Binance Trading Boom Signals Possible Bitcoin Rebound from $86K Low

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin trading activity on Binance suggests a potential bullish rebound despite recent price dips to $86,000, driven by record $1.17 trillion inflows and strong long positions in perpetual futures. Spot volumes hit $7 trillion this year, outpacing competitors, signaling growing investor optimism amid bearish market sentiment.

-

Binance leads with $1.17 trillion in capital inflows, a 31% year-over-year surge, highest among exchanges.

-

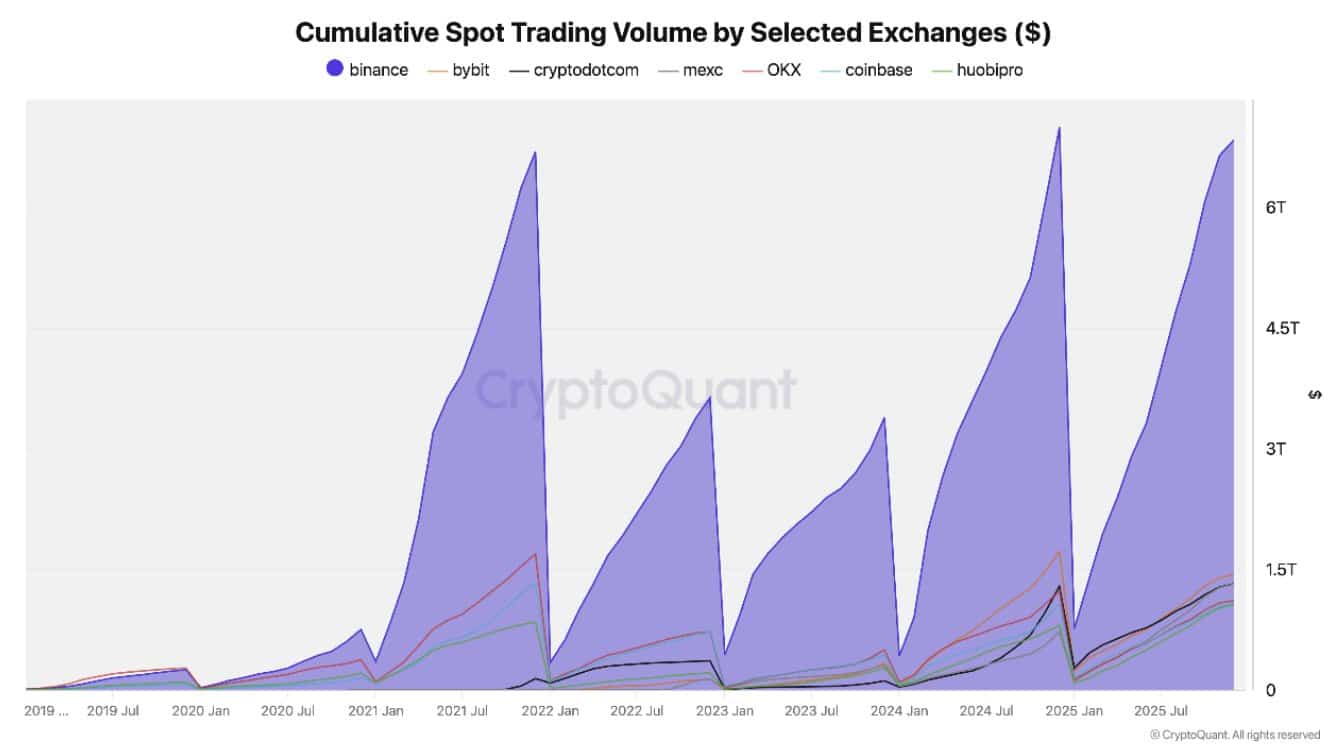

Spot trading volume reaches $7 trillion in 2025, nearly five times higher than Bybit, indicating robust participation.

-

Perpetual futures show bullish tilt with a 2.2 taker buy/sell ratio and $10.90 billion in Bitcoin open interest.

Discover how surging Bitcoin trading activity on Binance signals recovery potential amid market dips. Explore inflows, volumes, and sentiment indicators for informed crypto insights—stay ahead in 2025.

What does Bitcoin trading activity on Binance indicate for market recovery?

Bitcoin trading activity on Binance points to increasing investor confidence and a possible price rebound, even as the asset hovers around $86,000 following recent declines. Record capital inflows of $1.17 trillion and elevated spot and futures volumes reflect strong accumulation, contrasting broader bearish sentiment. This dominance on the world’s largest exchange by user base, as noted by CoinMarketCap data, could drive Bitcoin toward $90,000 if trends persist.

How are spot and futures markets performing on Binance?

Spot trading on Binance has surged to a record $7 trillion in volume this year, according to CryptoQuant reports, marking a significant lead over competitors like Bybit, which trails by nearly fivefold. This activity underscores heightened investor engagement, with over 300 million users contributing to the platform’s dominance. In perpetual futures, cumulative volume stands at $24.5 trillion, further highlighting robust participation. Expert analysts from CryptoQuant emphasize that such inflows, up 31% year-over-year, often precede market upturns, providing a data-backed view of investor conviction. Short paragraphs like these enhance readability, while statistics reinforce the platform’s pivotal role in shaping Bitcoin’s trajectory.

Source: Spot Trading Volume

These metrics not only demonstrate Binance’s market leadership but also suggest that Bitcoin’s price stability may hinge on sustained trading momentum. Funding rates and open interest trends further support this outlook, with minimal bearish pressure evident in recent sessions.

Frequently Asked Questions

What is the current Bitcoin open interest on Binance?

Bitcoin open interest on Binance currently totals $10.90 billion, representing the largest share of the market’s $58.63 billion overall. This figure, derived from CoinGlass data, indicates significant leveraged exposure and potential for volatility, as it reflects bets on future price directions amid ongoing accumulation.

Why is Binance trading volume important for Bitcoin price prediction?

Binance’s trading volume serves as a leading indicator for Bitcoin’s price movements because it captures the actions of the largest global user base. High volumes, like the recent $16.58 billion in Bitcoin trades, often signal shifts in sentiment—such as the current bullish lean in long positions—that can influence the broader market before widespread adoption.

Source: CoinGlass

The taker buy/sell ratio of 2.2 on Binance perpetuals, far exceeding the neutral 1.0 threshold, exemplifies this dynamic, where buyer dominance could propel recovery.

Key Takeaways

- Record Inflows Drive Dominance: Binance’s $1.17 trillion capital surge, up 31% from last year, positions it as the top exchange, influencing Bitcoin’s overall market direction.

- Bullish Signals in Futures: With $24.5 trillion in perpetual volume and a strong long/short ratio, traders on Binance are betting on upward momentum despite short-term dips.

- Accumulation Builds Momentum: Net spot inflows of $315 million this week suggest investors are positioning for a rebound, potentially targeting $90,000 levels soon.

Source: CoinGlass

In the spot market, $83 million in daily purchases highlight constructive sentiment, even as broader perpetual ratios dip slightly to 0.98. Funding rates remain positive, bolstering the case for optimism. As accumulation continues, Bitcoin trading activity on Binance could catalyze a shift from hesitation to sustained growth.

Conclusion

Bitcoin trading activity on Binance underscores a resilient undercurrent of bullish positioning amid prevailing bearish pressures, with spot and futures volumes setting new benchmarks and inflows reaching unprecedented levels. Sources like CryptoQuant and CoinGlass provide clear evidence of this trend, where over 300 million users are actively accumulating assets. As investor conviction strengthens, Bitcoin may soon overcome its $86,000 support, paving the way for renewed highs—monitor these indicators closely for timely opportunities in the evolving crypto landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026