Tokenized US Treasurys Grow to $7 Billion Market, Led by BlackRock’s BUIDL

ONDO/USDT

$52,680,768.32

$0.2587 / $0.2398

Change: $0.0189 (7.88%)

-0.0016%

Shorts pay

Contents

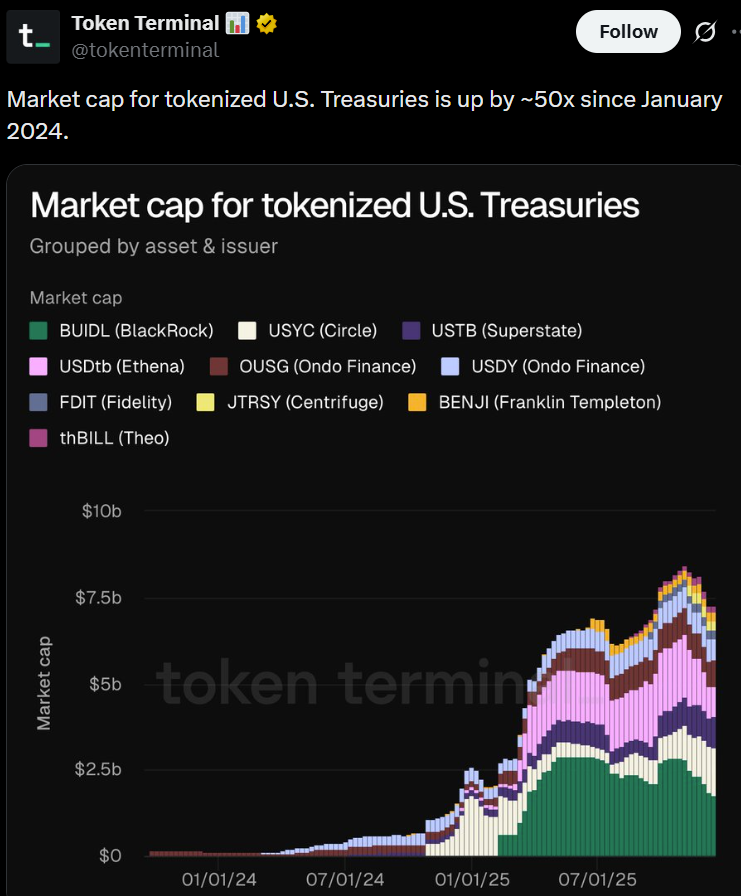

Tokenized US Treasurys represent a rapidly expanding segment of the real-world asset market, growing from under $200 million to nearly $7 billion in market capitalization since January 2024. This surge highlights institutional interest in secure, on-chain yield opportunities backed by US government debt.

-

Tokenized US Treasurys offer blockchain-based access to short-term government securities, combining safety with efficient settlement.

-

Leading products like BlackRock’s BUIDL fund have attracted billions in assets, driving mainstream adoption.

-

Market data indicates 50x growth in under two years, fueled by demand for low-risk on-chain yields amid rising interest rates.

Discover how tokenized US Treasurys are transforming institutional finance with $7B market cap growth. Explore key products and benefits for secure on-chain yields today.

What Are Tokenized US Treasurys?

Tokenized US Treasurys are digital representations of short-term US government debt instruments issued on blockchain networks, enabling seamless on-chain trading and yield generation. These tokens provide investors with exposure to the safety of US Treasurys while leveraging blockchain for faster settlement and transparency. As of late 2025, their market has seen explosive growth, reflecting broader institutional confidence in tokenized real-world assets.

The concept involves converting traditional Treasury bills into blockchain-compatible tokens through regulated structures. This allows institutions to hold and transact these assets digitally, reducing intermediary costs and improving liquidity. Data from market analytics platforms like Token Terminal underscores this trend, showing a dramatic increase in adoption.

Source: Token Terminal

At the forefront is BlackRock’s USD Institutional Digital Liquidity Fund, known as BUIDL, which focuses on short-term US Treasurys. This fund has accumulated nearly $2 billion in assets under management by offering daily yield accrual and blockchain settlement. Other notable entrants include Circle’s USD Coin Yield, Superstate’s US Treasury Bill Token, and Ondo Finance’s Short-Term US Government Bond Fund, each providing tokenized access to government-backed debt.

These products operate within compliant frameworks, ensuring they meet regulatory standards while bridging traditional finance with decentralized systems. The appeal lies in their low-risk profile, as US Treasurys are considered among the safest investments globally, backed by the full faith and credit of the US government.

How Do Tokenized US Treasurys Facilitate Institutional DeFi Access?

Tokenized US Treasurys serve as a secure entry point into decentralized finance (DeFi) for institutions, offering collateral for lending protocols and margin trading without exposing users to higher-risk crypto assets. Their government backing minimizes counterparty risk, making them ideal for capital-efficient operations in on-chain environments.

Analytics from RedStone indicate that tokenized Treasurys have paralleled the growth of other real-world assets like private credit, where yields often surpass traditional fixed-income options. For instance, institutions can use these tokens for settlement in cross-border transactions, reducing delays associated with legacy systems. DBS Bank, a major Southeast Asian lender, has piloted similar tokenized government securities to enhance collateral management, demonstrating practical applications in real-world banking.

Experts in the field emphasize the efficiency gains. As noted by industry observers, tokenized Treasurys enable 24/7 accessibility and atomic settlement, which traditional markets cannot match. Supporting data shows that adoption has accelerated with rising interest rates, as investors seek stable yields in volatile crypto markets. This segment’s growth from under $200 million to $7 billion in less than two years, per Token Terminal metrics, validates its role as a cornerstone of on-chain finance.

Furthermore, these tokens integrate with DeFi platforms for yield farming and liquidity provision, allowing institutions to earn compounded returns. Regulatory clarity from bodies like the SEC has bolstered confidence, with funds structured as investment vehicles to comply with securities laws. This evolution positions tokenized US Treasurys as a bridge between Wall Street and blockchain, potentially unlocking trillions in traditional assets for digital ecosystems.

Frequently Asked Questions

What Is the Current Market Size of Tokenized US Treasurys?

The market capitalization of tokenized US Treasurys stands at approximately $7 billion as of late 2025, up from less than $200 million in January 2024. This 50x expansion is driven by institutional demand for secure on-chain yields, with products like BlackRock’s BUIDL leading the charge through regulated blockchain funds.

How Can Institutions Benefit from Tokenized US Treasurys in DeFi?

Institutions can use tokenized US Treasurys as low-risk collateral in DeFi protocols for lending, borrowing, and settlement, improving capital efficiency while maintaining exposure to stable government debt. This setup allows for instant transfers and yield accrual, spoken naturally as a reliable way to blend traditional safety with blockchain speed for everyday financial operations.

Key Takeaways

- Explosive Growth: Tokenized US Treasurys have surged 50x to $7 billion, signaling strong institutional adoption for on-chain yield.

- Leading Products: BlackRock’s BUIDL and similar funds offer regulated access to US debt, amassing billions in assets.

- DeFi Integration: These tokens enable efficient collateral use, bridging traditional finance with blockchain for enhanced liquidity.

Conclusion

Tokenized US Treasurys have solidified their position as a pivotal element in the real-world asset landscape, with a $7 billion market cap reflecting institutional demand for secure, blockchain-enabled yields. As products like BUIDL and OUSG continue to innovate, they pave the way for broader tokenization of fixed-income instruments. Looking ahead, this trend promises greater efficiency in global finance—explore these opportunities to stay ahead in the evolving on-chain economy.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026