BONK Signals Potential Uptrend as Whales Accumulate Amid Volume Surge

BONK/USDT

$43,984,617.84

$0.000006 / $0.00000552

Change: $0.00000048 (8.70%)

+0.0006%

Longs pay

Contents

Why is BONK up today? The Solana-based memecoin BONK has rallied 13.25% after hitting a local low, driven by aggressive buying from whales and a 111% volume surge to $194 million. This shift indicates strong accumulation and renewed market demand, pushing the price to $0.00001007.

-

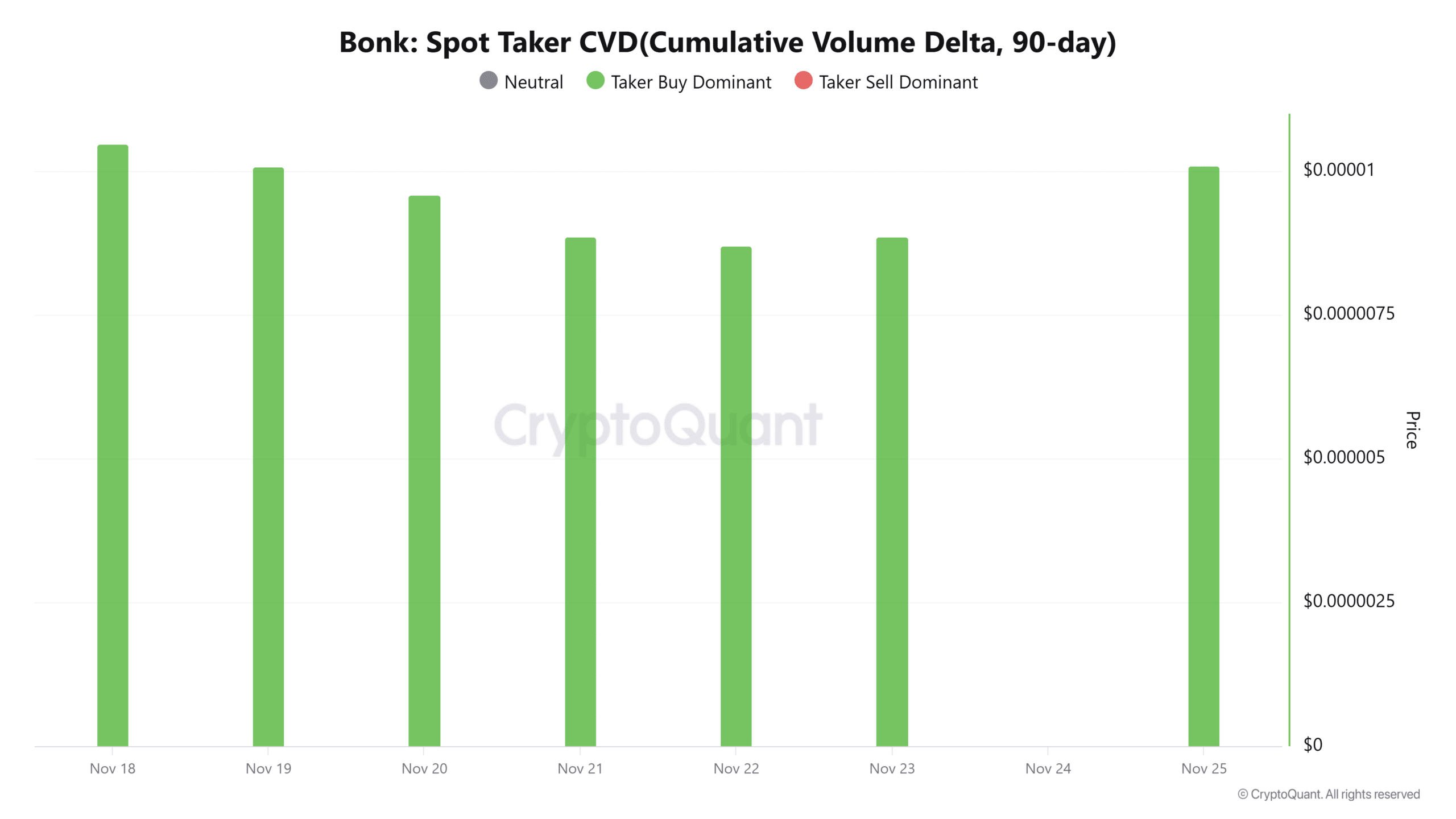

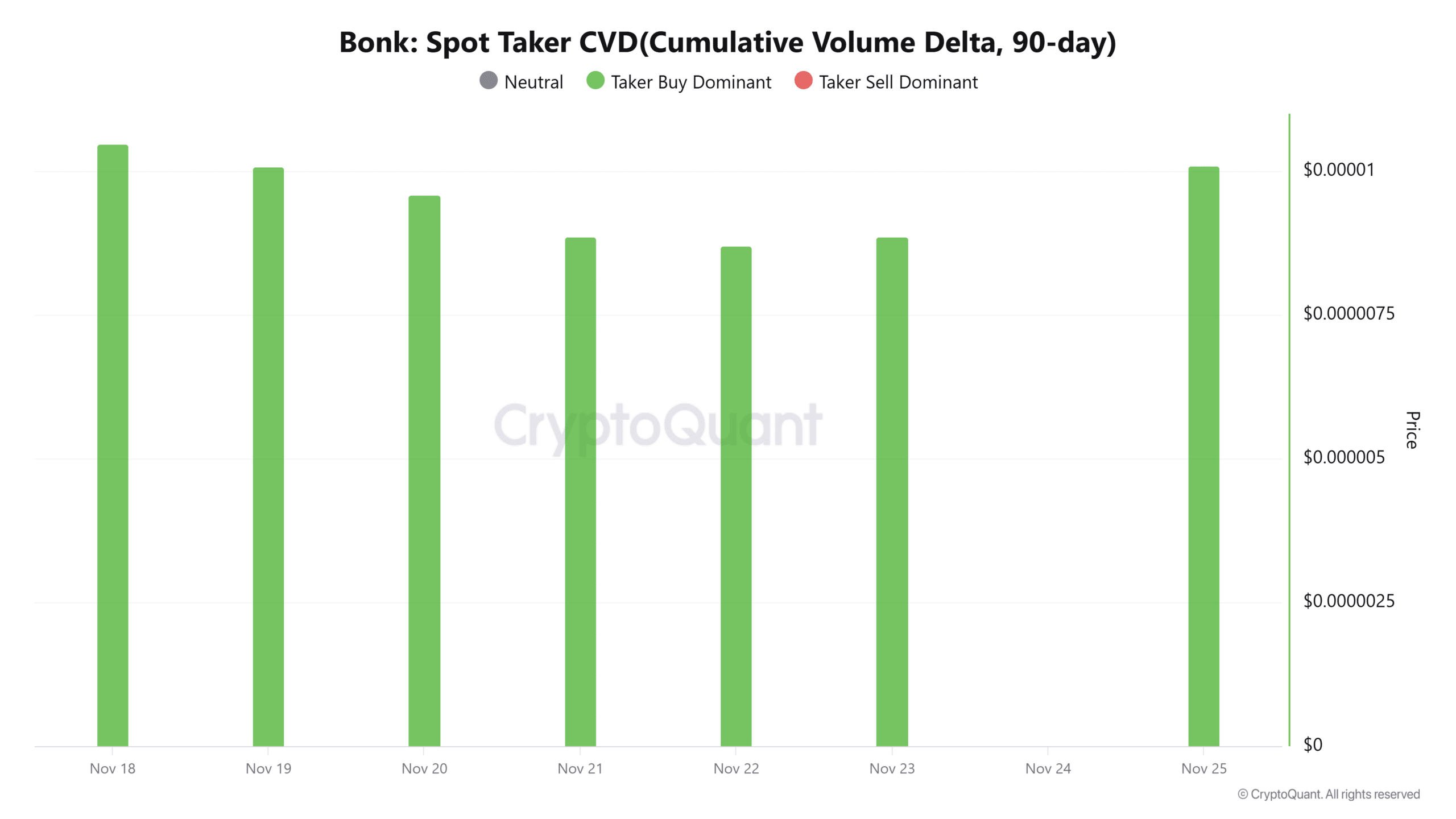

Buyer dominance: Spot Taker CVD shows buyers retaking control after a downtrend.

-

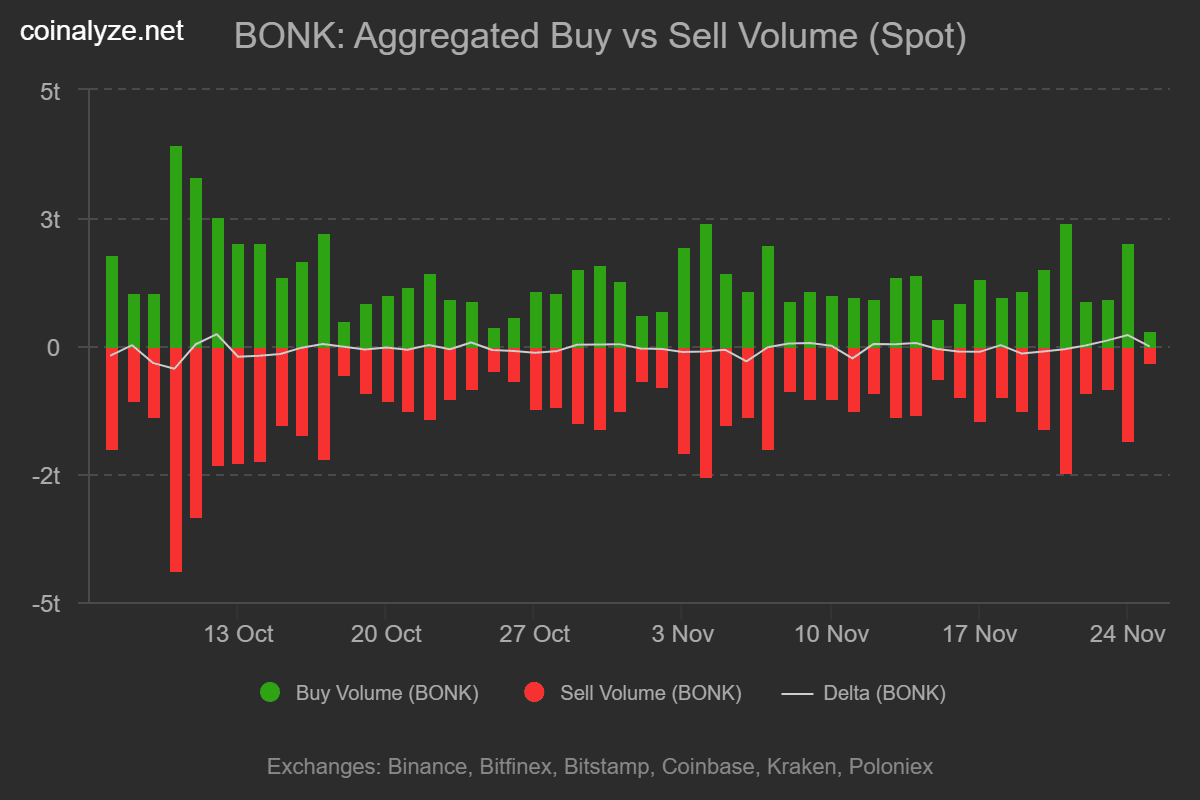

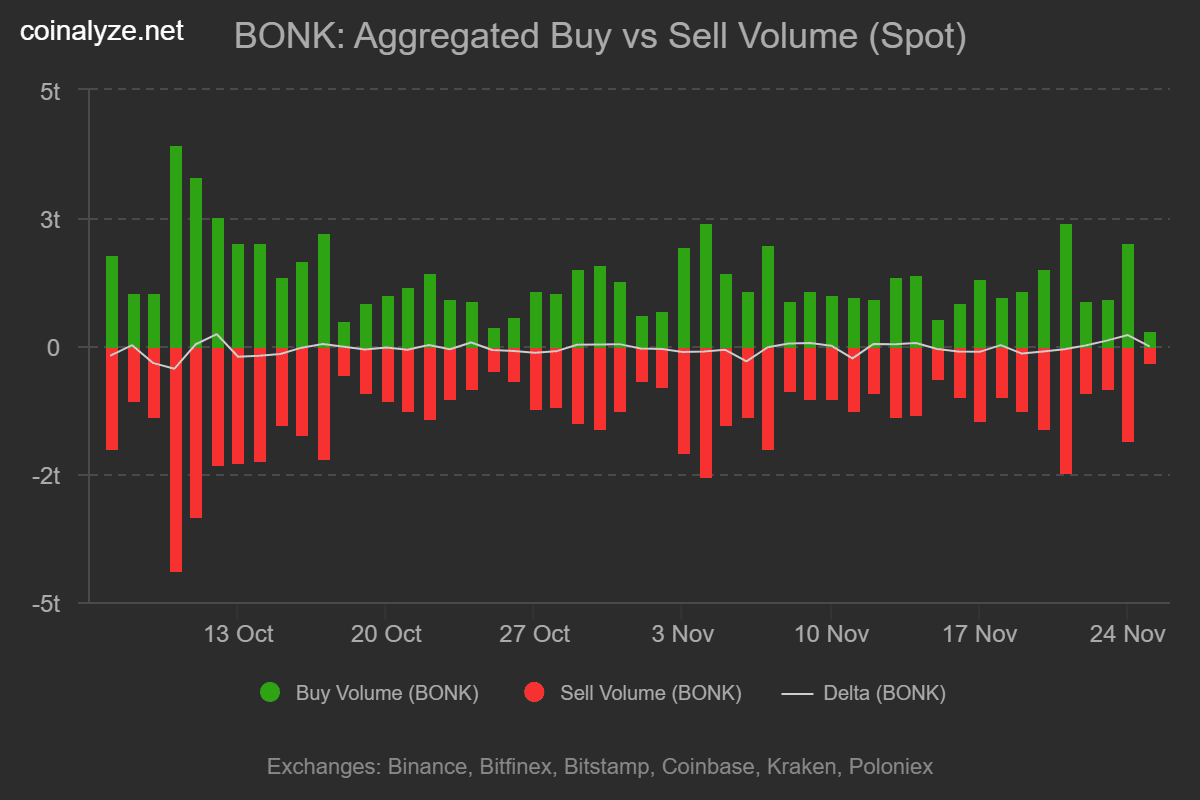

Volume explosion: Trading activity jumped 111%, with 4.3 trillion in buy orders over three days, signaling capital inflows.

-

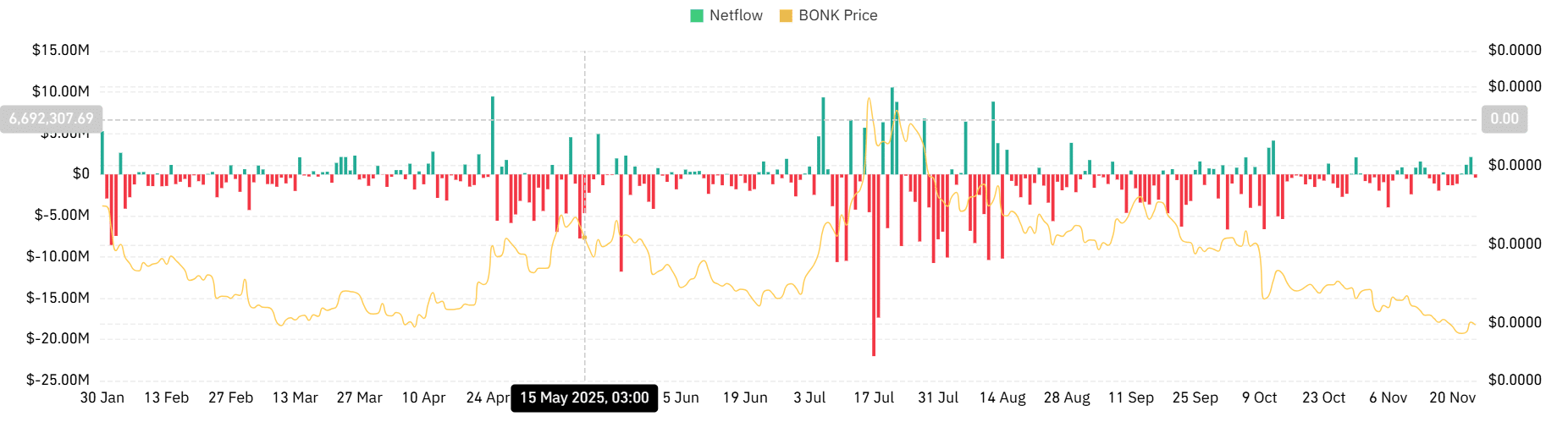

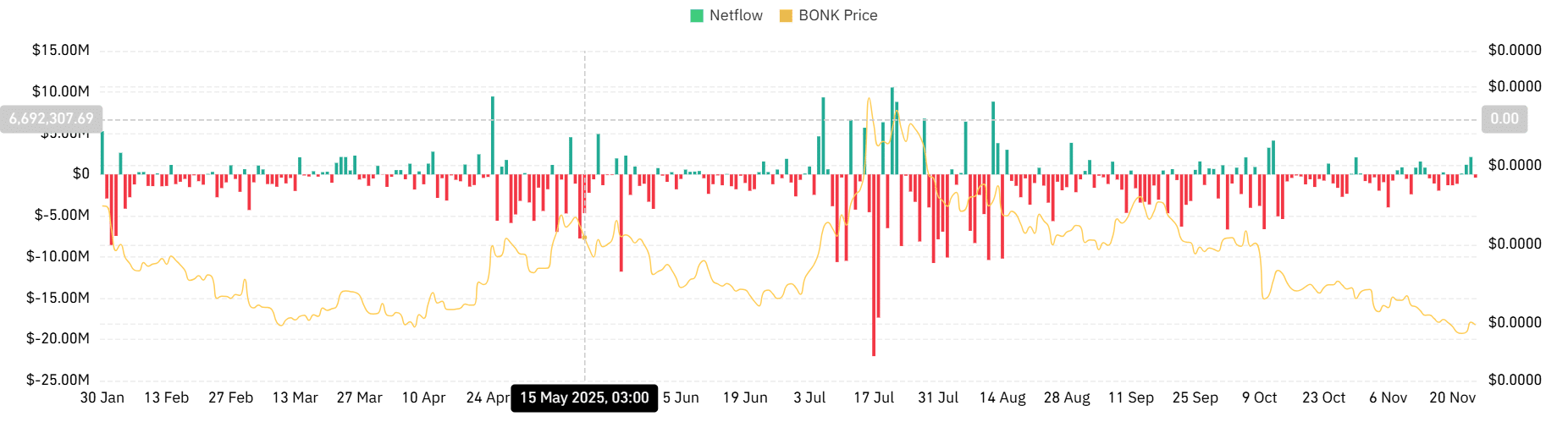

Whale accumulation: Large orders and negative netflows of -$385.6k confirm institutional interest, per data from CryptoQuant and CoinGlass.

Discover why BONK’s price is surging today with whale buys and volume spikes. Explore key indicators and potential targets in this in-depth analysis—stay ahead in the crypto market now!

What is causing BONK’s price to rise today?

BONK’s price rise today stems from a reversal in market sentiment, where buyers, particularly large whales, aggressively accumulated the token following a recent dip to $0.00000844. This has led to a 13.25% rally on daily charts, with trading volume surging 111% to $194 million, reflecting heightened investor interest and capital inflows into the Solana ecosystem memecoin.

How are whales influencing BONK’s recovery?

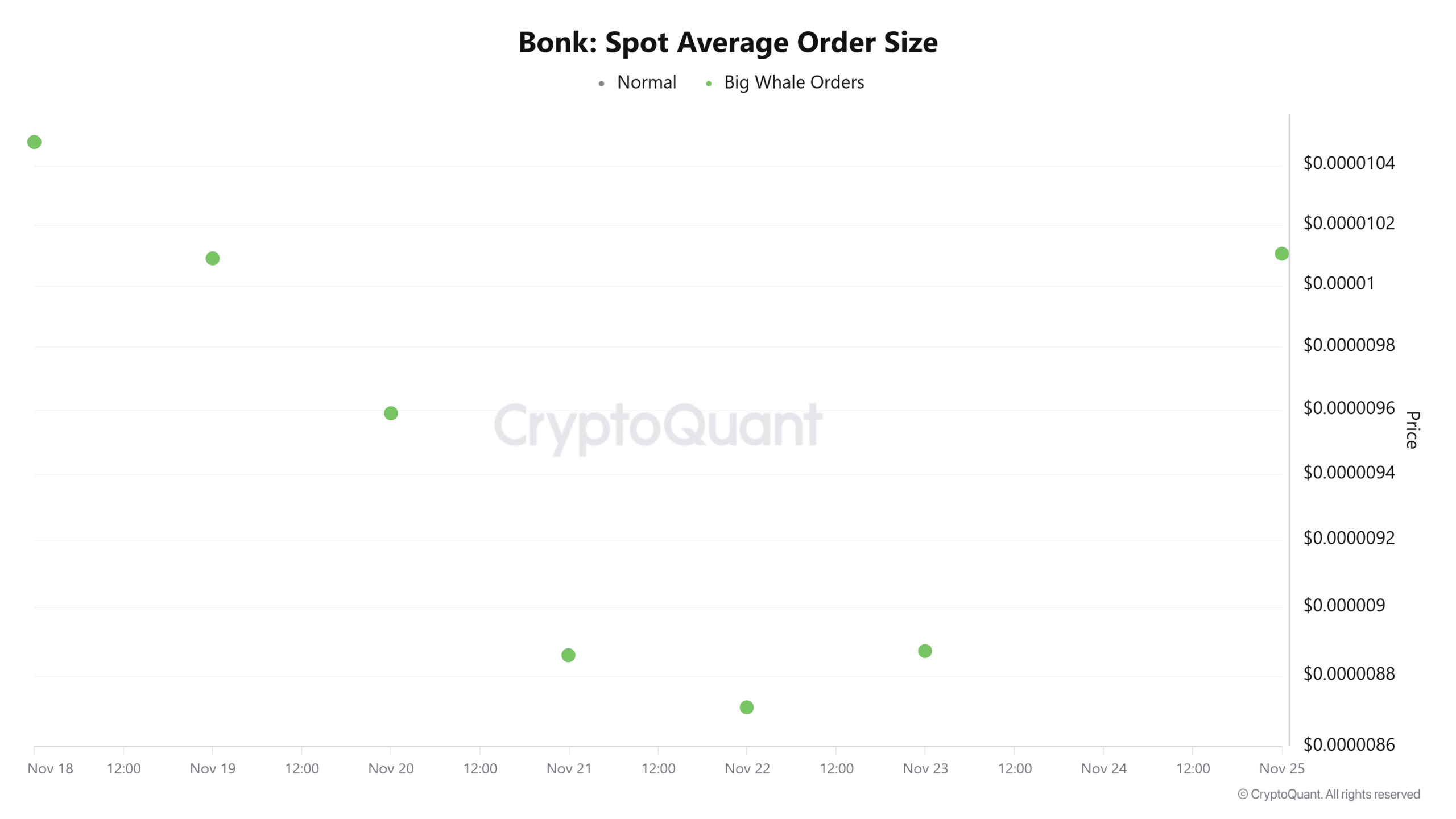

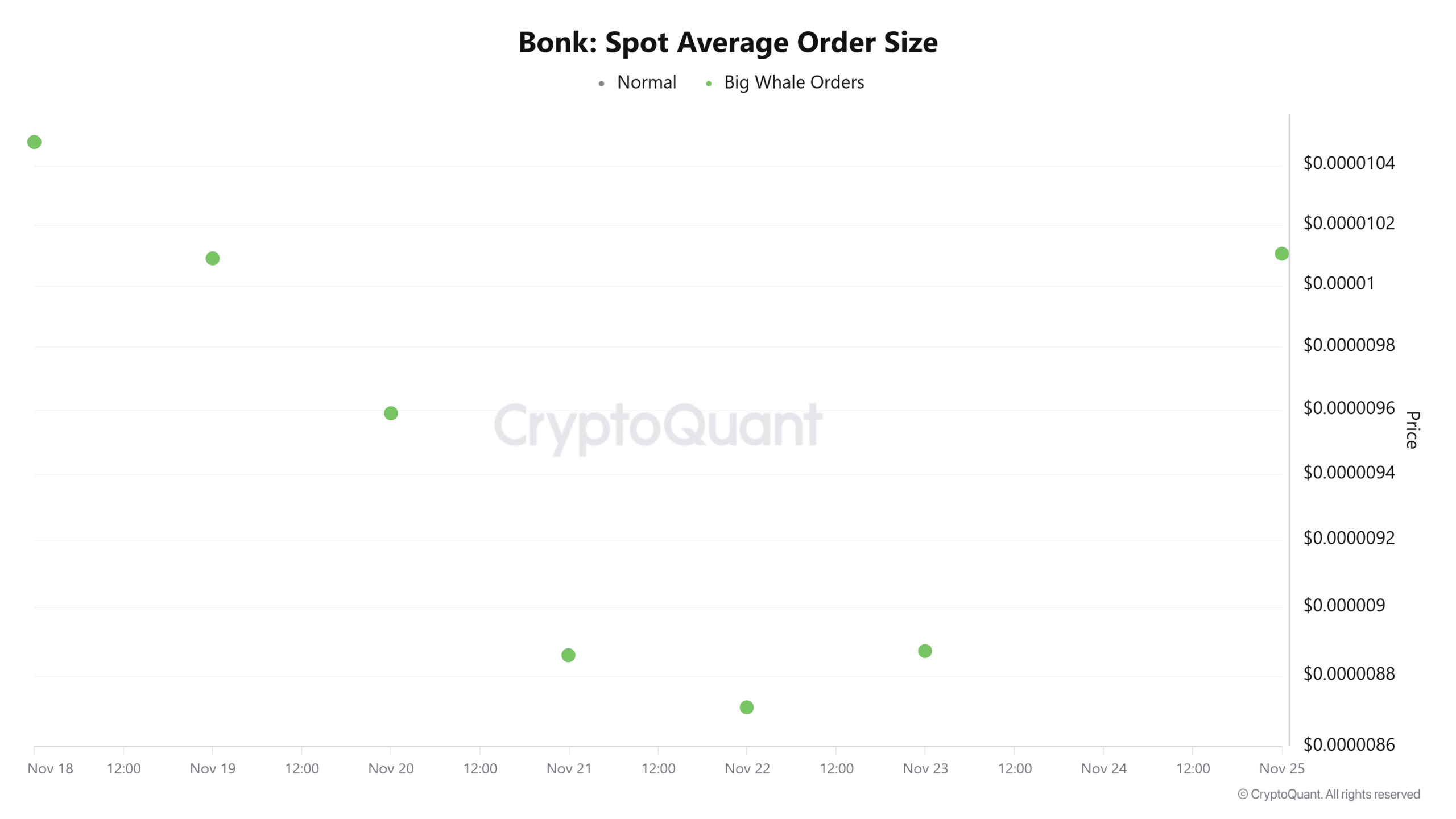

Large investors, often called whales, have played a pivotal role in BONK’s uptick by placing substantial orders that shifted the balance toward accumulation. Data from CryptoQuant indicates elevated spot average order sizes, pointing to coordinated buying from high-volume entities. This whale activity not only boosted buy volumes to 4.3 trillion over three days but also resulted in a positive Buy-Sell Delta of 300 billion, underscoring sustained demand. Historically, such patterns have preceded extended rallies in memecoins, as larger players view dips as entry opportunities. Expert analysis from on-chain metrics providers like CryptoQuant highlights that whale dominance often amplifies price momentum, with netflows turning negative at -$385.6k according to CoinGlass, signaling tokens moving to self-custody wallets away from exchanges.

Frequently Asked Questions

What volume changes confirm BONK’s bullish momentum?

BONK’s trading volume has increased by 111% to $194 million, with buy volumes reaching 2.4 trillion in the last 24 hours compared to 2.2 trillion in sells. This imbalance, tracked by platforms like Coinalyze, demonstrates aggressive accumulation and supports the ongoing price recovery without signs of immediate reversal.

Is BONK’s uptrend sustainable based on technical indicators?

Yes, BONK’s Stochastic RSI has climbed to 68, indicating buyer control, while the Relative Vigor Index shows a bullish crossover for trend validation. These signals from TradingView suggest potential continuation if demand persists, targeting $0.000011 next, though profit-taking could test support at $0.000009.

Key Takeaways

- Buyer resurgence: After sellers dominated, aggressive dip-buying flipped the market, with Spot Taker CVD confirming dominance over the past week per CryptoQuant data.

- Volume and delta surge: A 111% volume increase and 300 billion Buy-Sell Delta highlight accumulation, especially in the last three days, fostering upward pressure.

- Whale-driven accumulation: Large orders and negative netflows indicate strategic buying; monitor for sustained inflows to reach higher targets like $0.000013.

Conclusion

The BONK price rise today reflects a robust shift fueled by whale accumulation, volume spikes, and positive technical indicators like RSI and RVGI, as observed in data from CryptoQuant, Coinalyze, and TradingView. This memecoin’s recovery from recent lows positions it for potential further gains toward $0.000011 if buyer momentum holds, offering investors a timely opportunity to evaluate Solana ecosystem trends—keep an eye on on-chain developments for the next moves.

Key Takeaways

Why is BONK up today?

Buyers, especially whales, entered aggressively post-dip, reclaiming market control and driving the reversal.

What confirms the renewed demand?

A 111% volume surge, 4.3 trillion in buy orders over three days, and a 300 billion positive Buy-Sell Delta indicate robust accumulation.

After a sustained downtrend, BONK formed a bottom. The memecoin has since formed higher highs following a local low of $0.00000844 four days ago.

On daily charts, Bonk [BONK] advanced 13.25%, reaching a peak of $0.0000103 before a minor pullback to $0.00001007. Over this interval, its volume rose 111% to $194 million, showing greater capital entry. But what exactly is propelling BONK’s price rise today?

BONK buyers buy the dip

During the decline, holders shifted to heavy selling amid loss concerns. Sellers controlled the landscape until recent days, when dip-buyers surged in. Consequently, buyers now lead the spot market, as shown by Spot Taker CVD.

Source: CryptoQuant

CryptoQuant data reveals buyer control over the last seven days, pointing to ongoing demand. In the past, buyer leads have often led to strong price gains.

This demand intensified in the recent three days, with 4.3 trillion in Buy Volume recorded.

In the last 24 hours, buy volume hit 2.4 trillion, outpacing 2.2 trillion in sells.

Source: Coinalyze

This led to a 300 billion Buy-Sell Delta, evidencing spot accumulation.

Whales take charge

Notably, whales have been among the most engaged buyers. CryptoQuant’s Spot Average Order Size data shows prominent large orders.

Source: CryptoQuant

These orders typically signal major entity involvement in accumulation.

Past trends show whale builds often heighten price ascent.

Exchange flows reinforce this, with CoinGlass reporting BONK’s Spot Netflow negative after three days.

Source: CoinGlass

Netflow stood at -$385.6k, down sharply from $2.11 million prior, denoting outflows from platforms.

A start of a sustained uptrend?

BONK rebounded as buyers, including whales, accumulated actively.

Its Stochastic RSI rose to 68, affirming buyer lead. Meanwhile, Relative Vigor Index (RVGI) crossed bullishly, confirming momentum.

Source: TradingView

Such indicator alignments often predict trend persistence. Should demand continue, BONK eyes $0.000011.

Achieving this could solidify gains toward $0.000013 for a full breakout. Yet, fading demand or profit-taking might retreat to $0.000009.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026