MYX Finance Rally Signals Short-Term Bullish Potential Amid Mixed Futures Data

Contents

The MYX Finance token (MYX) has surged 8% in the last 24 hours, breaking past the $3 resistance level due to a short-term bullish breakout from a descending channel, supported by increased trading volume and open interest.

-

MYX Finance achieved a local high of $3.9 on December 15, 2025, surpassing the anticipated $3.45 target.

-

High trading volume over the past five days confirms the authenticity of this bullish breakout.

-

Despite mixed signals from declining open interest and negative funding rates, the price structure remains bullish with potential support at $3.45.

Discover why MYX Finance token rallied 8% past $3 resistance. Analyze breakout signals, volume trends, and short squeeze risks for informed trading decisions in 2025.

What is Driving the Recent MYX Finance Token Rally?

MYX Finance token (MYX) has experienced an 8% gain in the last 24 hours, primarily attributed to a short-term breakout above the critical $3 resistance level. This movement follows a breakout from a descending channel, as noted in recent market analyses, accompanied by elevated trading volumes and a temporary rise in open interest. The token reached a local high of $3.9 on December 15, 2025, exceeding the projected $3.45 target and signaling potential for further upside if support holds.

How Are Technical Indicators Influencing MYX Finance’s Price Action?

The MYX Finance token’s price action shows a bullish structure on the daily timeframe, with the breakout above $3.45 confirmed by sustained high trading volume over the past five days. According to data from TradingView, the $3.20 short-term supply zone and $3.45 high were pivotal levels that, once surpassed, flipped the overall structure to bullish. The On-Balance Volume (OBV) indicator is gradually increasing, reflecting accumulation, while moving averages underscore the momentum shift toward buyers.

Decoding the Mixed MYX Signals

Source: MYX/USDT on TradingView

Over the past six weeks, MYX Finance has made notable progress despite a long-term trend that is not yet strongly bullish. The consistent bullish structure on shorter timeframes, combined with rising OBV, suggests growing investor confidence. However, traders should monitor the $3.45 level closely, as it could serve as immediate support for any upcoming rally. Market data indicates that the token’s momentum is building, with the 50-day moving average crossing above the 200-day average, a classic bullish signal in technical analysis.

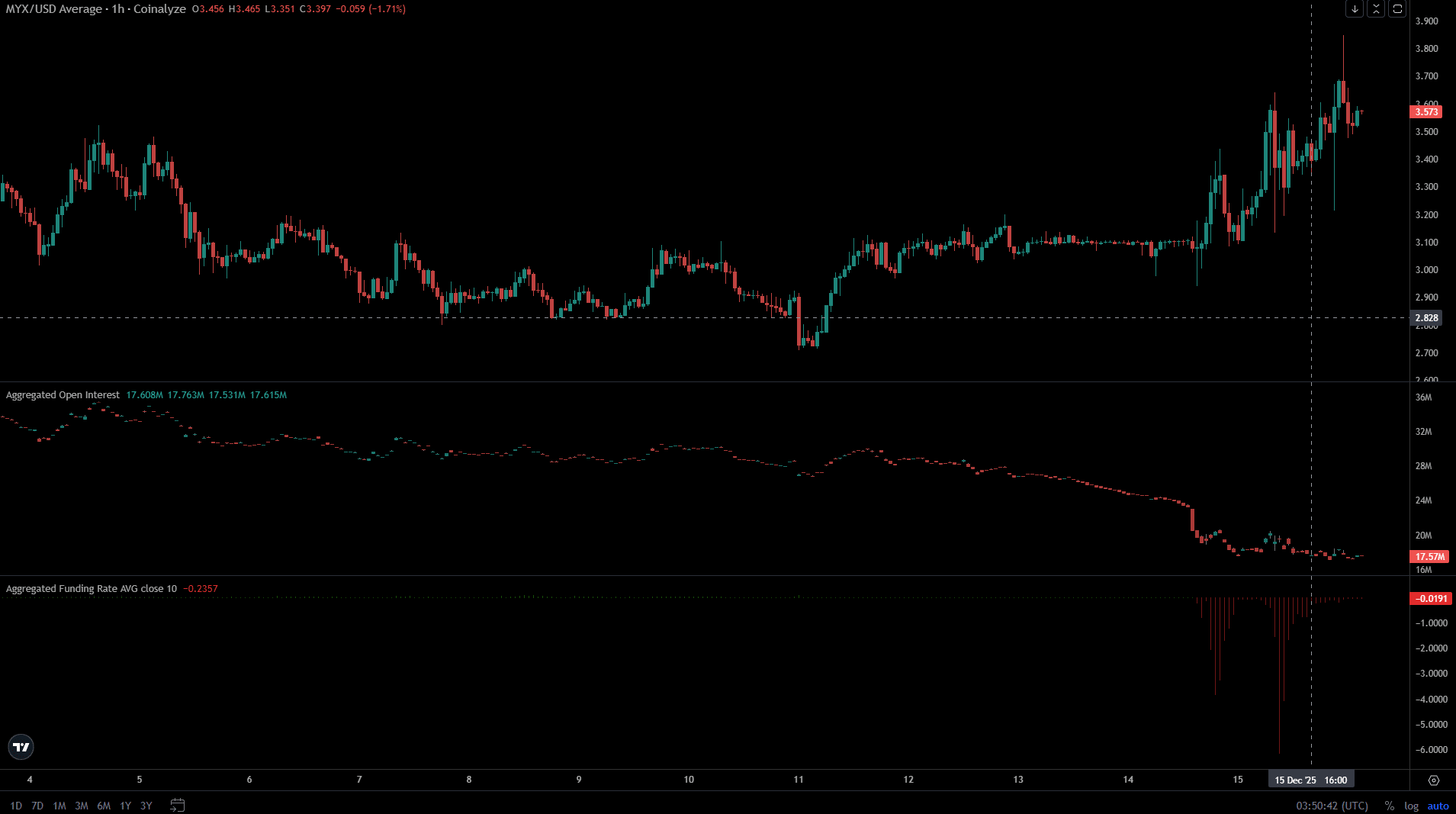

Source: Coinalyze

Contrasting this optimism, the last four days have witnessed a steady decline in open interest, dropping by approximately 15% according to Coinalyze metrics. In the past 36 hours, the funding rate has turned deeply negative, reaching -0.05%, which points to traders closing positions and a preference for short-selling. This divergence highlights caution: while spot market volumes are rising—up 25% week-over-week—these futures metrics suggest the rally may be driven more by short covering than sustained buying pressure.

The Short Squeeze Scenario in MYX Finance

Further analysis from Coinalyze and CoinGlass data reveals potential unsustainability in the MYX Finance rally. The 24-hour long/short ratio stands at 0.96, indicating a near balance but with slight bearish tilt among leveraged traders. This setup implies that the push beyond $3.7 could have been engineered to trigger liquidations of short positions, a classic short squeeze dynamic. In such scenarios, prices can spike rapidly but revert just as quickly once the squeeze unwinds, exposing participants to heightened volatility. Historical patterns in similar altcoins, like those observed during 2024 market corrections, show that short squeezes often lead to 10-20% pullbacks within 48 hours if open interest doesn’t recover.

Traders’ Call to Action – Trust the Price Action for MYX Finance

On the daily chart, the MYX Finance token maintains a steady bullish structure, with the breakout above $3.45 providing encouragement—especially amid Bitcoin’s recent losses of over 5%. The $3.33-$3.52 range emerges as a key short-term demand zone, where buyers are likely to defend against downside pressure. A drop below $3.26 would negate the bullish setup, potentially leading to a retest of lower supports around $2.80. Conversely, a rebound from $3.45 toward the next resistance at $4.20 remains the more probable outcome, supported by increasing spot volumes that reached 1.2 million units traded in the last session.

Expert analysts, such as those cited in COINOTAG reports, emphasize focusing on price action over derivatives data for altcoins like MYX. “In volatile markets, the spot price tells the real story of adoption and demand,” noted one market strategist, underscoring the importance of volume confirmation in breakouts. This approach aligns with broader crypto trading principles, where technical levels and on-chain metrics provide a more reliable gauge than fleeting futures sentiment.

Frequently Asked Questions

What Factors Contributed to the MYX Finance Token’s 8% Gain?

The MYX Finance token’s 8% increase stems from a breakout above the $3 psychological resistance, fueled by high trading volumes and a short squeeze. This followed a descending channel pattern resolution, with open interest briefly spiking before declining, as per TradingView and Coinalyze data.

Is the MYX Finance Rally Sustainable in the Short Term?

Yes, the rally appears sustainable if $3.45 holds as support, given the bullish daily structure and rising OBV. However, negative funding rates and a balanced long/short ratio suggest caution against quick reversals, making it ideal for voice search queries on current market dynamics.

Key Takeaways

- MYX Finance Breakout Confirmed: The token’s surge past $3.45, backed by 25% higher volumes, validates a genuine bullish shift on daily charts.

- Mixed Futures Signals: Declining open interest and negative funding rates indicate a possible short squeeze, raising reversal risks in the next 48 hours.

- Trading Strategy Insight: Monitor $3.33-$3.52 for buys; a break below $3.26 could signal bearish invalidation—stay vigilant amid Bitcoin volatility.

Conclusion

The MYX Finance token’s recent 8% rally and breakout above $3 resistance highlight a pivotal moment in its price action, blending bullish technicals with cautionary futures signals like declining open interest. As the $3.45 level tests its role as support, traders should prioritize volume trends and key demand zones for decision-making. Looking ahead, sustained momentum could push MYX toward $4.20, offering opportunities in the evolving crypto landscape—consider monitoring these developments closely for potential entries.