Bitcoin Outflows from Exchanges May Signal ETF and Institutional Accumulation

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin outflows from exchanges have reached over 403,000 BTC since December 7, 2024, signaling reduced selling pressure and long-term holding intentions. This movement, representing about 2% of the total supply, benefits the market as coins shift to secure storage, ETFs, and institutional holders, potentially stabilizing prices around $90,000.

-

Exchange Bitcoin reserves have dropped by at least 400,000 compared to last year, a bullish indicator for price stability.

-

Individual users are transferring BTC to cold storage wallets, reducing immediate sell-off risks.

-

ETFs and public companies now hold more than 2.5 million BTC, surpassing exchange totals and accounting for nearly 11% of supply.

Discover why Bitcoin outflows from exchanges signal a bullish shift in 2025, with over 400,000 BTC moving to secure holdings. Explore ETF accumulation and market impacts—stay informed on crypto trends today!

What Are Bitcoin Outflows from Exchanges?

Bitcoin outflows from exchanges refer to the transfer of BTC from trading platforms to external wallets, often indicating reduced liquidity and stronger holder confidence. Since December 7, 2024, more than 403,000 BTC—roughly 2% of the total supply—have left exchanges, as reported by market intelligence platform Santiment. This trend, with exchange reserves now at about 1.4 million BTC compared to 1.8 million a year ago, suggests a market leaning toward long-term retention rather than short-term trading.

How Do Bitcoin Outflows Impact Market Sentiment?

Bitcoin outflows from exchanges typically foster positive market sentiment by limiting available supply for immediate sales. Santiment data highlights that lower exchange balances correlate with historically fewer major sell-offs, easing downward price pressure. As Bitcoin’s value stabilizes near $90,000, this shift underscores growing investor maturity, with coins moving to secure, offline storage. Experts note that such patterns often precede price appreciation, as reduced liquidity amplifies buying demand. For instance, over the past year, steady outflows have coincided with BTC’s recovery from corrections, demonstrating resilience in volatile conditions. Institutional involvement further bolsters this, as regulated entities prioritize accumulation over speculation, per insights from crypto analytics platforms.

There are at least 400,000 fewer Bitcoin on exchanges compared to the same time last year, in a positive sign for the market, according to the market intelligence platform Santiment. Users often move their Bitcoin away from exchanges into cold storage wallets, which, in theory, makes it harder to sell and could signal long-term plans to hold onto it. “In general, this is a positive long-term sign. The less coins exist on exchanges, the less likely we’ve historically seen a major sell-off that causes downside pressure for an asset’s price.” “As Bitcoin’s market value hovers around $90K, crypto’s top market cap continues to see its supply moving away from exchanges,” Santiment added.

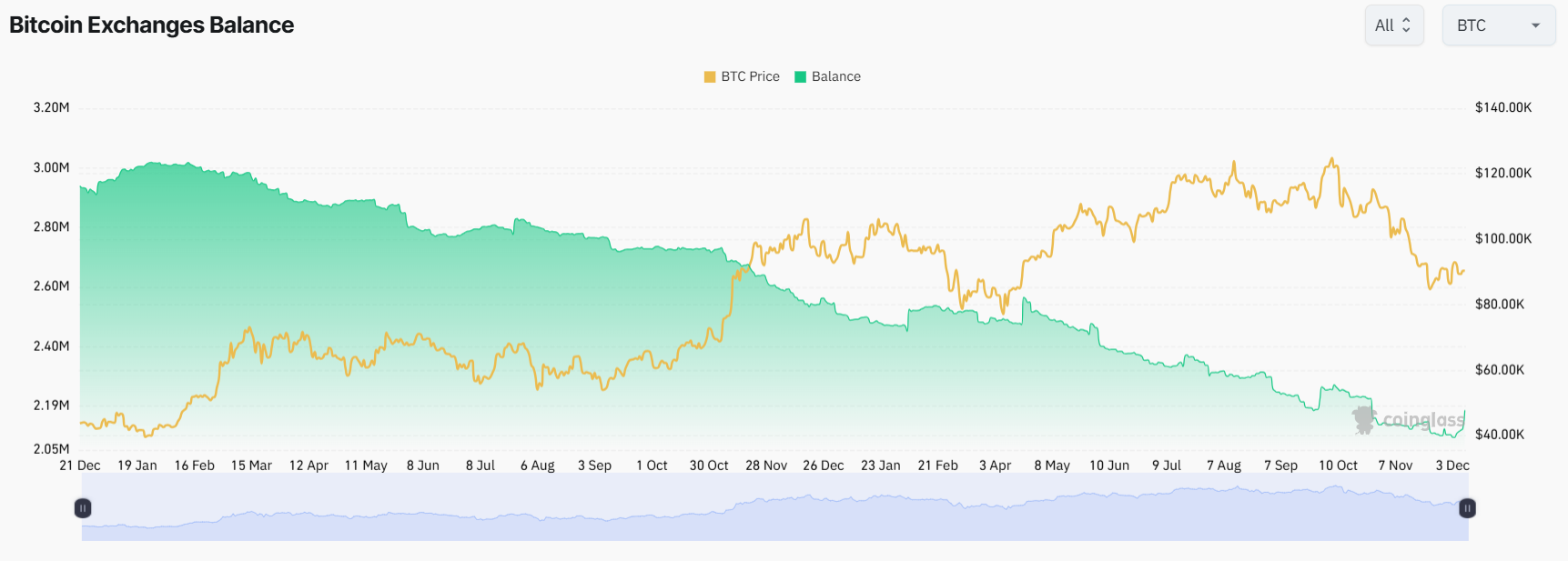

A year ago, there were around 1.8 million Bitcoin on exchanges. Source: Santiment

Bitcoin Is Also Shifting into ETFs

While much of the Bitcoin on exchanges is likely headed back to hodler wallets, Giannis Andreou, the founder and CEO of crypto miner Bitmern Mining, said that exchange-traded funds (ETF) could also be absorbing these coins. Citing data from BitcoinTresuries.Net, Andreou said that ETFs and public companies now hold more Bitcoin than all exchanges combined, after years of outflows and ETFs quietly accumulating in the background. “Institutional ownership has quietly crossed into a new phase: less liquid supply, more long-term holders, stronger price reflexivity, a market driven by regulated vehicles, not trading platforms,” Andreou said. “This shift is bigger than people think. Bitcoin isn’t moving to exchanges anymore. It’s moving off them straight into institutions that don’t sell easily. The supply squeeze is building in real time.”

Why Are Institutions Accumulating Bitcoin?

Institutions are accumulating Bitcoin due to its status as a hedge against inflation and its growing role in diversified portfolios. Data from analytics platforms like CoinGlass reveals exchange holdings at approximately 2.11 million BTC as of November 22, when prices dipped to around $84,600 during a market correction. This decline in exchange reserves reflects a broader trend of strategic buying by ETFs and corporations, which now control over 2.5 million BTC collectively—more than 11% of the circulating supply, according to BitBo. Such accumulation reduces market volatility over time, as these entities adopt long-term holding strategies backed by regulatory compliance. Expert analyses emphasize that this institutional influx provides a stabilizing force, countering retail-driven fluctuations and enhancing Bitcoin’s legitimacy as an asset class. For example, public companies have increased their BTC reserves amid favorable economic policies, further tightening supply dynamics.

Bitcoin held on exchanges has been steadily falling over the last year. Source: CoinGlass

Crypto data analytics platform CoinGlass shows the same trend, with Bitcoin held on exchanges sitting at around 2.11 million as of Nov. 22, when Bitcoin was suffering through a correction and trading hands for around $84,600. BitBo lists ETFs as holding over 1.5 million Bitcoin and public companies with over one million, representing nearly 11% of the total supply combined.

Frequently Asked Questions

What Causes Bitcoin Outflows from Exchanges?

Bitcoin outflows from exchanges are primarily driven by investors seeking secure storage to avoid trading risks and potential hacks. Since December 2024, over 403,000 BTC have been withdrawn, per Santiment data, as users opt for cold wallets for long-term holding. This behavior indicates confidence in Bitcoin’s future value and reduces short-term selling pressure.

How Does Institutional Bitcoin Accumulation Affect Prices?

Institutional Bitcoin accumulation, through ETFs and corporate treasuries, tends to support higher prices by locking up supply. With entities now holding more BTC than exchanges, as noted by BitcoinTresuries.Net, this creates a supply squeeze that amplifies upward momentum during demand surges. It also attracts more traditional investors, fostering sustained market growth.

Key Takeaways

- Reduced Exchange Reserves: Bitcoin outflows have cut exchange holdings by over 400,000 BTC year-over-year, limiting sell-off risks and promoting stability.

- Institutional Dominance: ETFs and companies control more than 2.5 million BTC, surpassing exchange totals and signaling a maturing market.

- Long-Term Bullish Signal: Continue monitoring outflows as a key metric for Bitcoin’s price trajectory, and consider secure storage for personal holdings.

Conclusion

Bitcoin outflows from exchanges represent a pivotal shift toward institutional and long-term holding, with over 403,000 BTC removed since December 2024 and reserves dropping significantly from last year’s levels. This trend, supported by ETF accumulation and expert insights from figures like Giannis Andreou, underscores reduced liquidity and potential for price appreciation near $90,000. As the crypto landscape evolves, investors should prioritize secure strategies to capitalize on this bullish momentum.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC