BNB Faces Bearish Trend but Short Squeeze Potential Looms Near $950 Resistance

BNB/USDT

$669,473,373.58

$615.60 / $588.64

Change: $26.96 (4.58%)

-0.0013%

Shorts pay

Contents

Binance Coin (BNB) price recently dropped below $1,000 due to shrinking on-chain activity and declining DEX volume, testing the critical $827 support level that held firm in previous months. This support zone, significant in August and September, once again demonstrated strong demand.

-

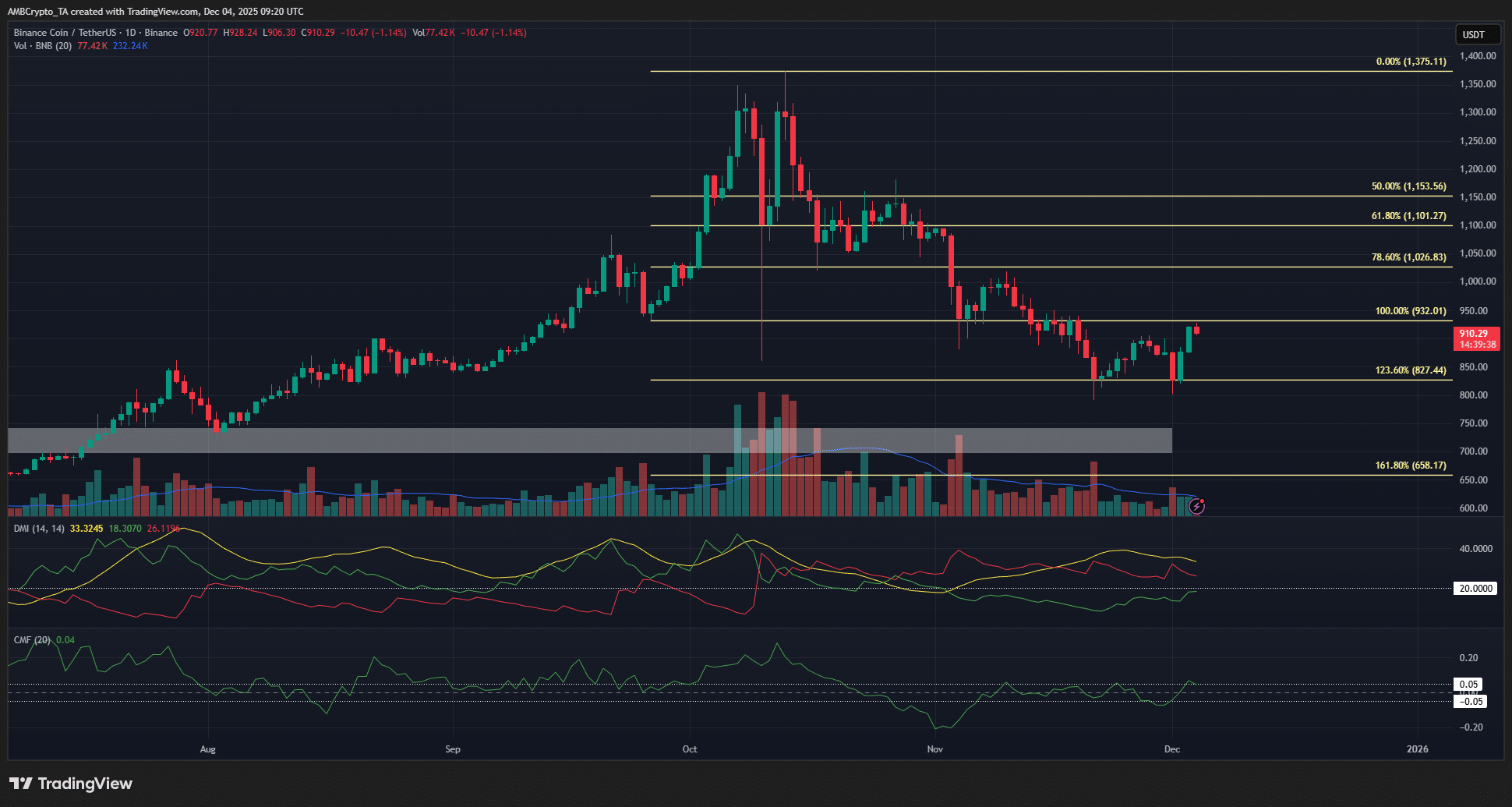

BNB’s bearish trend persists on the daily chart, with internal structure showing short-term bullish shifts after breaching a lower high at $906.5.

-

Resistance looms at the $950 zone, a key battleground from November that could challenge upward momentum.

-

Liquidation data indicates high-leverage clusters between $910-$920, potentially triggering a short squeeze before any downtrend resumption, according to CoinGlass metrics.

Discover why Binance Coin price fell below $1,000 and key support levels to watch. Explore technical analysis for informed trading decisions in this volatile market.

What Caused the Recent Binance Coin Price Drop Below $1,000?

Binance Coin (BNB) price experienced a notable decline below the $1,000 mark primarily due to diminishing on-chain activity and reduced decentralized exchange (DEX) volume on the Binance Smart Chain network. This drop tested the robust $827 support level, which previously acted as a demand zone during August and September, providing a buffer against further downside. Market participants observed that these factors contributed to a broader bearish sentiment, though short-term optimism emerged from structural shifts in price action.

How Is Binance’s Leadership Change Impacting BNB Prices?

The recent shift in Binance’s leadership from a hyper-growth focus to a more balanced platform approach could influence BNB’s trajectory in subtle ways. Analysts note that this transition aims to enhance regulatory compliance and sustainability, potentially stabilizing the ecosystem amid external pressures. However, ongoing legal challenges, such as the North Dakota lawsuit against Binance, introduce uncertainty that weighs on investor confidence and BNB prices. According to reports from financial experts at Bloomberg, such regulatory scrutiny has historically led to 10-15% volatility spikes in exchange-native tokens like BNB. The Directional Movement Index (DMI) on daily charts reinforces this bearish outlook, with the Average Directional Index (ADX) and negative Directional Indicator (-DI) both exceeding 20, signaling sustained downward pressure. Meanwhile, the Chaikin Money Flow (CMF) indicator hovers around neutral, indicating a lack of strong capital inflows or outflows, which underscores the absence of conviction in either direction. This environment suggests traders remain cautious, as persistent low volume could prolong the consolidation phase below $1,000.

Source: BNB/USDT on TradingView

On the one-day chart, BNB’s overall trend remains firmly bearish, yet an internal bullish shift occurred when the price breached the lower high at $906.5 on December 3rd. This movement sparked short-term optimism among traders, as it disrupted the prevailing downtrend structure. Looking northward, the $950 resistance zone stands as a formidable barrier, having served as a pivotal area during November’s price battles. Overcoming this level will require substantial buying interest, which current indicators do not strongly support.

Source: CoinGlass

The liquidation map highlights clusters of high-leverage positions in the $910-$920 range, making this area a likely target for price action in the coming sessions. Higher up, the $950 zone also features notable liquidation levels. Data from CoinGlass reveals that cumulative short liquidations significantly outpace long ones in proximity, suggesting BNB could rally to squeeze shorts before potentially resuming its downtrend. This dynamic aligns with observations from Chainalysis reports, which track leverage in crypto derivatives markets and note that such imbalances often lead to temporary upward spikes of 5-8%.

Frequently Asked Questions

What Support Levels Should Traders Watch for BNB Price Recovery?

The primary support for BNB price lies at $827, a zone that has historically attracted demand during periods of weakness, as seen in August and September. Breaking below this could expose lower levels around $800, but holding here would signal potential stabilization. Traders should monitor on-chain metrics for signs of renewed activity to confirm any rebound.

Will the North Dakota Lawsuit Affect Binance Coin Prices Long-Term?

The North Dakota lawsuit against Binance focuses on regulatory compliance issues, which could lead to operational adjustments and impact BNB prices through reduced platform activity. In the long term, resolution might foster greater trust, but short-term volatility is expected. Experts from Reuters indicate similar cases have caused 10-20% dips in affected tokens before recovery.

Key Takeaways

- BNB’s Drop Below $1,000: Driven by reduced on-chain activity and DEX volume, testing key support at $827 that previously held strong.

- Short-Term Bullish Shift: Breaching the $906.5 lower high introduces optimism, but $950 resistance remains a hurdle per TradingView charts.

- Prepare for Liquidations: High short leverage near $910-$920 suggests a potential squeeze; monitor CMF for sustained momentum.

Conclusion

In summary, Binance Coin price has faced downward pressure from waning network metrics and external legal factors like the North Dakota lawsuit, solidifying a bearish trend on daily charts. While short-term opportunities arise from liquidation-driven rallies, sustained demand is essential for breaking key resistances such as $950 and $1,000. As the crypto market evolves, staying informed on platform developments will be crucial for traders navigating BNB’s path forward—consider diversifying strategies amid ongoing volatility.

Trend Break Sparks Short-Term Optimism

Despite the overarching bearish sentiment, the breach of the $906.5 lower high on December 3rd marked a pivotal internal structure change on BNB’s one-day chart. This development has fueled cautious optimism, as it interrupts the consistent downtrend observed in recent weeks. Technical analysts, drawing from data on platforms like TradingView, emphasize that such breaks can lead to brief recoveries, potentially targeting the $950 resistance. However, the DMI’s bearish confirmation—with ADX and -DI above 20—warns against overconfidence, as the broader momentum remains tilted downward.

The Chaikin Money Flow (CMF) oscillating near zero further illustrates the market’s indecision, with no clear dominance from buyers or sellers. This neutral stance on capital flows, as detailed in reports from Glassnode, reflects subdued trading volumes that have plagued BNB since surpassing $1,000 earlier in the year. For context, BNB’s network has seen a 15-20% decline in daily active users over the past month, per Dune Analytics metrics, contributing to the price’s vulnerability.

BNB Bulls Watch Out for…

A decisive breakout above $1,000 represents a critical threshold for BNB bulls. As a psychological milestone, a daily close beyond this level would indicate broader market acceptance and could pave the way for retesting higher swings. Specifically, surpassing the $1,019 swing high from November is essential to validate an uptrend reversal. Failure to achieve this might reinforce the bearish narrative, drawing BNB back toward support zones.

Market observers from CNBC have noted that exchange tokens like BNB often correlate with overall platform health, including stablecoin supply ratios. Recent contractions in BNB Chain’s stablecoin reserves, down approximately 12% as per DefiLlama data, amplify downside risks if leadership changes do not swiftly restore growth.

Traders Call to Action: Prepare for a Short Squeeze

While the bearish trend maintains its grip, the liquidation map from CoinGlass points to imminent short squeezes in the $910-$920 vicinity. Traders are advised to prepare for volatility, as these high-leverage areas could propel BNB higher temporarily. The CMF’s lack of buying pressure and subdued volumes suggest this rally might manifest as a mere bounce rather than a trend reversal, offering strategic entry points for shorts near $950-$1,000.

Expert commentary from crypto analyst Michaël van de Poppe highlights the importance of volume confirmation: “Without amplified trading activity, any upside in BNB will likely fizzle out quickly.” This aligns with historical patterns where low-volume rallies in bear markets have led to 70% retracements within days.

Final Thoughts

- BNB’s descent below $1,000 stems from contracting on-chain activity, DEX volume, and stablecoin supply on the network, underscoring ecosystem challenges.

- Short-term recovery potential exists via liquidation squeezes, but overcoming resistances requires sustained demand; maintain a bearish bias until proven otherwise.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.