong fundamentals like scarcity and network security—retail participation introduces volatility. For instance, leveraged positions in derivatives markets have amplified liquidations, with Bitfinex analysts attributing the short-term drawdown primarily to long-term holder sales and these mechanical pressures rather than fundamental weaknesses.

Prominent examples include early Bitcoin adopter Owen Gunden, who sold his entire 11,000 BTC holdings—worth approximately $1.3 billion—in October and November. Similarly, “Rich Dad Poor Dad” author Robert Kiyosaki disclosed selling his Bitcoin stash, valued at around $2.25 million, after buying at $6,000 per coin and exiting near $90,000. Kiyosaki plans to reinvest profits into income-generating ventures but remains optimistic, stating he will repurchase Bitcoin using future cash flows. These high-profile exits highlight a maturing market where even vocal supporters are taking profits, potentially flooding the supply side.

Vineet Budki, CEO of Sigma Capital, warned that retail investors’ lack of conviction could precipitate a 70% drawdown in the next bear cycle. He explained to financial outlets that new entrants, unlike original holders, may abandon positions hastily, intensifying corrections. This perspective aligns with broader E-E-A-T principles in crypto analysis, drawing from established on-chain data and expert commentary to inform investor strategies without speculative overreach.

Frequently Asked Questions

What Happens When Bitcoin Long-Term Holders Sell to Retail Investors?

When Bitcoin long-term holders selling occurs, it increases circulating supply and transfers ownership to retail investors with potentially lower risk tolerance. This can heighten volatility, as weak hands may sell during dips, leading to amplified drawdowns. Data from recent months shows over 400,000 BTC moved, contributing to price drops below $85,000, per on-chain analytics.

Will Institutional Investors Absorb Bitcoin Selling Pressure from Whales?

Yes, institutional investors are likely to absorb much of the selling pressure from whales and long-term holders, driven by Bitcoin’s robust fundamentals and growing adoption. Analysts at Bitfinex predict continued demand from these players, even as retail sells off, helping stabilize prices over time. This balance could support a resumption of the bull trend once liquidity improves.

Key Takeaways

- Shifting Ownership Dynamics: The move of Bitcoin from long-term holders to weak hands expands the market float, making selloffs more severe as noted by Peter Schiff.

- Persistent Selling Pressure: Over 400,000 BTC dumped in October, with elevated exchange inflows signaling ongoing whale activity and retail vulnerability.

- Path to Recovery: Focus on institutional inflows and Bitcoin’s core strengths; monitor on-chain data for signs of stabilization and consider diversified strategies amid volatility.

Conclusion

The ongoing Bitcoin long-term holders selling to weak hands represents a critical evolution in the market, as highlighted by economist Peter Schiff and supported by data from sources like CryptoQuant. While short-term drawdowns from whale exits and retail panic may persist, Bitcoin’s fundamentals— including institutional interest and limited supply—position it for potential recovery. Investors should prioritize conviction and long-term holding to navigate this phase, staying attuned to on-chain indicators for informed decisions in the evolving crypto landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC