PUMP Whales Exit Positions at Loss, Recovery Extension Uncertain

OP/USDT

$91,578,723.81

$0.1211 / $0.1092

Change: $0.0119 (10.90%)

+0.0019%

Longs pay

Contents

PUMP token holders, including major whales, are exiting positions at substantial losses after a 78% price crash in 2025. A key whale sold 750 million PUMP worth $1.47 million, realizing a 51% loss, amid declining open interest and lukewarm recovery despite buybacks.

-

Whale capitulation: 6-month holder sold 750M PUMP at 51% loss on January 1.

-

Weekly buybacks fell below $10M but equaled 100% of revenue, with largest at 1.46B PUMP.

-

Open interest plunged 85% from $1B to $142M, signaling record low sentiment in futures markets.

PUMP token whale capitulation threatens recovery after 78% 2025 crash. Sell-offs at loss, buybacks lag, OI crashes 85%. Can technicals spark rebound? Analyze Solana memecoin trends now.

What is driving whale capitulation in the PUMP token?

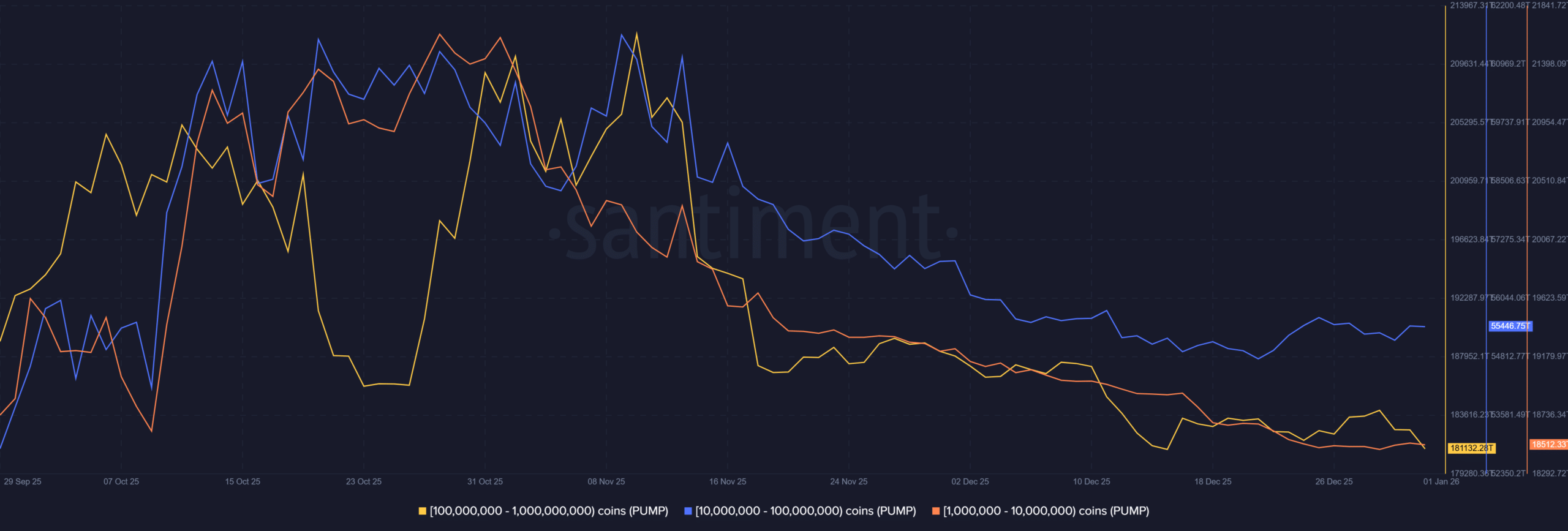

PUMP token, the native asset of the Solana-based memecoin launchpad Pump.fun, has seen notable whale holders exit their positions at significant losses. This capitulation follows a 78% price decline throughout 2025, prompting large investors to cut losses rather than hold amid ongoing market pressures. Data indicates multiple whales accelerated sell-offs starting mid-November, with a prominent 6-month holder transferring 750 million PUMP tokens—valued at approximately $1.47 million on Hyperliquid—likely for liquidation.

This particular move represents a 51% loss for the investor, who originally acquired the position for $3 million. Such actions highlight growing fatigue among long-term holders as the token struggles to regain footing.

Source: Santiment

How are Pump.fun buybacks affecting PUMP token price stability?

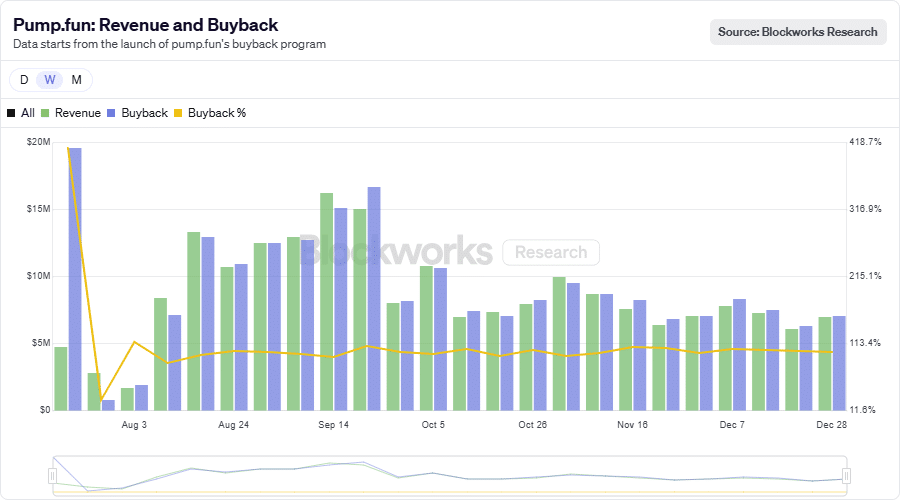

Pump.fun allocates protocol revenue toward PUMP token buybacks to support value accrual. By late 2025, weekly buybacks dropped below $10 million, yet this still captured 100% of generated revenue during that period. The most substantial buyback recorded recently involved 1.46 billion PUMP tokens valued at $2.74 million.

Source: Blockworks

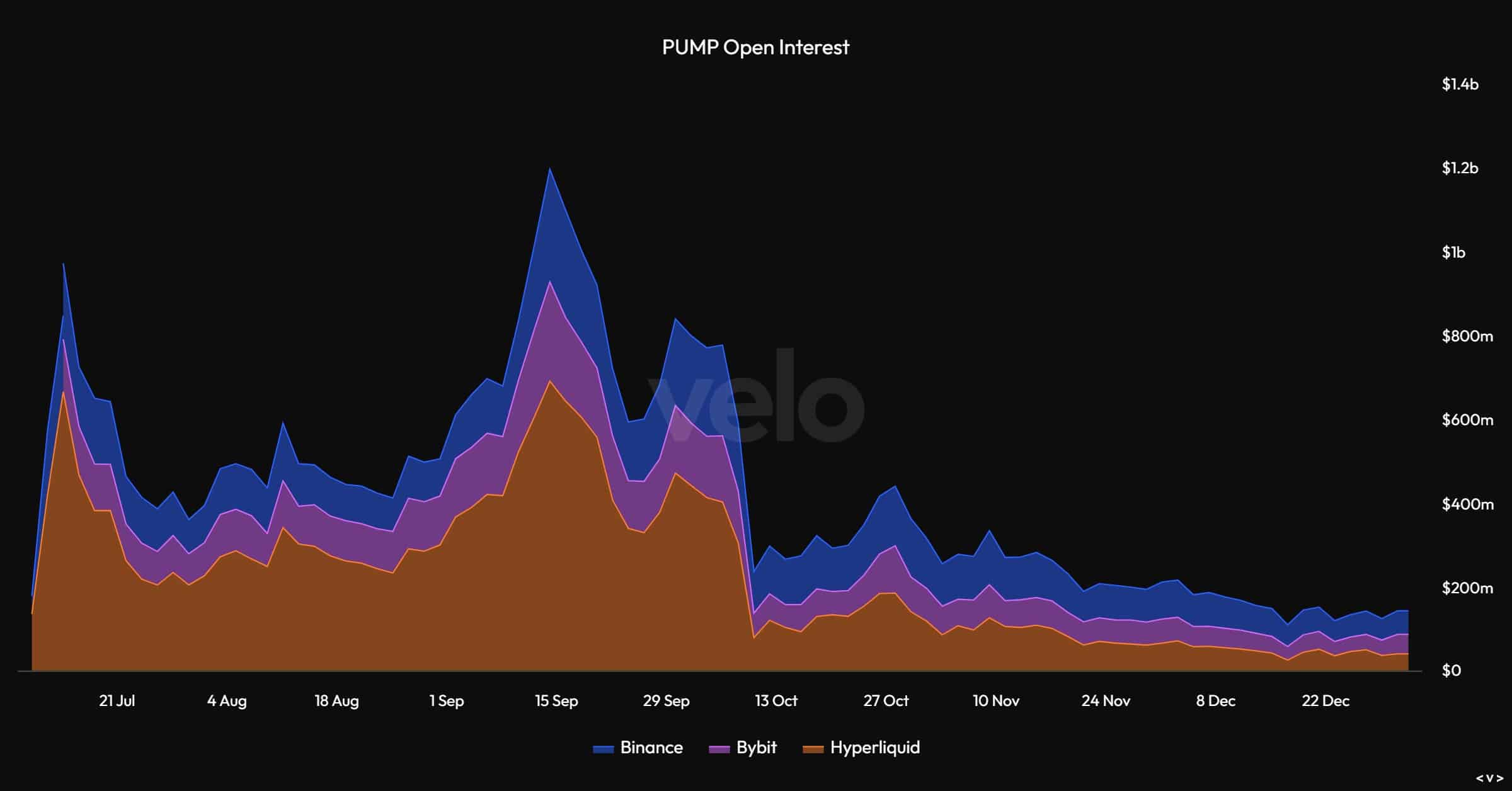

Despite these efforts and some whales purchasing at current lows, the price recovery remains subdued. Analysts from Front Runners note, “Price is still so depressed that this level of buybacks should start showing up in the chart relatively soon (chart looks quite bottomed out).” This suggests buybacks could provide upward pressure if sentiment improves. Pump.fun’s model as a Solana memecoin launchpad has driven initial hype, but sustained revenue is key for long-term PUMP token viability. Market data from derivatives exchanges reveals broader challenges, with open interest (OI)—the total value of outstanding futures contracts—plummeting 85% from $1 billion to $142 million between Q3 and Q4 2025.

Source: Velo

This sharp OI decline underscores diminished speculative interest, particularly in futures markets, which could delay any meaningful PUMP token price rebound until trading activity revives.

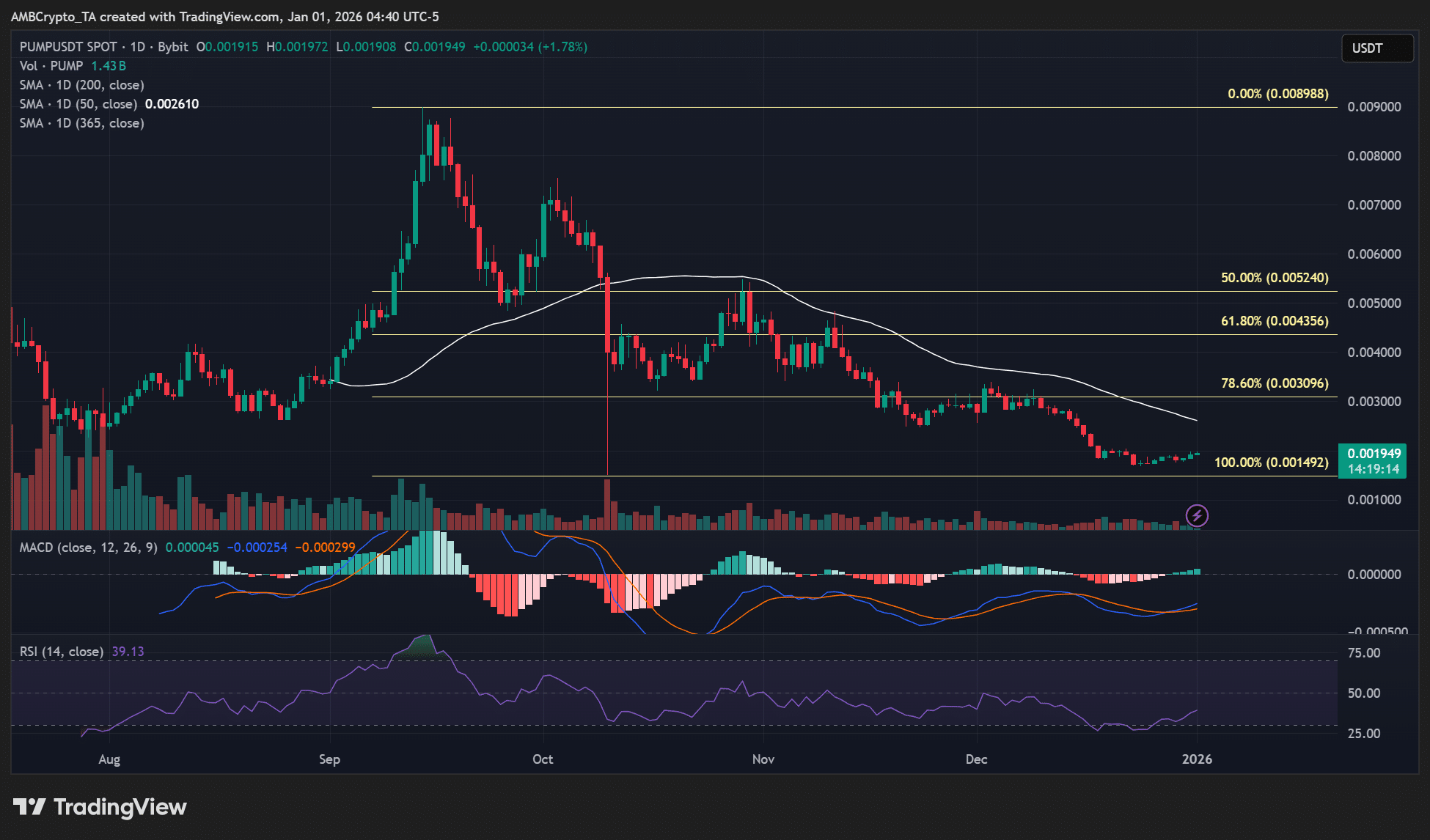

On technical charts, however, optimism lingers. The token posted a 16% gain during the December Santa rally, triggering a MACD golden cross—a bullish signal where the short-term moving average crosses above the long-term one. Confirmation of an extended recovery hinges on reclaiming the 50-day moving average.

Source: PUMP/USDT, TradingView

Frequently Asked Questions

Why are whales selling PUMP token positions at a 51% loss?

Whales are capitulating after PUMP token’s 78% crash in 2025, with sell-offs accelerating from mid-November. A 6-month holder liquidated 750 million tokens worth $1.47 million on January 1, accepting a 51% loss from a $3 million entry. Declining sentiment and revenue slowdowns are forcing exits, per Santiment data.

Will PUMP token price extend its recent recovery?

The PUMP token has rebounded 16% in December with a MACD golden cross signaling potential upside. However, reclaiming the 50-day MA is crucial amid 85% OI drop and whale sales. Buybacks offer support, but improved futures demand is needed for sustained gains, as noted by market analysts.

Key Takeaways

- Whale capitulation intensifies: Major holders like a 6-month whale sold 750M PUMP at 51% loss, risking recovery momentum.

- Buybacks persist but weaken: Down to under $10M weekly, yet 100% of revenue; largest recent at $2.74M shows commitment.

- Sentiment at lows: 85% OI crash to $142M; watch for MACD cross and 50-day MA reclaim for rebound confirmation.

Conclusion

The PUMP token faces headwinds from whale capitulation and an 85% futures open interest decline after its 78% 2025 crash, though buybacks and technical signals like the MACD golden cross provide counterbalance. As Pump.fun continues revenue-driven repurchases, monitoring whale activity and sentiment recovery will be essential. Investors should track the 50-day MA for confirmation of extended PUMP token price upside in the evolving Solana memecoin landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026