Bitcoin LTH Sell-Off Eases, ETF Pressure Drops Amid Murky January Outlook

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin demand has improved as long-term holders (LTH) eased their sell-off from over 400K BTC monthly average in mid-December to positive flows, and U.S. Spot BTC ETF net selling pressure dropped significantly. However, January 2026 events could introduce volatility.

-

Long-term holders reduced BTC sales after intense dumping since July, signaling potential bottom formation.

-

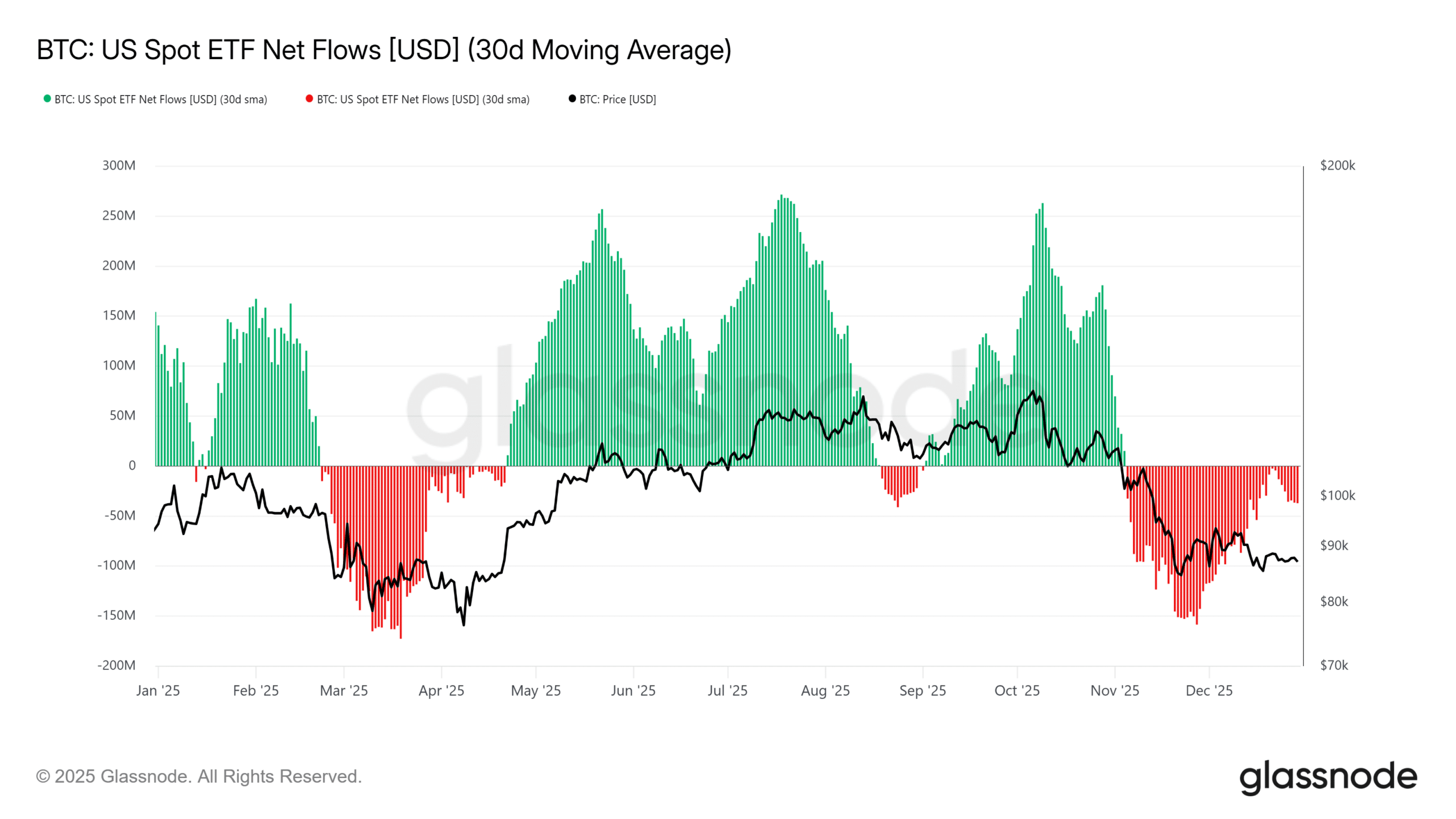

U.S. Spot BTC ETFs shifted from net sellers in November to easing outflows, supporting price stabilization.

-

January risks include MSCI delisting decisions, Fed rate updates, and government funding deadlines, with hedging eyeing $80K support.

Bitcoin demand shift strengthens with LTH sell-off easing and ETF pressure fading, but January 2026 Fed moves and MSCI rulings loom. Discover BTC outlook and key risks now.

What is driving the recent Bitcoin demand shift?

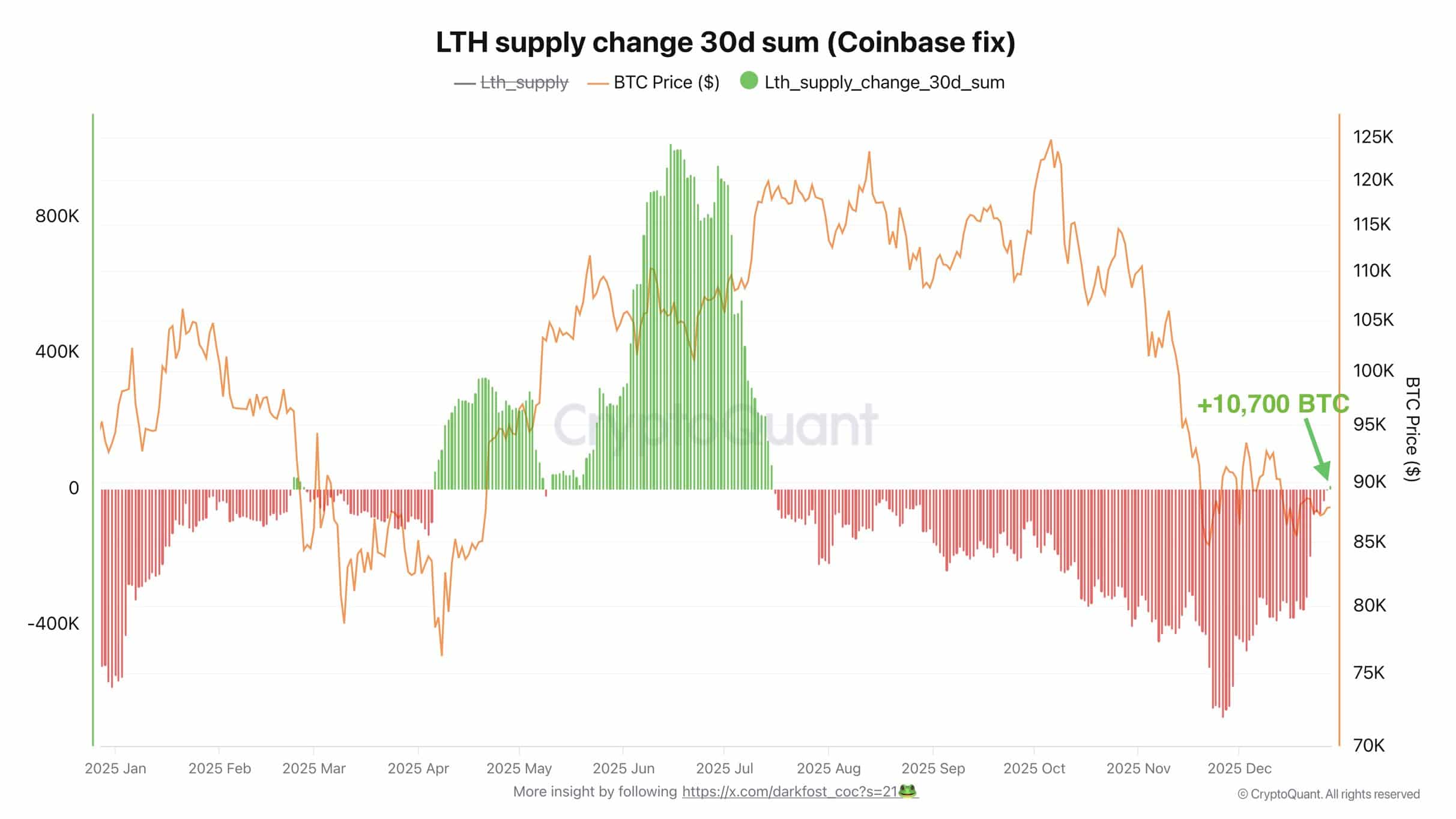

Bitcoin demand has shown clear signs of improvement, primarily driven by long-term holders (LTH)—investors holding BTC for over five months—easing their persistent sell-off that began in July. According to Glassnode data, LTH dumping peaked at over 400K BTC on a monthly average in mid-December before tapering off and turning positive. This reset, as noted by CryptoQuant analyst DarkFost, often precedes consolidation or bullish recoveries in historical patterns. Concurrently, U.S. Spot BTC ETF outflows have significantly diminished since November’s net selling phase, reducing downward pressure on prices currently hovering near $90K.

Source: Glassnode

The institutional sell-off has also notably slowed, positioning Bitcoin for a potential lift above $85K if these trends persist. DarkFost emphasized, “Historically, such shifts have often preceded the formation of consolidation phases or even bullish recoveries, depending on how the broader trend evolves.” These developments reflect growing confidence among seasoned investors, countering earlier price drags.

What January 2026 risks could disrupt Bitcoin’s demand recovery?

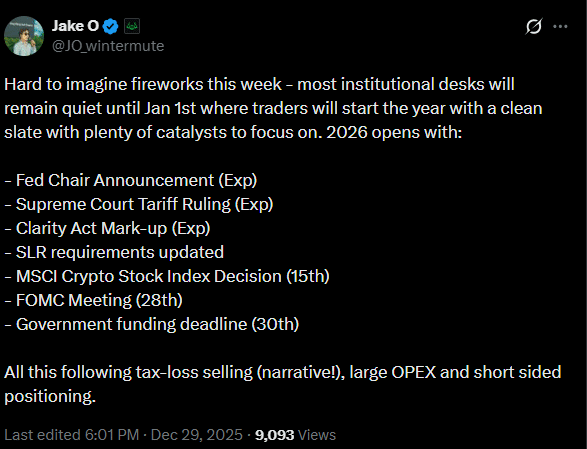

Despite improving Bitcoin demand, January 2026 introduces multiple volatility catalysts. Bloomberg ETF analyst Eric Balchunas observed BTC’s price action resembling ETF heartbeat trades—short-term, tax-motivated sales unrelated to sentiment—with major players offloading at losses to offset tax liabilities. A pivotal event on January 15 is the MSCI index eligibility decision for MicroStrategy and other BTC treasury firms; delisting Michael Saylor’s Strategy could erode market confidence.

Source: Glassnode

Balchunas noted, “Bitcoin’s price chart looks a lot like ETF heartbeat trades (short term tax-motivated trades that have nothing to do with actual sentiment).” Later, January 28-30 brings the Federal Reserve rate decision and government funding deadline, potentially leading to a shutdown if unresolved. A crypto bill markup delay amid 2026 U.S. elections, combined with Jerome Powell’s replacement by a White House-aligned Fed chair, could heighten uncertainty. Upside requires MSCI approval and bill progress; otherwise, expect subdued action.

Source: X

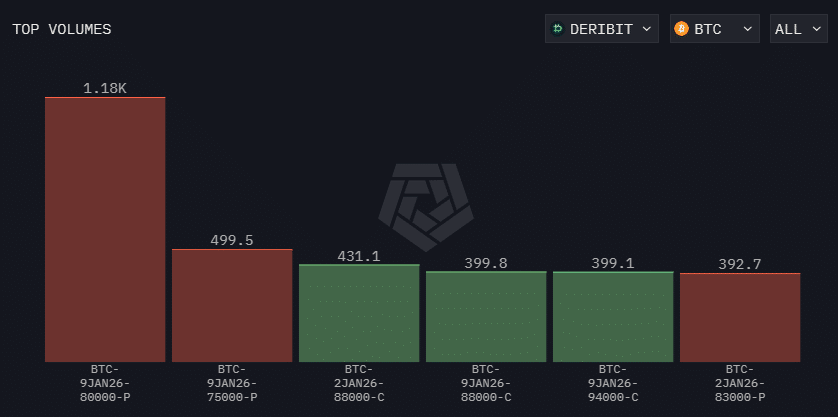

Market positioning reveals caution: Arkham data shows heightened put volumes hedging $80K-$83K support, with some eyeing $75K, while calls cluster at $88K and $94K, suggesting muted price swings below $95K short-term.

Source: Arkham

Frequently Asked Questions

Will Bitcoin hold $80K support amid January 2026 volatility?

Bitcoin’s $80K-$83K zone faces testing from hedging activity and tax sales, per Arkham and Glassnode metrics. LTH stabilization offers support, but MSCI delisting or Fed hikes could pressure it lower; positive ETF flows and index inclusion would reinforce the level in 40-50 words of analysis.

What’s the outlook for Bitcoin demand in early 2026?

Bitcoin demand continues improving with LTH sell-offs flipping positive and ETF pressures easing, as shown in Glassnode charts. January events like Fed decisions and funding deadlines introduce short-term choppiness, but historical patterns suggest potential recovery if macro catalysts align favorably.

Key Takeaways

- LTH sell-off eased: From 400K+ BTC monthly peak to positive flows, per Glassnode, aiding demand recovery.

- ETF outflows diminished: U.S. Spot BTC funds shifted from November net selling, reducing price drag.

- January hedging dominant: Puts at $80K outweigh calls at $94K, signaling volatility ahead per Arkham data.

Conclusion

The Bitcoin demand shift underscores resilience as LTH and ETF pressures subside, backed by Glassnode and CryptoQuant insights. Yet, January 2026’s MSCI rulings, Fed updates, and fiscal deadlines demand vigilance amid hedging toward $80K. Investors should monitor these for Q1 positioning, as bullish bill progress could propel BTC toward new highs.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC