Solana ETF TSOL Attracts $5.7M Inflows as Whales Accumulate, Hinting at Price Reversal

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

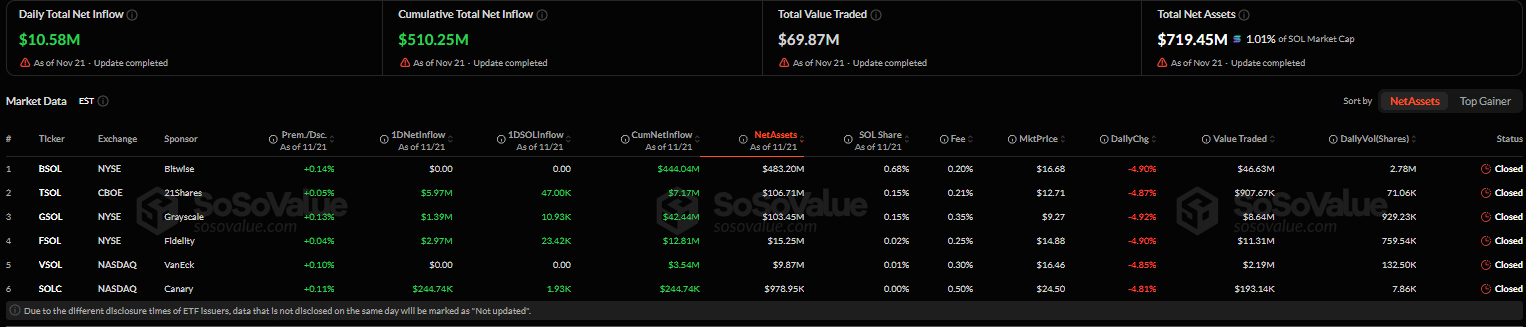

The 21Shares Solana ETF (TSOL) led inflows with $5.7 million in the last 24 hours, outpacing other Solana spot ETFs and boosting total daily inflows to $10.58 million. This surge reflects growing institutional interest in Solana amid its price stability around the $120 support level.

-

TSOL’s strong performance: Recorded the highest daily inflows since its November 20 launch, signaling investor preference for new funds.

-

Institutional rotation: Investors are shifting to freshly listed Solana ETFs for enhanced exposure to the asset.

-

Price implications: Solana’s $120 demand zone holds firm, supported by rising whale accumulation, potentially targeting $170 resistance with 15% upside potential based on recent patterns.

Discover the latest Solana ETF inflows as TSOL surges with $5.7M, driving institutional demand. Explore price analysis and whale activity for bullish signals—stay ahead in crypto investments today.

What Are the Latest Solana ETF Inflows?

Solana ETF inflows have shown robust growth, with the 21Shares TSOL ETF leading the pack by attracting $5.7 million in a single day following its debut on November 20. This figure surpassed other Solana spot ETFs, contributing to cumulative daily inflows reaching $10.58 million and underscoring renewed institutional enthusiasm for the Solana ecosystem. The momentum highlights how new listings are drawing capital rotations for better market access.

How Is Whale Activity Influencing Solana’s Market?

Whale accumulation in Solana has intensified, with large holders adding to their positions despite recent price dips, as evidenced by increased spot market order sizes tracked by CryptoQuant. This trend aligns with broader institutional buying over recent weeks, bolstering confidence in a potential reversal. Short sentences reveal key insights: average order sizes have risen notably, indicating strategic accumulation at current levels. Data from TradingView further shows Solana’s price reacting positively to the $120 support, where buying pressure has prevented further declines. Experts note that such whale movements often precede retail participation, amplifying upward momentum. According to CryptoQuant analytics, long-term holders have not reduced their stakes, maintaining over 70% of supply in dormant wallets, which supports network stability and growth prospects.

Source: SoSoValue

TSOL’s position as the top performer among Solana spot ETFs stems from its recent launch, attracting investors seeking fresh avenues for exposure to SOL. This shift is evident as capital moves from established funds to newer ones offering potentially lower fees or innovative structures. Meanwhile, Solana’s price has stabilized around the crucial $120 demand zone, a level that has repeatedly drawn buyers during corrections. According to TradingView charts, this support has held through multiple tests, with volume spikes confirming its strength. If breached, downside risks could emerge toward $100, but current patterns suggest resilience.

Source: TradingView

The broader market dynamics for Solana are bolstered by heightened whale participation on spot exchanges. Data from CryptoQuant indicates a surge in average order sizes, pointing to large-scale buying that counters selling pressure. Long-term holders, who control a significant portion of SOL supply, have ramped up acquisitions at these levels, viewing the dip as an entry point. This accumulation phase mirrors patterns seen in previous cycles, where institutional moves paved the way for recoveries. Retail investors typically follow suit, potentially accelerating any upward shift. Overall, these factors contribute to a cautiously optimistic outlook, with metrics like on-chain activity remaining elevated despite price consolidation.

Source: CryptoQuant

In assessing whether these ETF inflows will propel Solana higher, the interplay of institutional demand and whale behavior stands out. TSOL’s debut success and total inflows signal sustained interest, yet price action requires confirmation above key moving averages for a clear bounce. Bears could test lower supports if broader market sentiment sours, but bullish indicators like rising accumulation suggest a reversal is plausible. Market observers from platforms like SoSoValue emphasize that ETF flows often correlate with price strength in the medium term, providing a foundation for growth.

Frequently Asked Questions

What Factors Are Driving TSOL’s High Inflows Among Solana ETFs?

TSOL’s $5.7 million inflows stem from its recent November 20 launch, attracting institutions rotating into new funds for optimized exposure. This outperforms other Solana ETFs, as per SoSoValue data, reflecting preferences for fresh listings amid Solana’s ecosystem appeal and price stability at $120.

Is Solana’s Price Poised for a Reversal Based on Current Whale Activity?

Yes, Solana’s price shows reversal potential as whales increase spot market accumulation, per CryptoQuant insights. The $120 support holds strong, with patterns indicating a push toward $170 if buying sustains, making it a natural fit for voice searches on crypto trends.

Key Takeaways

- TSOL Leads Inflows: The 21Shares Solana ETF saw $5.7 million in daily net inflows, topping all competitors and highlighting institutional shifts to new products.

- Bullish Price Support: Solana maintains integrity at the $120 demand zone, backed by TradingView analysis, setting up for possible gains to $170 amid volatility.

- Whale Accumulation Rises: Increased large-order activity from whales, as tracked by CryptoQuant, signals confidence and could draw retail interest for amplified momentum.

Conclusion

Solana ETF inflows, led by TSOL’s impressive $5.7 million daily surge, combined with whale accumulation and price stability at $120, paint a promising picture for institutional adoption. These developments underscore Solana’s resilience in the crypto landscape, supported by data from sources like SoSoValue and CryptoQuant. As metrics align bullishly, investors should monitor for breakout signals, positioning for potential upside in the coming weeks—explore Solana opportunities to capitalize on this momentum.