Polkadot Shows Short-Term Bullish Momentum Amid Long-Term Bearish Trend

DOT/USDT

$385,283,558.63

$1.651 / $1.458

Change: $0.1930 (13.24%)

+0.0059%

Longs pay

Contents

Polkadot DOT price analysis shows a persistent long-term bearish trend since March 2025, with weekly charts confirming selling pressure. Yet, DOT achieved 4.41% gains last week, driven by bullish 4-hour structural breaks, potentially targeting $2.00-$2.50 amid Bitcoin volatility.

-

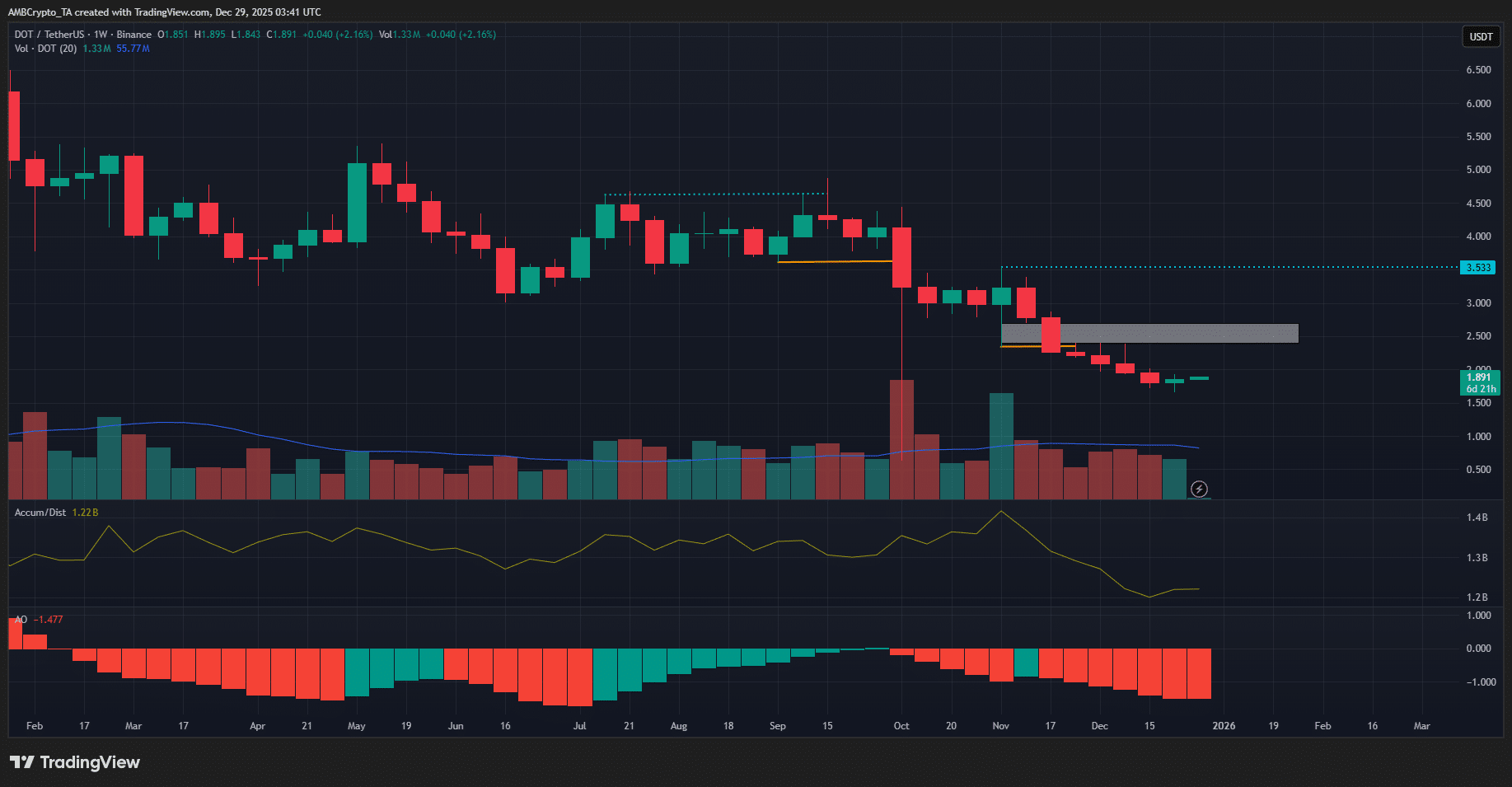

Weekly timeframe: Bearish structure intact with ongoing breaks since September 2025.

-

4-hour chart signals bullish shift via breaches of $1.75-$1.85 lower highs.

-

Accumulation/Distribution indicator rises, Awesome Oscillator confirms momentum; Bitcoin $90k resistance adds caution.

Polkadot DOT price analysis: 4.41% weekly gain in bearish trend. Multi-timeframe insights reveal short-term bullish potential to $2.5. Trading tips and risks amid BTC fear. Stay informed on DOT trends today.

What is the Polkadot DOT price trend in 2025?

Polkadot DOT price analysis indicates a dominant long-term bearish trajectory since March 2025, marked by consistent downward swings. Despite this, recent 4.41% weekly appreciation highlights short-term resilience, fueled by 4-hour bullish momentum. Traders eye $2 resistance, though higher-timeframe pressures persist.

How does multi-timeframe analysis impact DOT price outlook?

Multi-timeframe evaluation of Polkadot DOT price analysis underscores key divergences. Weekly charts depict unbroken bearish architecture from September, with Accumulation/Distribution reflecting sustained selling and Awesome Oscillator signaling negative momentum. A $2.5 imbalance zone may act as supply before further declines on this scale.

Source: DOT/USDT on TradingView

In contrast, the 4-hour timeframe reveals a bullish reversal over the past week. Key structural breaks exceeded prior lower highs at $1.75 and $1.85. Rising Accumulation/Distribution and positive Awesome Oscillator bars suggest upward continuation toward $2 psychological resistance or even the weekly $2.5 supply area.

Source: DOT/USDT on TradingView

Frequently Asked Questions

Will Polkadot DOT price reach $2 in the short term during 2025 bearish trend?

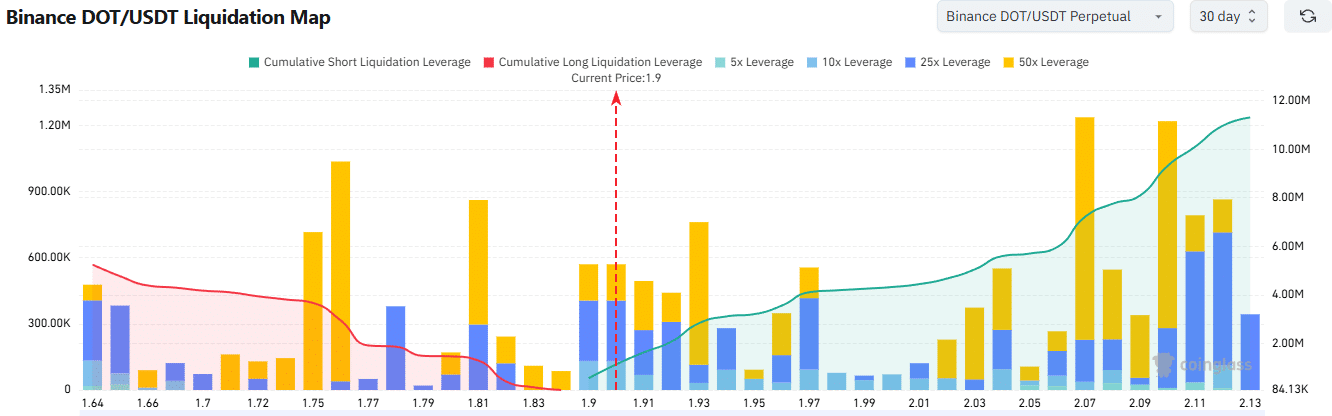

Polkadot’s 4-hour bullish momentum supports a push to $2.00-$2.11, backed by liquidation clusters and structural breaks. However, weekly bearish dominance suggests this as a bounce target, not reversal. Risk-averse traders should monitor $1.82 support for invalidation.

Is Polkadot a good buy now with Bitcoin at $90k resistance?

Short-term traders may capitalize on DOT’s bounce, but long-term investors face elevated risks from Bitcoin’s $90k barrier and fearful market sentiment. Higher-timeframe selling pressure outweighs immediate gains; sidelining remains prudent until demand strengthens.

Bitcoin’s $90k resistance remains a formidable hurdle for bulls, constraining liquidity despite recent inflows. Altcoins like Polkadot encounter spillover effects, limiting sustained rallies. While 4-hour trends favor upside, overarching bearish weekly patterns demand caution for extended positions.

The dangers for DOT bulls in current market conditions

Short-term positivity on lower timeframes does not erase higher-timeframe bearishness. Polkadot bulls risk entrapment if Bitcoin fails at $90k, triggering altcoin corrections. Demand remains thin amid widespread fear, underscoring the need for precise entry and exit strategies.

Traders’ call to action – Capitalizing on Polkadot’s potential bounce

Source: CoinGlass

Conservative approaches favor observation given weekly bearishness. The 4-hour uptrend eyes $2.11, where 30-day liquidation maps highlight dense short positions. Price often hunts liquidity here, offering profit opportunities at $2.00-$2.10. Breaches below $1.82 negate bullish setups.

Key Takeaways

- Short-term opportunity: Lower timeframe traders can profit from DOT bounce to $2-$2.5 zones.

- Long-term caution: Weekly bearish trend and Bitcoin resistance signal limited upside sustainability.

- Risk management: Use $1.82 invalidation; target liquidation-driven highs for exits.

Conclusion

This Polkadot DOT price analysis highlights short-term bullish signals clashing with entrenched bearish multi-timeframe trends since March 2025. While 4.41% weekly gains and 4-hour momentum offer trading prospects, Bitcoin headwinds and light demand warrant vigilance. Monitor key levels for informed decisions in volatile crypto markets.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Comments

Other Articles

ING Germany Expands MATIC Crypto Products with Bitwise and VanEck

February 3, 2026 at 08:50 AM UTC

Bitcoin Spot Order Pattern Hints at Potential Rally Amid Mixed Signals

December 30, 2025 at 02:14 AM UTC

Robinhood Expands Prediction Markets with NFL Features as BTC Holds at $87,400

December 18, 2025 at 01:10 PM UTC