Berachain Refund Clause Sparks Investor Concerns Over Brevan Howard Deal

Contents

Berachain’s Series B funding controversy involves Brevan Howard’s Nova Digital securing a secret refund right on their $25 million investment, active until February 2026, sparking backlash from other investors over undisclosed terms.

-

Berachain raised $100 million in April 2024 at a $1.5 billion valuation.

-

Nova Digital invested $25 million but gained downside protection via a side letter.

-

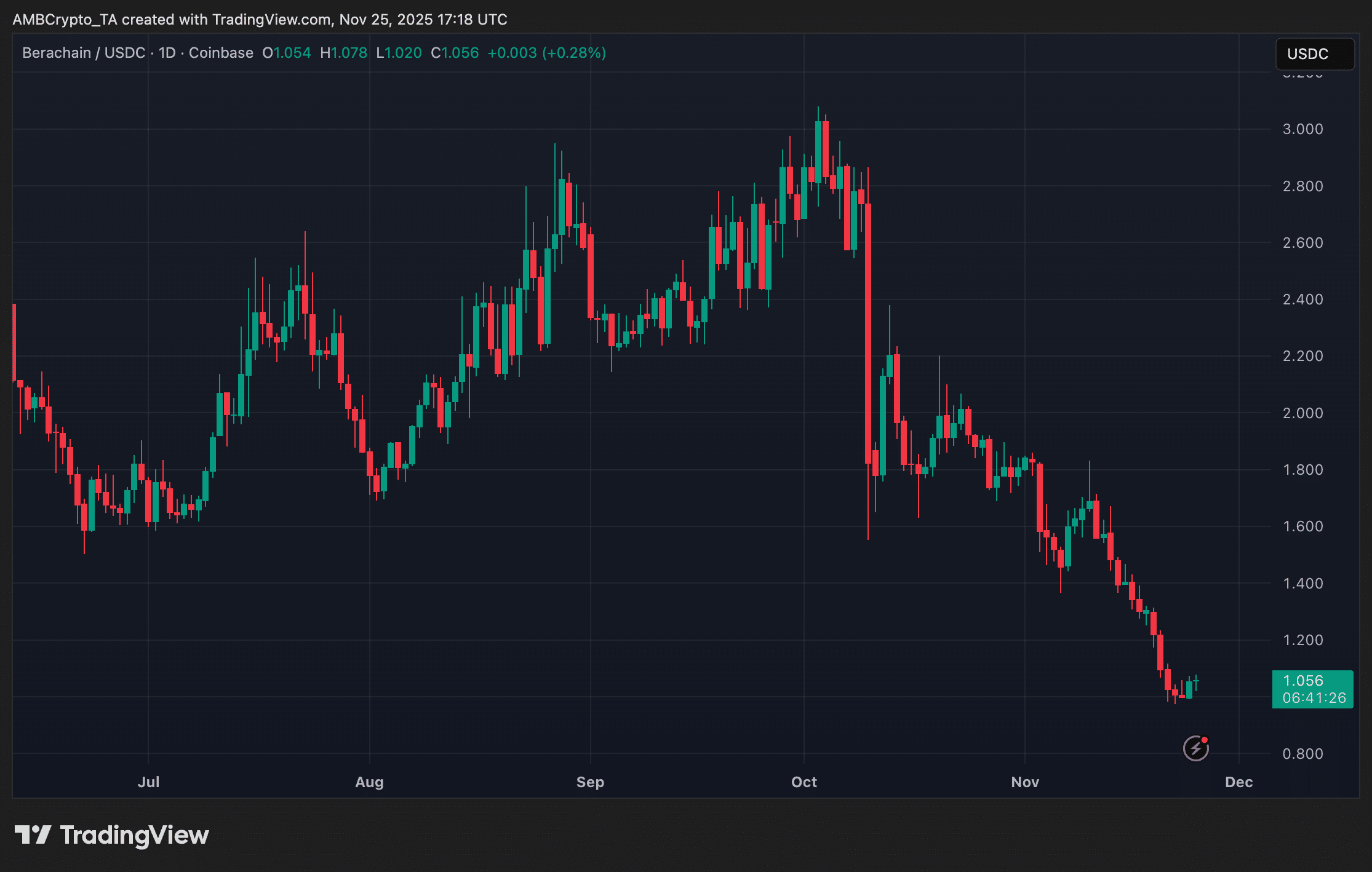

BERA token price has dropped 67% to around $1, highlighting investor disparities.

Discover the Berachain refund clause controversy shaking crypto investments. Brevan Howard’s special terms raise transparency issues in Series B funding. Stay informed on this pivotal crypto news development.

What is the Berachain refund clause controversy involving Brevan Howard?

The Berachain refund clause controversy centers on a hidden agreement granting Brevan Howard’s crypto arm, Nova Digital, the ability to recover their $25 million Series B investment until February 2026. This provision, detailed in a side letter dated March 5, 2024, offers downside protection not extended to other investors. It activates under specific conditions tied to Berachain’s token launch, amid a 67% drop in BERA token value to about $1.

How did Nova Digital secure these special terms in Berachain’s funding round?

Nova Digital participated in Berachain’s April 2024 Series B round, which raised $100 million at a $1.5 billion valuation, co-led by Framework Ventures. The refund right allows Nova to request repayment of some or all funds within five business days, functioning similarly to a put option that shields against losses. To trigger it, Nova was required to deposit $5 million into a Berachain wallet post-launch, though confirmation of this step remains unverified. Investigative reporting by Unchained revealed these details through leaked documents, emphasizing the rarity of such clauses in crypto token deals, as noted by four crypto lawyers who described them as “extremely rare.”

Berachain, a layer-1 blockchain project known for its proof-of-liquidity consensus, attracted significant institutional interest with promises of innovative DeFi infrastructure. However, the disparity in investor protections has drawn scrutiny. While Nova benefits from this safety net—retaining upside potential if BERA appreciates but avoiding full exposure to downside—co-investors like Framework Ventures reportedly face over $50 million in unrealized losses based on current token prices.

The side letter specifies the clause expires exactly one year after Berachain’s token generation event, set for February 2025. This timeline adds urgency, as market volatility could prompt Nova to exercise the option if BERA fails to recover. Standard industry practices typically limit refunds to outright project failures, not performance-based underperformance, making this arrangement stand out in the competitive crypto funding landscape.

Frequently Asked Questions

What special terms did Brevan Howard secure in Berachain’s Series B?

Nova Digital, part of Brevan Howard, obtained a secret refund right allowing reclamation of some or all of their $25 million investment until February 2026, as outlined in a March 2024 side letter. This protects against losses without limiting gains, differing from typical investor agreements in crypto rounds.

Why is the Berachain refund clause causing controversy among investors?

The controversy arises because two anonymous Series B investors were not informed about Nova’s refund clause, potentially breaching Most Favored Nation provisions that mandate equal treatment. This lack of disclosure has led to claims of unfair advantages, eroding trust in Berachain’s funding transparency, a key factor in crypto investment decisions.

Key Takeaways

- Downside Protection for Nova: Brevan Howard’s arm can refund their investment if conditions aren’t met by 2026, shielding them from BERA’s 67% price decline.

- Investor Disparities: Other participants, including Framework Ventures, lack similar safeguards, facing full market risk on substantial commitments.

- Transparency Issues: Undisclosed side letters highlight opacity in crypto deals; investors should scrutinize terms to avoid surprises.

Anonymous investors cry foul

Two Series B investors expressed to Unchained their complete unawareness of Nova’s advantageous terms. This revelation has ignited debates over compliance with Most Favored Nation clauses, which are designed to ensure all investors receive equivalent protections. In the crypto space, where trust is paramount, such oversights can deter future participation and invite regulatory attention.

Experts in cryptocurrency law, as interviewed by Unchained, underscored that refund mechanisms like this are outliers. They typically apply only if a project fails to launch entirely, not for tokens that merely depreciate. One lawyer noted, “This setup blurs the line between venture capital and high-risk speculation, potentially setting a precedent for uneven playing fields.”

Berachain pushes back

Berachain’s pseudonymous co-founder, Smokey The Bera, addressed the uproar on X, attributing the clause to regulatory necessities for Nova’s Abu Dhabi-based liquid-only vehicle. He clarified that it activates solely if the token generation event fails or exchanges reject BERA listings, not due to price drops. Smokey highlighted Nova’s post-launch actions, including increased BERA holdings, positioning them as a major supporter and liquidity provider.

This defense aims to reframe the narrative, but skepticism persists among observers. Berachain’s team emphasizes the project’s ongoing development, including its unique reward system for liquidity providers. Nonetheless, the incident underscores broader challenges in crypto governance, where institutional players like Brevan Howard—managing over $35 billion in assets—wield significant influence.

What’s at Stake

The Berachain refund clause controversy illuminates the shadowy underbelly of crypto fundraising. Side letters and bespoke arrangements can profoundly alter risk dynamics, leaving retail and smaller institutional investors at a disadvantage. As BERA’s price hovers near $1, down sharply from Nova’s $3 entry point, the February 2026 deadline looms large.

Market analysts, drawing from data platforms like TradingView, point to Berachain’s volatile trajectory since launch. The project’s proof-of-liquidity model, inspired by Cosmos SDK, aims to align incentives between validators and users, but funding disputes could undermine adoption. With the crypto market maturing, demands for standardized disclosures grow, potentially influencing future rounds.

Source: TradingView

While co-investors like Framework Ventures face paper losses exceeding $50 million, Nova can request a full refund within five business days. The arrangement functions like a put option. If BERA rallies, Nova captures the upside. If it crashes—as it has—they walk away whole. To activate this safety net, Nova needed to deposit $5 million into a Berachain wallet within 30 days of launch. However, confirmation of this deposit remains unclear.

The deal that raised eyebrows: Nova invested $25 million at $3 per BERA token during the April 2024 Series B round, which raised $100 million at a valuation of $1.5 billion. Framework Ventures co-led the round alongside Nova. Here’s the kicker: BERA now trades around $1, down approximately 67% from Nova’s entry price.

This controversy exposes the often-opaque world of crypto fundraising, where side letters can create vastly different risk profiles within the same investment round. With BERA’s February 2026 refund deadline approaching, all eyes remain on whether Nova will exercise its get-out-of-jail-free card.

Conclusion

The Berachain refund clause controversy with Brevan Howard underscores critical transparency gaps in crypto investment rounds, where special terms can favor large institutions over others. As revealed through leaked documents and expert insights from sources like Unchained, such practices challenge the equitable foundations of blockchain projects. Investors must prioritize due diligence amid evolving regulations. Looking ahead, greater standardization could foster a more inclusive crypto ecosystem, benefiting innovative platforms like Berachain in their quest for widespread adoption.

Comments

Other Articles

Mantra CEO Urges OM Token Holders to Withdraw from OKX Amid Migration Disputes

December 8, 2025 at 02:08 PM UTC

Corporate Ether Acquisitions Fall 81% as Top Holders Persist in Buying Amid Crypto Consolidation

December 5, 2025 at 07:06 PM UTC

Balancer DeFi Protocol Details $116M Stable Pool Exploit in Post-Mortem Report

November 5, 2025 at 08:09 PM UTC