TAO Momentum Builds Quietly in Descending Channel Amid Rising Activity

TAO/USDT

$156,159,744.33

$181.60 / $165.60

Change: $16.00 (9.66%)

+0.0031%

Longs pay

Contents

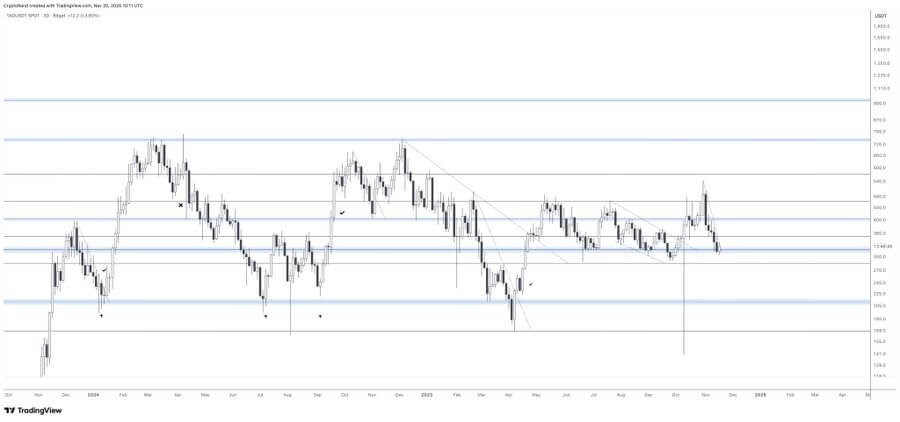

Bittensor’s TAO token shows building momentum as it tests a key downtrend line in a descending channel, with rising liquidity, trading volume, and user interest from over 168,000 trackers indicating steady growth potential without sharp volatility.

-

TAO maintains steady trades within a descending channel, approaching resistance with controlled price swings.

-

Rising market activity reflects stable liquidity and strong engagement from more than 168,000 users tracking the asset.

-

Technical analysis reveals compression patterns near long-term support and resistance, with 24-hour volume at $205.4 million and a market cap of $3.13 billion.

Discover how Bittensor TAO price momentum builds in a descending channel amid rising volume and user tracking. Stay informed on key support levels for potential breakouts—explore the latest crypto trends now.

What is Driving the Current TAO Momentum in Bittensor’s Token?

TAO momentum in Bittensor’s native token is building steadily as it navigates a descending channel on the 4-hour chart, showing controlled price action toward resistance. Market indicators point to increasing liquidity and volume, with over 168,000 users actively tracking the asset, signaling growing interest. This structured movement suggests potential for a measured breakout without abrupt volatility.

How Does the Descending Channel Influence TAO Price Behavior?

The descending channel for TAO has formed since late October, characterized by clear lower highs and lower lows that guide price swings. Analysis from Captain Faibik highlights a balanced spacing of candles within the channel, with the token climbing from support toward the upper boundary. A projected 11.5% measured move above resistance could emerge if the structure breaks upward, based on recent chart patterns. Coingecko reports confirm this stability, with TAO trading at $326.45, up 1.6% in the last 24 hours, and volume reaching $205.4 million. The asset’s market cap stands at $3.13 billion, supported by a circulating supply of 9,597,491 tokens out of a total 21 million, underscoring its fixed-supply model.

Don’t sleep on $TAO..

Momentum is building quietly.. ⌛️#Crypto #TAO #TAOUSDT pic.twitter.com/5y7Ad7KUbo— Captain Faibik 🐺 (@CryptoFaibik) November 20, 2025

Green projection zones on charts mark potential upside targets, aligning with the TAO/USDT pair’s 4-hour timeframe. This setup reflects disciplined market behavior, as liquidity remains steady and user tracking exceeds 168,000, per platform data. Experts note that such channels often precede consolidations or directional shifts, emphasizing the importance of monitoring boundary tests for entry points.

Recent 24-hour trading ranged from $305.90 to $331.60, illustrating the channel’s bounding effect. The fully diluted valuation hits $6.85 billion, reinforcing TAO’s position in the AI-driven crypto sector. Analysts from platforms like Coingecko emphasize that sustained volume growth, now at $205.4 million daily, supports this quiet momentum buildup.

Frequently Asked Questions

What Factors Are Contributing to TAO’s Rising User Tracking and Liquidity?

TAO’s user tracking has surpassed 168,000, driven by Bittensor’s innovative AI network features and steady market performance. Liquidity remains stable within the descending channel, with 24-hour volume at $205.4 million, attracting traders seeking low-volatility opportunities. This combination of technological appeal and technical stability fosters broader adoption, as reported in recent market analyses.

Is TAO Approaching a Key Breakout Point in Its Price Channel?

Yes, TAO is testing the upper resistance of its descending channel after bouncing from long-term support, forming a compression pattern over months. If it surpasses this level, a projected 11.5% upside could follow, based on measured moves from chart data. This natural progression suits voice searches on crypto trends, highlighting controlled momentum for potential gains.

Key Takeaways

- Stable Channel Trading: TAO’s price respects the descending channel’s boundaries, showing balanced momentum without erratic swings.

- Growing Market Metrics: With $205.4 million in volume and $3.13 billion market cap, activity levels support sustained interest from over 168,000 users.

- Monitor Support Zones: Repeated interactions with horizontal levels suggest compression, offering insights for traders eyeing breakouts or consolidations.

Conclusion

In summary, TAO momentum continues to build within its descending channel structure, bolstered by rising liquidity, volume, and user engagement on platforms tracking Bittensor’s token. Key support and resistance zones have shaped months of stable behavior, positioning TAO for potential measured moves ahead. As market data from sources like Coingecko and analyst observations from Captain Faibik and CryptoRand indicate, staying attuned to these patterns could reveal timely opportunities—consider reviewing your portfolio strategies in this evolving crypto landscape.

Support Interaction and Range Behavior Across Months

TAO’s price has interacted repeatedly with established horizontal support and resistance zones, forming a multi-month range that influences current swings. CryptoRand notes that the token is “squeezing against the downtrend resistance while bouncing over the main support,” highlighting compression near these blue-marked levels. This behavior underscores long-term stability, with sharp wicks during volatility tests reinforcing the range’s reliability.

Consolidation phases dominate the chart, with price hovering in midrange areas before approaching boundaries. The latest action targets the lower support zone, mirroring prior bounces and setting up renewed compression. Overall, TAO’s range behavior reflects disciplined market dynamics, aligning with broader trends in AI-focused cryptocurrencies. Expert commentary from CryptoRand emphasizes these zones’ role in guiding future momentum, providing a factual basis for informed trading decisions. As activity rises, the token’s fixed supply and growing adoption continue to underpin its value proposition in the sector.