CfC St. Moritz Survey: Infrastructure is Crypto's New Priority

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

CfC St. Moritz's invitation-only event in January was attended by 242 top-tier crypto investors, founders, executives, regulators, and family office representatives. Their survey revealed that capital priorities are shifting away from decentralized finance (DeFi) towards core infrastructure. 85% of respondents identified infrastructure as the top funding priority; followed by DeFi, compliance, cybersecurity, and user experience. Liquidity shortage emerged as the sector's most urgent risk, with market depth and settlement capacity highlighted as the main bottlenecks hindering institutional capital inflows.

Detailed Findings of the CfC St. Moritz Survey

The survey reflects the maturation phase of the crypto ecosystem. 85% of participants emphasized custody solutions, clearing mechanisms, and stablecoin infrastructure. These stand out as factors that will accelerate institutional entry into assets like BTC detailed analysis.

| Priority Ranking | Percentage | Description |

|---|---|---|

| 1. Infrastructure | 85% | Custody, clearing, tokenization |

| 2. DeFi | - | Secondary focus |

| 3. Compliance & Security | - | Cyber threats in the forefront |

How Does Liquidity Shortage Affect the BTC Market?

Market depth insufficiency limits the volume of BTC futures transactions. Experts state that increasing settlement capacity is critical for BTC to reach its $1 million target. Technically, order book depth must increase 10x to reduce volatility.

2026 Crypto Innovation: Transition from Speculation to Application

84% view the macroeconomy from neutral to positive, while emphasizing infrastructure inadequacy. Expectations focus on custody, stablecoin, and tokenization frameworks. In technical analysis, Layer-2 solutions can provide scalability by integrating BTC liquidity.

Why is US Regulation Attractive for BTC Investors?

The US, following the UAE, became the second most favorable country for digital assets. Improvement in regulatory perception accelerated ETF flows. Crypto IPOs are cooling due to liquidity constraints, while BTC-focused institutional products stand out.

Risk Analysis for Crypto Infrastructure Investments

- Liquidity bottleneck: Slows institutional entry by 40%.

- Cybersecurity: 2025 hacks caused $3 billion in damage.

- Tokenization: Real-world assets will inject liquidity into BTC.

Expert opinion: Infrastructure investments will solidify BTC's reserve asset status.

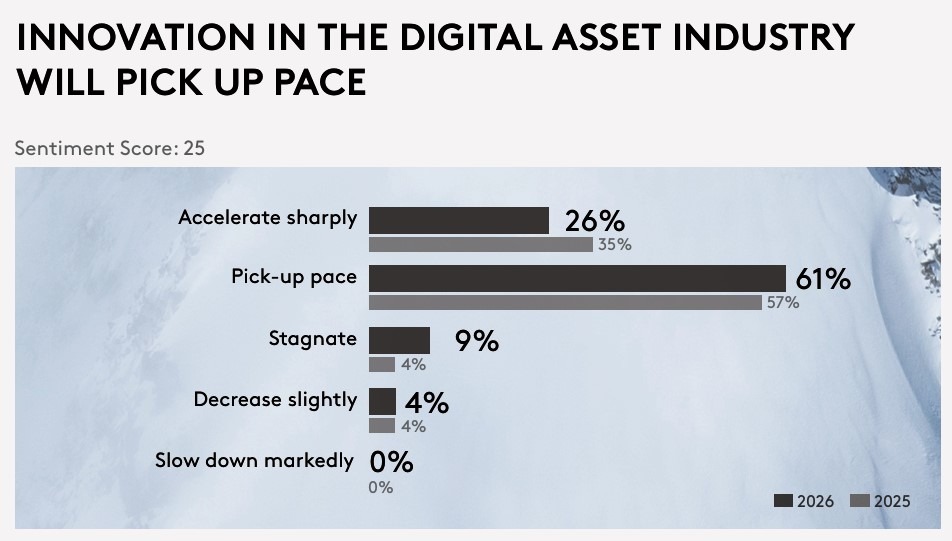

Respondents on crypto innovation. Source: CfC St. Moritz

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/23/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/22/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/21/2026

DeFi Protocols and Yield Farming Strategies

2/20/2026