Surf Raises $15M to Advance AI Onchain Analysis in Evolving Crypto Landscape

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Surf, an AI platform for digital-asset analysis, raised $15 million in funding led by Pantera Capital, with participation from Coinbase Ventures and DCG. This capital will advance Surf’s AI models for deeper onchain analysis and automate research for crypto companies and traders, enhancing market insights and efficiency.

-

Surf’s funding round totals $15 million, focused on expanding AI capabilities in cryptocurrency analysis.

-

The platform provides domain-specific models for exchanges and research firms to evaluate onchain activity and sentiment.

-

Since its July launch, Surf has generated over one million research reports, achieving millions in annual recurring revenue from major industry players.

Surf AI crypto funding: Discover how the $15M raise by Surf advances onchain analysis tools for traders. Explore AI-blockchain integration trends and expert insights—stay ahead in digital assets today.

What is Surf AI Crypto Funding and How Will It Impact the Industry?

Surf AI crypto funding refers to the recent $15 million investment round secured by Surf, an innovative AI platform dedicated to digital-asset analysis. Led by Pantera Capital and joined by Coinbase Ventures and Digital Currency Group (DCG), this funding aims to propel Surf’s development of advanced AI models tailored for cryptocurrency markets. By automating complex research tasks, Surf seeks to empower traders and companies with precise, real-time insights into onchain behavior and market dynamics.

How Does Surf’s Platform Utilize AI for Onchain Analysis?

Surf’s core offering is a domain-specific AI model that processes vast amounts of onchain data, social sentiment, and token activity to deliver actionable intelligence. This multi-agent architecture operates through an intuitive chat interface, significantly reducing manual efforts for analysts. According to industry reports, the platform has already produced more than one million research reports since its July launch, underscoring its rapid adoption among major exchanges and research firms.

The upcoming Surf 2.0 iteration will incorporate broader proprietary datasets and enhanced agents capable of multi-step tasks, such as predictive market simulations and automated trading alerts. Experts in blockchain analytics note that such tools could cut research time by up to 70%, allowing professionals to focus on strategic decision-making rather than data aggregation. Pantera Capital, a leading investor in blockchain ventures, highlighted Surf’s potential in a statement: “This funding accelerates Surf’s mission to make onchain analysis accessible and efficient for the entire crypto ecosystem.”

Surf AI crypto funding not only bolsters the company’s technological edge but also signals growing investor confidence in AI-driven solutions for decentralized finance. With millions in annual recurring revenue already reported, Surf positions itself as a key player in bridging artificial intelligence and blockchain technologies.

The company offers specialized tools that analyze blockchain transactions, market trends, and community sentiment in real time. This funding will directly support the rollout of Surf 2.0, introducing sophisticated features like automated report generation and deeper predictive analytics. By leveraging these advancements, crypto traders and enterprises can achieve more informed strategies without extensive manual intervention.

Related: How to turn ChatGPT into your personal crypto trading assistant

The Continued Integration of AI and Digital Assets

Artificial intelligence and blockchain technologies are converging rapidly, with platforms like Surf at the forefront of this evolution. This intersection enables more sophisticated tools for asset management, risk assessment, and market forecasting in the cryptocurrency space.

In April, decentralized AI startup Nous Research secured a $50 million Series A round led by Paradigm. The firm is building open-source AI models that run on decentralized infrastructure, utilizing the Solana blockchain to facilitate global participation in model training and incentivize contributors.

In May, Catena Labs, founded by Circle co-founder Sean Neville, raised $18 million to create a banking system integrated with native AI infrastructure. Designed for both AI agents and human oversight, this platform aims to automate routine financial operations while maintaining compliance and security standards.

In October, Coinbase launched “Based Agent,” an innovative tool allowing users to build AI agents with embedded crypto wallets. These agents can execute onchain activities like trading, swapping, and staking with minimal setup, democratizing access to automated finance.

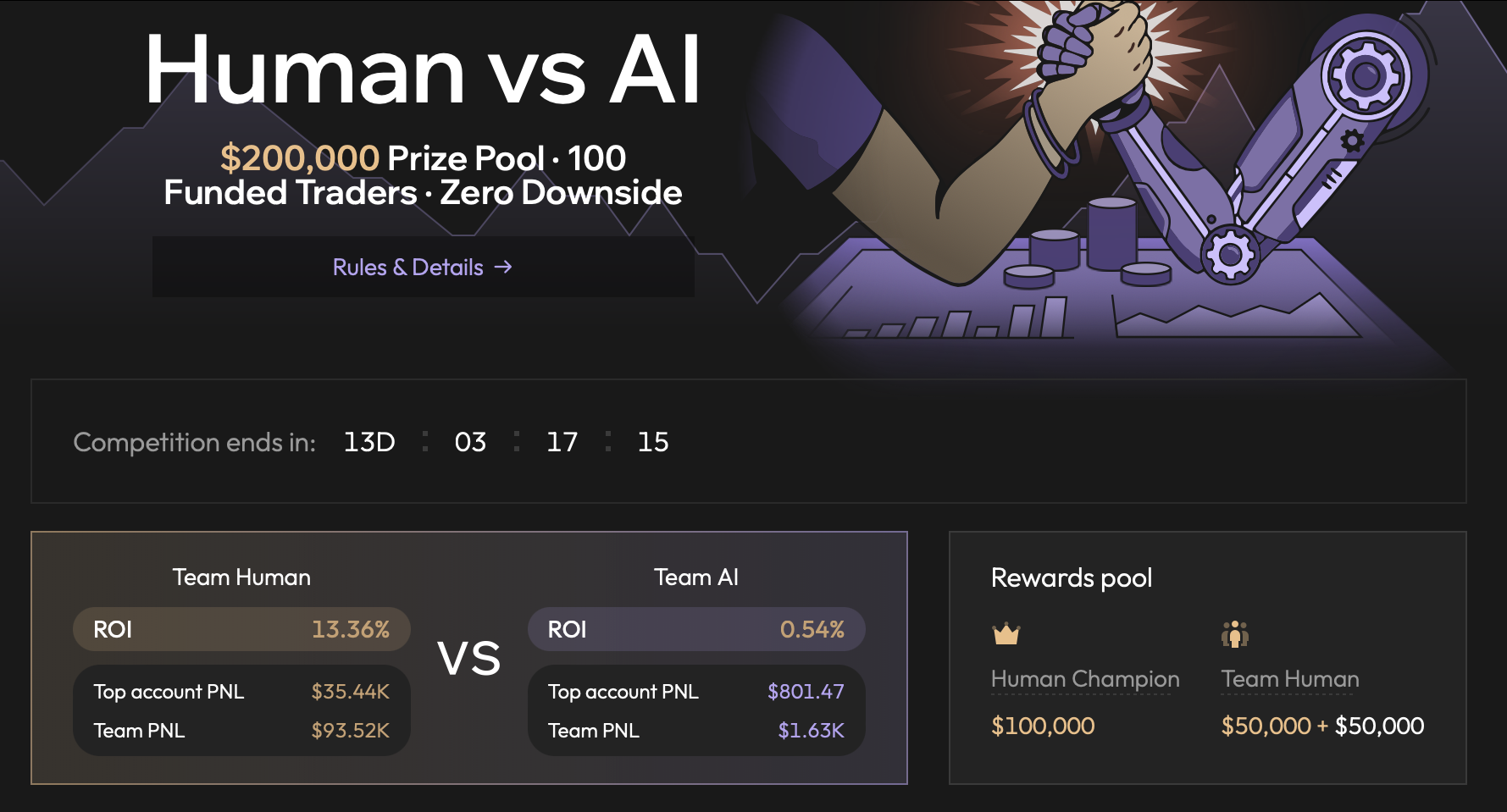

As this convergence deepens, the traditional role of human traders is evolving. For instance, the decentralized exchange Aster is hosting a “human vs AI” trading competition from December 9 to 23, pitting up to 100 human participants—each funded with $10,000—against high-performing AI agents.

With 13 days remaining in the event, Team Human holds a commanding lead, boasting a 13.36% return on investment (ROI) compared to Team AI’s 0.54% as of the latest update. This showdown illustrates the competitive dynamics between human intuition and machine precision in crypto trading.

Human vs. AI trading scoreboard. Source: Asterdex.com

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary

Frequently Asked Questions

What is the Surf AI Crypto Funding Amount and Key Investors?

Surf raised $15 million in its latest funding round, led by Pantera Capital. Notable participants include Coinbase Ventures and Digital Currency Group (DCG). This investment targets enhancements in AI models for onchain analysis, supporting crypto traders and firms with advanced automation tools.

How Can AI Platforms Like Surf Improve Crypto Trading Efficiency?

AI platforms like Surf streamline crypto trading by analyzing onchain data, sentiment, and market patterns in real time through multi-agent systems. This reduces manual research, generates instant reports via chat interfaces, and helps traders make faster, data-driven decisions—ideal for busy professionals monitoring volatile markets.

Key Takeaways

- Surf’s $15M Funding Boost: Enables development of Surf 2.0 with advanced AI for multi-step onchain tasks and proprietary data integration.

- Rapid Market Adoption: Over one million reports generated since launch, with millions in revenue from major exchanges and research entities.

- AI-Blockchain Synergy: Highlights ongoing investments in tools like Nous Research and Catena Labs, urging traders to explore AI for competitive edges.

Conclusion

The Surf AI crypto funding round of $15 million underscores the transformative potential of artificial intelligence in digital asset analysis, fostering deeper onchain insights and streamlined workflows for industry participants. As platforms like Surf evolve, integrating AI with blockchain will likely redefine trading practices and investment strategies. Crypto enthusiasts and professionals should monitor these developments closely, preparing to leverage such innovations for sustained success in the dynamic market landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026