XRP Eyes Potential Rally Amid Low Resistance and Strong Market Buying Activity

XRP/USDT

$2,431,226,288.85

$1.4703 / $1.4052

Change: $0.0651 (4.63%)

-0.0145%

Shorts pay

Contents

The cryptocurrency market is witnessing a bullish trend for XRP, driven by increasing investor interest and a lack of significant resistance ahead.

-

Recent analysis indicates that XRP faces minimal obstacles, which could pave the way for considerable price appreciation.

-

Market experts suggest that a surge in investor participation could significantly boost XRP’s value.

XRP is on a bullish trajectory, seeing a 4.56% price increase in the last 24 hours and a weekly gain of 21.21%, pointing to strong market momentum.

Is this a free path for XRP?

According to COINOTAG, XRP has encountered negligible resistance levels, offering it an unobstructed path for potential price gains.

Resistance levels signify areas where sell orders tend to accumulate, which can trigger corrections; however, the absence of these levels suggests a possible rally is on the horizon.

Source: Glassnode

Even in the face of broader market volatility, XRP is likely to find support around a key level of $2.38, offering some stability to investors.

Buying activity remains high across the market

Market sentiment is bullish, with strong buying activity observed in both derivatives and spot markets, intensifying the potential for an upward price trajectory.

In just the past week, investors withdrew $48.93 million worth of XRP from exchanges, moving it into private wallets—a sign of bullish sentiment for long-term holding.

Source: CoinGlass

This fund movement indicates a long-term bullish outlook among spot traders, hinting at an accumulation phase before a possible major upward price shift.

Additionally, a noticeable increase in position sizes in the derivatives market points to growing bullish sentiment, with Open Interest rising to $5.5 billion—a 17.17% increase in the Futures market.

Moreover, the Options market has also seen an 18.78% rise, reaching $1.03 million, signaling strong demand for leveraged positions as traders bet on XRP’s subsequent rise.

Source: CoinGlass

However, the bullish implications from rising Open Interest will hold true only if long positions dominate these unsettled contracts, as indicated by the Open Interest Weighted Funding Rate.

A positive OI-Weighted Funding Rate suggests that expectations for an XRP rally are primarily driven by leveraged bullish positions.

Conditions still remain for XRP

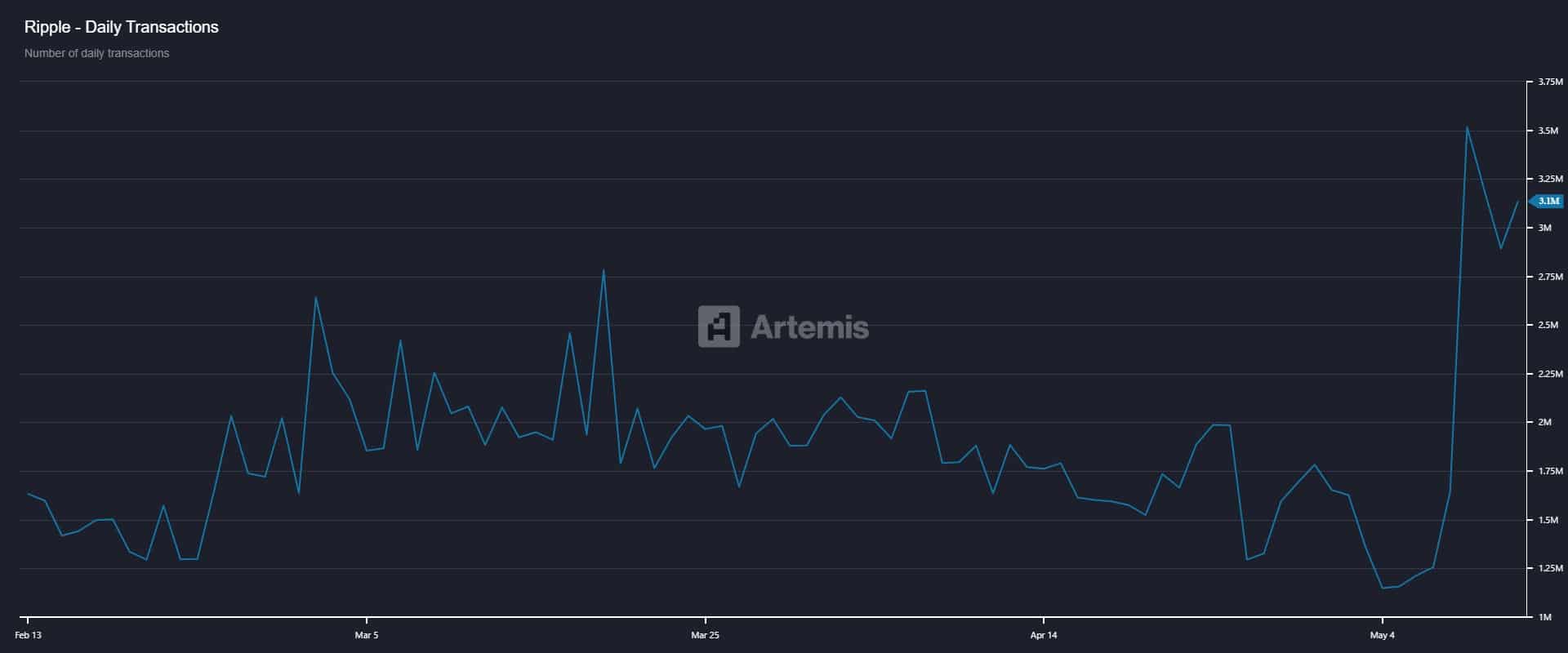

Despite the overall optimistic market sentiment, two critical indicators—daily active addresses and transaction volume—remain below previous highs, indicating the market is not yet fully engaged.

Source: Artemis

The current decline in investor participation has resulted in fewer transactions and reduced utility for XRP. Should these investors return, there is a significant potential for continued appreciation, fueled by renewed accumulation.

With no barriers or resistance levels present, XRP holds the capability to achieve remarkable gains that could reshape the market landscape.

Conclusion

In summary, XRP stands at a pivotal juncture, showing strong momentum supported by a lack of resistance and rising buying activity. As we monitor investor engagement metrics, the potential for a significant price rally could redefine XRP’s market position. Investors are encouraged to keep an eye on critical trends as they unfold.