Double Zero (2Z) May Signal Recovery After 25% Decline Amid Mixed Sentiment

OP/USDT

$91,578,723.81

$0.1211 / $0.1092

Change: $0.0119 (10.90%)

+0.0019%

Longs pay

Contents

Double Zero (2Z) cryptocurrency shows signs of a potential turnaround after a 25% monthly decline, with a 10% daily gain and rising holder count to 6,100. However, bearish derivatives data suggests ongoing caution among traders.

-

Recent 10% price surge indicates recovering confidence in Double Zero (2Z).

-

Holder numbers reached a new high of 6,100, supporting accumulation trends.

-

Negative funding rates in derivatives markets signal bearish bets worth $4.3 million in inflows.

Discover Double Zero (2Z) latest price action: 10% rebound amid mixed signals. Explore holder growth and market sentiment for informed crypto decisions. Stay updated on 2Z trends today!

What is Double Zero (2Z) and its recent performance?

Double Zero (2Z) is an infrastructure blockchain token designed to support scalable decentralized applications. It has experienced a month-long decline of 25%, but recent data indicates a steady recovery, including a 10% price increase in the past 24 hours. This uptick is backed by growing participation from investors, though mixed market signals keep the outlook cautious.

How are market sentiments affecting Double Zero (2Z) price?

Market sentiments around Double Zero (2Z) are showing renewed interest due to its recent performance gains. Data from reliable tracking platforms reveals inconsistencies in community sentiment readings, where not all investors are fully bullish despite the price bounce. Holder counts have climbed to a record 6,100, suggesting increased accumulation and potential supply constraints if the trend persists. This growth reflects recovering confidence among long-term participants, but broader market dynamics remain divided.

Double Zero, the infrastructure blockchain, could be witnessing a turnaround after a month-long decline that saw its value drop by 25%.

Recent data showed that its performance has been growing steadily, with a 10% gain in the past day. However, this sentiment does not align with all market participants.

2Z’s gains attract renewed interest

There has been a significant increase in interest around DoubleZero [2Z] recently, which COINOTAG traced to the asset’s notable performance over the past day.

However, the Community Sentiment reading on CoinMarketCap showed inconsistencies, and the sample size did not confirm the claim that “100% of investors were bullish.”

Source: CoinMarketCap

Even so, rising participation supported the recent bounce. By press time, holder count climbed to 6,100 and set a new peak. This growth hinted at recovering confidence and a potential supply squeeze if accumulation continued. In the infrastructure blockchain space, such metrics are crucial indicators of long-term viability, as they demonstrate real user engagement beyond short-term speculation. Analysts note that tokens like 2Z benefit from network effects where increased holders can lead to enhanced liquidity and stability.

Despite these positive on-chain developments, not all indicators point to a full recovery. The cryptocurrency market remains volatile, influenced by broader economic factors such as interest rate expectations and regulatory news. For Double Zero (2Z), the interplay between holder growth and price action underscores the need for sustained momentum to overcome recent losses.

Frequently Asked Questions

What caused the recent 10% gain in Double Zero (2Z) price?

The 10% gain in Double Zero (2Z) price stems from increased holder participation and steady performance metrics over the past day. Data shows a climb in unique holders to 6,100, signaling accumulation amid a broader market recovery. This uptick follows a 25% monthly drop, highlighting potential reversal patterns in the infrastructure token sector.

Is Double Zero (2Z) a good investment right now?

When considering Double Zero (2Z) as an investment, note the recent holder surge to 6,100 and 10% daily gain, which suggest building interest. However, bearish derivatives signals and negative funding rates indicate caution. Investors should monitor resistance levels near current prices for signs of sustained upward movement before committing capital.

A segment of the market remained bearish on 2Z, increasing the likelihood that the month-long downtrend could continue.

Analysis of Derivative market data revealed a negative Open Interest-Weighted Funding Rate. When this indicator turns negative, it implies that more open contracts come from traders who anticipate a possible price drop.

Source: CoinGlass

This bearish sentiment has also strengthened alongside capital inflows worth $4.3 million. If this trend continues, it may indicate that more investors expect a further decline in upcoming trading sessions.

Bearish positions in the derivatives market, evidenced by a negative Open Interest-Weighted Funding Rate and $4.3 million in inflows, point to expectations of continued downside. These metrics, drawn from established market analysis tools, highlight the divergence between spot market optimism and futures trading pessimism. In the context of 2Z, such discrepancies can prolong uncertainty, as short-term traders often influence price volatility.

Furthermore, the infrastructure focus of Double Zero positions it uniquely in the blockchain ecosystem, where real-world adoption metrics like holder growth provide a counterbalance to speculative trading. Experts from financial analysis firms emphasize that negative funding rates typically precede corrections in altcoins, urging diversified strategies for exposure to tokens like 2Z.

Key Takeaways

- Holder Growth Signals Recovery: Double Zero (2Z) holders hit 6,100, a new peak indicating accumulation and potential supply squeeze.

- Mixed Derivatives Sentiment: Negative funding rates and $4.3 million inflows suggest bearish bets amid the recent 10% gain.

- Watch Resistance Levels: A break above key zones could target $0.28; rejection may extend the downtrend—monitor closely for entry points.

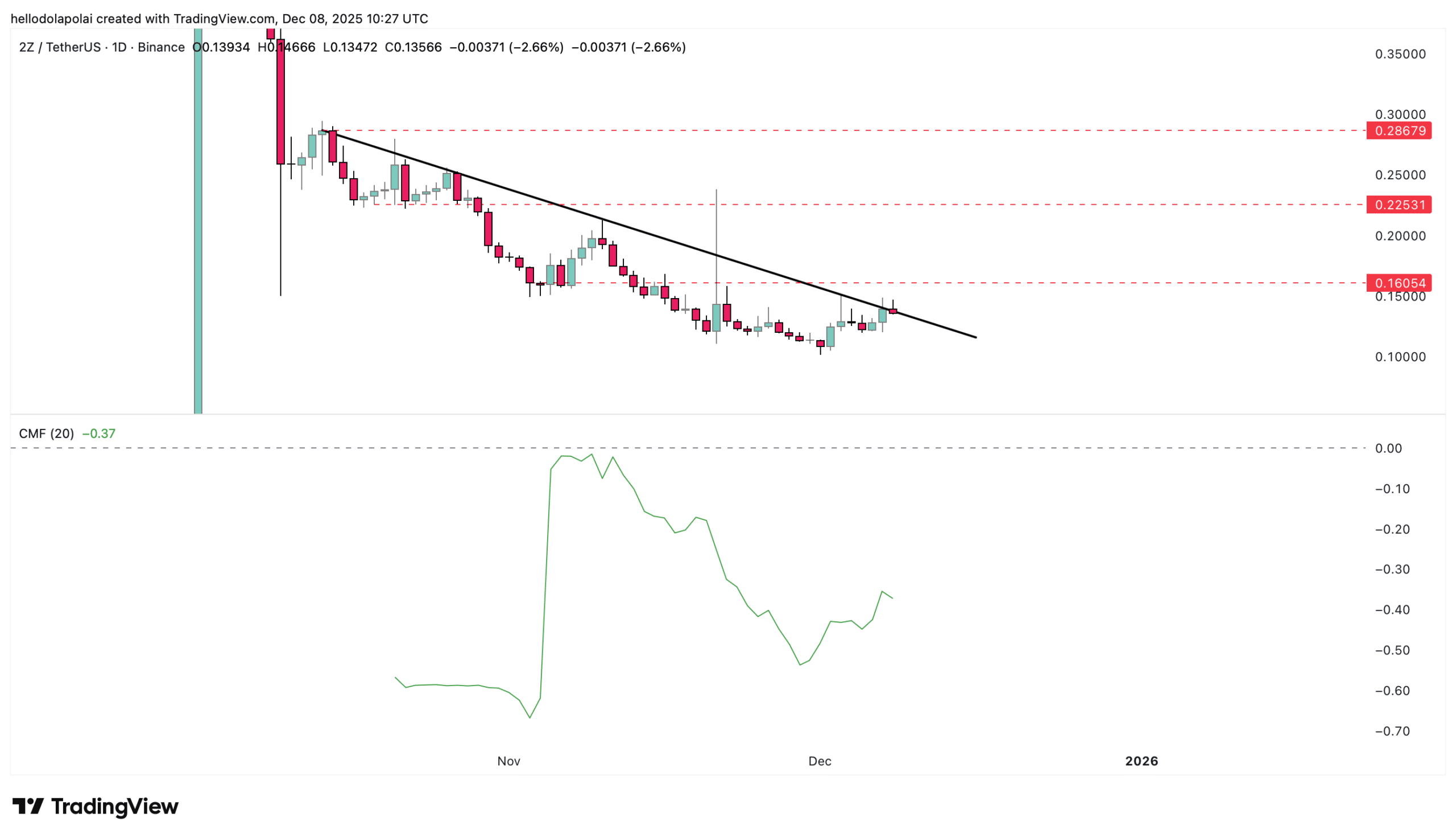

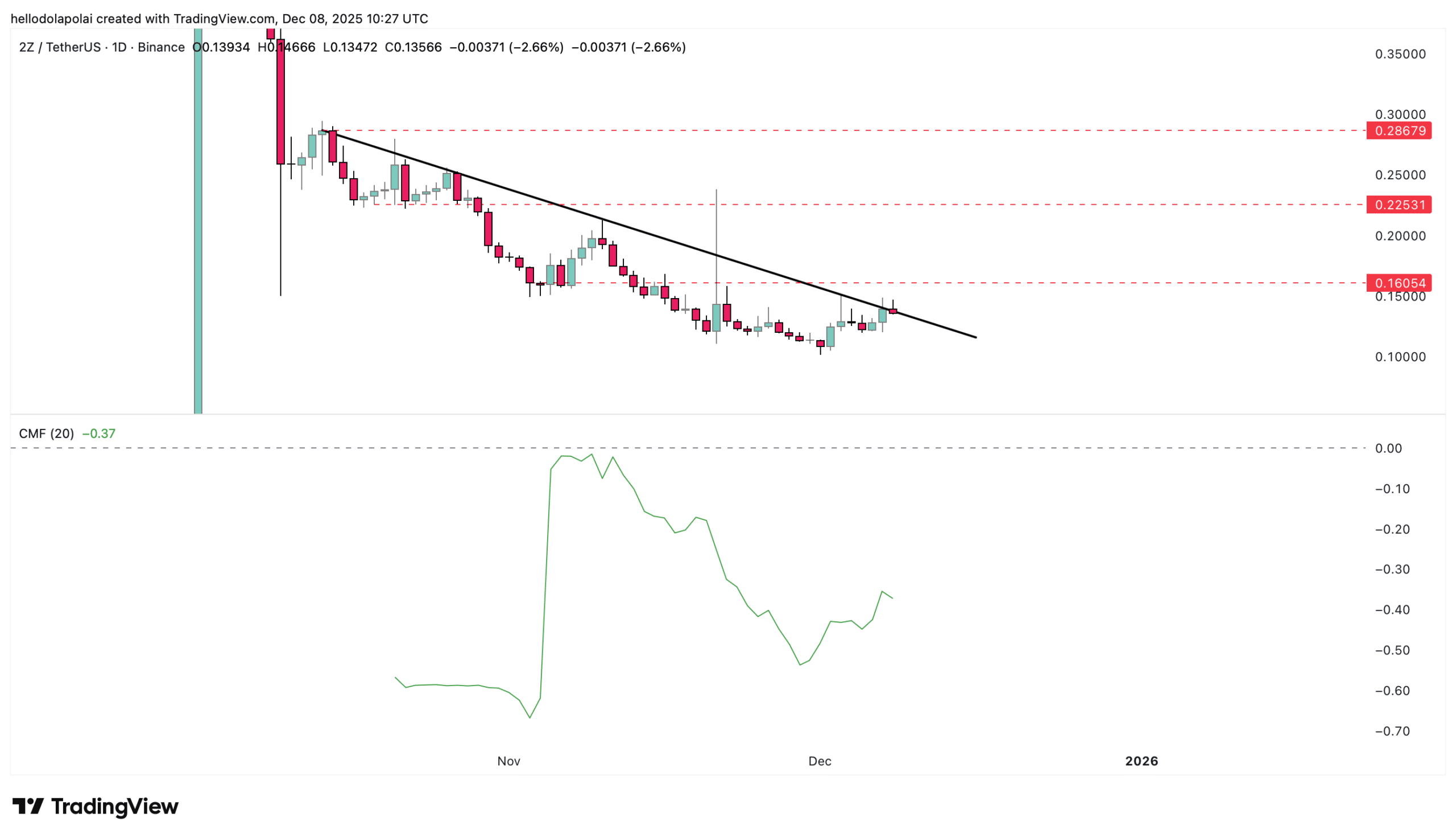

2Z traded near a key resistance zone on the 1-day chart. A clean break above this area could confirm a bullish shift and open the path toward $0.28.

On top of that, the downtrend line still capped upside attempts. However, a rejection at resistance would strengthen bearish control and extend the decline.

Source: TradingView

Chaikin Money Flow printed a negative reading of near -0.37, which showed distribution outweighed accumulation. This left traders focused on whether demand improves before the next move.

For now, sentiment stayed cautious, and 2Z may continue trending lower unless buyers regain control at resistance.

Conclusion

In summary, Double Zero (2Z) cryptocurrency is at a pivotal juncture, balancing a 10% daily gain and record holder count of 6,100 against bearish derivatives pressures like negative funding rates. Technical indicators, including Chaikin Money Flow at -0.37, underscore the need for buyers to break resistance for a confirmed 2Z turnaround. As the infrastructure blockchain evolves, investors should track these mixed signals closely, positioning for potential upside toward $0.28 while remaining vigilant on market volatility. For the latest on Double Zero (2Z) price movements, continue monitoring key on-chain and trading data to inform your strategy.