Bitcoin Dominance May Persist as ETFs Drive Inflows, Retail Steps Back

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s dominance in 2025 continues as altcoins underperform, with Spot ETFs driving major inflows of $4-6 billion monthly while retail traders reduce activity, favoring ETF convenience alongside self-custody practices for a balanced investment approach.

-

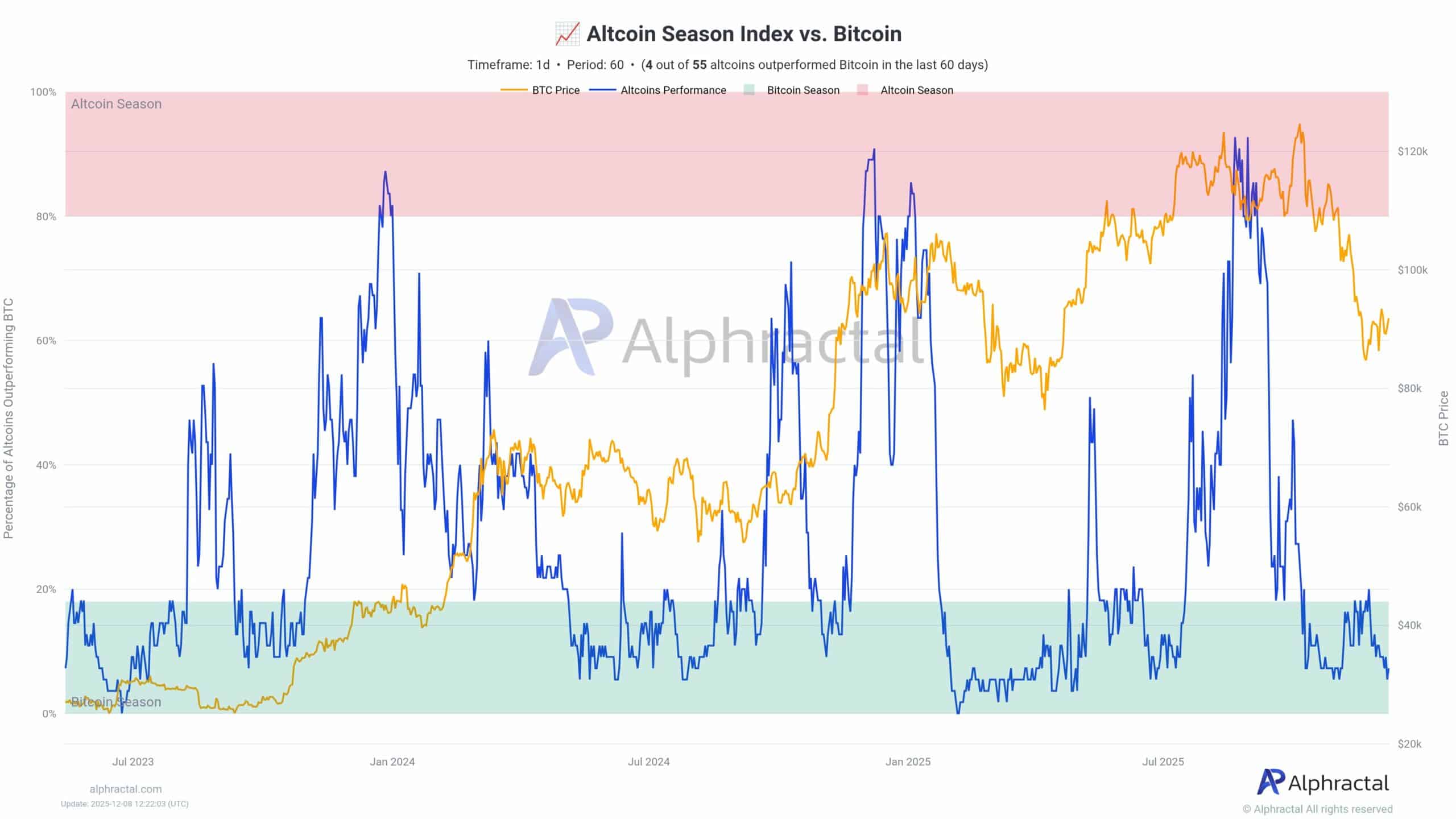

Bitcoin leads the market with only 4 of 55 altcoins outperforming it over the past 60 days, per the Altcoin Season Index.

-

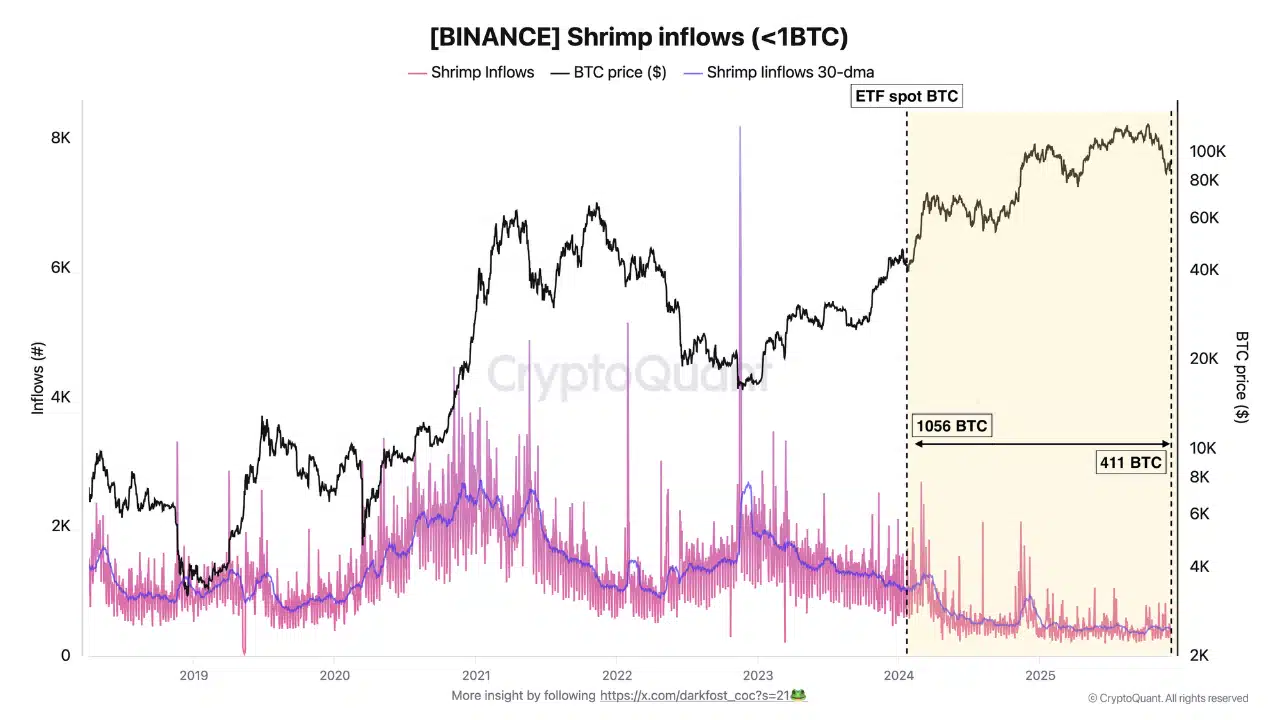

Retail inflows to exchanges have dropped over 60% since ETF launches, shifting focus to institutional ETF flows.

-

Bitcoin’s price hovers at $90,196, below key EMAs like the 20-day at $91,315, indicating hesitant upside potential backed by CryptoQuant data.

Explore Bitcoin’s dual strategy in 2025: ETF inflows and self-custody control shape the market as altcoins lag. Stay informed on dominance trends and investment shifts for smarter crypto decisions—read now!

What is Bitcoin’s dual strategy in 2025?

Bitcoin’s dual strategy in 2025 involves investors balancing the ease of Spot Bitcoin ETFs with the security of self-custody, allowing participation in institutional-grade products while maintaining personal control over assets. This approach has fueled consistent ETF inflows of $4-6 billion monthly, as reported by financial analysts, while long-term holders emphasize the value of holding private keys. It reflects a maturing market where accessibility meets decentralization.

How are Spot ETFs influencing retail trader behavior?

Spot ETFs are reshaping retail participation by offering a regulated, straightforward entry into Bitcoin investment, leading to a 60% decline in small-holder inflows to exchanges like Binance since their launch. According to on-chain data from CryptoQuant, shrimp wallets (under 1 BTC) transferred just 411 BTC recently, compared to 2,675 BTC during the 2022 FTX crisis and 1,056 BTC post-ETF debut. This shift suggests retail investors prioritize ETF simplicity and safety over direct trading, reducing volatility but sustaining market liquidity through institutional channels. Experts like analyst Darkfost note that this trend stabilizes Bitcoin’s price amid rising dominance, with correlations to major altcoins remaining high at 0.7-0.9. As ETF assets under management grow, retail’s retreat underscores a broader evolution toward professionalized crypto exposure.

Bitcoin is hogging the spotlight while altcoins struggle to find a pulse. At the same time, retail traders (once the heartbeat of every rally) have stepped back and have been replaced by the clinical flows of Spot ETFs.

The market looks familiar, but also… just a bit different.

This is interesting because COINOTAG previously reported that Bitcoin’s [BTC] landscape in 2025 is being shaped by a new “dual strategy.” This is where investors embrace both ETF convenience and self-custody control.

ETFs have logged months of $4-$6 billion inflows, while long-time users continue to defend the importance of holding their own keys.

BTC sets the pace

Source: Alphractal

Bitcoin continued to dominate the market, and the data made it hard to argue otherwise.

The Altcoin Season Index showed that only 4 out of 55 altcoins have outperformed BTC in the last 60 days. That’s far below the 75% threshold needed to enter true altcoin season.

So, the chart kept the market deep in “Bitcoin season,” with the index hovering around the 5-10% range.

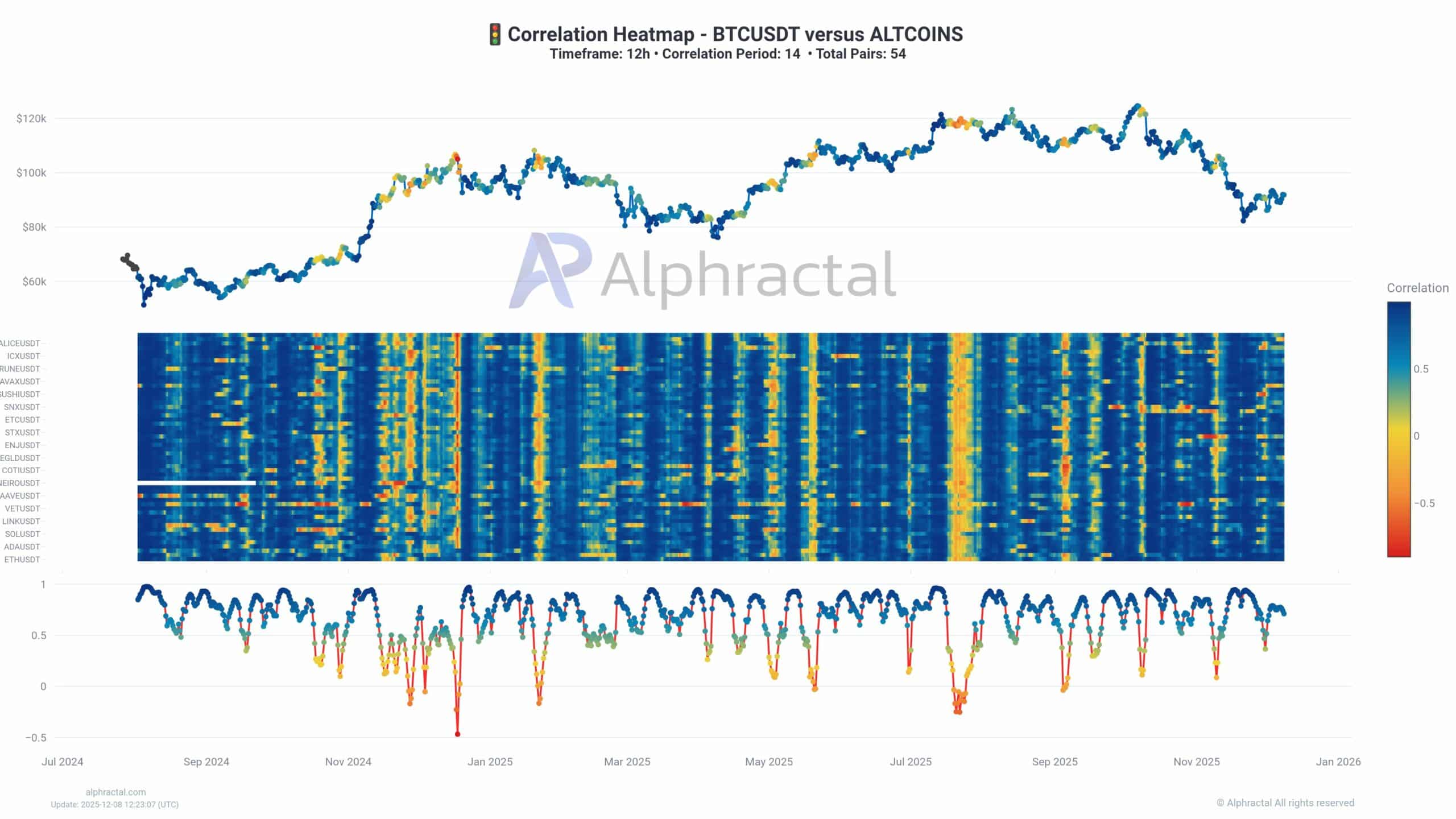

Source: Alphractal

The correlation chart also has a similar observation. Most major altcoins are tight with BTC, clustering around 0.7-0.9 correlation on average.

That means Bitcoin’s moves still dictate the entire market’s direction. Altcoins are reacting, not leading.

Retail steps back as ETFs take the wheel

Building on Bitcoin’s firm grip over the market, the drop in retail activity adds more.

According to analyst Darkfost, small holders – “Shrimps” with less than 1 BTC – sent just 411 BTC to Binance, down from 2675 BTC during the post-FTX panic in late 2022.

Even within the ETF era alone, their inflows have fallen more than 60%, sliding from 1056 BTC after Spot ETFs launched to the lows on the 9th of December.

Source: CryptoQuant

The timing is peculiar. Bitcoin has been rising, yet retail presence on exchanges has been fading.

Rather than chasing rallies, everyday investors now appear to prefer the simplicity and safety of ETFs. This can make the market relatively steadier.

There’s still a bit of a struggle, though

Bitcoin’s price action looked hesitant.

BTC traded at $90,196 at the time of writing, stuck below all major EMAs – with the 20-day at $91,315, 50-day at $96,902, and 100-day at $102,323. Until the price reclaims at least the 20-day average, upside conviction is likely to stay weak.

Source: TradingView

The RSI showed muted demand, while the CMF at 0.07 only indicated mild capital inflows. The market seems to be waiting for a clear catalyst.

For now, Bitcoin is holding its ground… but it’s not pushing forward either.

Frequently Asked Questions

What factors are driving Bitcoin’s dominance in 2025?

Bitcoin’s dominance in 2025 stems from strong Spot ETF inflows totaling $4-6 billion monthly and reduced altcoin performance, with the Altcoin Season Index below 10%. High correlations of 0.7-0.9 between BTC and major altcoins ensure Bitcoin dictates market direction, as evidenced by Alphractal analytics.

Why are retail investors shifting to Bitcoin ETFs?

Retail investors are turning to Bitcoin ETFs for their regulated access and lower risk compared to direct exchange trading, especially as small-holder activity on platforms like Binance has dropped 60% since ETF approvals. This move provides simplicity and aligns with the dual strategy of combining ETF exposure with self-custody, per CryptoQuant reports.

Key Takeaways

- Bitcoin dominance persists: With altcoins underperforming and ETF inflows surging, BTC remains the market leader in 2025.

- Retail evolution: A 60% drop in small-holder exchange activity highlights the rise of ETFs as a preferred vehicle for everyday investors.

- Price caution advised: Until BTC surpasses the 20-day EMA at $91,315, monitor for catalysts to confirm upward momentum.

Conclusion

In summary, Bitcoin’s dual strategy in 2025—merging Spot ETF accessibility with self-custody principles—solidifies its market dominance amid altcoin struggles and declining retail exchange activity. As inflows from ETFs continue to bolster liquidity and stability, investors should weigh these trends against current price hesitancy below key EMAs. Looking ahead, this balanced approach may pave the way for sustained growth; consider aligning your portfolio with these dynamics for informed participation in the evolving crypto landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Over 100 Crypto ETFs, Including Bitcoin, Could Launch in 2026 But Many May Close by 2027

December 18, 2025 at 04:37 AM UTC

Over 100 Crypto ETFs, Including Bitcoin, Could Launch in 2026 But Many May Close by 2027

December 18, 2025 at 04:22 AM UTC