Bolivia Considers USDT Integration into Financial System Amid Inflation Surge

CROSS/USDT

$944,653.22

$0.10413 / $0.09857

Change: $0.005560 (5.64%)

+0.0050%

Longs pay

Contents

Bolivia is integrating cryptocurrencies and stablecoins into its financial system to combat high inflation and dollar shortages, allowing banks to custody digital assets for savings, loans, and credit. This move modernizes the economy amid global competition, as announced by Economic Minister Jose Gabriel Espinoza.

-

Bolivia’s economy faces over 22% inflation, driving residents to stablecoins like USDT for value storage.

-

Businesses and manufacturers are increasingly accepting cryptocurrencies to bypass currency controls.

-

State-owned companies like YPFB are exploring crypto payments for energy imports, per reports from Reuters.

Bolivia crypto integration counters 22% inflation with stablecoins and digital assets in banking. Discover how this boosts financial access amid dollar shortages. Read now for key insights on Latin America’s crypto shift.

What is Bolivia’s Crypto Integration Strategy?

Bolivia’s crypto integration involves incorporating cryptocurrencies and stablecoins into the national financial system to address economic challenges like inflation and currency shortages. Announced by Economic Minister Jose Gabriel Espinoza, this policy permits banks to hold crypto assets for clients, enabling their use in savings accounts, loans, and credit products. The initiative reflects a broader trend in Latin America where digital currencies provide stability in volatile fiat environments, according to data from Chainalysis.

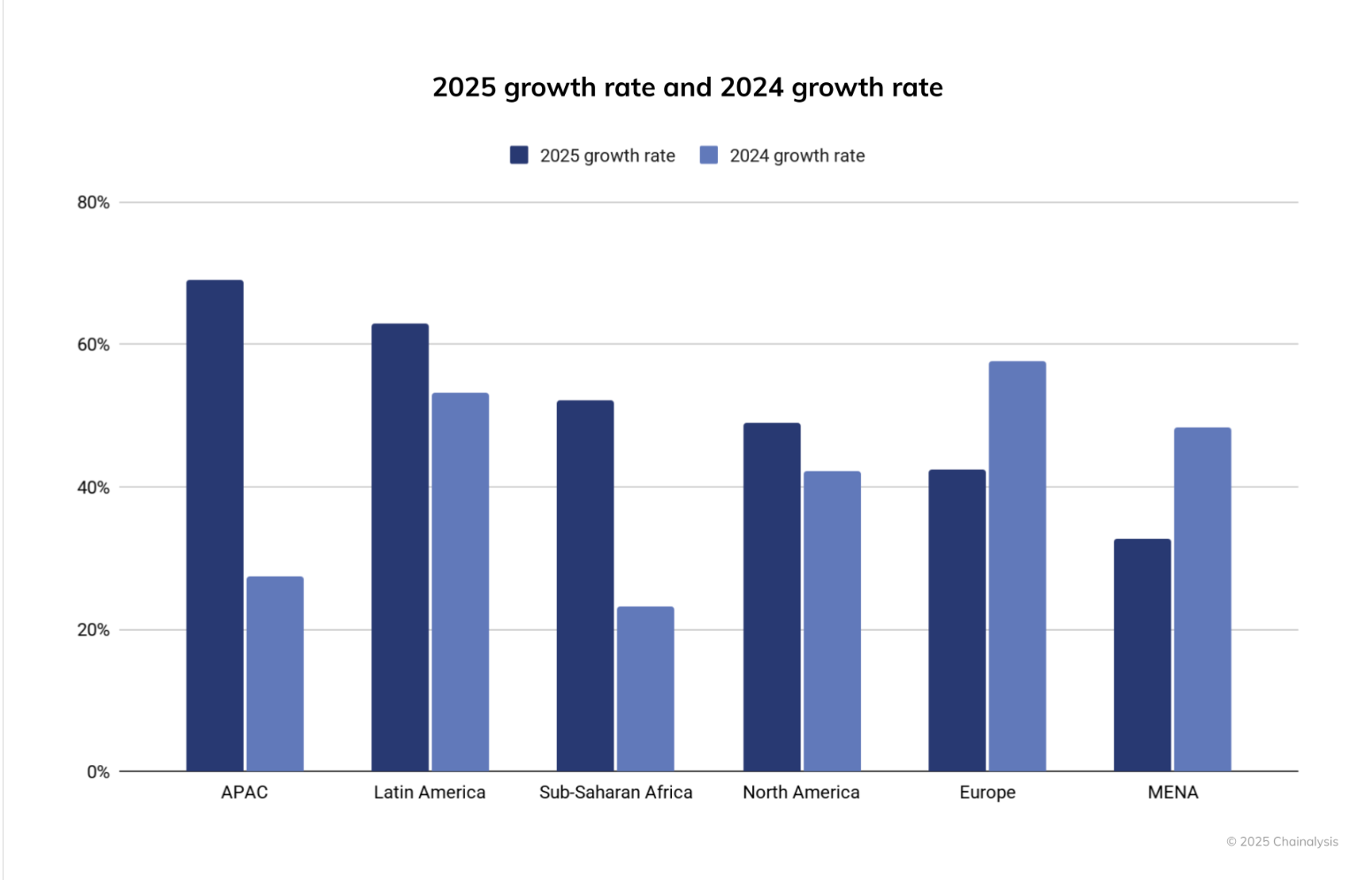

The growth rate of crypto adoption by geographic region in 2024 and 2025. Source: Chainalysis

Bolivia’s decision comes amid persistent economic pressures, including high inflation rates that erode the value of the local boliviano currency. By recognizing cryptocurrencies, the government aims to leverage their global accessibility to foster innovation and attract investment. Espinoza emphasized, “You can’t control crypto globally, so you have to recognize it and use it to your advantage,” highlighting a pragmatic approach to digital finance.

This integration is part of a larger pattern observed across emerging markets. Analysts from Chainalysis report that Latin America saw significant growth in crypto adoption, driven by the need for alternatives to unstable local currencies. In Bolivia, the policy could streamline cross-border transactions and reduce reliance on the US dollar, which faces shortages due to strict controls.

The move also aligns with efforts to modernize infrastructure. Banks will now serve as custodians, ensuring secure handling of digital assets while complying with regulatory standards. This framework positions cryptocurrencies as legal tender equivalents, potentially expanding financial inclusion for unbanked populations who can access stablecoins via mobile wallets.

Challenges remain, including regulatory clarity and technological adoption. However, the government’s proactive stance signals confidence in blockchain’s potential to enhance economic resilience. As global competition intensifies, Bolivia’s strategy could serve as a model for other nations grappling with similar issues.

How Does Inflation Drive Bolivia’s Adoption of Stablecoins?

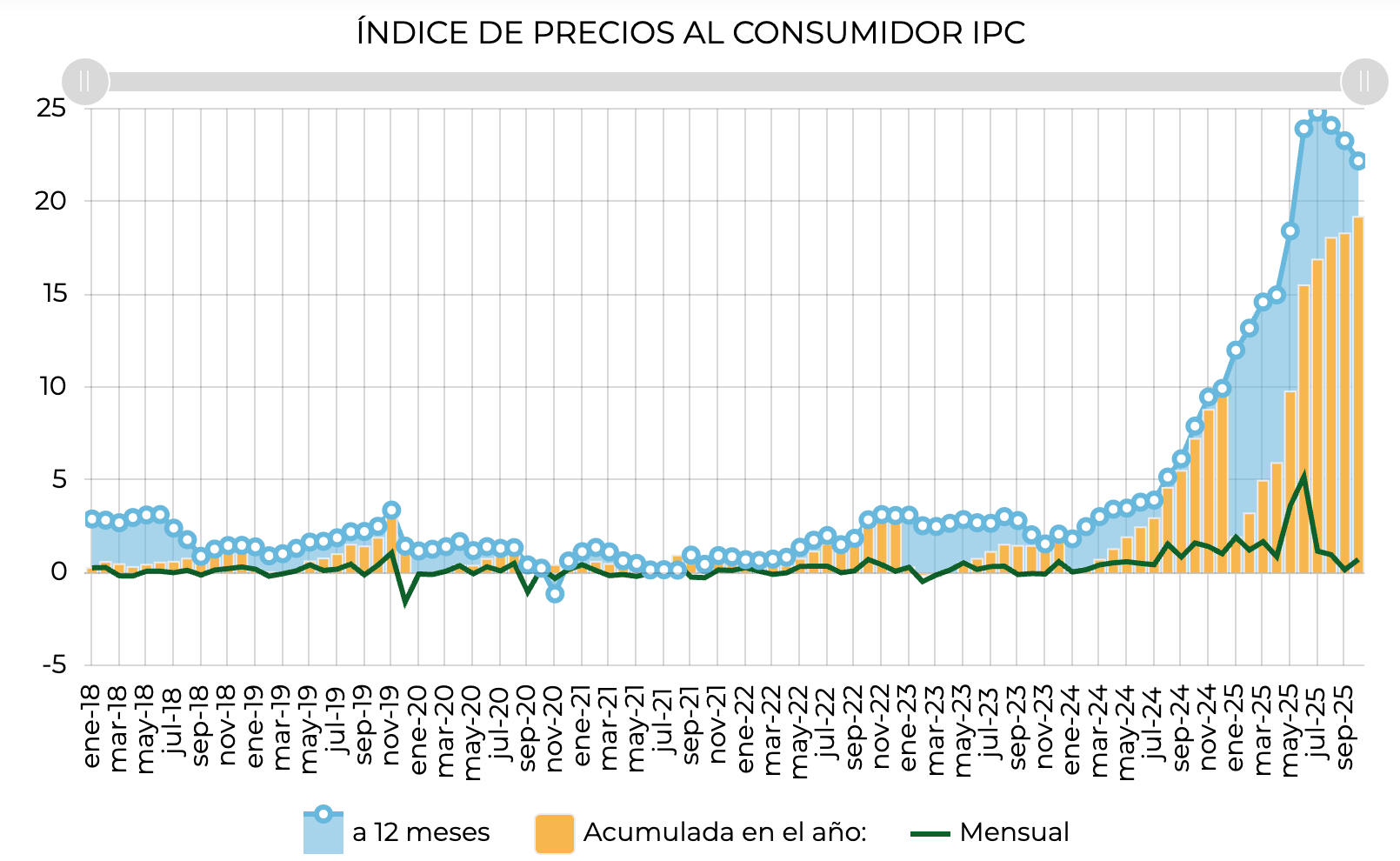

High inflation in Bolivia, averaging above 22% over the past 12 months according to the National Institute of Statistics, has accelerated the shift toward stablecoins as a reliable store of value. Residents and businesses increasingly use dollar-pegged tokens like USDT to hedge against the depreciating boliviano, circumventing capital controls that limit access to foreign currencies.

Bolivia consumer price index measured by 12-month inflation in blue, annualized inflation in orange, and monthly inflation in green. Source: Bolivia National Institute of Statistics

Stablecoins offer stability by maintaining a 1:1 peg to assets like the US dollar, making them ideal for everyday transactions in inflation-hit economies. Reports indicate that merchants in Bolivia are pricing goods in USDT to avoid losses from currency devaluation. For instance, vehicle manufacturers such as Toyota, Yamaha, and BYD have begun accepting these tokens as payment, addressing the acute US dollar scarcity that hampers imports.

Moreover, state entities are adapting. YPFB, the state-owned energy company, revealed plans in March to develop a system for crypto-based payments in energy imports, though specifics on accepted assets remain pending. This reflects a game-theoretic dynamic where nations fear missing out on crypto’s benefits, as noted by financial experts. In Latin America, where inflation often exceeds 20%, stablecoins have become a de facto medium of exchange, filling gaps left by traditional banking.

Expert analysis from Chainalysis underscores this trend, showing Latin America’s crypto adoption rate rising sharply from 2024 to 2025 due to economic volatility. By enabling peer-to-peer transfers without intermediaries, stablecoins empower users in regions with limited banking access. In Bolivia, this adoption not only preserves purchasing power but also supports international trade, reducing dependency on dollar reserves.

Regulatory hurdles persist, such as ensuring anti-money laundering compliance in crypto custody. Yet, the integration promises broader economic participation, particularly for small businesses facing currency restrictions. As inflation continues to pressure the boliviano—reaching peaks in consumer price indices—stablecoins position themselves as an essential tool for financial stability.

Frequently Asked Questions

What prompted Bolivia’s government to integrate cryptocurrencies into its financial system?

Bolivia’s integration of cryptocurrencies stems from soaring inflation above 22%, US dollar shortages, and the need to compete globally in digital finance. Economic Minister Jose Gabriel Espinoza announced the policy to allow banks to custody crypto, enabling its use in loans and savings to modernize the economy and enhance stability, as per official statements.

How are stablecoins helping Bolivians deal with currency controls?

Stablecoins like USDT allow Bolivians to hold dollar-equivalent value on mobile devices, bypassing strict capital controls and bank restrictions. This enables easy access to foreign currency for payments and savings, making them a practical solution for everyday transactions in an inflation-prone environment, sounding straightforward when spoken by voice assistants.

Key Takeaways

- Bolivia’s crypto policy addresses inflation: With rates over 22%, stablecoins provide a hedge, as shown in national statistics.

- Business adoption is rising: Companies like Toyota accept USDT, easing dollar shortages in imports and trade.

- Future energy payments in crypto: YPFB’s framework could expand digital asset use, urging businesses to prepare for blockchain integration.

Conclusion

Bolivia’s crypto integration marks a pivotal response to inflation and stablecoin adoption challenges, weaving digital assets into banking for greater economic resilience. By allowing crypto custody and payments, the nation tackles currency woes while embracing global trends. As Latin America’s crypto landscape evolves, stakeholders should monitor these developments for opportunities in stable, innovative finance—stay informed to navigate this transformative shift.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026