ARB Price May Form Double Bottom Amid Surging Network Activity

ARB/USDT

$122,099,291.40

$0.1010 / $0.0909

Change: $0.0101 (11.11%)

-0.0065%

Shorts pay

Contents

ARB price has surged over 11% in the last 24 hours, outperforming the broader crypto market’s 7% rebound, driven by Arbitrum’s accelerating network activity and a potential double bottom formation on the charts.

-

Arbitrum One’s active addresses hit 2 million, up 135% weekly, leading EVM chains in growth.

-

Developer activity reached a three-month peak, boosting dApp volumes across the network.

-

Total Value Locked rose 7% this month to $6.53 billion, while perps and DEX volumes held steady at $639 million and $607 million.

Discover why ARB price is rallying amid Arbitrum’s booming network metrics. Explore key indicators, TVL trends, and what it means for Ethereum Layer 2 solutions. Stay informed on crypto developments.

Is ARB price forming a bottom?

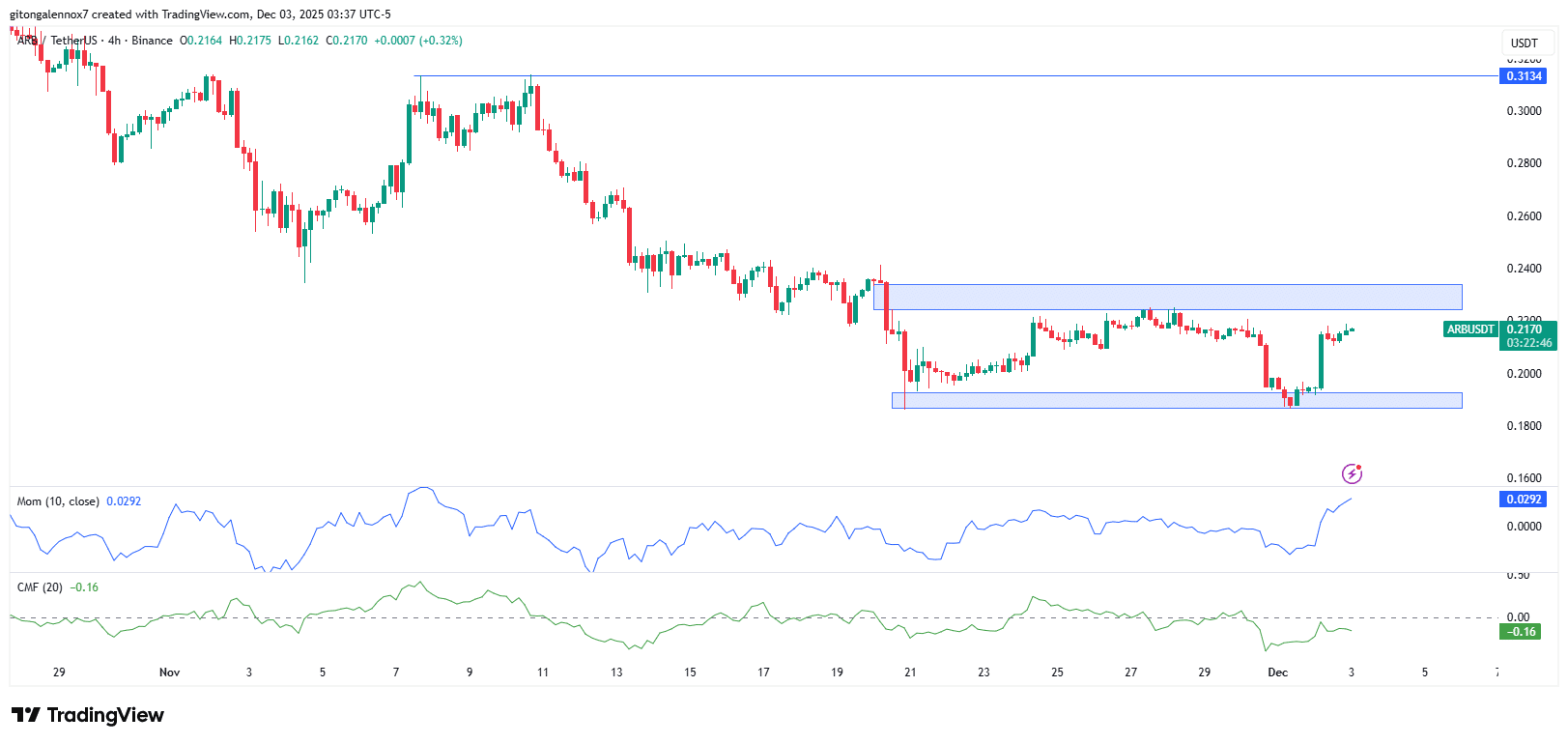

ARB price appears to be establishing a double bottom pattern on the 4-hour chart following recent declines, with bulls driving it from $0.19 to $0.24. A decisive break above the $0.24 neckline could signal a bullish reversal, supported by improving momentum indicators rising to 0.0292 from negative levels. However, sustained capital inflows are needed, as the Chaikin Money Flow remains at -0.16, indicating bulls have not yet fully dominated.

How is network activity influencing ARB price trends?

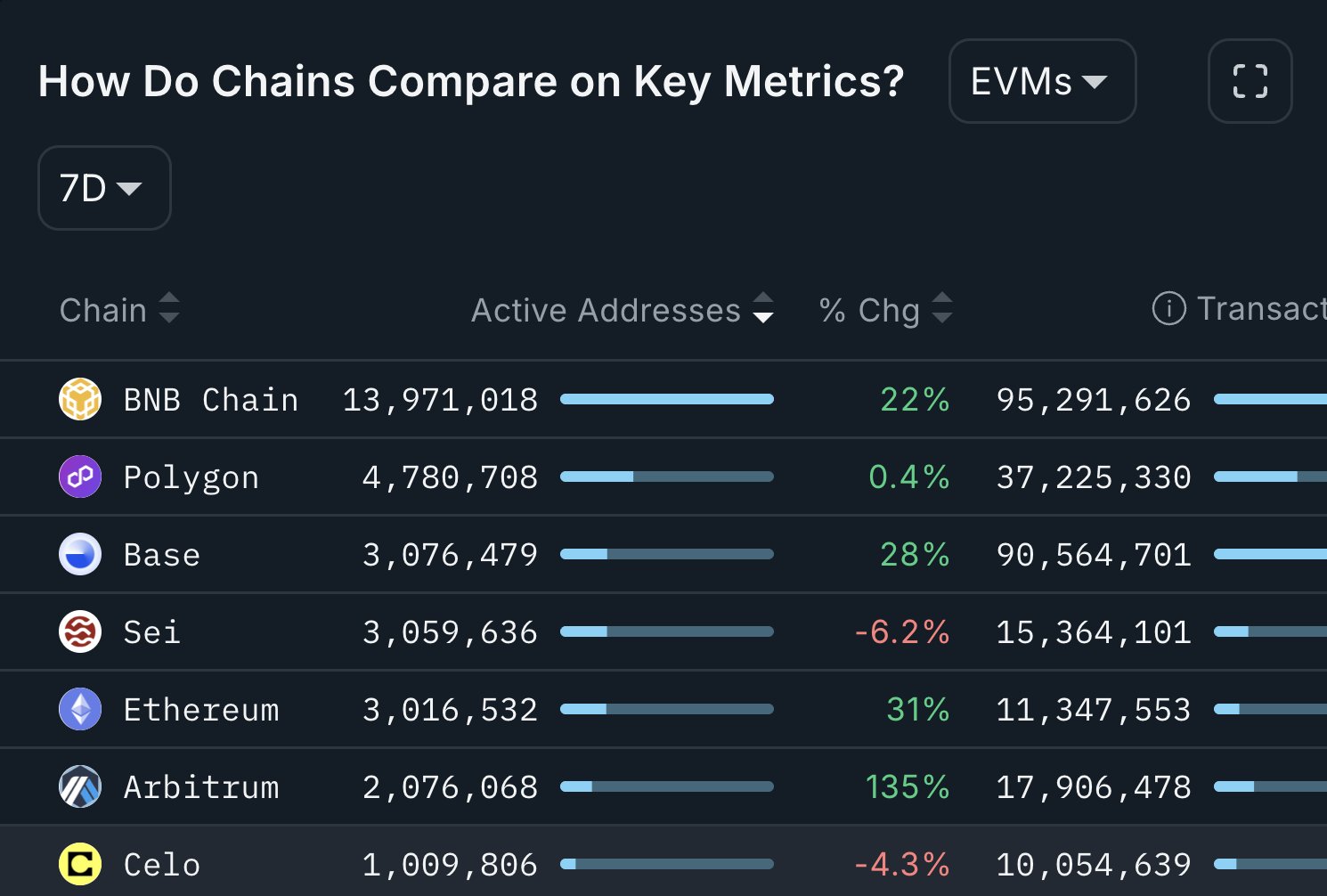

Arbitrum One has demonstrated robust growth among EVM-compatible chains, with active addresses surpassing 2 million—a 135% increase over the past week, as reported by Nansen. This surge underscores heightened user engagement on the platform. Developer activity has also climbed to a three-month high, correlating with a spike in dApp volumes; over 900 decentralized applications, including major protocols like Uniswap, collectively generated $1.20 billion in daily trading volume. These metrics suggest strong fundamentals bolstering ARB price potential, though sustained demand is crucial for breaking resistance levels.

Source: TradingView

If ARB price successfully breaches the $0.24 resistance, it could target the $0.311 level, aligned with positive on-chain developments. Market observers note that Ethereum’s Layer 2 ecosystem, where Arbitrum plays a pivotal role, continues to attract institutional interest, potentially amplifying this upward trajectory.

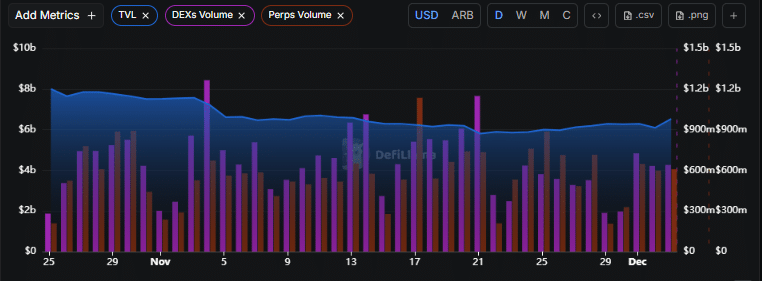

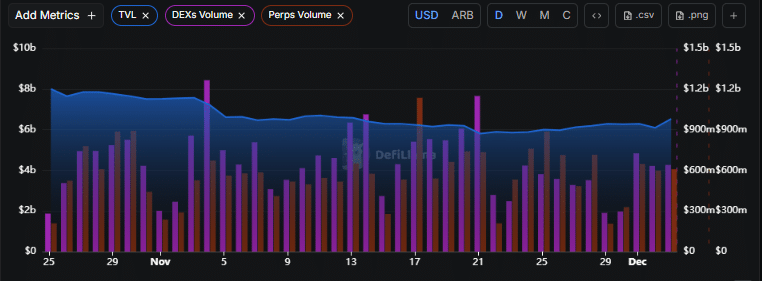

What are the latest metrics for Arbitrum’s TVL and volumes?

Arbitrum’s Total Value Locked has maintained stability around early December levels but registered a 7% monthly gain, reaching approximately $6.53 billion, according to data from DefiLlama. Perpetual futures volume and decentralized exchange activity remain consistent at $639 million and $607 million, respectively, showing resilience amid the recent price uptick. November saw intermittent surges in these indicators, highlighting periodic bursts of trading interest on the network.

Source: Nansen

While BNB Chain dominates with nearly 14 million active addresses, followed by Polygon at 4.7 million and Base at 3 million, Arbitrum’s growth trajectory positions it as a frontrunner in Layer 2 scalability solutions. Experts from blockchain analytics firms emphasize that such on-chain vitality often precedes sustained ARB price appreciation, provided broader market sentiment remains favorable.

Source: DefiLlama

Traders are closely monitoring whether the current ARB price momentum, coupled with network expansion, will propel the token beyond the $0.24 threshold. A failure to do so might confine it to its established trading range, underscoring the interplay between technical patterns and fundamental health in the volatile crypto landscape.

Frequently Asked Questions

What factors are driving the recent ARB price increase?

The 11% rise in ARB price stems from Arbitrum One’s 135% weekly surge in active addresses to over 2 million and heightened developer activity, as per Nansen data. This aligns with a broader market recovery of 7%, enhancing Ethereum Layer 2 adoption and boosting token demand.

How does Arbitrum compare to other EVM chains in network activity?

Arbitrum leads EVM chains with a 135% increase in active addresses to 2 million last week, outpacing Polygon and Base, though BNB Chain tops overall at 14 million. Its developer metrics and $1.20 billion dApp volume highlight superior growth in the Ethereum scaling space.

Key Takeaways

- Strong Network Growth: Arbitrum’s active addresses jumped 135% to 2 million, driving ARB price up 11% amid market rebound.

- Stable TVL and Volumes: TVL climbed 7% to $6.53 billion, while perps at $639 million and DEX at $607 million indicate steady ecosystem health.

- Watch the Neckline: Breaking $0.24 could target $0.311; monitor momentum for sustained bullish trends.

Conclusion

Arbitrum’s impressive network metrics, including a 135% rise in active addresses and a 7% TVL increase to $6.53 billion, have fueled the recent ARB price rally, reinforcing its status as a leading Ethereum Layer 2 solution. As on-chain activity continues to expand, with dApps generating substantial volumes, the ecosystem shows promising resilience. Investors should track key resistance levels for potential further gains in this dynamic crypto environment, staying attuned to evolving market conditions for informed decisions.