Surging Fed Rate Cut Odds Fuel Bitcoin Price Bottom Speculation

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Surging odds of a Federal Reserve rate cut in December, now at 69.40%, have boosted optimism among Bitcoin holders, potentially signaling a price bottom for BTC at around $85,071 amid a 10.11% weekly decline.

-

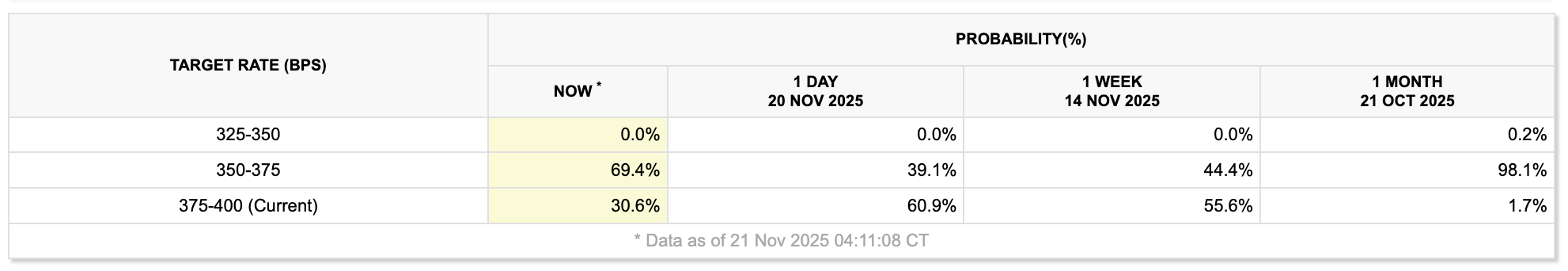

Rate cut odds doubled to 69.40% on Friday, up from 39.10% the previous day, per CME FedWatch Tool data.

-

Dovish comments from New York Fed President John Williams contributed to the shift, emphasizing near-term rate reductions without inflation risks.

-

Bitcoin’s current price stands at $85,071, reflecting a 10.11% drop over the past seven days, according to CoinMarketCap statistics.

Discover how rising Fed rate cut odds could stabilize Bitcoin’s price at $85,071. Explore expert insights and market reactions in this analysis—stay informed on BTC trends today.

What Impact Do Surging Fed Rate Cut Odds Have on Bitcoin’s Price?

Fed rate cut odds for December have nearly doubled to 69.40%, sparking renewed optimism among Bitcoin investors who see this as a potential catalyst to halt the cryptocurrency’s recent decline. Trading at $85,071 after a 10.11% drop over the past week, per CoinMarketCap, Bitcoin could find a temporary price bottom if these expectations materialize. Analysts note that lower interest rates typically favor risk assets like BTC by making traditional investments less appealing.

The odds of a US Federal Reserve rate cut jumped 30.30% on Friday. Source: CME Group

How Have Recent Fed Comments Influenced Market Sentiment?

New York Federal Reserve President John Williams recently indicated that the central bank could implement rate cuts in the near term without compromising its 2% inflation target, a statement that partly drove the sharp increase in cut probabilities. Bloomberg analyst Joe Weisenthal highlighted this as a key factor behind the “massively increased” odds. However, economist Mohamed El-Erian cautioned against overreacting, urging a balanced view amid ongoing economic uncertainties. In the crypto space, this dovish tone has shifted sentiment from fear to cautious hope, with the Crypto Fear & Greed Index registering an “Extreme Fear” score of 14 on Friday, signaling widespread market anxiety despite the positive signals.

The broader implications for Bitcoin stem from the transition from a tightening to an easing monetary policy environment. Lower rates reduce the yield on safe-haven assets like bonds, prompting investors to seek higher returns in volatile markets such as cryptocurrencies. Crypto analyst Moritz observed on social media that this development might be “enough to find a bottom here for now,” reflecting a common view among Bitcoin enthusiasts. Historical patterns support this outlook; during previous easing cycles, Bitcoin has often experienced upward momentum as liquidity improves.

Despite the optimism, challenges persist. Bitcoin’s price has faced headwinds from broader market weakness, including ETF outflows described by analysts as “tactical rebalancing” rather than a full institutional exit. Coinbase Institutional’s analysis points to mispriced odds, suggesting that recent tariff studies, private market data, and real-time inflation metrics indicate a stronger case for cuts than currently reflected. Since the October FOMC meeting, futures markets had leaned toward maintaining rates due to inflation worries, but short-term effects of policy changes like tariffs could dampen demand and ease price pressures, potentially aligning with rate reduction expectations.

Frequently Asked Questions

What Are the Current Odds of a Fed Rate Cut in December and How Do They Affect Bitcoin?

The odds of a Federal Reserve rate cut in December stand at 69.40% as of Friday, nearly double the 39.10% from the prior day, according to the CME FedWatch Tool. For Bitcoin, this increases liquidity and attractiveness as a risk asset, potentially supporting a price stabilization around $85,071 after recent declines.

Why Is the Crypto Market Experiencing Extreme Fear Despite Positive Fed Signals?

The Crypto Fear & Greed Index hit an “Extreme Fear” level of 14 on Friday due to Bitcoin’s 10.11% weekly drop and ongoing volatility. However, dovish Fed remarks are gradually countering this sentiment, as lower rates historically boost crypto investments by diverting capital from low-yield traditional options.

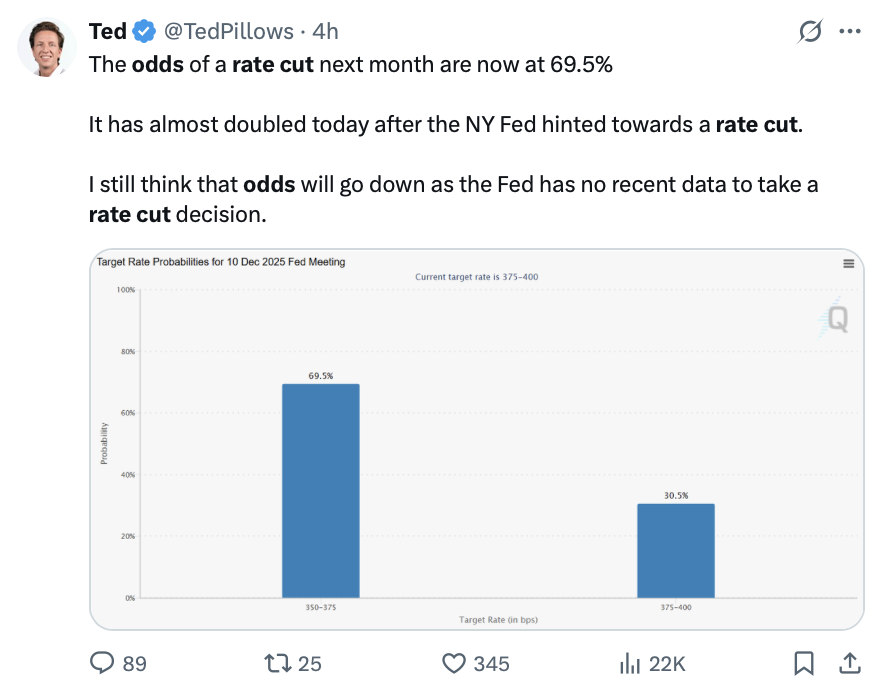

Source: Ted

Crypto analysts remain divided but increasingly bullish. Mister Crypto noted on social media that such developments are “usually bullish” for assets like Bitcoin. Jesse Eckel echoed this, describing the overall setup as “unfathomably bullish” amid the shift to an easing cycle, questioning why prices continue to dip. Similarly, analyst Curb predicted a “massive rally” for crypto if rate cuts proceed. These views underscore the interplay between macroeconomic policy and cryptocurrency performance.

Looking at institutional perspectives, Coinbase Institutional emphasized in a recent update that markets may be underestimating cut probabilities. Their assessment incorporates tariff impact research showing potential for reduced inflation and higher unemployment in the short term, akin to negative demand shocks that could prompt Fed action. This contrasts with post-October FOMC futures pricing, which favored holding rates steady amid inflation concerns.

Bitcoin’s resilience in past rate cut environments provides context. During the 2019 easing cycle, BTC surged over 90% as the Fed lowered rates three times. Current conditions, while different, share similarities in policy pivots that enhance risk appetite. Yet, the market’s “Extreme Fear” reading highlights the need for caution; sentiment indices like this one, which aggregate volatility, volume, and social media trends, often precede rebounds but can prolong downturns if external shocks occur.

Expert quotes further illustrate the divide. John Williams’ assurance of sustainable cuts bolsters confidence, while El-Erian’s warning promotes prudence. In the crypto community, voices like Moritz and Eckel represent a groundswell of optimism, grounded in the mechanics of monetary policy influencing asset allocation.

Key Takeaways

- Fed Rate Cut Odds Surge: Probability jumped to 69.40% for December, driven by dovish Fed comments, potentially aiding Bitcoin’s recovery from $85,071 lows.

- Market Sentiment Shift: From “Extreme Fear” at 14 on the Fear & Greed Index, analysts see bullish setups as easing cycles favor crypto over traditional yields.

- Cautious Optimism: While experts predict rallies, monitor inflation data and FOMC decisions for confirmation before increasing BTC exposure.

Conclusion

The surge in Fed rate cut odds to 69.40% has injected fresh hope into the Bitcoin market, potentially marking a price bottom at $85,071 amid broader crypto sentiment challenges. As analysts highlight the bullish transition to an easing cycle, investors should weigh dovish signals against persistent fears. With upcoming FOMC meetings on the horizon, staying attuned to policy shifts will be crucial for navigating Bitcoin’s path forward—consider diversifying portfolios to capture emerging opportunities in this evolving landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC