Trend Research Shorts AAVE ETH Position

AAVE/USDT

$252,005,252.94

$124.25 / $112.98

Change: $11.27 (9.98%)

+0.0031%

Longs pay

Contents

Trend Research Reduced ETH Risk on AAVE

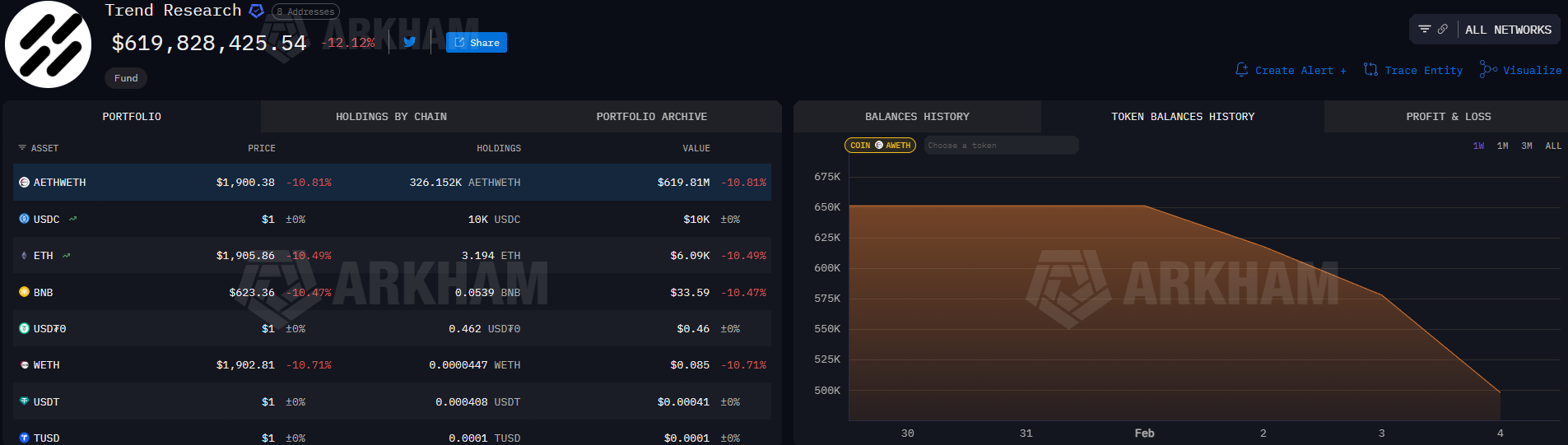

Ethereum investment vehicle Trend Research significantly reduced its Ether (ETH) position due to the market crash and sold assets to pay off debts. On Sunday, Aave held approximately 651,170 ETH as Ethereum wrapped Ether (AETHWETH); this amount dropped to 247,080 ETH on Friday. Since the beginning of the month, it transferred 411,075 ETH to the Binance exchange (AAVE detailed analysis) (Arkham data).

Trend Research, WETH token balance history, one-week chart. Source: Arkham

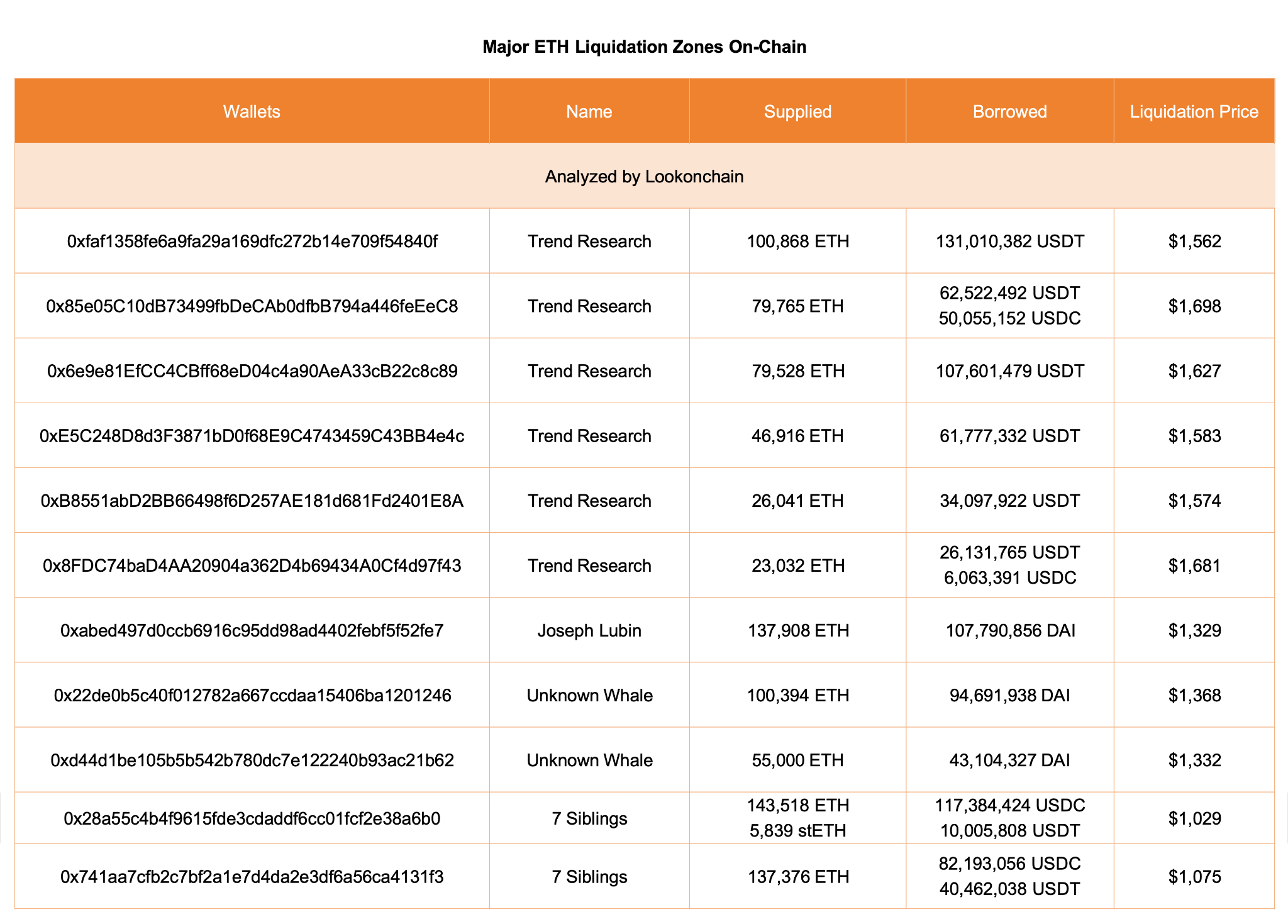

ETH price fell 30% in the last week to 1,748 dollars (CoinMarketCap); at the time of writing, it was trading at 1,967 dollars. The company is linked to Jack Yi, founder of Hong Kong-based Liquid Capital, with ETH liquidation levels between 1,698 and 1,562 dollars (Lookonchain).

Trend Research liquidation levels. Source: Lookonchain

Yi acknowledged that his market bottom prediction was early but stated it remains bullish and he will manage risks. Trend Research attracted attention with aggressive ETH accumulation after the 19 billion dollar liquidation in October 2025. This move increased liquidity pressure on the Aave protocol.

AAVE Technical Outlook and Support Levels

AAVE is currently trading at 108.22 dollars, down 7.83% in 24 hours. RSI 28.88 (Oversold), showing downtrend and bearish Supertrend signal. EMA 20: 137.93$. Supports: S1 92.25$ (strong, 14.76% distance), S2 100.97$. Resistances: R1 108.76$ (close), R2 126.36$. AAVE futures may increase volatility.

- RSI: 28.88 (Oversold)

- Support S1: 92.25$ (⭐ Strong)

- Resistance R1: 108.76$ (⭐ Strong)

Impact of ETH Crash on AAVE

Vitalik Buterin's vision update for L2s increased uncertainty in the Ethereum ecosystem. DeFi protocols like Aave are directly affected by ETH volatility.