ZEC Surges 11% on Ecosystem Yields, Technicals Suggest Further Upside Potential

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

ZCash (ZEC) price has surged over 11% in the last 24 hours, reaching a trading volume of $744 million, driven by ecosystem enhancements and bullish technical indicators. This privacy-focused token shows potential for further gains, with nearly 1,000% yearly appreciation signaling strong investor interest.

-

Bullish momentum fueled by ecosystem developments offering up to 2% APY on multi-chain yields.

-

Institutional holdings, such as Cyberpunk’s 1.42% of ZEC supply, reduce circulating tokens and boost demand.

-

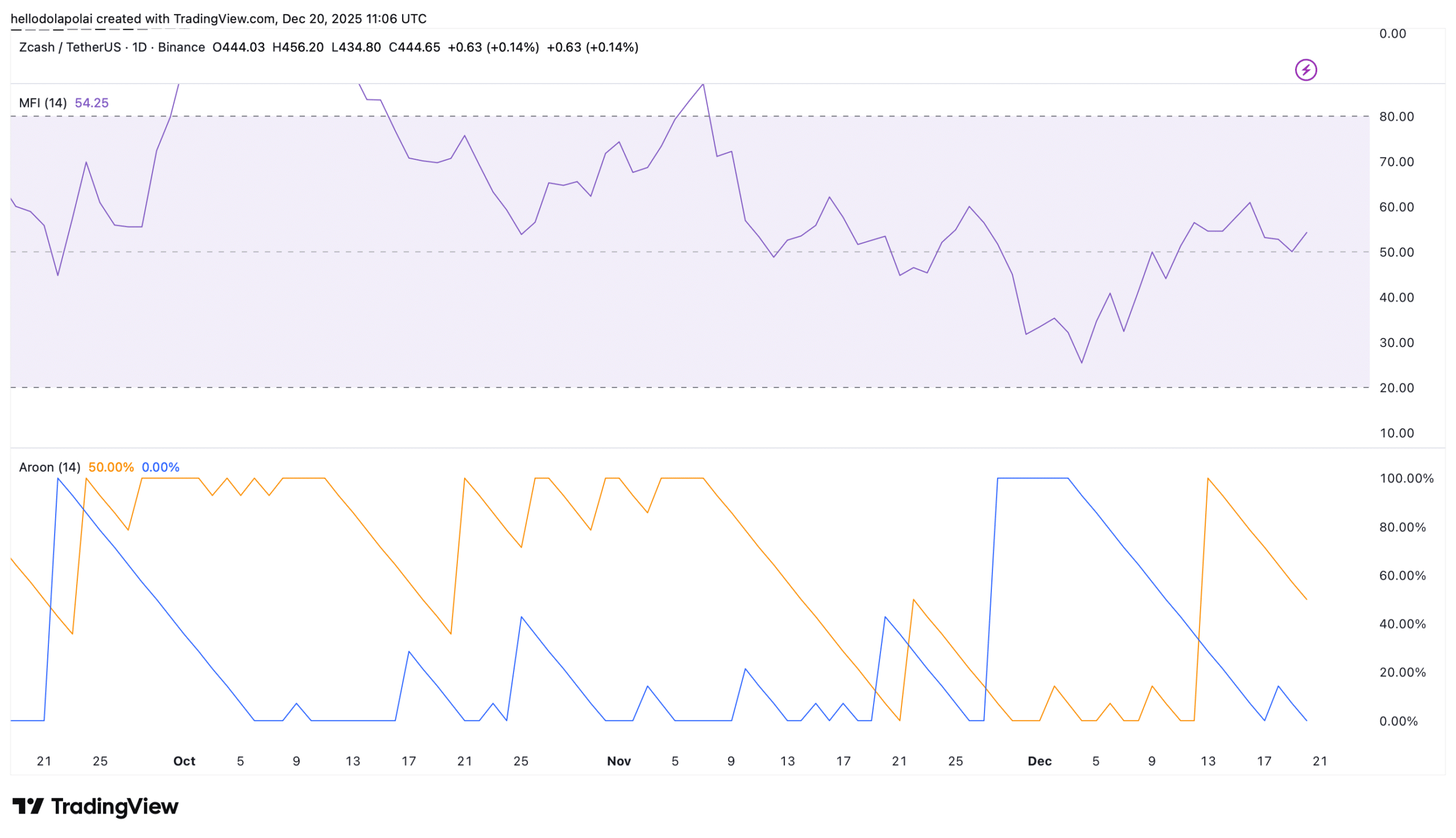

Technical signals like Aroon Up above Aroon Down and MFI at 65 indicate sustained upward trends without overbought conditions.

Discover why ZCash price is surging 11% amid privacy token revival. Explore bullish charts, yields, and institutional interest driving ZEC’s 1,000% yearly gain. Stay informed on crypto trends today.

What is driving the ZCash price surge?

ZCash price has experienced a notable uptick, climbing more than 11% in the past day to fuel heightened trading activity at $744 million in volume. This movement aligns with broader market recovery and specific advancements within the ZCash ecosystem, including expanded utility for token holders through yield-generating opportunities. Over the last year, ZEC has delivered approximately 1,000% returns, underscoring its resilience as a leading privacy cryptocurrency.

The resurgence in ZCash interest stems from ongoing protocol improvements that enhance its appeal in decentralized finance circles. Privacy remains a core tenet, attracting users wary of transparent blockchains. As regulatory scrutiny intensifies globally, ZEC’s shielded transactions provide a compelling alternative, encouraging adoption among privacy advocates and institutional players alike.

How are technical indicators supporting ZCash’s bullish trend?

Technical analysis reveals several positive signals for ZCash, positioning it favorably for continued appreciation. The Aroon indicator currently shows Aroon Up holding above Aroon Down, a configuration that typically signifies bullish dominance in price action. Although Aroon Up has not yet surpassed the 70% threshold, its position above 50% confirms moderate but steady upward momentum, as observed in recent charts.

Complementing this, the Money Flow Index (MFI) stands at 65, comfortably in bullish territory since readings above 50 denote increasing buying pressure. This level avoids the overbought zone near 80, suggesting room for additional inflows without immediate reversal risks. Data from TradingView highlights these trends, with liquidity steadily entering the market, bolstering ZEC’s price stability.

Further supporting evidence comes from volume patterns, where 24-hour trades have spiked to $744 million, reflecting genuine demand rather than speculative noise. According to on-chain metrics, this surge correlates with reduced sell-offs, as more holders opt to stake or yield-farm their ZEC, tightening supply dynamics.

Source: TradingView

Experts in cryptocurrency analysis, such as those cited in DeFiLlama reports, emphasize that sustained MFI readings in this range often precede extended rallies. For ZCash, this could translate to testing higher resistance levels, provided broader market sentiment remains supportive.

Frequently Asked Questions

What factors are contributing to ZCash’s 11% price increase in the last 24 hours?

ZCash’s recent 11% surge is primarily driven by ecosystem upgrades enabling multi-chain yields up to 2% APY, attracting long-term holders. Institutional accumulation, including Cyberpunk’s stake of 1.42% of total ZEC supply, has also limited available tokens, per DeFiLlama data. Combined with positive technicals, this has amplified trading volume to $744 million.

Is ZCash a good investment for privacy-focused traders?

ZCash offers robust privacy features through zk-SNARKs technology, making it ideal for users prioritizing transaction anonymity. With over 1,000% gains in the past year and current bullish indicators, it presents opportunities for yield generation. However, as with all cryptocurrencies, potential investors should assess risks like market volatility and regulatory changes.

Key Takeaways

- Ecosystem Enhancements: ZCash’s integration of yield options up to 2% APY encourages holding over selling, reducing supply pressure and supporting price stability.

- Institutional Interest: Holdings by entities like Cyberpunk, representing 1.42% of ZEC supply according to DeFiLlama, signal growing confidence and potential for demand spikes.

- Technical Strength: Bullish Aroon and MFI readings suggest continued upside; monitor for breakouts to target previous highs around $750.

Conclusion

ZCash price continues to demonstrate resilience and potential amid a recovering crypto landscape, with ecosystem developments and technical indicators pointing to sustained bullish trends. Institutional adoption further solidifies ZEC’s position as a privacy leader, potentially limiting supply and fostering higher valuations. As the market evolves, ZCash holders may see additional rewards from yields and price appreciation—consider exploring these opportunities to capitalize on the momentum.

Bullish Momentum Driven by Ecosystem Development

The core of ZCash’s recent performance lies in strategic ecosystem expansions that broaden its utility beyond basic transactions. By introducing multi-chain yield mechanisms, ZCash now allows holders to earn up to 2% APY on deposited assets, a feature designed to promote long-term retention. This shift from exchange-based holding to protocol-integrated staking diminishes sell pressure, as participants lock in fixed income streams.

Data from on-chain analytics platforms like DeFiLlama illustrate this trend, showing Cyberpunk’s allocation of 1.42% of the total ZEC supply. Such institutional moves not only validate ZCash’s privacy model but also create scarcity in the circulating market. As more entities enter, demand could outpace supply, propelling prices higher.

Privacy blockchains like ZCash have historically underperformed during bull runs dominated by high-throughput networks, but recent innovations are closing that gap. The emphasis on yield generation aligns with DeFi’s growth, where annual yields incentivize participation. For ZCash, this means transitioning from a niche privacy coin to a multifaceted asset, appealing to a wider investor base.

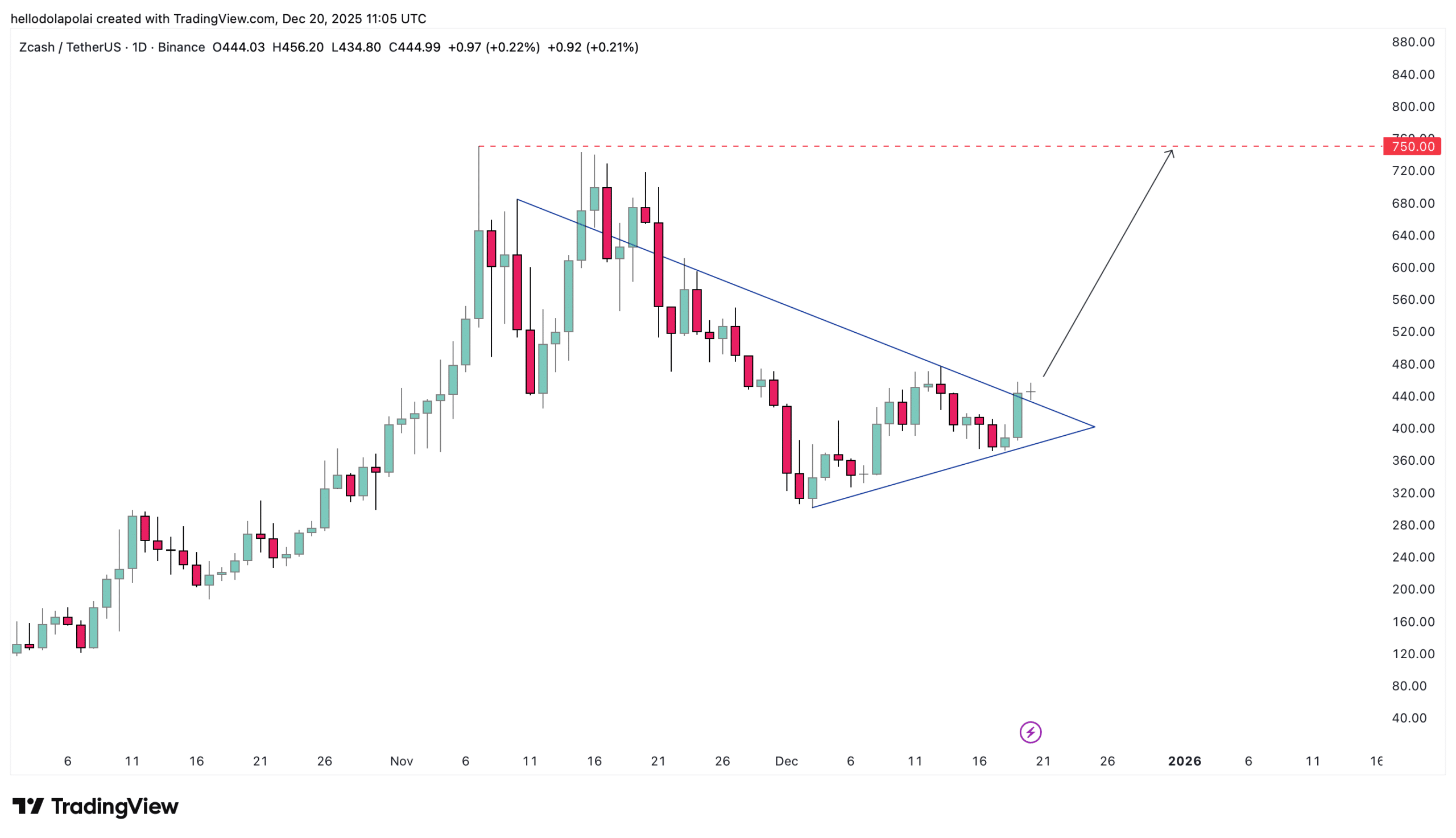

Chart Patterns Support ZCash Prices

From a charting perspective, ZCash has emerged from a symmetrical triangle pattern, a classic bullish continuation setup. This formation involves price compression between converging trendlines, culminating in a breakout above resistance. For ZEC, the recent surge confirms this breakout, with implications for extended rallies.

Projecting forward, chart targets align with ZCash’s prior all-time high near $750, achieved earlier in the year. Current momentum, backed by volume increases, supports this trajectory, though traders should watch for retests of the triangle’s upper boundary to confirm validity. TradingView analysis underscores the pattern’s reliability, with historical precedents showing 20-30% follow-through gains in similar setups.

Source: TradingView

Overall, the combination of fundamental upgrades and technical confirmations paints an optimistic picture for ZCash. While external factors like macroeconomic shifts could influence outcomes, the internal dynamics suggest ZEC is well-poised for near-term gains. Investors monitoring privacy tokens should note ZCash’s evolution as a benchmark for the sector.

In summary, ZCash’s 11% daily gain and 1,000% annual performance reflect more than transient hype; they indicate a maturing asset with real-world applications. As privacy demands grow in an era of increasing data surveillance, ZCash stands out, supported by yields and chart-driven momentum. For those engaged in cryptocurrency, tracking ZEC could yield valuable insights into broader market directions.