Asia-Pacific Trading May Support Bitcoin Amid Western Session Declines

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

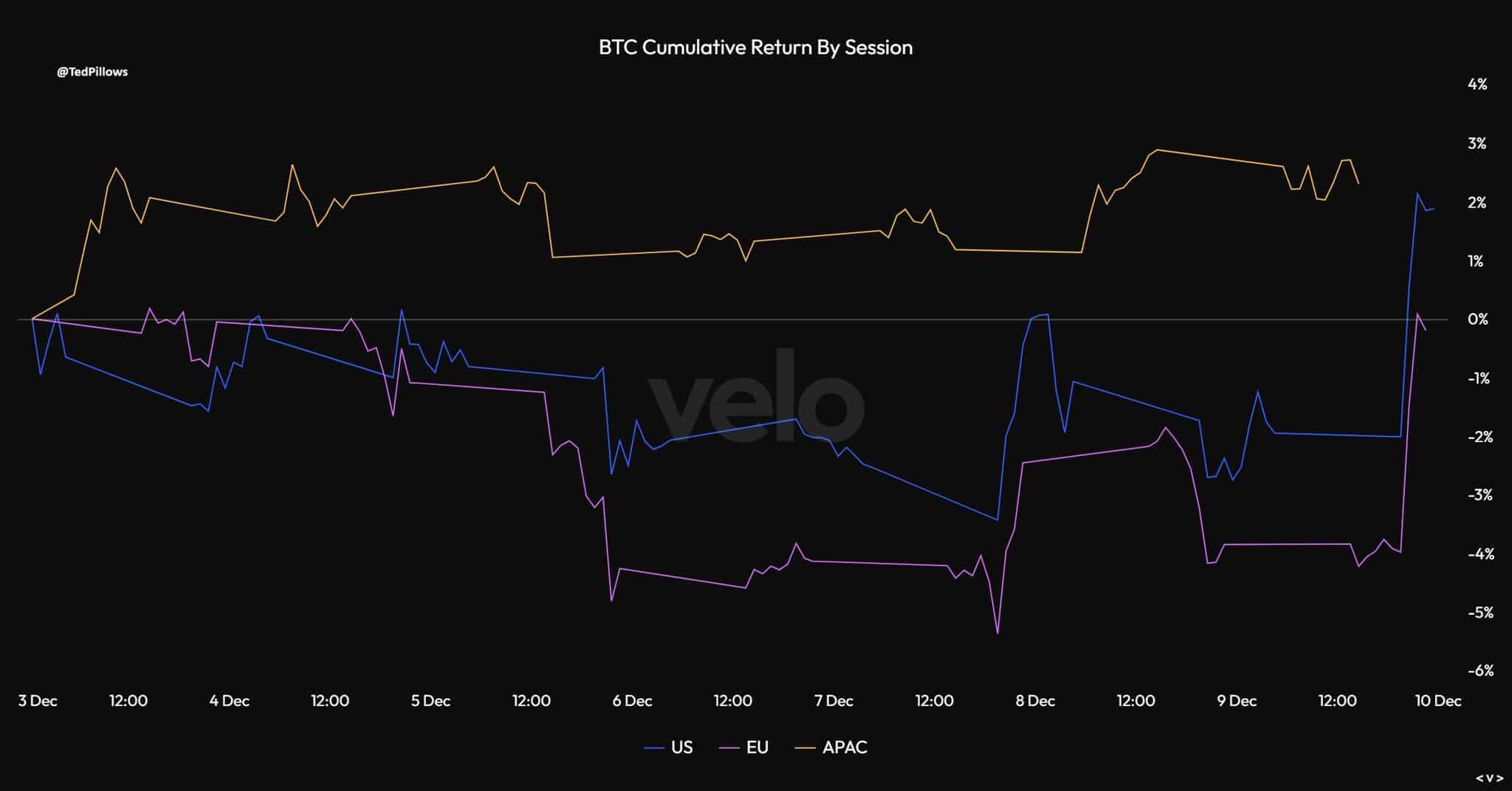

Asia-Pacific traders are primarily driving Bitcoin’s recent upswing, delivering around 2% cumulative returns during their sessions, while U.S. and European trading pulls prices down by 3-4%. This dynamic, combined with contained leverage and rising corporate holdings over one million BTC, provides a stable foundation amid regional divergences.

-

Asia-Pacific session leads Bitcoin gains: APAC trading consistently lifts BTC prices by about 2%, countering Western session losses.

-

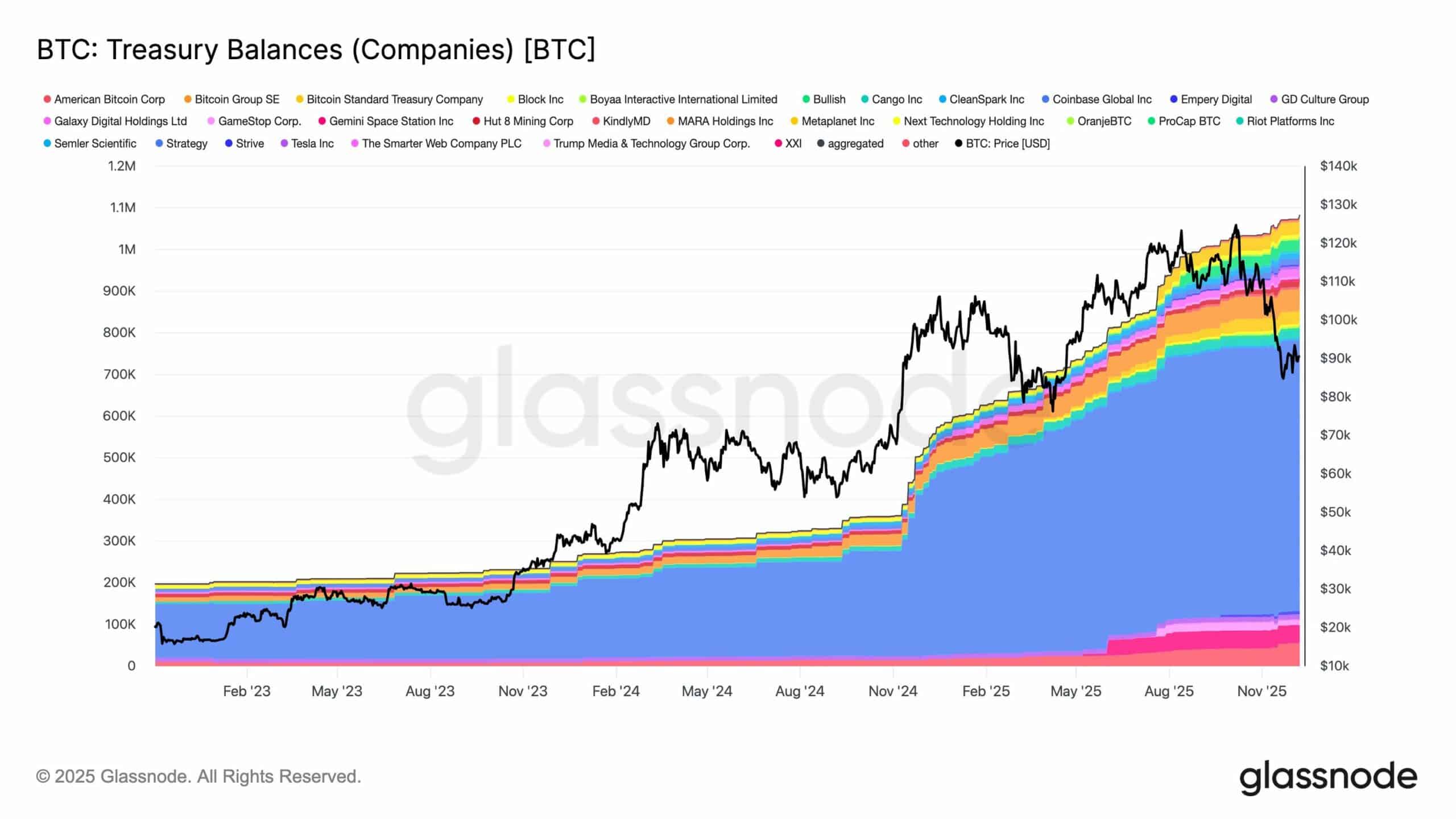

Corporate Bitcoin holdings surge to 1.08 million BTC, up 448% since 2023, bolstering long-term market stability.

-

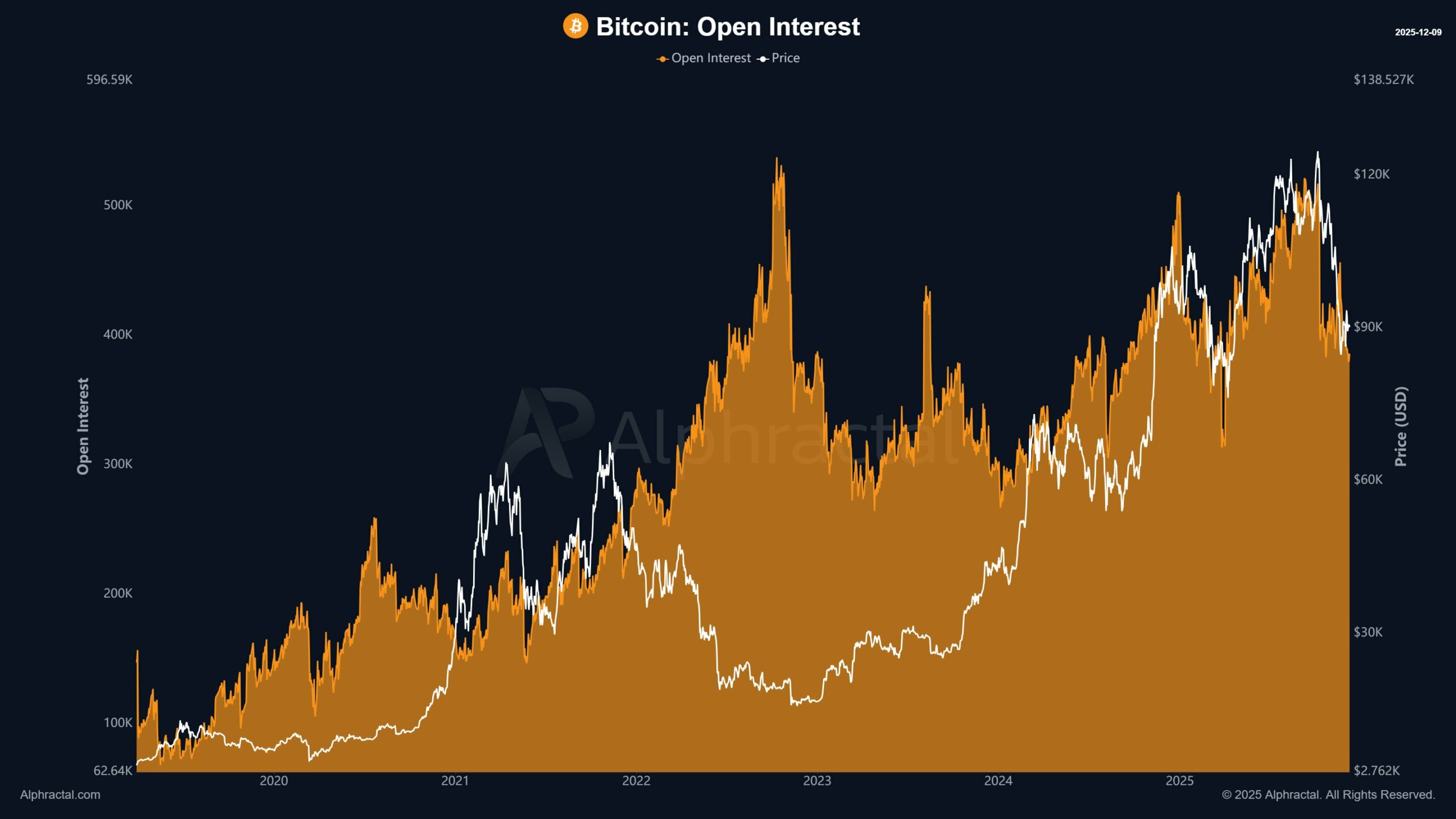

Leverage remains subdued in BTC terms, with open interest below 2022 peaks despite USD values hitting $70 billion.

Discover how Asia-Pacific traders and corporate treasuries are fueling Bitcoin’s price amid Western drags. Explore regional dynamics and leverage trends shaping BTC’s future—stay informed on key crypto shifts today.

What is Driving Bitcoin’s Recent Upswing in the Asia-Pacific Region?

Bitcoin’s Asia-Pacific Bitcoin trading surge is propelled by consistent buying pressure from traders in that region, achieving approximately 2% returns per session. This contrasts sharply with negative performance in U.S. and European markets, which have seen declines of 3% and 4%, respectively. The overall market benefits from reduced leverage speculation and a dramatic increase in institutional ownership, creating a more resilient price structure.

Source: X

The pattern observed in recent trading sessions highlights a clear regional divide. During Asia-Pacific hours, Bitcoin experiences upward momentum that prevents deeper declines. This support is crucial as Western sessions often reverse these gains, yet the net effect keeps BTC afloat. Data from on-chain analytics indicates that this buying activity aligns with broader market stabilization efforts by long-term holders.

Institutional participation has further solidified this trend. Corporate entities have accumulated Bitcoin at an unprecedented rate, shifting the supply dynamics. As of late 2025, entities like publicly traded firms hold substantial positions, reducing available supply for short-term volatility. This institutional backbone ensures that Asia-Pacific-driven gains have lasting impact.

How Has Leverage Influenced Bitcoin’s Market Stability?

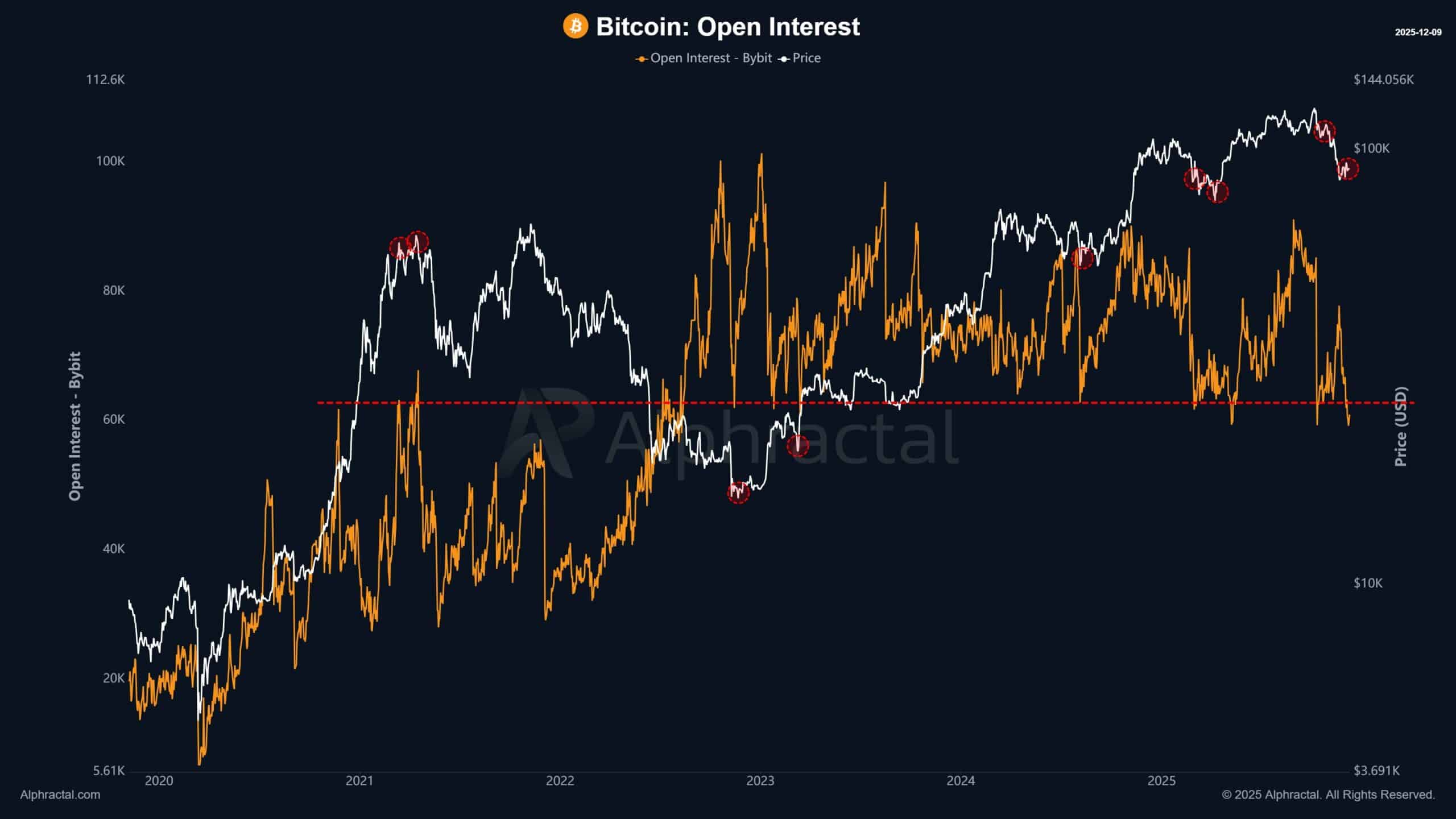

Leverage in the Bitcoin market appears elevated when measured in USD terms but remains contained in cryptocurrency-denominated open interest, signaling a more mature trading environment. Aggregate open interest in USD reached new cycle highs above $70 billion, yet BTC-denominated figures have not surpassed the 2022 peak of around 500,000 BTC. This discrepancy arises from Bitcoin’s price appreciation, expanding the dollar value without a proportional increase in leveraged positions.

Source: Alphractal

Joao Wedson, CEO of Alphractal, notes, “The market’s dollar size has expanded significantly, but traders are not leveraging up to previous cycle extremes.” This observation underscores a shift toward more conservative positioning. On platforms like Bybit, open interest hovers below the critical 60,000-62,000 BTC threshold, where past overheating occurred. Current levels suggest subdued speculative activity, reducing the risk of sharp liquidations during downturns.

Source: Alphractal

Analytics from sources like Glassnode and CoinMetrics confirm this trend. Leverage ratios are lower than in prior bull runs, with funding rates remaining neutral. This setup allows Asia-Pacific inflows to accumulate without the overhang of excessive debt positions. As a result, Bitcoin’s price resilience improves, even as global economic factors introduce uncertainty.

Furthermore, the integration of institutional strategies has tempered leverage use. Hedge funds and corporations prioritize spot holdings over derivatives, as evidenced by on-chain data showing increased HODLing. This behavior aligns with regulatory clarity in regions like Asia-Pacific, where adoption is accelerating through compliant exchanges.

Corporate Bitcoin Holdings as Market Stabilizers

Corporate adoption of Bitcoin has transformed it into a core treasury asset, with holdings escalating from 197,000 BTC in January 2023 to over 1.08 million BTC by late 2025—a 448% increase. This accumulation, driven by major public companies, provides a robust demand floor that previous market cycles lacked. Such positions lock away supply, mitigating sell-off pressures during weaker sessions.

Source: Glassnode

The growth in corporate treasuries reflects Bitcoin’s maturation as an inflation hedge and balance sheet diversifier. Reports from financial analysts at firms like Fidelity and BlackRock highlight this shift, with executives citing Bitcoin’s scarcity as a key factor. In Asia-Pacific markets, where economic growth outpaces the West, such holdings align with digital asset strategies.

This locked supply influences price behavior profoundly. During U.S. and European sessions, potential downward pressure is absorbed by the illiquid nature of these holdings. Asia-Pacific traders then capitalize on dips, reinforcing the upswing. On-chain metrics show that over 50% of Bitcoin supply is now dormant for extended periods, underscoring institutional commitment.

Frequently Asked Questions

How is Asia-Pacific trading impacting Bitcoin’s overall price stability?

Asia-Pacific sessions contribute around 2% gains to Bitcoin, countering 3-4% losses in Western markets. This regional buying provides consistent support, especially with institutional holdings locking over one million BTC, reducing volatility and fostering a healthier price trajectory in 2025.

What role do corporate Bitcoin holdings play in current market dynamics?

Corporate holdings, now at 1.08 million BTC, act as a supply buffer, preventing sharp declines during off-peak hours. This 448% growth since 2023, driven by public companies, enhances long-term stability and amplifies the effects of Asia-Pacific demand.

Key Takeaways

- Regional Divergence in Trading: Asia-Pacific’s 2% session gains offset Western losses, maintaining Bitcoin’s upward bias.

- Contained Leverage Levels: USD open interest hits $70 billion, but BTC-denominated figures stay below 2022 highs, indicating reduced speculation.

- Institutional Backbone: Corporate treasuries holding 1.08 million BTC lock supply, supporting price resilience and long-term holder influence.

Conclusion

In summary, Asia-Pacific Bitcoin trading dynamics, paired with surging corporate holdings and moderated leverage, are key to Bitcoin’s current market positioning. These factors create a balanced environment where regional strengths outweigh temporary Western weaknesses. As institutional adoption continues into 2025, Bitcoin remains poised for sustained growth, offering opportunities for informed investors to engage with this evolving asset class.