Rails Vault Launch on Stellar: Impact on XLM

XLM/USDT

$49,414,411.81

$0.1569 / $0.1492

Change: $0.007700 (5.16%)

+0.0011%

Longs pay

Contents

Rails, an institutional crypto derivatives provider, announced on Tuesday the launch of its “Institutional-Grade Vaults” product on the Stellar network. This system allows brokerages, fintechs, and intermediaries to access crypto perpetuals contracts through a single backend. The company aims to launch options trading in the second quarter of 2026.

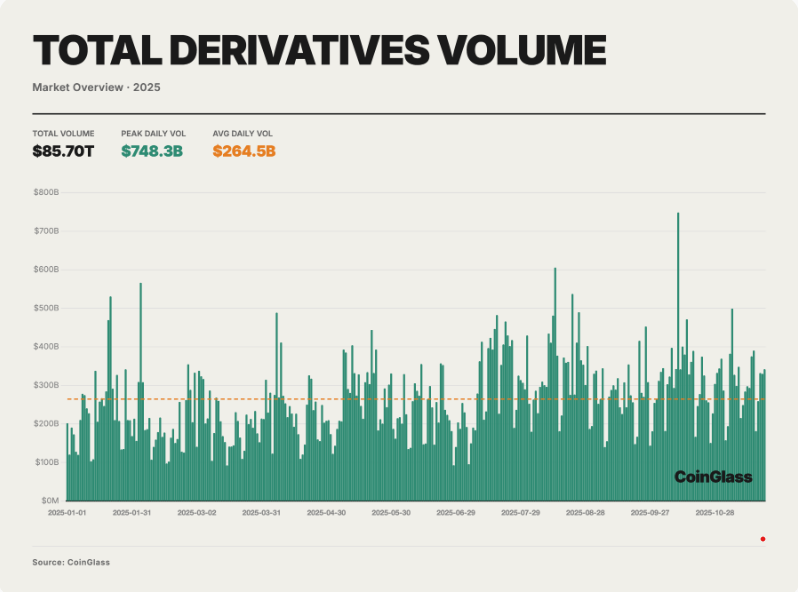

Total crypto derivatives volume in 2025. Source: CoinGlass

Details of Rails' Stellar Vault Launch

According to Rails CEO Satraj Bambra, the system separates the matching engine from funds, emphasizing custody and verifiability. A centralized matching engine is used, while customer assets are held in audited smart contract vaults on Stellar. Every 30 seconds, profit/loss, fees, and liabilities are recorded on-chain as Merkle roots. This strengthens the blockchain-based proof-of-reserves mechanism and increases transparency.

FTX Lessons: How It Reduces Counterparty Risk

This approach reduces counterparty and operational risks by learning from exchange collapses like FTX; customer collateral is separated from market maker capital. Vaults are protected with multisig approvals and time-locked withdrawals. Stellar's fast finality (3-5 seconds) minimizes settlement risk while preserving liquidity. Experts say this model bridges DeFi and CeFi.

Why Was Stellar (XLM) Chosen?

Stellar was chosen due to its fast settlement finality and 10 years of experience with banks. Its Anchor network with fiat-crypto ramps increases institutional compliance. Rails has reached $3.4 billion in trading volume, is registered with the Cayman Islands Monetary Authority (CIMA), and is in the application process with the US National Futures Association (NFA). This launch strengthens the XLM ecosystem for institutional adoption. Click here for detailed XLM analysis.

XLM Price and Technical Analysis: Current Trend

Current XLM price is 0.18 USD, 24-hour change -3.88%. RSI at 29.36 is in oversold territory, downtrend dominant. Supertrend bearish, EMA 20: 0.2008. Although this news is a positive catalyst, market pressure continues.

| Supports | Price | Score | Distance |

|---|---|---|---|

| S1 | 0.1682 | 81/100 (Strong) | -4.27% |

| S2 | 0.1186 | 48/100 | -32.50% |

| Resistances | Price | Score | Distance |

|---|---|---|---|

| R1 | 0.1852 | 69/100 (Strong) | +5.41% |

| R2 | 0.1787 | 63/100 (Strong) | +1.71% |

Details of XLM futures here.

2025 Crypto Derivatives Volume and Future Expectations

According to CoinGlass, 2025 crypto derivatives volume reached $85.7 trillion. Rails' vaults could shift the institutional portion of this volume to Stellar. When options arrive in Q2 2026, XLM transaction fees and staking demand may increase, supporting the price.

XLM Investor Recommendations for Institutional Adoption

Investors should watch R1 at 0.1852. Recovery is possible with an RSI rebound. However, watch the bearish supertrend; if S1 breaks, 0.1682 could be tested. Integrations like Rails strengthen long-term XLM value.