Powell’s Mixed Signals May Limit Bitcoin Rally Until 2026 Rate Cuts

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The Federal Reserve’s recent 25 basis point interest rate cut to 3.5%-3.75% has not sparked a sustained Bitcoin price rally due to unclear signals on future reductions under Chair Jerome Powell, with analysts predicting only one cut in 2026 amid persistent inflation risks.

-

Federal Reserve’s mixed signals: Chair Powell highlighted upside inflation risks and downside employment concerns, tempering expectations for aggressive rate cuts.

-

Bitcoin’s sensitivity to monetary policy: Lower rates typically boost risk assets like BTC, but delayed easing cycles introduce volatility.

-

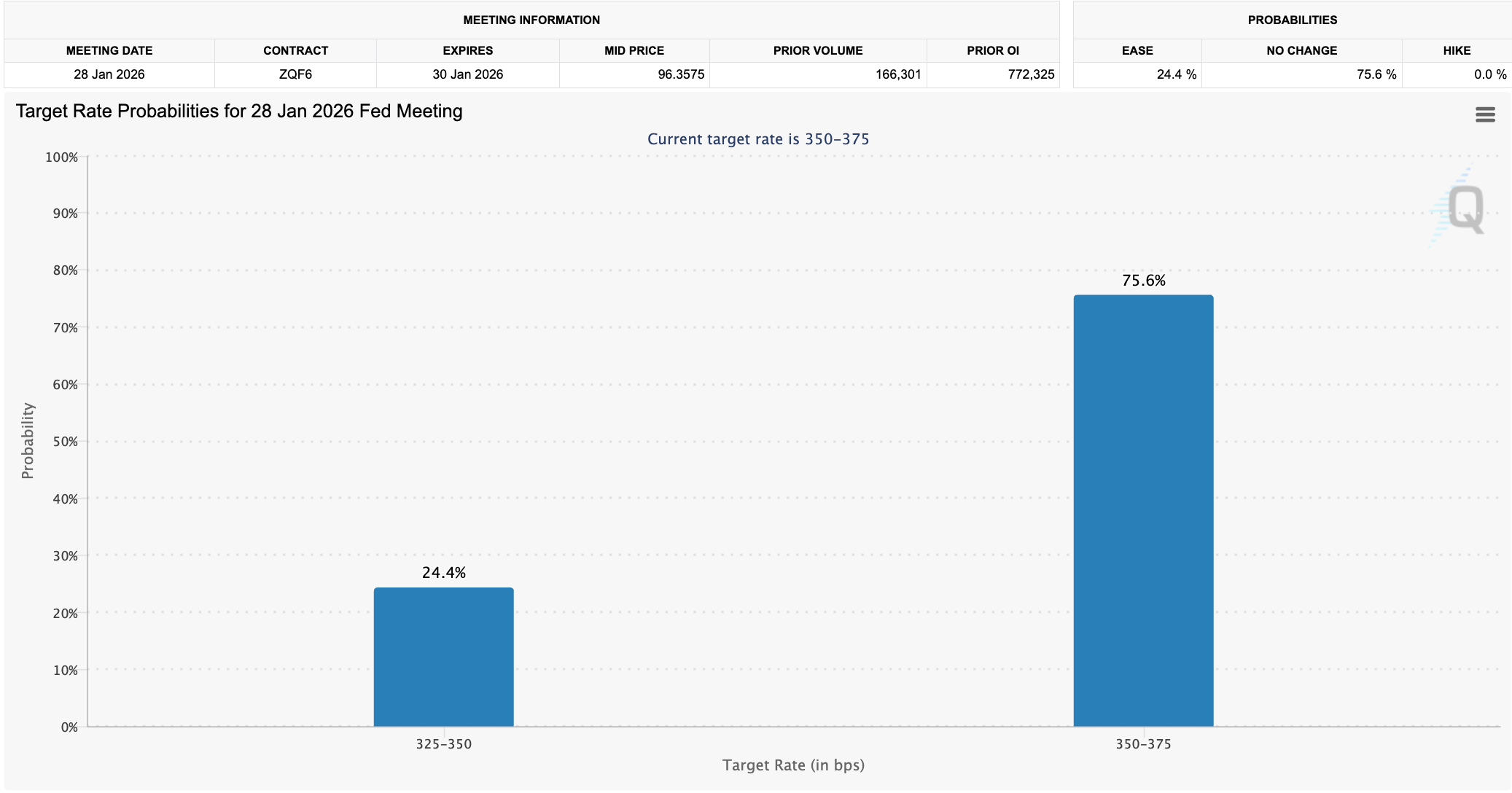

Market expectations: Only 24.4% of traders anticipate a rate cut at the January 2026 FOMC meeting, per CME Group data, signaling caution.

Discover how Federal Reserve rate cuts under Powell are impacting the Bitcoin price rally in 2025. Gain insights on policy shifts and BTC market reactions—stay ahead with expert analysis today.

How Do Federal Reserve Interest Rate Cuts Affect the Bitcoin Price Rally?

Federal Reserve interest rate cuts play a pivotal role in influencing the Bitcoin price rally by altering the broader economic environment that favors risk assets. When the Fed lowers rates, it reduces the appeal of traditional safe-haven investments like bonds, driving capital toward high-growth options such as Bitcoin. In December 2025, the Fed implemented a 25 basis point reduction to a target range of 3.5% to 3.75%, yet ambiguity surrounding subsequent cuts has restrained BTC’s upward momentum, as investors weigh persistent inflation against slowing employment indicators.

This dynamic underscores Bitcoin’s role as a barometer for monetary policy shifts. Historically, BTC has surged during periods of accommodative Fed policy, but Chair Powell’s recent remarks emphasized a cautious approach, noting no straightforward path forward without risks. As a result, market participants are bracing for potential delays in further easing until 2026, which could prolong sideways trading for Bitcoin before any renewed rally gains traction.

What Mixed Signals from Jerome Powell Mean for Bitcoin Investors?

Jerome Powell’s comments during the December 2025 Federal Open Market Committee (FOMC) meeting revealed a balanced yet uncertain outlook, stating, “In the near term, risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. There is no risk-free path for policy.” These remarks, while not overtly hawkish, fell short of dovish expectations that could have fueled an immediate Bitcoin price rally.

Analysts interpret this as a signal for measured policy adjustments. Market expert Nic Puckrin, founder of Coinbureau, noted that the Fed is likely to deliver just one rate cut in 2026 under Powell’s leadership. He further explained, “Attention will turn to liquidity and the Fed’s balance sheet policy in early 2026. However, despite the Treasury bill purchase announced today, quantitative easing isn’t coming until things start breaking, and that always means more volatility and potential pain.” This perspective aligns with data from the CME Group, where only 24.4% of traders polled expect a rate adjustment at the January 2026 meeting.

Interest rate target probabilities for January 2026. Source: CME Group

Powell’s assessment drew from available market indicators, acknowledging gaps in economic data due to the U.S. government shutdown, which has delayed key reports. Consumer spending and business investment continue to show resilience, with low layoffs and steady hiring rates providing some stability. However, inflation lingers above the Fed’s 2% target, and the housing sector remains subdued, contributing to the Fed’s deliberate pace.

From a Bitcoin standpoint, these factors amplify volatility. Low interest rates historically correlate with increased allocations to cryptocurrencies, as they enhance liquidity and risk appetite. Yet, the prospect of a protracted pause in cuts—potentially extending into 2026—could pressure BTC prices downward in the short term. Investors monitoring Fed communications closely will find that Powell’s emphasis on data dependency reinforces a wait-and-see approach, potentially capping the Bitcoin price rally until clearer dovish signals emerge.

Adding to the uncertainty is external political pressure. U.S. President Donald Trump has voiced intentions to influence the next Fed chair’s policy, with reports indicating National Economic Council director Kevin Hassett as a leading candidate to replace Powell, whose term ends in May 2026. Hassett, a former adviser on Coinbase’s Academic and Regulatory Advisory Council, has advocated for more aggressive easing measures, which could alter the trajectory if appointed.

Jerome Powell delivers remarks following the December 2025 FOMC meeting. Source: Federal Reserve

Trump’s public statements urging the incoming chair to pursue rate slashes highlight the intersection of politics and monetary policy, a factor that Bitcoin markets have grown increasingly sensitive to. Such developments could either accelerate a Bitcoin price rally through anticipated looser policy or introduce fresh uncertainties if transitions lead to inconsistent signaling.

In summary, Powell’s mixed remarks reflect the Fed’s commitment to balancing inflation control with economic support, but they underscore the challenges ahead. For Bitcoin, this translates to tempered optimism: while the recent cut provides some tailwind, the lack of a defined easing path limits bullish momentum. Data from authoritative sources like the CME Group and insights from analysts such as Puckrin emphasize the need for vigilance, as Bitcoin’s price often mirrors these macroeconomic tensions.

Frequently Asked Questions

What Impact Will the 2026 Federal Reserve Rate Cut Have on Bitcoin Prices?

The anticipated single rate cut in 2026 under Powell’s guidance is expected to provide modest support for Bitcoin prices by easing borrowing costs and boosting liquidity. However, with inflation risks elevated, this may not trigger a full-scale rally immediately. Analysts from Coinbureau suggest focusing on balance sheet policies, as BTC could see increased volatility before sustained gains materialize in 40-50 words of factual outlook.

Why Is Jerome Powell’s Leadership Causing Uncertainty in the Bitcoin Market?

Jerome Powell’s leadership introduces uncertainty in the Bitcoin market because his balanced approach to inflation and employment risks delays aggressive rate cuts that typically fuel crypto rallies. His recent FOMC comments highlight a data-driven path with no quick fixes, leading traders to adjust expectations downward for near-term BTC appreciation, making it a natural topic for voice search queries on policy effects.

Key Takeaways

- Fed’s Cautious Stance: The 25 basis point cut offers limited immediate lift to Bitcoin, with Powell’s upside inflation warnings signaling restraint through 2026.

- Market Sentiment: CME Group data shows subdued trader optimism, with just 24.4% eyeing a January 2026 cut, heightening BTC volatility risks.

- Political Influences: Trump’s push for a rate-slashing Fed chair like Kevin Hassett could reshape policy, potentially reigniting the Bitcoin price rally post-May 2026.

Conclusion

The interplay between Federal Reserve interest rate cuts and the Bitcoin price rally remains a critical dynamic in 2025, as Jerome Powell’s mixed signals highlight the Fed’s delicate balancing act amid inflation pressures and economic slowdowns. With only one projected cut in 2026 and ongoing data gaps from the government shutdown, Bitcoin investors face a period of heightened caution before liquidity improvements take hold. As political transitions loom, including potential shifts under a new chair, staying informed on these developments will be essential—position yourself to capitalize on the next policy pivot for long-term BTC growth.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC