ZCash Leads Privacy Coin Declines, Hinting at Possible Relief Rally

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

The ZCash (ZEC) price has declined sharply, leading a broader downturn in privacy coins where over 95% of assets are in the red. ZEC dropped more than 25% in a single day, erasing 60% from its recent peak amid fading market enthusiasm for privacy narratives.

-

ZEC leads privacy coin losses with a 25% daily drop, pushing its value to $324.31.

-

Overall privacy token market cap has shrunk to just over $15 billion as liquidity shifts away.

-

98 out of 104 privacy coins are declining, per Cryptorank data, highlighting short-lived hype.

Discover why ZCash ZEC price decline is dragging privacy coins down in 2025. Explore key factors, market data, and potential recovery paths. Stay informed on crypto trends today.

What is causing the ZCash ZEC price decline?

ZCash (ZEC) is experiencing a significant price decline primarily due to waning investor interest in privacy-focused cryptocurrencies following short-term price surges. After weeks of heightened activity, ZEC lost over 25% of its value in the past 24 hours, contributing to a broader market correction that has left more than 95% of privacy coins in negative territory. This drop, which has erased 60% from ZEC’s recent peak, underscores the challenges in sustaining the privacy narrative beyond initial pumps.

Privacy coins like ZEC promised enhanced transaction anonymity, but market dynamics have shifted. The rally, which showed signs of slowing, ultimately collapsed under broader crypto market pressures. ZEC’s price now hovers near $324.31, a level that marks substantial losses from its all-time high.

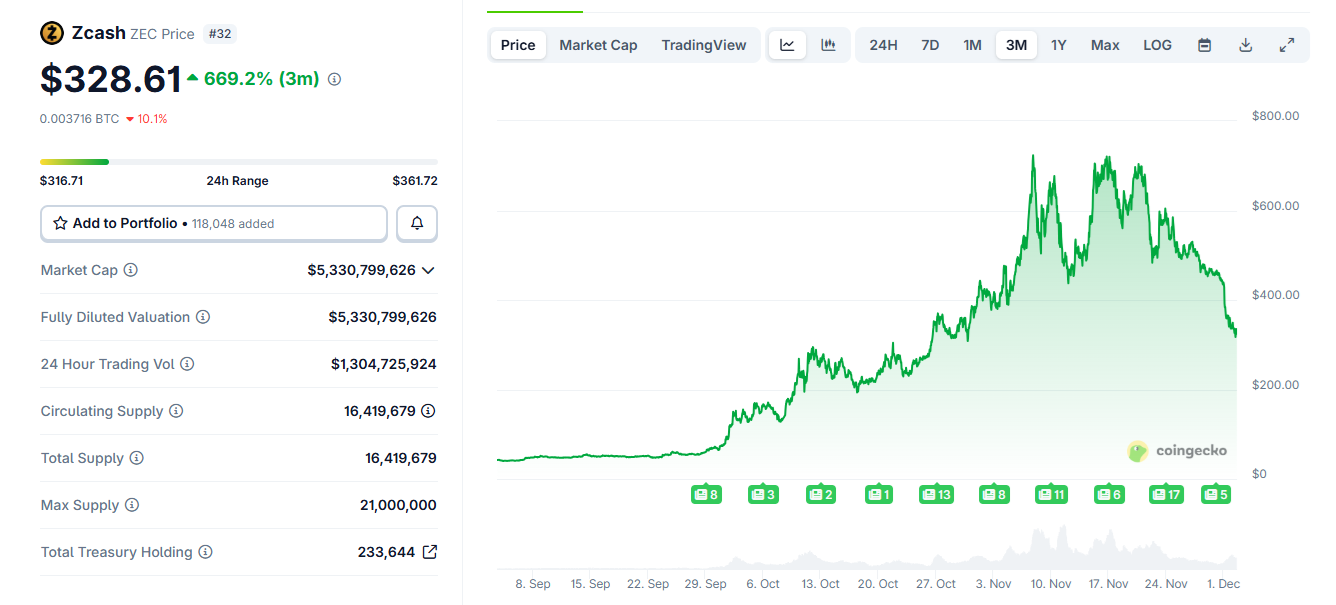

ZEC is down 60% from its peak, after losing another 25% of its price in the past 24 hours. | Source: Coingecko

ZEC is down 60% from its peak, after losing another 25% of its price in the past 24 hours. | Source: CoingeckoHow are other privacy coins performing amid the ZEC decline?

The ZCash ZEC price decline has rippled across the privacy coin sector, with the total market capitalization now standing at just over $15 billion. Monero (XMR), which briefly overtook ZEC as the leading privacy asset, has only erased about 4% in the last day and remains closer to its typical trading range. According to data from Cryptorank, 98 out of 104 tracked privacy coins and tokens are currently in the red, reflecting a sector-wide loss of momentum.

This downturn reveals the temporary nature of recent enthusiasm, which was largely driven by price pumps rather than fundamental adoption. Despite real-world applications for privacy tools in enhancing transaction security, most of these assets have struggled to reclaim their historical highs. For instance, ZEC’s extended losing streak includes long liquidations that have further eroded trader confidence. Experts note that while privacy narratives initially attracted liquidity, the inability to maintain gains points to underlying market skepticism. As one analyst from a leading crypto research firm observed, “Privacy coins’ appeal is real but volatile; sustained value requires more than hype.”

The sector’s challenges are compounded by ZEC’s trading concentration, with 35% of activity on a major exchange, making it susceptible to rapid shifts in USDT liquidity. In contrast, assets like XMR show more stability, trading without the dramatic swings seen in ZEC. Overall, the data indicates a cooling off after a period of elevated activity, with daily transactions for ZEC dropping to around 7,000 from recent records.

Frequently Asked Questions

What factors contributed to the recent ZCash ZEC price decline in privacy coins?

The ZCash ZEC price decline stems from a market correction following short-term pumps fueled by privacy hype. ZEC lost over 25% in 24 hours, dropping to $324.31, as broader crypto trends pulled liquidity away. This has left 95% of privacy coins down, with ZEC’s losses totaling 60% from its peak, per Coingecko metrics.

Can privacy coins like ZEC recover from this downturn?

Privacy coins such as ZCash may see a relief rally if liquidity rotates back, given ZEC’s concentrated trading patterns. Historical dips, like the November drop to $440 followed by a rebound above $700, suggest potential. However, sustained recovery depends on rebuilding trader confidence and addressing skepticism around competing with established assets like Bitcoin.

Key Takeaways

- Privacy coins face sector-wide losses: Over 95% of assets, including ZEC, are down, with market cap at $15B, signaling faded appeal.

- ZEC’s sharp drop highlights volatility: A 25% daily decline to $324.31 reflects short-lived hype and long liquidations.

- Recovery potential exists but is uncertain: Shielded ZEC holdings and past rebounds offer hope, though competition with BTC infrastructure poses challenges.

Conclusion

The ZCash ZEC price decline exemplifies the broader struggles within privacy coins, where initial enthusiasm has given way to substantial losses affecting over 95% of the sector. As ZEC trades 60% below its peak and daily activity normalizes, the narrative’s limitations are clear, yet shielded holdings and potential liquidity shifts could spark a turnaround. Investors should monitor these developments closely for opportunities in the evolving crypto landscape, staying attuned to market corrections and adoption trends.

Can ZEC return with a relief rally?

At current levels near $324.31, ZEC is 60% off its peak, positioning it for possible relief rally predictions similar to past patterns. In early November, it rebounded from $440 to over $700, but recent support breaks and underwater retail positions raise capitulation risks. Concentrated liquidity on major platforms could drive a short-term pump, though skepticism persists on ZEC replacing Bitcoin.

Shielded ZEC remains at a high level

Shielded ZEC provides a stable holder base, with over 4.79 million coins in key pools unlikely to hit exchanges soon. Cypherpunk Technologies holds 233,644 ZEC as treasury, amid a total supply of 16.41 million. Despite this, ZEC’s DeFi integration lags, with only 1,412 wrapped as ZenZec on Solana, and transaction volumes have fallen to 7,000 daily post-peak.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC