Arthur Hayes Accumulates LDO, PENDLE Ahead of Potential Technical Breakouts

LDO/USDT

$35,125,965.16

$0.3035 / $0.2809

Change: $0.0226 (8.05%)

-0.0056%

Shorts pay

Contents

BitMEX co-founder Arthur Hayes accumulated roughly $1.03 million in LDO and $973,000 in PENDLE tokens during price compression phases, positioning ahead of potential trend reversals in these DeFi assets focused on staking and yield generation.

-

Strategic timing: Hayes bought before confirmed breakouts, signaling preparation for upward moves in LDO and PENDLE.

-

Concentrated focus on DeFi primitives rather than broad diversification highlights confidence in staking and yield sectors.

-

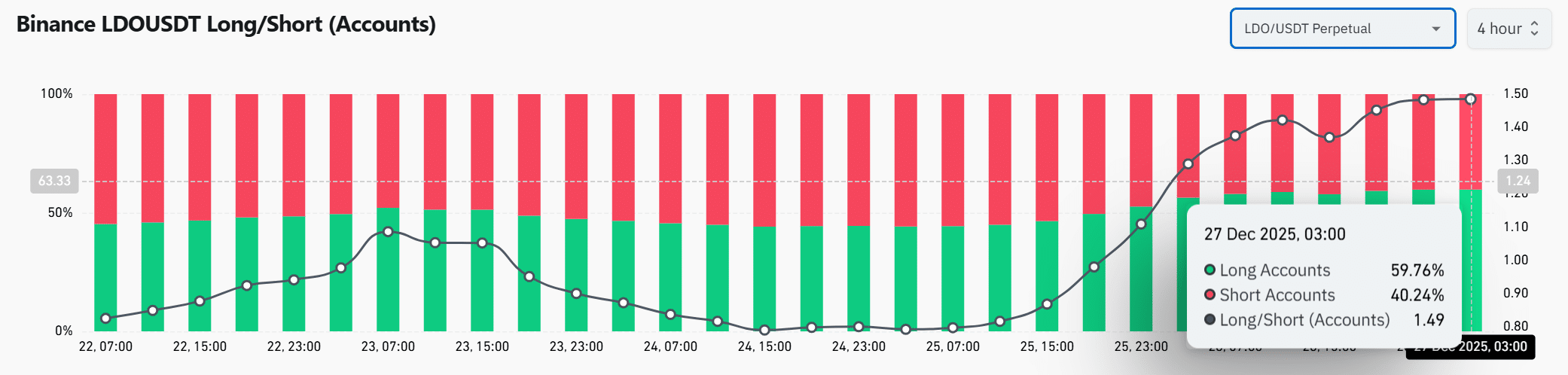

Derivatives data shows PENDLE volume up 29% to $78.9M and open interest rising 7% to $43.09M, with LDO long accounts nearing 60%.

Arthur Hayes buys LDO and PENDLE amid compression: $1.03M in LDO, $973K in PENDLE signal DeFi positioning. Technicals align for reversals. Explore implications now!

What did Arthur Hayes do with LDO and PENDLE?

Arthur Hayes LDO PENDLE accumulation involved committing approximately $1.03 million to LDO and $973,000 to PENDLE in a short timeframe. These purchases occurred as both tokens traded near compressed price structures following prolonged downtrends. Hayes targeted DeFi primitives linked to staking and yield, concentrating capital rather than spreading it across multiple assets, which underscores a deliberate strategy.

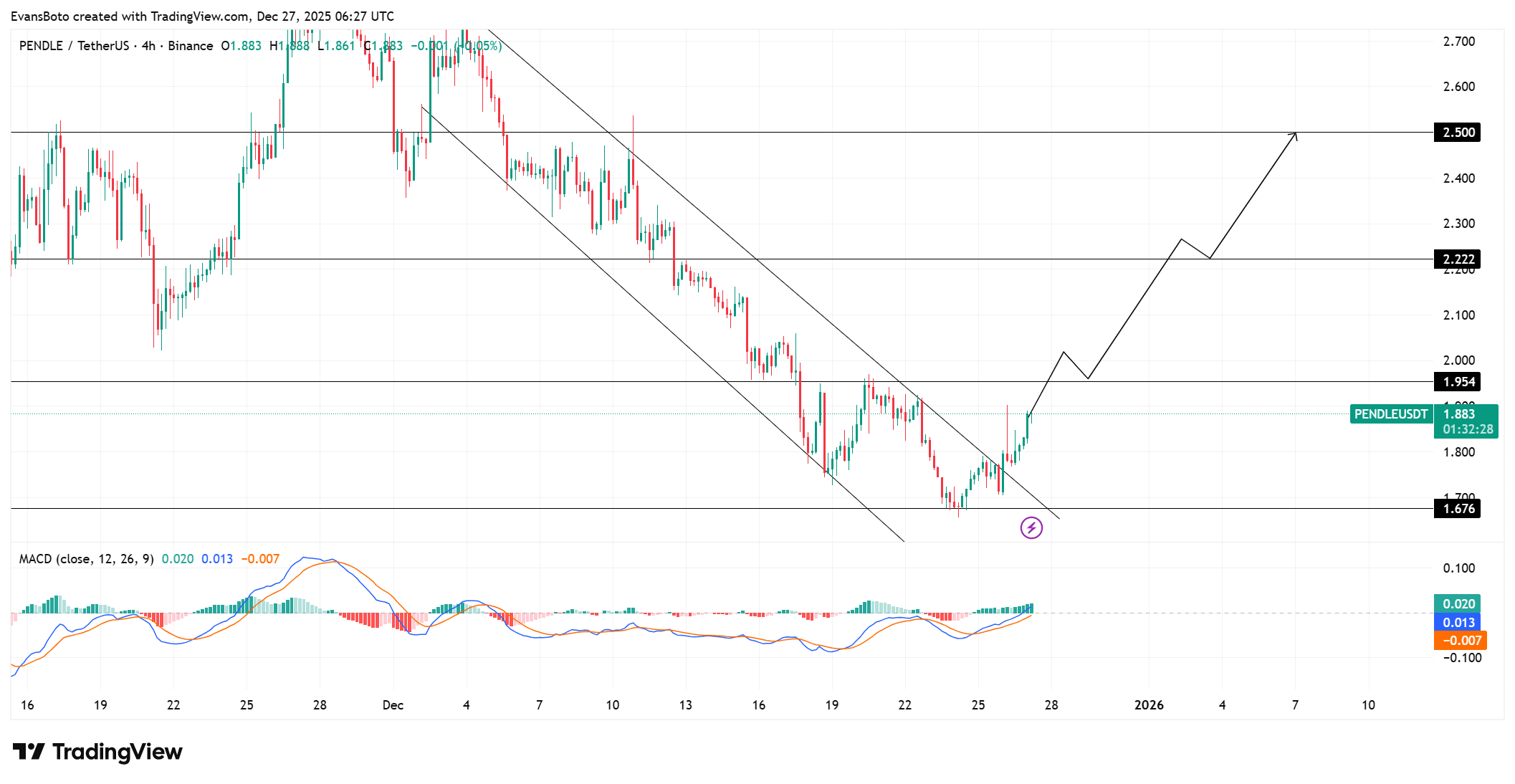

How has PENDLE derivatives activity evolved?

PENDLE derivatives metrics indicate increasing market participation. Trading volume rose 29% to $78.9 million, while open interest grew 7% to $43.09 million, according to CoinGlass data. This surge typically reflects new leverage entering rather than position closures. Price responded positively, advancing without stalling, with controlled leverage growth minimizing liquidation risks. Such patterns often support gradual rebuilding of speculative interest, favoring trend continuation. Hayes’s entry aligned with this shift from compression to potential expansion.

Source: CoinGlass

LDO traders lean long, but stay measured

LDO positioning data provides further evidence of bullish sentiment. On Binance, long accounts approached 60%, driving the long-short ratio near 1.5. Bulls hold a distinct advantage, yet shorts persist, avoiding overcrowding that could signal reversals. Price has advanced steadily rather than spiking, indicating measured optimism. This aligns with Hayes’s spot accumulation, tilting probabilities toward continuation over downside.

Source: CoinGlass

What does PENDLE’s price structure indicate?

PENDLE broke above a descending channel after defending the $1.67 demand zone multiple times. Trading near $1.88 at press time, it reclaimed the channel midpoint, turning short-term structure bullish. Open interest increased 5% to $43.09 million alongside 29% volume growth to $78.9 million, confirming participation during the breakout. MACD histogram flipped positive with signal lines turning upward, supporting momentum. Holding above $1.95 sustains the reversal; below risks pullback to $1.67 invalidation.

Source: TradingView

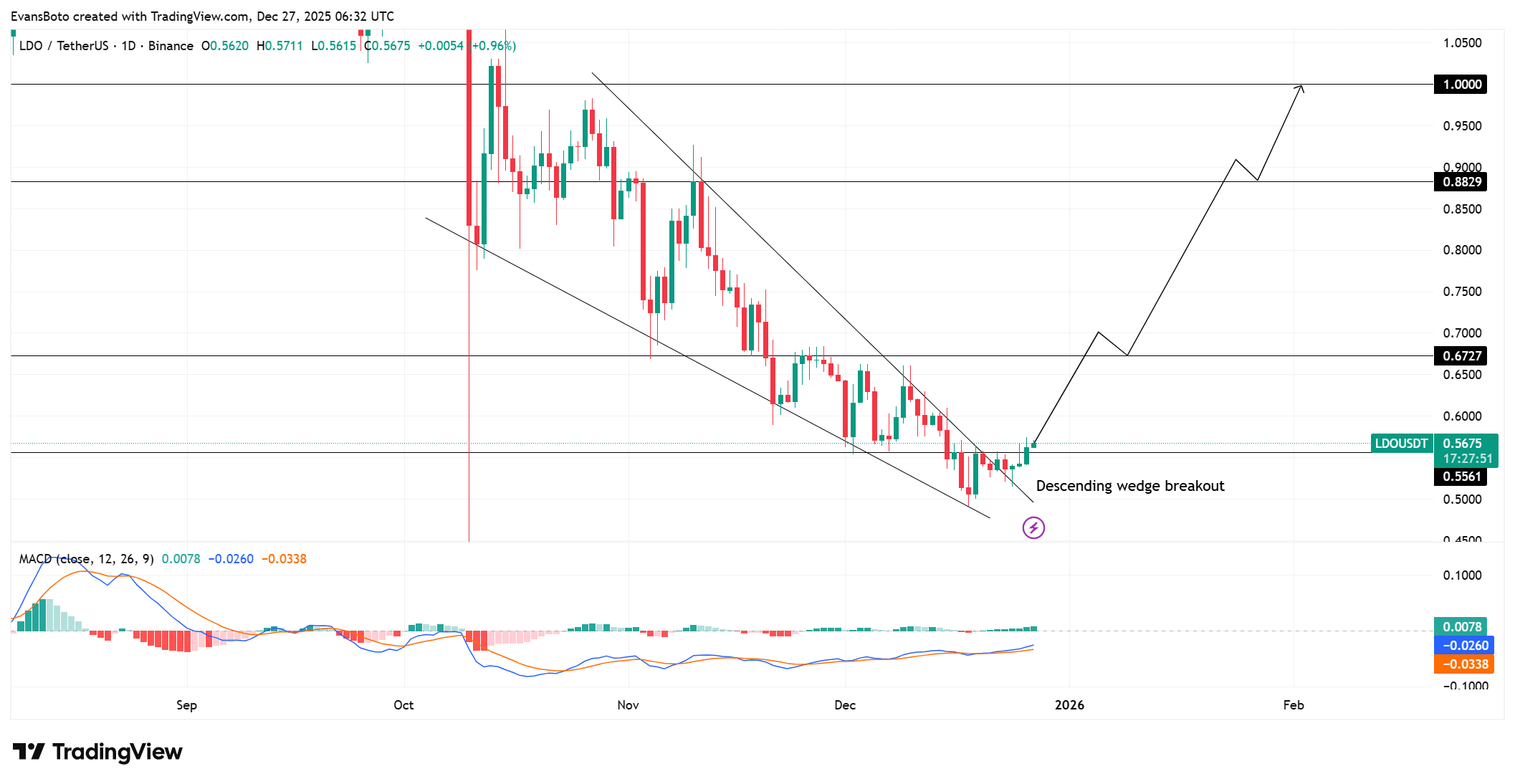

LDO wedge break signals stabilization

LDO escaped a prolonged descending wedge by holding the $0.55–$0.56 support band through December. Valued at $0.57 at press time, it stabilized above the breakout. MACD histogram turned positive, with signal lines nearing a bullish crossover. Long accounts at 59–60% reflect positioning support without excess. Next resistance at $0.67, then $0.88. Breakout above $0.67 confirms uptrend; loss of $0.56 invalidates.

Source: TradingView

Frequently Asked Questions

What is the significance of Arthur Hayes LDO PENDLE accumulation before trend reversals?

Arthur Hayes’s $1.03M LDO and $973K PENDLE buys occurred during compressed structures post-downtrends, before breakouts. This anticipatory positioning by a DeFi veteran often precedes expansions. On-chain data confirms large spot entries, aligning with rising derivatives interest for potential continuation.

Are LDO and PENDLE set for a DeFi rally after Arthur Hayes buys?

Hayes’s accumulation, combined with PENDLE’s channel breakout and LDO’s wedge escape, plus favorable derivatives metrics, positions both for possible advances. Controlled leverage and measured longs suggest early-stage strength. Key levels like PENDLE $1.95 and LDO $0.67 will determine next moves.

Key Takeaways

- Arthur Hayes strategic buys: $1.03M LDO and $973K PENDLE target DeFi yield primitives during compression.

- Derivatives confirmation: PENDLE volume +29%, OI +7%; LDO longs ~60% with steady price grind.

- Technical alignment: Breakouts intact; hold key supports for continuation toward higher targets.

Conclusion

Arthur Hayes LDO PENDLE accumulation highlights targeted DeFi positioning amid technical reversals, backed by derivatives growth and on-chain activity. PENDLE and LDO show structural bullish shifts with measured participation, per CoinGlass and TradingView data. Monitor critical levels for sustained momentum, as early capital inflows by figures like Hayes often catalyze sector recoveries.