Worldcoin Falls 14% on Regulatory Crackdowns and Unlocks, Signaling Possible Reversal

WLD/USDT

$89,152,127.76

$0.3931 / $0.3626

Change: $0.0305 (8.41%)

+0.0056%

Longs pay

Contents

Worldcoin’s WLD token declined over 14% in a single day due to intensified global regulatory pressures, a major token unlock event, and prevailing bearish market conditions. These factors exacerbated selling pressure on the cryptocurrency, which has been trading sideways for months amid broader crypto downturns.

-

Regulatory Scrutiny: Governments in Colombia, the Philippines, and Thailand imposed restrictions on Worldcoin’s biometric data collection, halting operations and eroding investor confidence.

-

Token Unlock Impact: The release of 37 million WLD tokens worth approximately $25 million flooded the market with supply, intensifying downward price momentum.

-

Bear Market Influence: With Bitcoin hovering near $80,000 and the overall crypto market down 9%, Worldcoin’s decline amplified due to negative sentiment and short-selling volume.

Discover why Worldcoin (WLD) plunged 14% amid regulatory hurdles and token unlocks. Stay informed on crypto market trends and potential recovery signals for savvy investors.

What Caused Worldcoin’s 14% Decline in One Day?

Worldcoin (WLD) experienced a sharp 14% drop in the past 24 hours, outpacing the broader cryptocurrency market’s 9% decline. This downturn stems from a combination of escalating regulatory challenges worldwide and internal supply dynamics, pushing the token below key support levels after months of consolidation. Investors reacted swiftly to these developments, leading to heightened volatility in the altcoin space.

How Are Global Regulations Impacting Worldcoin’s Operations?

Regulatory bodies continue to target Worldcoin’s unique iris-scanning technology for identity verification, citing privacy concerns. In Colombia, authorities mandated the immediate deletion of biometric data collected from citizens, effectively suspending operations in the country. Similarly, the governments of the Philippines and Thailand issued cease-and-desist orders, prohibiting further data collection activities that underpin Worldcoin’s user onboarding and airdrop incentives.

These actions not only disrupt Worldcoin’s expansion plans but also undermine trust among its user base. According to data from on-chain analytics platforms, user activity on the Worldcoin network dipped noticeably following these announcements, contributing to reduced demand for WLD tokens. Experts in blockchain compliance, such as those referenced in reports from the Blockchain Association, emphasize that such crackdowns highlight the growing tension between innovative Web3 projects and traditional data protection laws.

Worldcoin’s founders, including Sam Altman of OpenAI, have defended the project as a means to create a global digital identity system, but repeated interventions from regulators signal ongoing risks. With over 5 million verified users worldwide, the project’s reliance on biometric verification makes it particularly vulnerable to privacy-focused legislation like the EU’s GDPR or emerging laws in Asia and Latin America.

To begin with, Worldcoin [WLD] continues to face regulatory crackdowns from across the globe, with Colombia being the new government to axe WLD’s services.

They ordered immediate deletion of biometric data collected from the nation’s nationals.

Additionally, the Philippines and Thailand released a cease-and-desist order. Worldcoin was to stop the operations, which was a big blow to users and receivers of the airdrop.

The airdrop was a way to attract users to the chain, which was now operational.

Furthermore, the unlock of more than 37 million WLD tokens valued at slightly above $25 million increased the sell pressure.

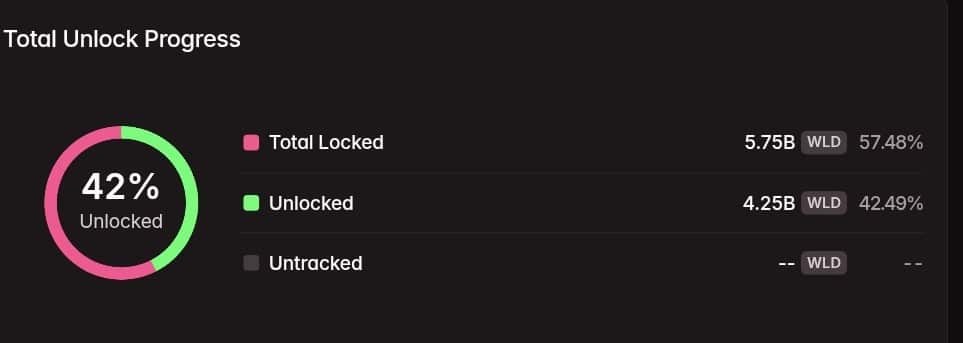

As of press time, there was still about 42% locked, which was equivalent to 4.25 billion WLD coins.

Source: Tokenomist

Last but not least, WLD was driven by the overall bearish structure in the market. Most of the cryptocurrencies were declining, with Bitcoin [BTC] also a few thousand shy of the $80K mark.

Beyond these immediate triggers, Worldcoin’s price action reflects deeper market dynamics. The token has lingered in a multi-month sideways channel since rallying from $0.60 earlier in the year, failing to capitalize on bullish phases in the crypto sector. This stagnation, combined with the recent events, has led to a loss of momentum, as evidenced by declining trading volumes reported by exchanges like Binance and Coinbase.

Frequently Asked Questions

What triggered Worldcoin’s sharp 14% price drop on November 21, 2025?

Worldcoin’s WLD token fell 14% primarily due to regulatory bans in Colombia, the Philippines, and Thailand, which required halting biometric data collection and deleting user information. Coupled with a 37 million token unlock adding $25 million in supply and a 9% broader market decline, these factors overwhelmed buyers and fueled heavy selling.

Is Worldcoin’s decline linked to overall crypto market trends?

Yes, Worldcoin’s price movement mirrors the crypto market’s bearish turn, with Bitcoin approaching but not surpassing $80,000. However, specific pressures like token unlocks and regulatory news amplified WLD’s drop beyond the sector average, making it a notable underperformer in recent sessions.

Key Takeaways

- Regulatory Risks Persist: Ongoing global scrutiny over biometric data practices in Worldcoin could lead to further operational setbacks and price volatility for WLD holders.

- Supply Pressure from Unlocks: With 42% of tokens still locked—equating to 4.25 billion WLD—future releases may continue to challenge price stability unless offset by adoption growth.

- Potential Reversal Signals: Technical indicators suggest a possible breakout from consolidation, with liquidity pools above $0.63 potentially drawing prices higher if bulls regain control.

Will Bears Maintain Dominance Over Bulls in Worldcoin’s Market?

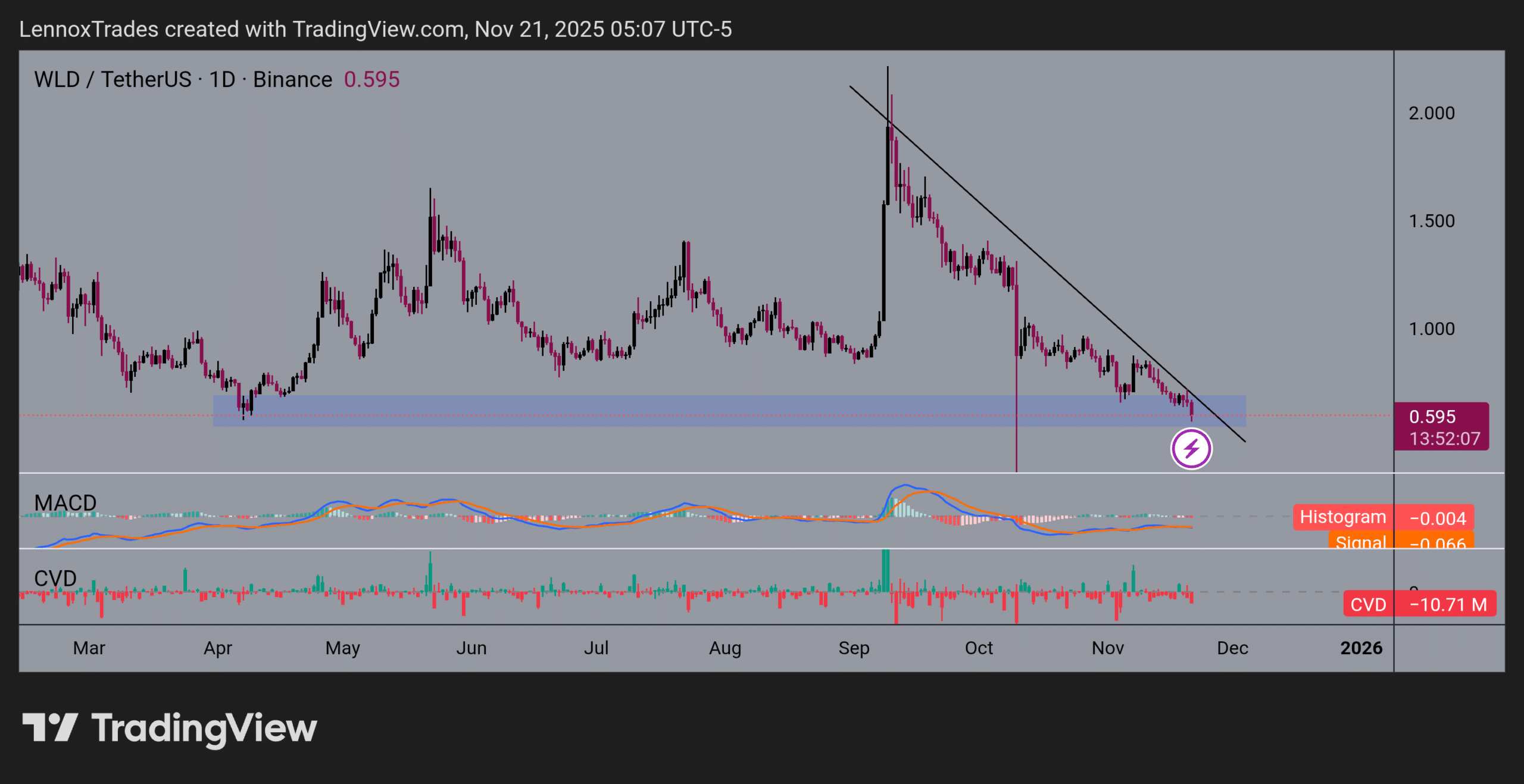

On the charts, WLD was trading below a slanting trendline over the last three months, asserting the bearish outlook. Before this downtrend, WLD traded within a range from April to September.

The MACD confirmed the strength of sellers, though it was not significant enough to breach the $0.60. The Cumulative Volume Delta was negative $10.71 million, indicating the volume was coming mainly from shorters.

Source: TradingView

However, the current price outlook of WLD was about to break out of the consolidation pattern, as price action was at its apex.

Typically, an expansion follows a price contraction, although the direction of the move remains uncertain.

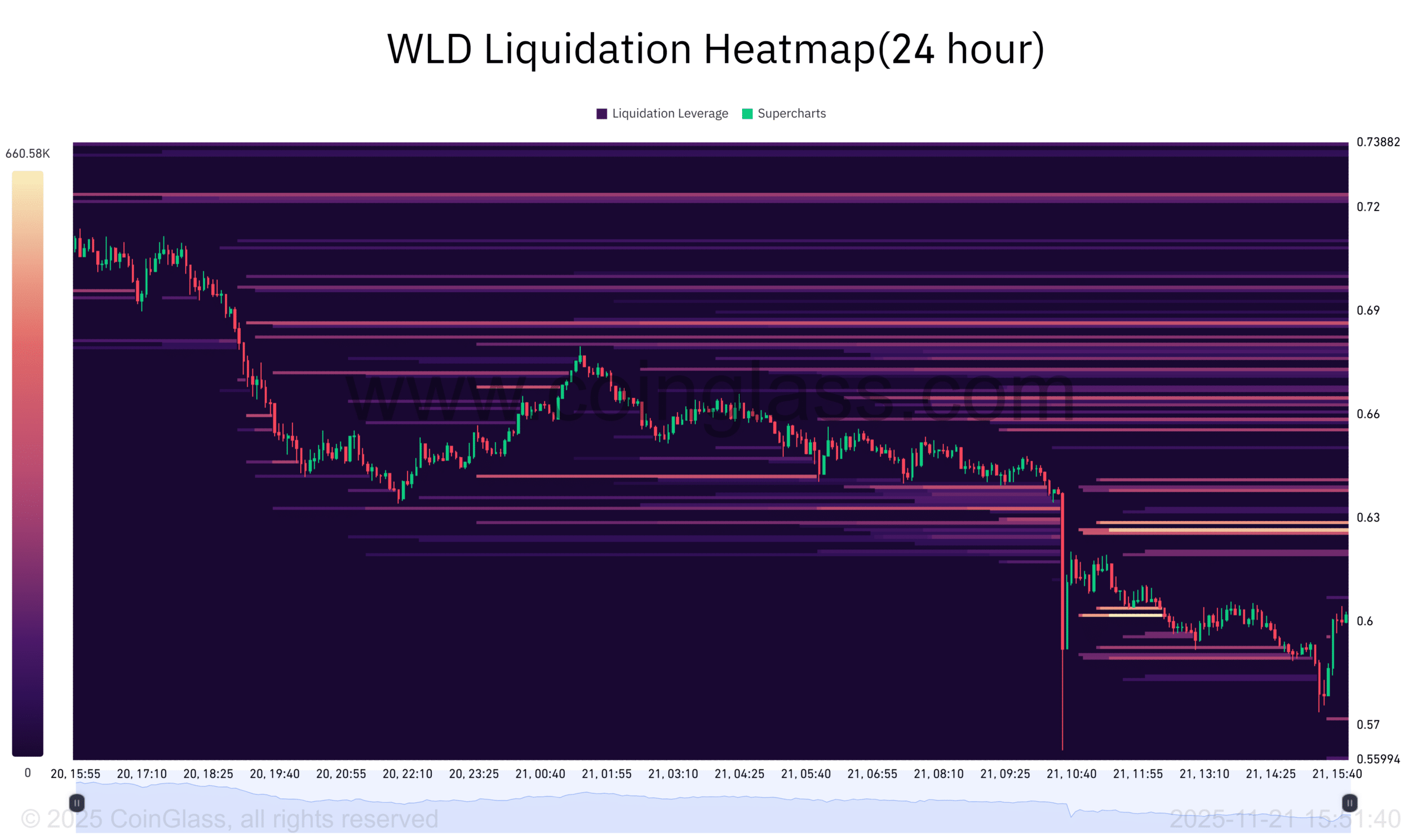

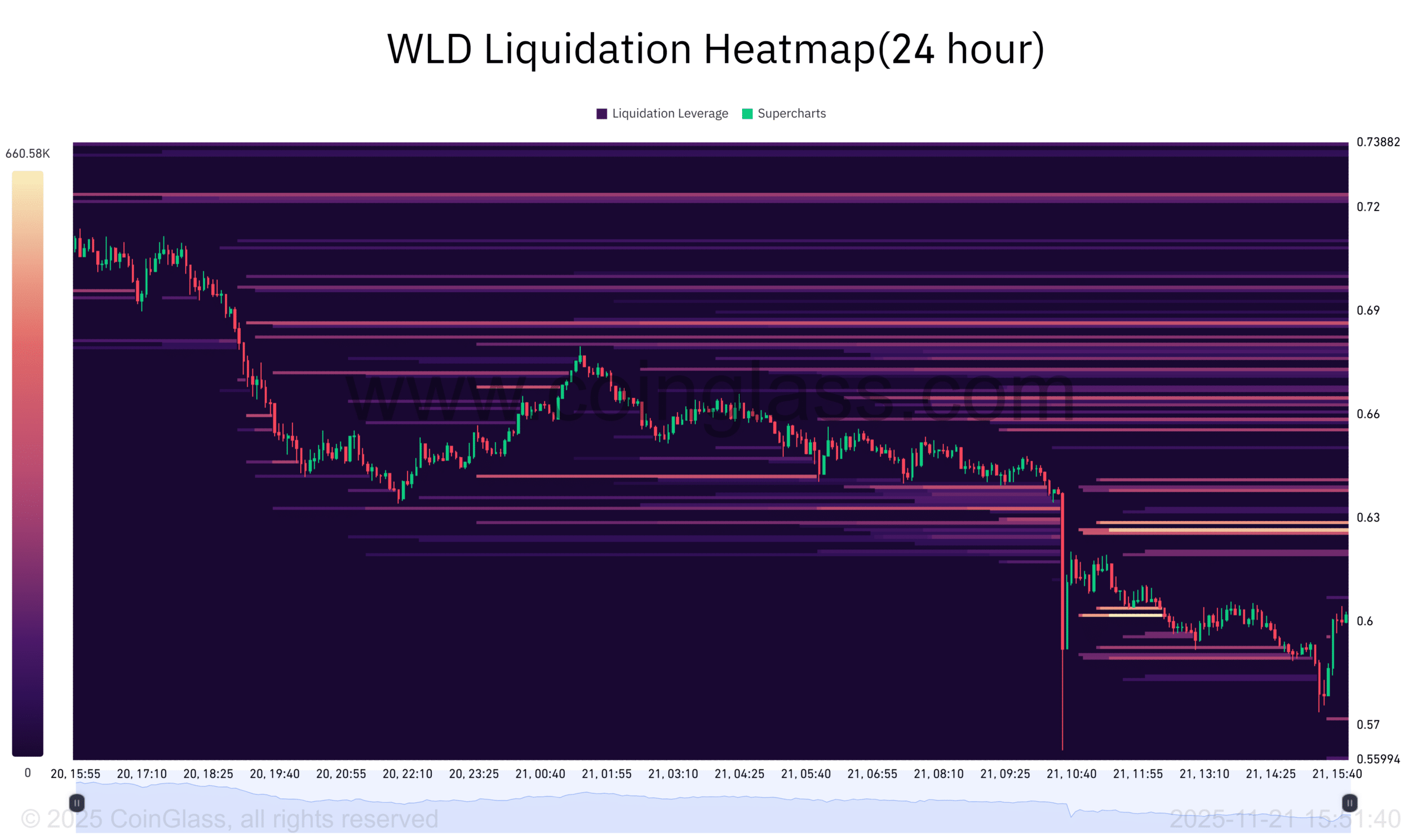

The liquidation heatmap indicated that more than $1.5 million in massive liquidity was clustered at the price level of $0.63.

Meanwhile, the lower liquidity clusters had been wiped, and thus the price may be set for the higher one.

Source: CoinGlass

The liquidity above $0.63, which was still forming, could pull the price toward it. This was a hint that WLD was nearing a reversal, especially now that the price was above a key zone as well as at the apex of the wedge.

That suggests that Worldcoin might not continue dropping, with bulls expected to step in.

Technical analysis from platforms like TradingView shows WLD forming a wedge pattern at the end of its consolidation phase, often preceding significant moves. The MACD histogram, while bearish, shows diminishing momentum, and the negative Cumulative Volume Delta of -$10.71 million underscores short-seller dominance but also potential exhaustion. Liquidation data from CoinGlass reveals over $1.5 million in clustered liquidity at $0.63, suggesting a magnet for price action if upward momentum builds.

In the broader context, Bitcoin’s proximity to $80,000 adds uncertainty, as any pullback in the flagship asset could drag altcoins like WLD lower. However, Worldcoin’s unique proposition in decentralized identity could attract renewed interest if regulatory hurdles ease. Analysts from firms like Messari note that projects blending AI and blockchain, such as Worldcoin backed by OpenAI, hold long-term potential despite short-term headwinds.

Conclusion

Worldcoin’s recent 14% decline highlights the vulnerabilities of WLD to regulatory crackdowns and token supply dynamics within a bearish crypto landscape. While immediate pressures from countries like Colombia and token unlocks have intensified selling, technical indicators point to a possible reversal targeting liquidity at $0.63. As the market evolves, investors should monitor global policy shifts and on-chain metrics closely; staying informed positions you to navigate Worldcoin’s path toward potential recovery and innovation in digital identity solutions.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC