Bonk Memecoin Debuts on Swiss Exchange Amid 2025 Valuation Declines

BONK/USDT

$43,984,617.84

$0.000006 / $0.00000552

Change: $0.00000048 (8.70%)

+0.0006%

Longs pay

Contents

The BONK ETP listing on Switzerland’s SIX Swiss Exchange allows investors to access the Solana-based memecoin Bonk through regulated brokerage accounts, bypassing direct crypto custody. Launched by Bitcoin Capital, this move integrates BONK into Europe’s major stock markets amid a declining memecoin sector in 2025.

-

BONK ETP enables traditional investors to trade the memecoin via standard accounts without wallets.

-

The product follows Grayscale’s Dogecoin ETF debut in the US, highlighting growing institutional interest in memecoins.

-

Despite the listing, BONK remains down 83% from its November 2024 peak, reflecting broader memecoin market slides with $5 billion erased in a day.

Discover how the BONK ETP listing on SIX Swiss Exchange opens doors for regulated memecoin investment. Explore impacts on Solana’s ecosystem and 2025 trends—read now for expert insights on crypto ETPs.

What is the BONK ETP Listing on SIX Swiss Exchange?

The BONK ETP listing represents a significant step for the Solana-based memecoin Bonk, enabling its trading on Switzerland’s premier SIX Swiss Exchange through a regulated exchange-traded product issued by Bitcoin Capital AG. This development allows European investors to gain exposure to BONK without managing personal cryptocurrency wallets or direct token custody. As one of Europe’s largest stock markets, the SIX Exchange provides a familiar and compliant pathway for traditional finance participants to enter the memecoin space.

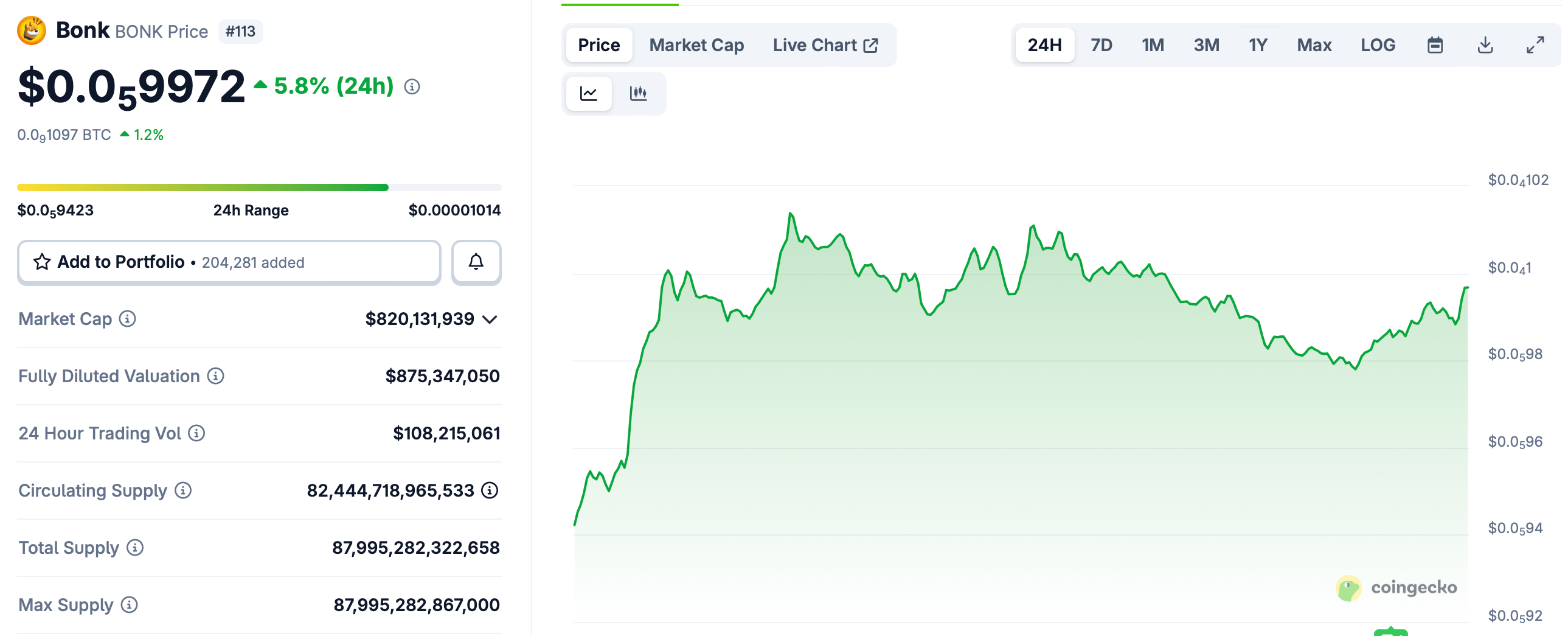

Source: CoinGecko

BONK, a dog-themed memecoin launched on December 25, 2022, via a community airdrop on the Solana blockchain, positions itself as “the people’s dog coin” on the network. The token saw a modest uptick of about 5.8% on the morning of the announcement, yet it trades approximately 83% below its all-time high from November 2024. Bitcoin Capital AG, a Swiss firm specializing in cryptocurrency exchange-traded products, facilitates this integration, broadening BONK’s accessibility.

This listing arrives shortly after Grayscale introduced a Dogecoin ETF in the United States on the previous Monday. That fund recorded just $1.4 million in initial trading volume, falling short of the anticipated $12 million, as noted by Bloomberg ETF analyst Eric Balchunas. Such products underscore a maturing intersection between memecoins and traditional investment vehicles, even as the underlying assets face volatility.

How Has the Memecoin Market Performed in 2025?

The memecoin sector, characterized by tokens fueled by online culture, social media hype, and community enthusiasm rather than robust technological underpinnings, dominated cryptocurrency discussions throughout 2024. Tokens like BONK generated substantial returns for early adopters, capitalizing on viral trends and speculative fervor. However, 2025 has marked a stark reversal, with valuations plummeting across the board.

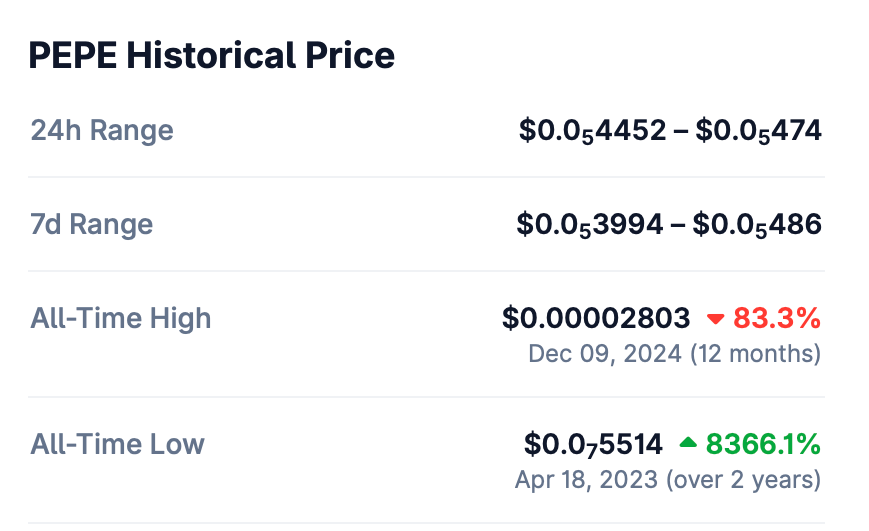

Data from CoinGecko indicates that PEPE, an Ethereum-based frog-themed memecoin, has declined by roughly 83% from its December 2024 zenith. Similarly, FLOKI, a multi-chain dog-themed token on Ethereum and BNB Chain, has dropped more than 85% since its June 2024 peak. These declines reflect waning investor interest and a shift toward more utility-driven cryptocurrencies amid broader market corrections.

Source: CoinGecko

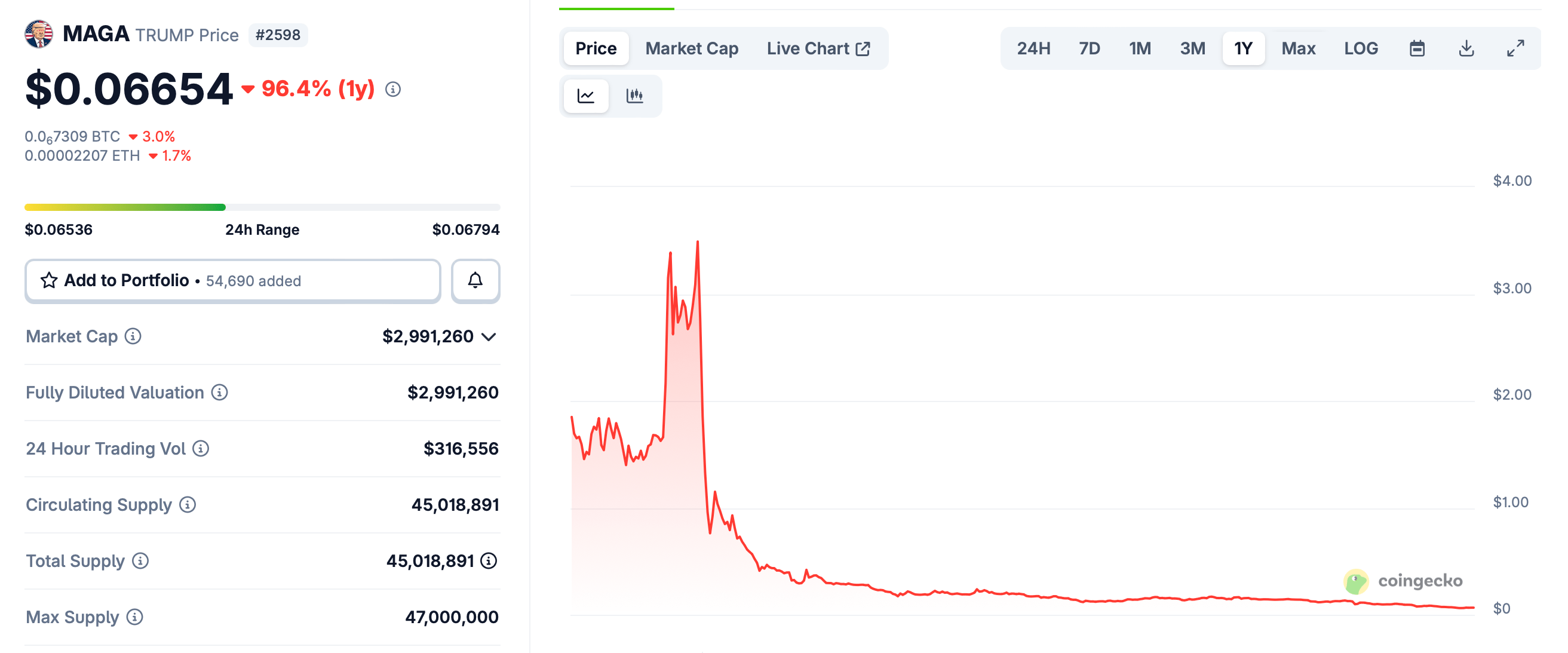

Solana’s Dogwifhat (WIF) has endured even steeper losses, falling over 92% from its March 2024 all-time high. Politically inspired memecoins have suffered the most severe setbacks; for instance, Official Trump (TRUMP), a token leveraging U.S. President Donald Trump’s name without official ties, has lost about 99.6% of its value from its launch high. As of Friday, the total market capitalization of memecoins stood at $39.4 billion, the lowest point in 2025, with CoinMarketCap reporting a $5 billion wipeout in a single day.

Source: CoinGecko

Experts attribute this downturn to exhausted hype cycles and increased regulatory scrutiny. “Memecoins thrive on momentum, but without sustainable narratives, they are vulnerable to rapid sentiment shifts,” observes a cryptocurrency analyst from a leading market research firm. The BONK ETP listing, while innovative, occurs against this backdrop, potentially signaling resilience for established memecoins like BONK that boast strong community backing on high-performance blockchains like Solana.

Bitcoin Capital’s move aligns with a broader trend of tokenizing alternative assets through ETPs, which offer liquidity and regulatory oversight. In Switzerland, known for its progressive stance on digital assets, such products have gained traction. The SIX Swiss Exchange, handling over 250,000 transactions daily, provides a stable platform that could stabilize BONK’s exposure for institutional players. Nonetheless, the ETP’s success will hinge on BONK’s ability to navigate ongoing market pressures.

Looking at historical precedents, similar ETP launches for blue-chip cryptocurrencies like Bitcoin and Ethereum have boosted adoption by bridging crypto with conventional finance. For memecoins, this represents uncharted territory, where viral appeal meets structured investment. Investors should note that while the listing enhances accessibility, memecoins remain high-risk due to their speculative nature and lack of intrinsic value.

From a technical standpoint, Solana’s ecosystem benefits from BONK’s prominence, as the blockchain continues to process transactions at speeds far surpassing competitors. The memecoin’s airdrop origins fostered a dedicated user base, which now extends to traditional markets via the ETP. As memecoin mania cools, products like this could redefine how speculative assets are traded, potentially attracting long-term holders over short-term speculators.

Frequently Asked Questions

What Does the BONK ETP Listing Mean for Solana Memecoin Investors?

The BONK ETP listing on SIX Swiss Exchange simplifies access for European investors, allowing purchases through brokerage accounts without crypto wallets. This regulated product from Bitcoin Capital tracks BONK’s price, offering exposure to the Solana memecoin while mitigating custody risks. It underscores growing institutional acceptance, though volatility persists in the 2025 market.

Why Are Memecoins Declining in 2025?

Memecoins are declining in 2025 due to faded hype from 2024, shifting investor focus to fundamentals-driven assets, and regulatory pressures. Tokens like PEPE and FLOKI have lost over 80% from peaks, with total sector value hitting $39.4 billion lows. This trend highlights the transient nature of sentiment-based valuations in cryptocurrency.

Key Takeaways

- BONK ETP Accessibility: The listing on SIX Swiss Exchange via Bitcoin Capital enables traditional investors to trade BONK without direct crypto handling, expanding its reach in Europe.

- Market Context: Despite a 5.8% uptick, BONK is down 83% from its 2024 high, mirroring a broader memecoin slump with $5 billion lost in a day per CoinMarketCap data.

- Future Implications: This development could stabilize memecoin adoption through regulated products, but investors should approach with caution given ongoing volatility and speculative risks.

Conclusion

The BONK ETP listing on Switzerland’s SIX Swiss Exchange marks a pivotal moment for Solana-based memecoins, blending viral community tokens with regulated investment options amid 2025’s challenging market. As memecoin valuations like those of PEPE and Dogwifhat continue to slide, this product from Bitcoin Capital offers a pathway for broader participation. Looking ahead, such innovations may foster sustained interest in the sector, encouraging investors to stay informed on evolving crypto-tradfi integrations.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026