Shiba Inu Whale Surge and Burn Spike Hint at Upside Potential During Retest

SHIB/USDT

$71,890,200.82

$0.00000583 / $0.00000544

Change: $0.00000039 (7.17%)

-0.0009%

Shorts pay

Contents

Shiba Inu whale activity has surged with 406 transfers over $100k since June 6, signaling large-holder repositioning and a net 1.06 trillion SHIB inflow to exchanges, indicating potential bullish momentum amid technical breakouts.

-

Shiba Inu whale transactions spike to 406 above $100k, highest since June 6.

-

Net exchange inflows reach 1.06 trillion SHIB, showing trader repositioning.

-

Price respects key zones near $0.00000883, with MACD signaling upward momentum and burn rate up 1,244%.

Discover surging Shiba Inu whale activity, breakout retests, and rising burn rates driving potential SHIB gains. Stay informed on crypto trends and explore investment opportunities today.

What is Driving the Recent Surge in Shiba Inu Whale Activity?

Shiba Inu whale activity has intensified, with Santiment data showing 406 transactions exceeding $100,000 since June 6, marking the strongest wave in months and reflecting a clear shift in large-holder strategies. This spike coincides with over 1.06 trillion SHIB tokens flowing net into exchanges, suggesting repositioning rather than outright selling. While heavy inflows can introduce uncertainty, the overall market structure indicates underlying demand as SHIB holds key support levels, providing traders with signals of potential continuation in this volatile phase.

How Does Shiba Inu’s Breakout Retest Influence Future Price Movements?

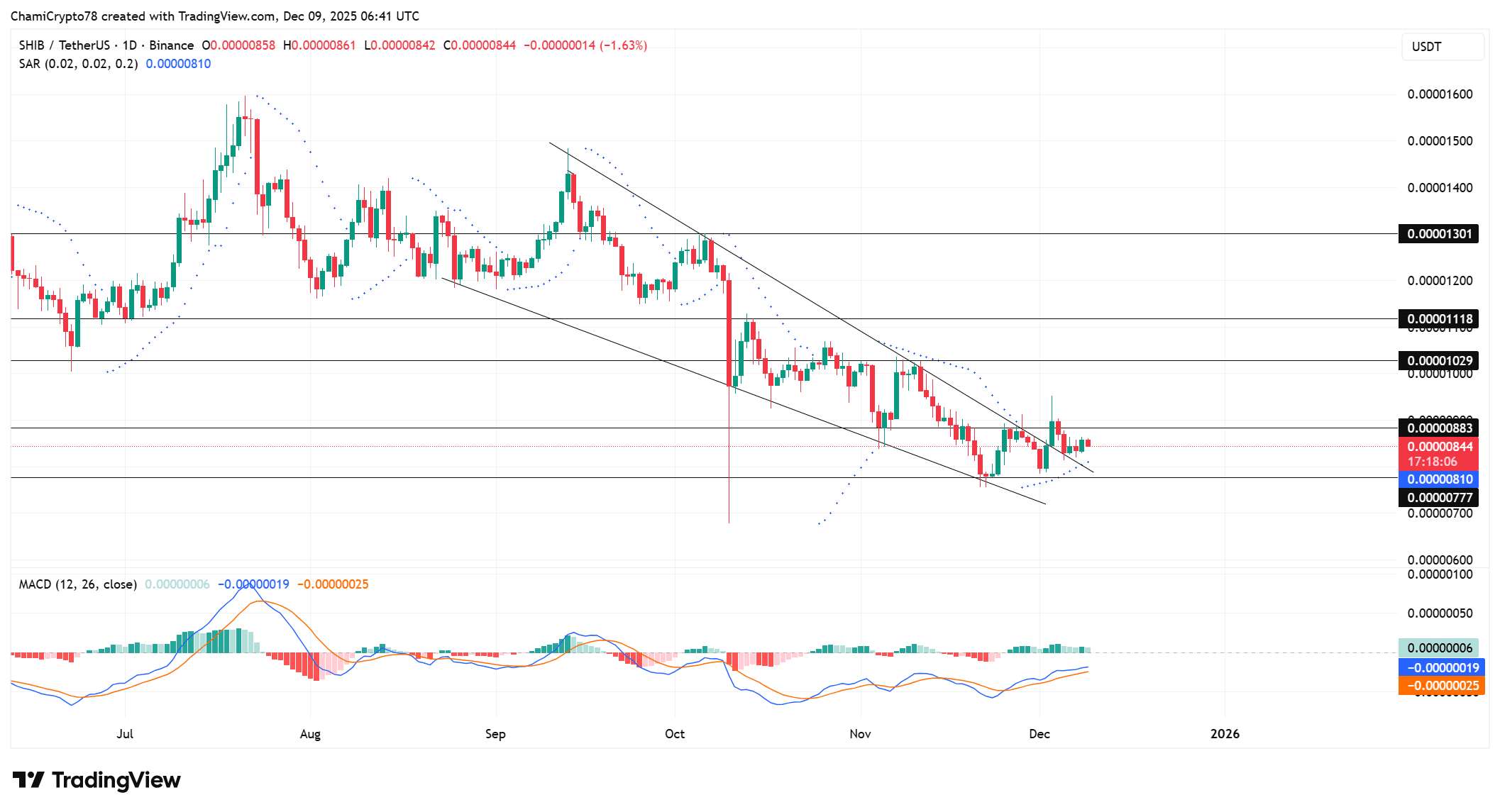

Shiba Inu recently broke out from a falling wedge pattern and is now retesting the upper boundary, a critical validation point for buyers. This breakout followed weeks of price compression, testing whether large traders will defend the shift at around $0.00000883, a level where price has reacted multiple times. According to TradingView charts, the MACD indicator on the daily timeframe has tilted upward, with the histogram expanding positively, which often precedes clearer upside momentum. However, SHIB’s price remains confined in a narrow band, favoring continuation only if buyers secure this retest zone. In historical patterns, successful defenses of such boundaries have led to sustained rallies, as seen in prior cycles where buy-side pressure absorbed dips effectively. This setup underscores the importance of volume confirmation to differentiate genuine breakouts from false signals.

Source: TradingView

Shiba Inu CVD Confirms Aggressive Buy-Side Absorption

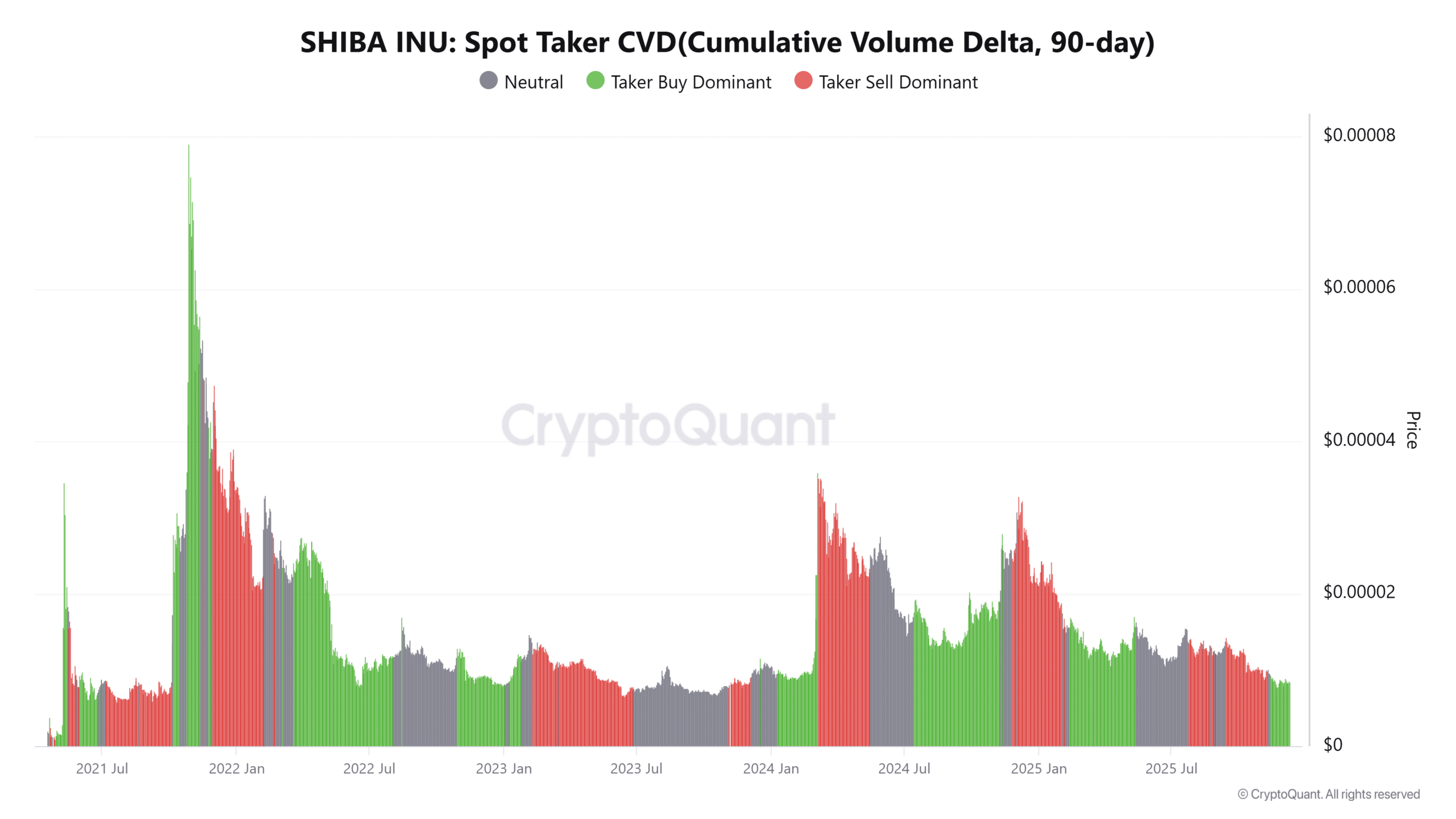

The Cumulative Volume Delta (CVD) for Shiba Inu spot takers over a 90-day window highlights sustained buyer dominance, reinforcing the strength behind recent price bounces. CryptoQuant data reveals that buyers have consistently absorbed dips, preventing deeper corrections and establishing a short-term base amid intraday pressures. This buy-side persistence, combined with the whale activity surge, points to early accumulation phases where large traders scale in gradually without rapid rotations out of positions.

Moreover, such CVD trends during compressed volatility often precede directional moves, as they demonstrate reliable demand. For SHIB, this indicator now stands as a key pillar, especially as volatility builds and price tests structural zones. Analysts note that when CVD aligns with technical breakouts, it enhances the probability of trend continuation, with historical data showing similar patterns leading to 15-20% gains in analogous setups.

Source: CryptoQuant

Burn Rate Spikes as Supply Pressure Drops in Shiba Inu

Shiba Inu’s burn rate has skyrocketed by over 1,244% in the last 24 hours, leading to a notable reduction in circulating supply and tightening market conditions. While burns alone do not ensure price appreciation, they gain significance when paired with rising whale activity and positive CVD, as these factors collectively build a scarcity narrative that supports demand. This recent spike aligns perfectly with SHIB’s bullish technical structure, potentially amplifying short-term price responsiveness.

Historically, SHIB burns have contributed to supply deflation, with over 410 trillion tokens removed since inception, per on-chain records. The timing here suggests strategic efforts by the community to enhance token utility amid growing interest. Experts from blockchain analytics firms emphasize that such events, when synchronized with accumulation signals, can lead to sustained upward pressure, though long-term effects hinge on broader market adoption and continued trend confirmation.

Why Has Shiba Inu’s Funding Rate Turned Positive?

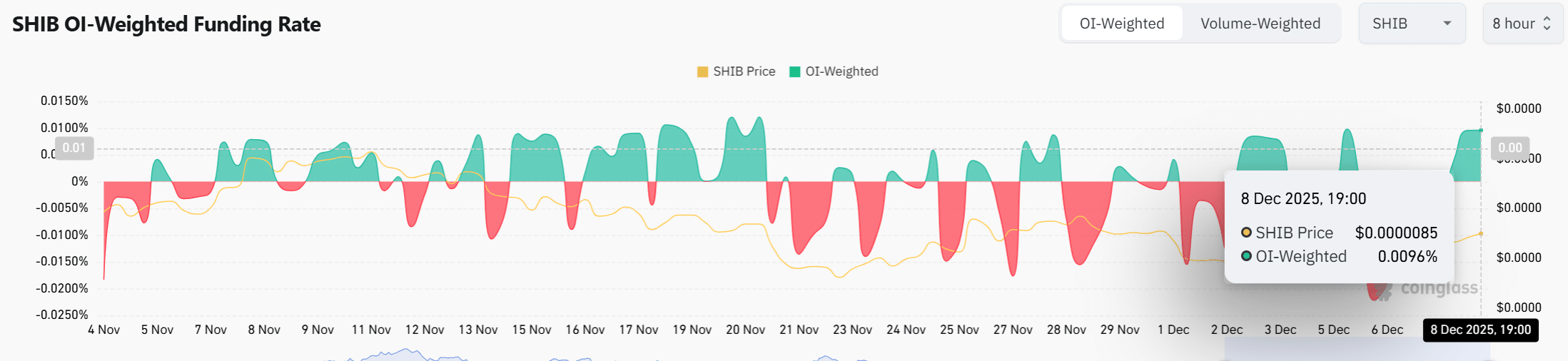

Funding rates for Shiba Inu have flipped positive according to CoinGlass metrics, indicating growing conviction among long-position traders as SHIB maintains its breakout structure. This shift follows earlier hesitation, with the OI-weighted funding rate rising while price holds above key support lines. Liquidation heatmaps cluster around $0.0000084 and $0.00000886, zones prone to volatility as markets seek liquidity. Although positive funding can heighten risks for over-leveraged positions, the current alignment between spot and derivatives sentiment provides a constructive backdrop for potential extensions higher. In practice, this convergence often signals the early phases of bullish cycles, where perpetual traders reinforce spot demand.

Source: CoinGlass

Frequently Asked Questions

What Impact Does the Recent Shiba Inu Whale Activity Have on Price?

The surge in Shiba Inu whale activity, with 406 transfers over $100k and 1.06 trillion SHIB inflows, indicates large holders are repositioning for potential upside. This often precedes rallies as it reflects confidence in underlying demand, though confirmation above the retest zone at $0.00000883 is needed to solidify bullish momentum.

Is Shiba Inu’s Burn Rate Increase a Sign of Long-Term Growth?

Yes, the 1,244% burn rate jump reduces circulating supply, enhancing scarcity when combined with whale accumulation and positive funding. While not a guarantee, historical patterns show such events supporting price stability and growth during favorable market conditions, fostering community-driven value appreciation over time.

Key Takeaways

- Whale Activity Surge: 406 large transactions signal repositioning, with inflows hinting at accumulation amid technical breakouts.

- Technical Confirmation: Retest of the falling wedge upper boundary at $0.00000883 is crucial, supported by upward MACD for momentum shift.

- Supply and Sentiment Boost: Burn rate up 1,244% and positive funding rates strengthen the bullish case, urging traders to monitor defense of key zones.

Conclusion

In summary, recent Shiba Inu whale activity and aligned metrics like CVD absorption, burn rate spikes, and positive funding rates position SHIB for potential extension if the retest zone holds. These factors, drawn from on-chain data by Santiment and CryptoQuant, highlight a constructive market structure amid volatility. As large holders demonstrate conviction, investors should watch for confirmation above resistance, staying attuned to evolving crypto dynamics for informed decisions.

Comments

Other Articles

Shiba Inu Trades Near Support in Tight Range, BTC and ETH Ratios Signal Positioning

December 11, 2025 at 11:10 PM UTC

Shiba Inu Burn Rate Spikes 1,822%: SHIB Eyes Potential Breakout Amid Rising Momentum

December 3, 2025 at 10:13 PM UTC

Binance UNI Inflows Signal Potential Selling as Altcoins Like SHIB See Outflows

November 26, 2025 at 07:31 AM UTC