VCs Debate Web3's Failure: Dixon vs Qureshi

ALT/USDT

$13,167,377.07

$0.008300 / $0.006810

Change: $0.001490 (21.88%)

-0.0107%

Shorts pay

Contents

Leading crypto venture capital investors are debating online whether non-financial use cases in crypto, Web3, and blockchain have failed due to lack of investor demand and product-market fit. The discussion started with a post published on Friday by Chris Dixon, managing partner of a16z crypto; Dixon argued that areas like decentralized social media, digital identity management, Web3 video games have not developed due to scams, exploitative behaviors, and regulatory attacks.

Chris Dixon's Criticisms of Web3 Non-Financial Areas

Dixon attributes the failure of Web3 in social media and gaming to external factors: scams (e.g., FTX-like scandals), exploitative tokenomics, and pressures from regulators like the SEC. He argues that instead of the freedom promised, these areas have created chaos. The discussion also questions the future of infrastructure projects like ALT detailed analysis.

Haseeb Qureshi's Product-Market Fit Thesis

Dragonfly's Haseeb Qureshi, in his Sunday response, did not blame events like Gensler, SBF, or Terra. Instead, he emphasized that decentralized social networks and Web3 games are "bad products" with no user demand. He pointed to fundamental market mismatch independent of financial disasters like the LUNA collapse.

Nic Carter and VC Time Frames

Castle Island Ventures' Nic Carter noted that VC funds must make bets in 2-3 year short-term cycles. Dixon argued that new industries require a 10-year horizon. This divergence reflects 2025 VC flows: shift to tokenized RWAs and financial infrastructure.

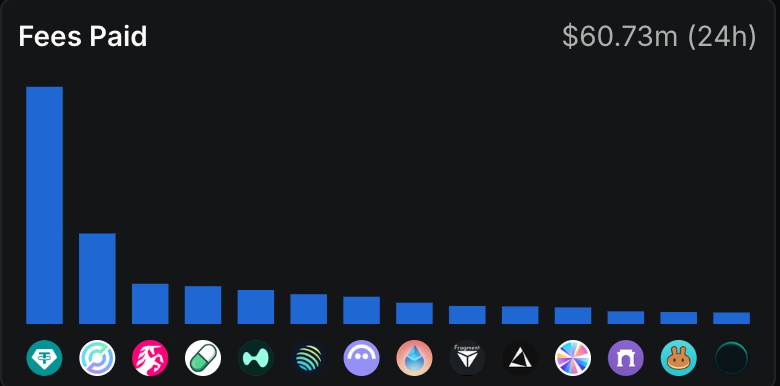

DeFiLlama Data: Dominance of Financial Use Cases

According to DeFiLlama, $60.7 million in fees in the last 24 hours came entirely from exchanges and DeFi applications. The top 10 apps are financial: DEXes like Uniswap dominate. This justifies Dragonfly's financial focus.

ALT Price Analysis: Market Impact of the Discussion

ALT (AltLayer), as Web3 infrastructure, is affected by this discussion. Current data: Price $0.01, 24h -2.00%, RSI 33.69 (Oversold), downtrend, Supertrend bearish, EMA20 $0.0100. ALT futures volatile.

| Supports | Level | Score | Distance |

|---|---|---|---|

| S1 | $0.0084 | 71/100 ⭐ | -0.12% |

| S2 | $0.0069 | 66/100 ⭐ | -17.95% |

| Resistances | Level | Score | Distance |

|---|---|---|---|

| R1 | $0.0088 | 73/100 ⭐ | +4.64% |

| R2 | $0.0130 | 56/100 | +54.58% |

Expert opinion: RSI low, S1 strong support. ALT could recover with financial integration like UNI detailed analysis, risky with LUNA lesson.

2025 VC Trends and Future Expectations

Dragonfly focuses on financial infrastructure, a16z on Coinbase-Uniswap-Web3 games. Tokenized RWAs on the rise, long-term patience needed for non-financial areas.