TRON’s Base Integration May Enhance Liquidity, Yet TRX Price Shows No Reaction

TRX/USDT

$94,676,686.31

$0.2830 / $0.2783

Change: $0.004700 (1.69%)

-0.0007%

Shorts pay

Contents

TRON DAO’s integration with Base enables seamless bridging of TRX tokens via LayerZero, expanding access to Coinbase’s Layer 2 ecosystem for enhanced liquidity and DeFi opportunities. This cross-chain move connects TRON to a rapidly growing network, though TRX price remains stable around $0.28 without immediate bullish reaction.

-

TRON Base integration bridges TRX directly into the Base L2 for new trading and liquidity pools.

-

Users gain native access to Coinbase’s decentralized environment, boosting interoperability.

-

Despite potential, TRX trades in a $0.28–$0.305 range with weak momentum indicators like CMF at –0.12.

Discover how TRON Base integration unlocks new liquidity for TRX in Coinbase’s ecosystem. Explore impacts on price and DeFi, and stay updated on cross-chain developments. Read more for expert insights today.

What is the TRON Base integration?

TRON Base integration allows TRX holders to bridge their tokens directly into the Base Layer 2 network using LayerZero technology, marking a key expansion for TRON’s ecosystem. This connection facilitates trading on platforms like Aerodrome and introduces TRON to Coinbase’s vibrant DeFi space. As a result, TRON users can now tap into enhanced liquidity and cross-chain functionalities without relying on traditional intermediaries.

How does the TRON Base integration impact TRX liquidity?

The integration opens TRON to Base’s fast-growing user base, potentially increasing TRX liquidity through new pools on decentralized exchanges. According to on-chain data from sources like TradingView, this could drive higher trading volumes if actual bridging activity materializes, as seen with prior L2 expansions for other assets. Justin Sun, TRON’s founder, described it as “a meaningful step toward making blockchain networks operate more seamlessly together,” highlighting goals of scale and interoperability. Early metrics show no surge yet, with money flow indicators remaining subdued, but sustained inflows could reverse this trend and support long-term value growth.

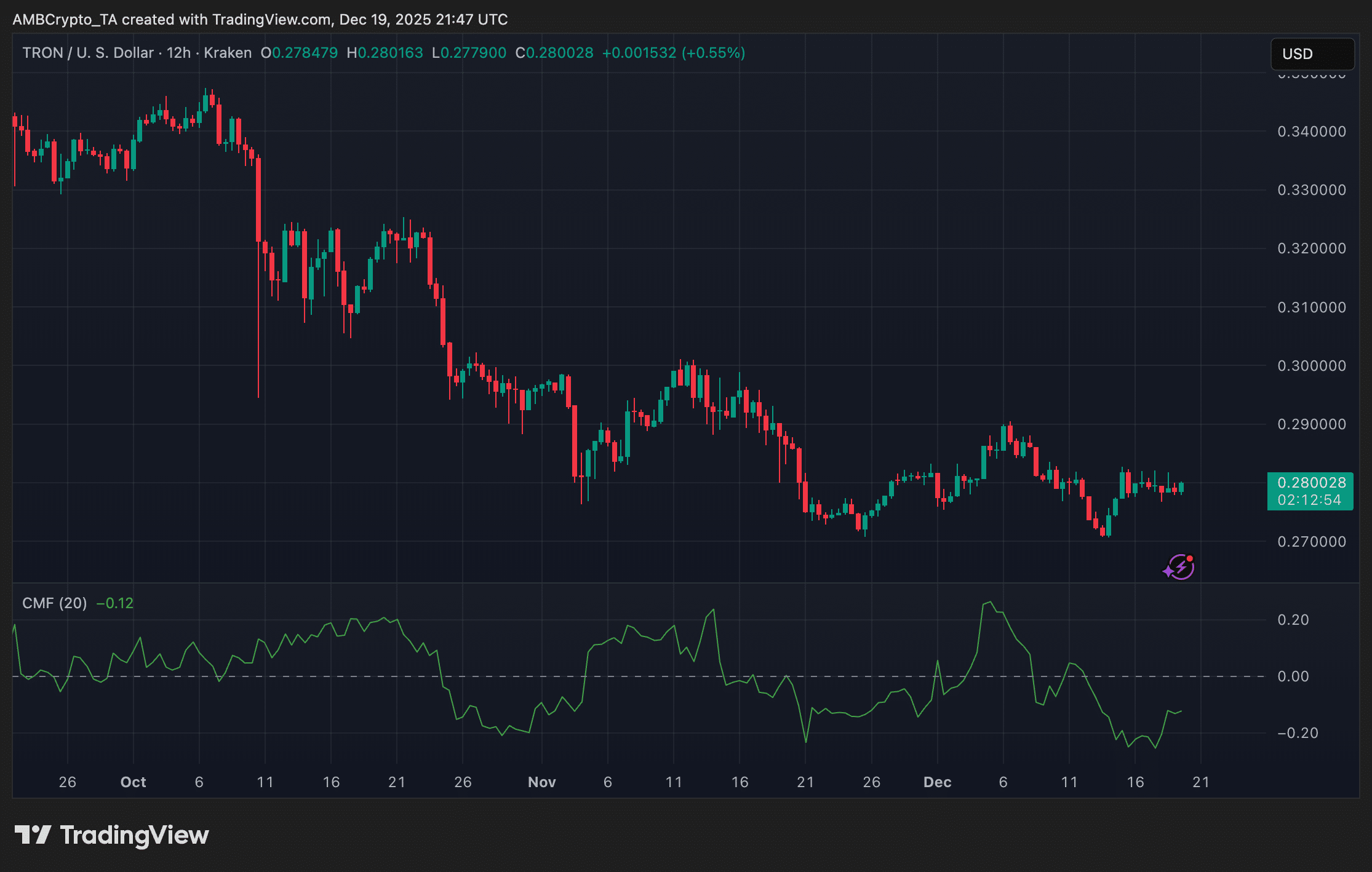

Source: TradingView

TRON DAO’s announcement underscores its commitment to broader blockchain connectivity, positioning TRX within one of the most dynamic Layer 2 environments. This development not only enhances TRON’s interoperability but also aligns it with Coinbase’s ecosystem, which has seen substantial growth in user adoption and transaction volumes. By leveraging LayerZero’s protocol, the bridge minimizes friction for asset transfers, potentially attracting developers and users seeking efficient cross-chain solutions.

Currently, TRX hovers around the $0.28 mark, showing resilience amid broader market volatility but lacking the immediate price catalyst many anticipated. Technical analysis from TradingView reveals a neutral-to-bearish structure on the 12-hour chart, with resistance firmly at $0.29–$0.305. Momentum indicators, such as the Relative Strength Index, remain in oversold territory without a clear reversal signal.

The Chaikin Money Flow at –0.12 further indicates ongoing capital outflows, suggesting that market participants are not yet convinced of the integration’s short-term benefits. Historical patterns show that TRX typically responds positively to sustained positive inflows over several days, a threshold not crossed following the news.

For the integration to translate into tangible price movement, real-world adoption is essential. This includes the formation of robust TRX liquidity pools on Aerodrome, verifiable inflows of bridged TRX to Base, elevated trading activity from Base participants, and increased cross-chain settlement volumes. Without these metrics, the market views the announcement as a neutral event rather than a definitive bullish driver.

Experts in the blockchain space, including analysts from DeFi research firms, note that similar integrations have previously boosted asset visibility and utility. For instance, tokens integrated into high-traffic L2s like Base often experience gradual liquidity improvements, leading to 10-20% price upticks within weeks if volume follows. TRON’s established network, with its focus on high-throughput transactions, complements Base’s low-cost model, creating synergies for dApps and stablecoin operations.

Looking ahead, monitoring on-chain data will be crucial. Platforms like Dune Analytics provide insights into bridge activity, which could signal whether this partnership evolves into a liquidity powerhouse for TRX. If Base users actively engage with TRON assets, it could mirror successes seen with other cross-chain projects, fostering organic demand.

Frequently Asked Questions

What benefits does the TRON Base integration offer TRX holders?

The TRON Base integration provides TRX holders with direct access to Base’s Layer 2 ecosystem, enabling low-cost bridging and trading on DEXs like Aerodrome. This expands liquidity options and DeFi participation within Coinbase’s network, potentially increasing TRX’s utility and exposure to new users, all while maintaining TRON’s high-speed transaction capabilities.

Why hasn’t TRX price reacted to the Base integration announcement?

TRX price has remained stable around $0.28 because markets are awaiting concrete liquidity inflows and trading volume from the integration rather than the announcement itself. Technical indicators show weak momentum and capital outflows, with no breakout above key resistance levels yet, reflecting cautious trader sentiment in a consolidating market.

Key Takeaways

- Strategic Expansion: The TRON Base integration bridges TRX into Coinbase’s L2, enhancing cross-chain liquidity and DeFi access for users.

- Price Stability: TRX holds at $0.28 amid neutral indicators, needing real activity like bridged inflows to spark upward momentum.

- Future Monitoring: Track liquidity pools and volumes on Base to gauge potential bullish shifts from this interoperability milestone.

Conclusion

The TRON Base integration represents a pivotal step in advancing blockchain interoperability, connecting TRX to a thriving Layer 2 ecosystem rich in liquidity and user engagement. While initial TRX liquidity impacts remain subdued without volume surges, this development lays the groundwork for sustained growth in DeFi and cross-chain applications. As adoption builds, TRON could see meaningful price appreciation—investors should monitor on-chain metrics closely for emerging opportunities in this evolving landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026