Xinbi Surpasses Sanctions with 17.9 Billion $ Volume

TON/USDT

$51,246,150.67

$1.306 / $1.224

Change: $0.0820 (6.70%)

-0.0132%

Shorts pay

Contents

According to the TRM Labs report, Xinbi, a Chinese-language crypto escrow marketplace, reached 17,9 billion dollars in onchain transaction volume despite platform bans and US sanctions. This volume covers inflows, outflows, and internal transfers in wallets attributed to the platform; it does not represent net illicit proceeds and may include internal fund circulation.

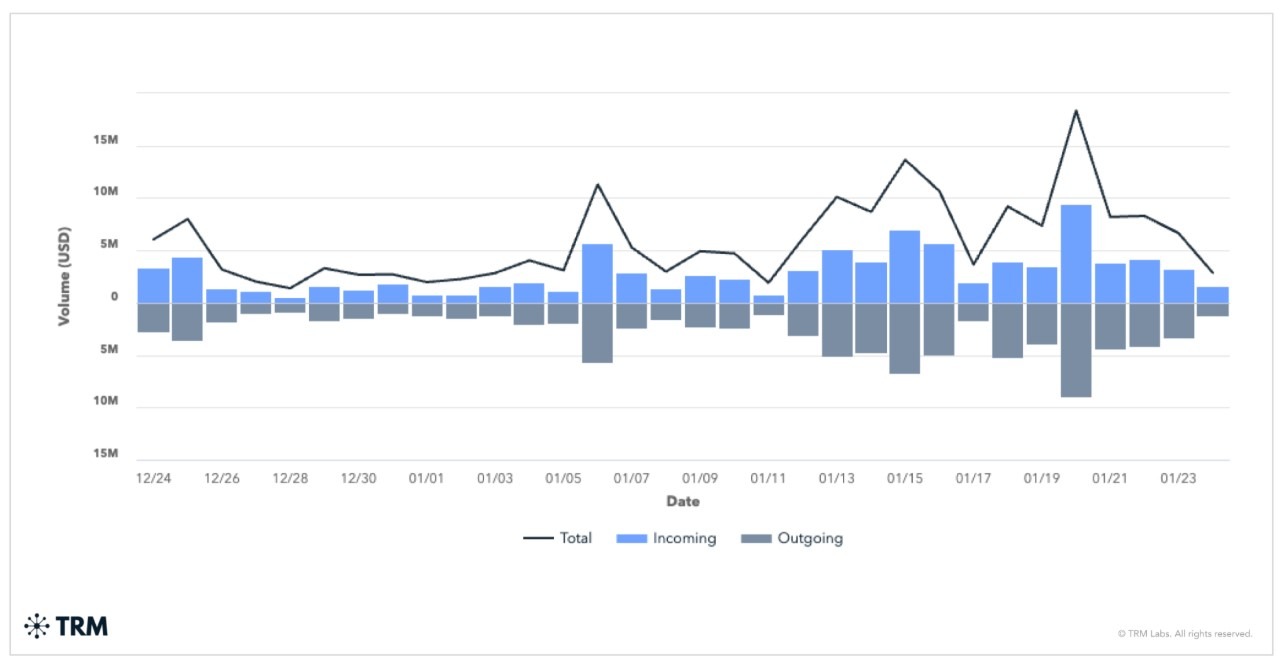

Quick Recovery in XinbiPay Wallet Activity

The report, in the context of the detailed TON analysis linked to the Telegram ecosystem, notes that despite Telegram's bans in 2025, Xinbi quickly migrated to alternative messaging services and the XinbiPay wallet to continue its operations. Wallet activity recovered in January 2026. This adaptation increases the appeal of escrow markets (escrow services) for cybercriminals.

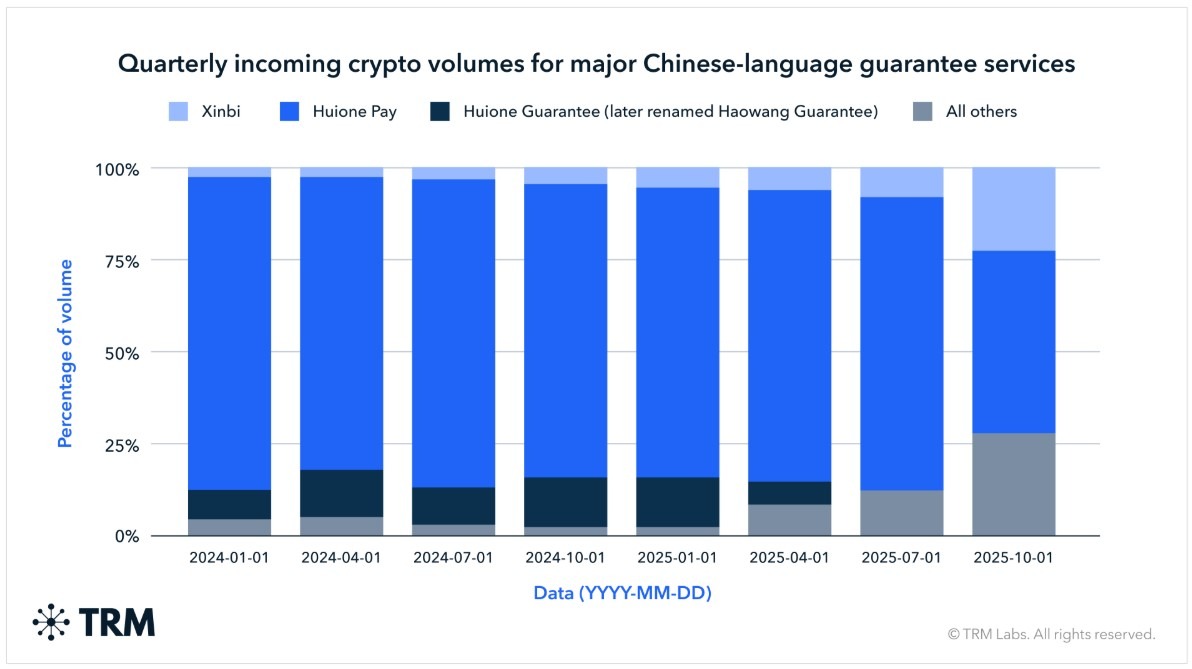

Xinbi Leadership in Quarterly Volumes

Xinbi plays a role as a money laundering hub for fraud operations and cybercrime networks, especially pig-butchering scams (long-term relationship-building frauds). TRM Labs policy head Ari Redbord stated that these services adapt to pressures by fragmenting platforms and building their own infrastructure. Previously, Elliptic reported 8,4 billion dollars in stablecoin flows in wallets linked to Xinbi. These data show that the majority of the volume consists of stablecoins.

Role and Risks in Cybercrime Financing

Platforms like Xinbi hold a leading position among Chinese-language escrow services. According to TRM Labs, even though this volume includes internal transfers, it underscores the importance of illicit finance monitoring tools. Users can minimize risks by following reports from onchain analysis firms.

TON Market: Current Technical Indicators

In Telegram-linked TON futures and the spot market, movement is observed following Xinbi news. Today's data:

- Price: $1.35

- 24h Change: -3.42%

- RSI: 38.46 (Near Oversold)

- Trend: Downtrend, Supertrend: Bearish

- EMA 20: $1.4455

- Supports: S1 $1.2902 (72/100 ⭐ Strong), S2 $1.1240 (68/100 ⭐ Strong)

- Resistances: R1 $1.3873 (74/100 ⭐ Strong), R2 $1.5956 (69/100 ⭐ Strong)

Investors should monitor Ichimoku and Fibonacci levels; downward pressure dominates.