MYX Finance Leads Weekly Crypto Gainers Amid Broader Market Volatility

BCH/USDT

$257,040,765.71

$465.00 / $439.60

Change: $25.40 (5.78%)

-0.0221%

Shorts pay

Contents

The crypto market experienced volatility this week, with Bitcoin and Ethereum dipping amid risk aversion. Utility chains like MYX Finance led gains at 17%, while Canton saw a 25% drop. Key winners include Bitcoin Cash and Chainlink, highlighting selective strength in the sector.

-

MYX Finance [MYX] surged 17% to $3.04, confirming a bullish weekly structure with higher highs.

-

Bitcoin Cash [BCH] rose 8% to $580, approaching key resistance after three green candles.

-

Chainlink [LINK] climbed 6.84% to $13.8, showing early bottom formation with whale accumulation support, per market data.

Crypto weekly winners and losers revealed volatility in 2025: MYX Finance tops gains at 17%, while Canton leads losses at 25%. Discover top performers and insights for informed trading decisions today.

What are the crypto weekly winners and losers this week?

Crypto weekly winners and losers this week showcased a mixed landscape amid broader market downturns. Bitcoin briefly fell below critical support before a modest recovery, and Ethereum mirrored this choppiness, as investors shifted from high-risk assets. Despite the overall 2-3% market contraction, select utility-focused tokens like MYX Finance rallied impressively, gaining 17% and underscoring internal momentum independent of Bitcoin’s influence.

How did top crypto gainers perform in detail?

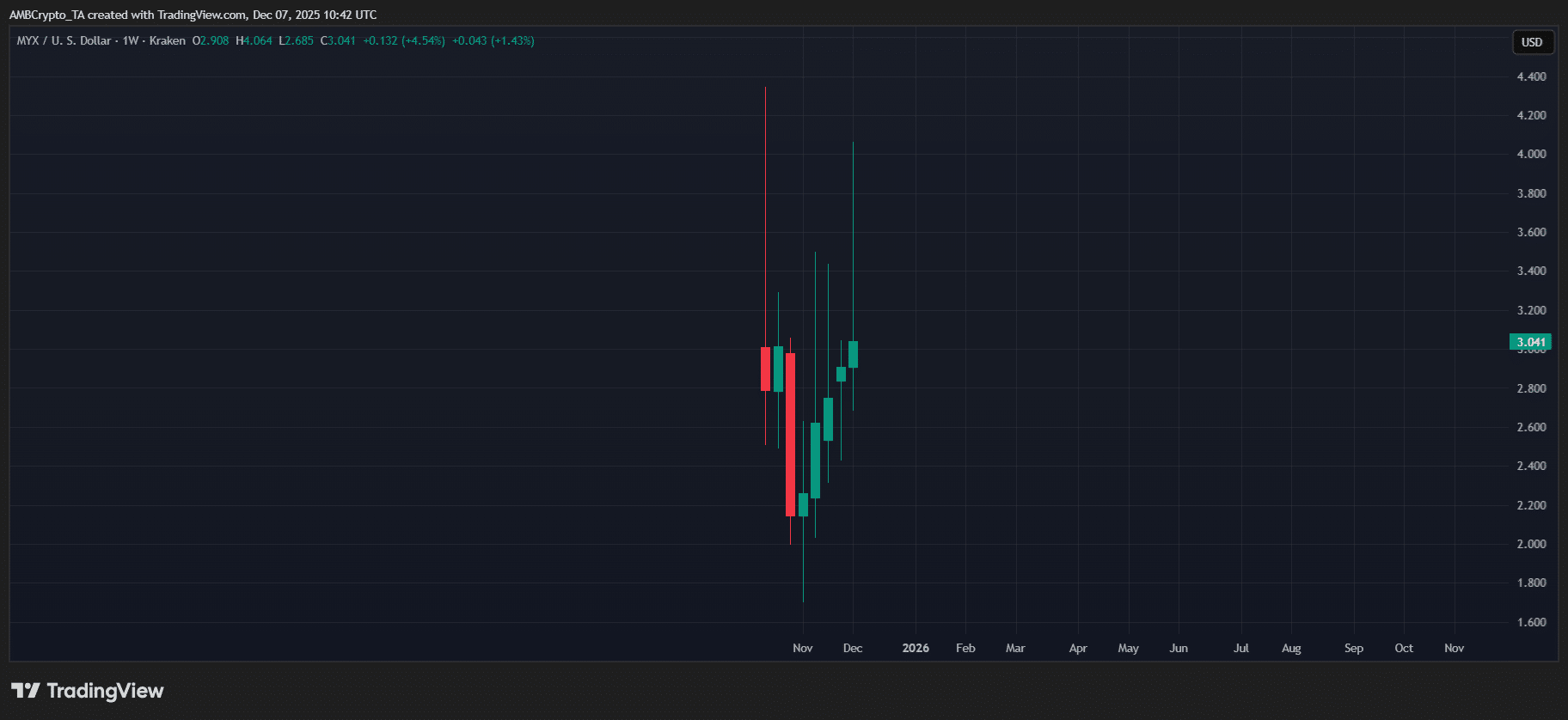

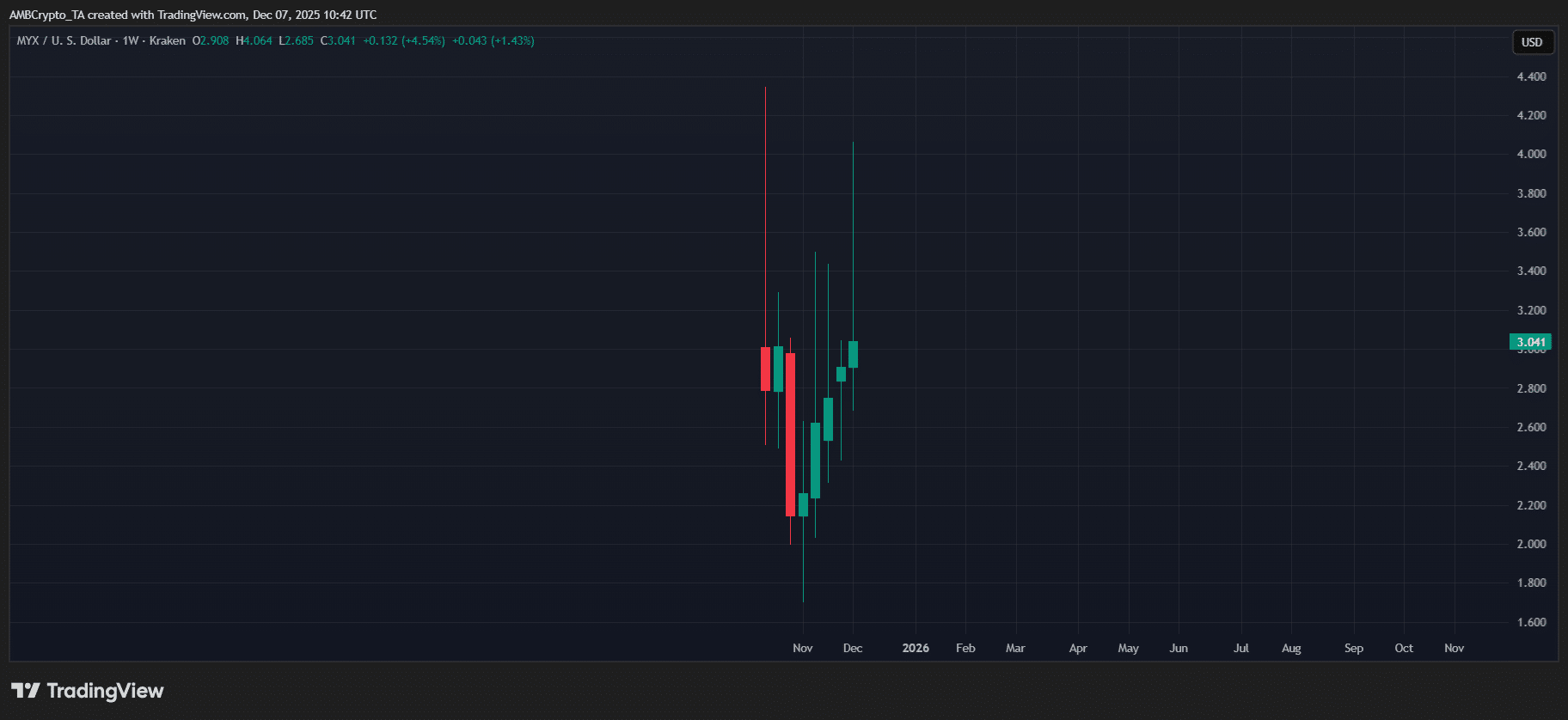

Among the standout crypto weekly winners, MYX Finance [MYX] emerged as the clear leader, posting a robust 17% increase to reach $3.04. This marked its fifth consecutive green weekly candle, a rare feat in a red-dominated market. According to TradingView data, MYX has formed three higher highs on the weekly chart, decisively breaking key resistance and solidifying a bullish structure. This self-sustained climb, up 50% in just over a month, suggests organic buyer interest rather than fleeting rotation from majors.

Source: TradingView (MYX/USDT)

Market analysts from COINOTAG have noted that this surge involved significant leverage, with open interest rising sharply, yet the price action remains bullish. Buyers appear committed, positioning for a potential push above $3, which could signal further upside if volume sustains.

Following closely, Bitcoin Cash [BCH] secured the second position among crypto weekly winners, advancing 8% to $580. This fork of Bitcoin has maintained a steady uptrend, achieving three successive green weekly candles. However, its price hovers just below a pivotal resistance zone, the same level it unsuccessfully challenged in early October, leading to a 16% decline to $480. Technical indicators, including the Relative Strength Index (RSI), remain below overbought territory, offering room for additional gains. Defending the $560-$580 range could pave the way for a breakout toward $600, as per chart patterns observed on TradingView.

Chainlink [LINK], the oracle network essential for smart contracts, rounded out the top three with a 6.84% gain to $13.8. This performance is particularly noteworthy, as it occurs at a critical inflection point after a mid-third quarter breakdown. Representing the second consecutive weekly bounce, LINK’s action suggests exhaustion of selling pressure and the onset of a potential V-shaped recovery. COINOTAG reports highlight a $22 million acquisition by a major whale, bolstering accumulation signals. With depleted downside momentum, LINK positions as a compelling buy-the-dip opportunity in the current environment.

Beyond these leaders, smaller altcoins demonstrated explosive potential. GaiAi (GAIX) skyrocketed 287%, Terra Luna Classic (LUNC) surged 187%, and TerraClassicUSD (USTC) advanced 98%. These gains reflect heightened speculative interest in niche projects amid broader caution.

Frequently Asked Questions

What are the biggest crypto weekly losers in 2025?

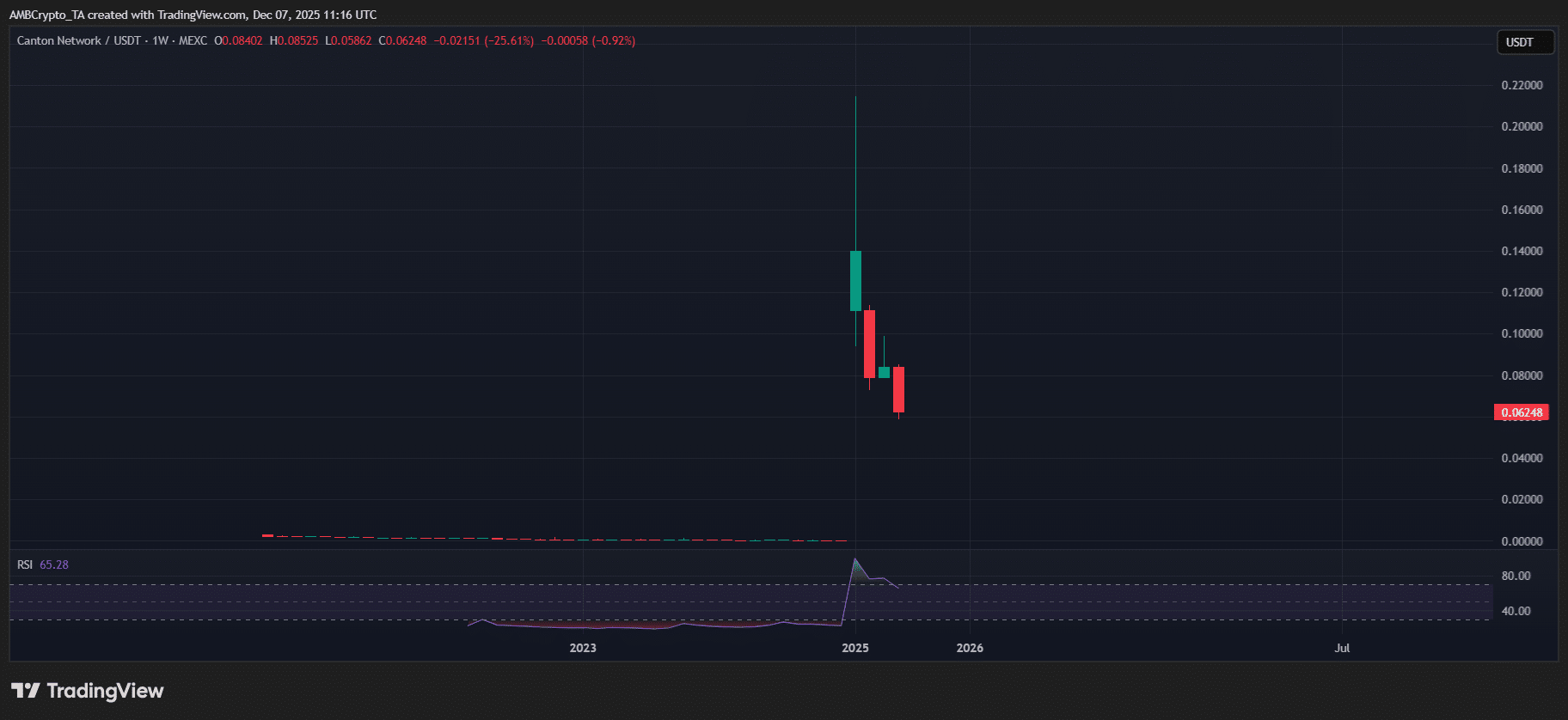

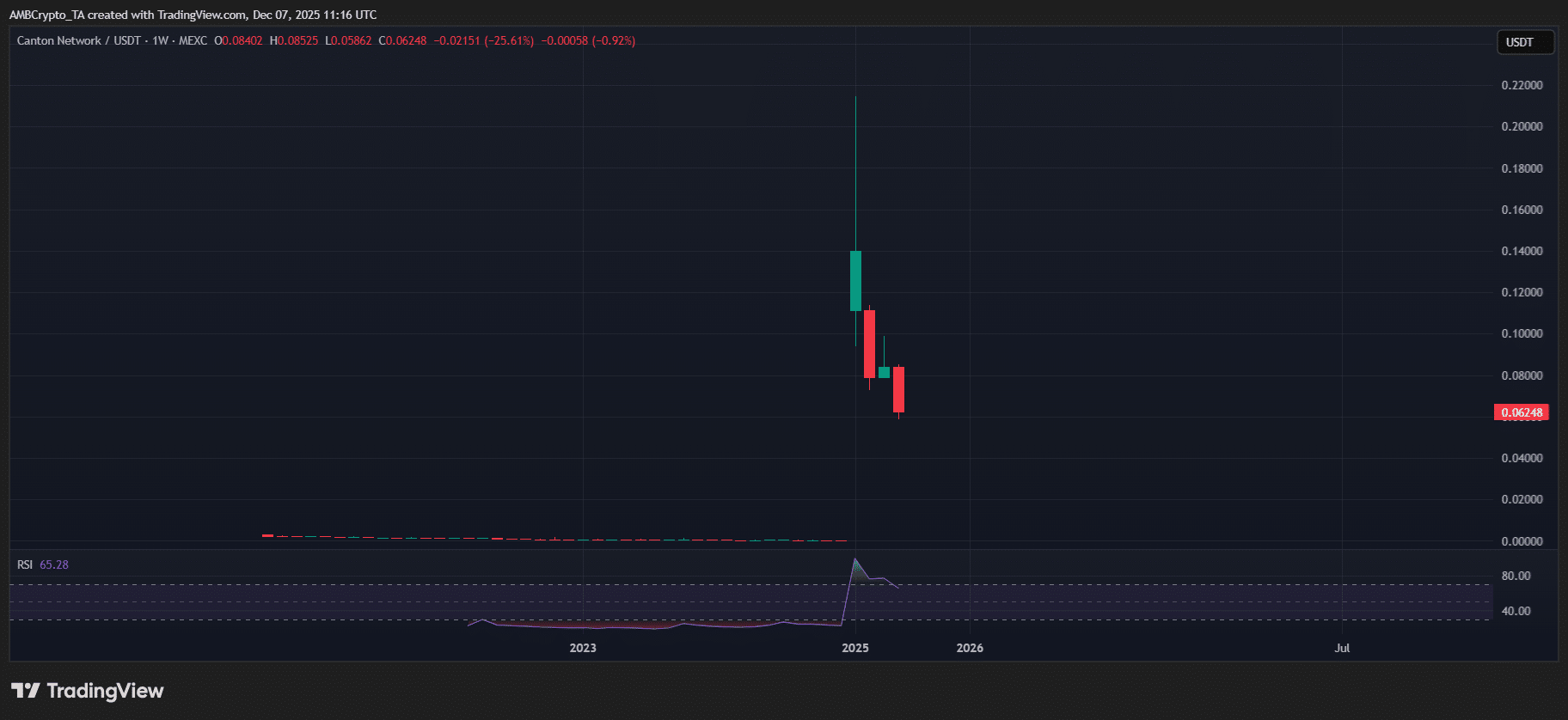

Canton [CC] topped the crypto weekly losers with a 25% decline, confirming a bearish structure through three lower lows on the weekly chart. Zcash [ZEC] followed at 19% down, while Morpho [MORPHO] slipped 15%, all amid fading buyer support and thin liquidity zones.

Why did MYX Finance lead crypto gains this week?

MYX Finance outperformed due to its fifth straight green candle and a 50% monthly rise, breaking resistance with strong buyer momentum. Even in a risk-off market, elevated open interest and technical confirmations point to sustained bullishness, making it a standout performer for investors seeking utility-driven tokens.

Key Takeaways

- Selective Strength in Utility Tokens: MYX Finance, Bitcoin Cash, and Chainlink led gains, showing resilience against market-wide dips through technical breakouts and whale activity.

- Bearish Pressures on Decliners: Canton, Zcash, and Morpho faced heavy selling, with consecutive red candles and weak volume indicating potential for further downside without reversal catalysts.

- Monitor Resistance and Support Levels: Traders should watch $3 for MYX upside and $560-$580 defense for BCH; breaches could dictate next moves in this volatile week.

Conclusion

This week’s crypto weekly winners and losers painted a picture of divergence in a choppy market, where Bitcoin and Ethereum’s modest recoveries contrasted with sharp altcoin movements. Top gainers like MYX Finance demonstrated robust internal dynamics, while losers such as Canton highlighted ongoing seller dominance. As 2025 progresses, investors are advised to prioritize technical levels and volume trends for strategic positioning, staying vigilant for emerging opportunities in utility chains.

Weekly Losers Analysis

Shifting focus to the underperformers, Canton [CC] claimed the dubious honor of the largest drop at 25%, extending a multi-week bearish trend. The smart-contract platform’s weekly chart reveals three consecutive lower lows, with a late-November bounce quickly reversed, underscoring persistent bull reluctance. COINOTAG analysis indicates subdued technical support during this decline, driven primarily by seller conviction rather than balanced interest.

Source: TradingView (CC/USDT)

Elevated derivatives activity further tilts toward speculation, with bearish skews dominating. Absent spot demand revival, Canton’s vulnerability persists, potentially targeting lower supports.

Zcash [ZEC], the privacy-focused coin, retreated 19% from $427, marking three red weekly candles each exceeding 15% losses. This follows a remarkable 1,120% rally from late September to early October, one of the year’s sharpest recoveries. Current profit-taking amid fear, uncertainty, and doubt (FUD) drives exits, though expanding privacy applications suggest this as a temporary cooldown rather than structural failure.

Morpho [MORPHO], a DeFi lending protocol token, declined 15% from $1.40, ending a three-month consolidation with failed breakout attempts. Sellers now dominate, with thin support eyeing the $1 level. A breach here could accelerate toward $0.80, unless buyers intervene decisively.

Other notable decliners included TOMI (TOMI) at 66% down, Legacy Token (LGTC) at 64%, and Humanity (H) at 52%, illustrating amplified volatility in lower-cap assets.

In summary, this week’s dynamics emphasize the importance of differentiated analysis in crypto. While majors stabilize, altcoin rotations offer both risks and rewards, rewarding those attuned to chart structures and market flows.

Comments

Other Articles

SEC Delays Bitwise 10 Crypto Index ETF Including BTC, ETH, SOL, XRP, ADA, AVAX, LINK, BCH, DOT, UNI: Impact on Cryptocurrency Market and Investor Sentiment

January 14, 2025 at 09:31 PM UTC

SEC Files Bitwise 10 Crypto Index ETF Inclusion of Major Coins – UNI, BTC, ETH, SOL, XRP, ADA, and more

November 27, 2024 at 08:39 PM UTC

Bitcoin Plummets Below $60,000 Amidst Massive Crypto Market Sell-Off

August 4, 2024 at 10:10 AM UTC