Bitcoin at On-Chain Fair Value Amid Peak Sell Pressure, Eyes Potential $82K Dip

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

Bitcoin faces its highest sell pressure in three years, driven by aggressive taker selling and negative spot ETF flows. Traders can expect a short-term price drop toward $82,000 before a potential bounce to $95,000 following the recent options expiry.

-

Record sell pressure: Highest in three years per on-chain data.

-

Negative ETF inflows signal weak market sentiment amid year-end volatility.

-

On-chain fair value metrics show Bitcoin returning to equilibrium, with key support at $83,500.

Bitcoin price action reveals intense sell pressure and on-chain equilibrium. Explore predictions, key levels like $82K support, and trading insights for December 2025 volatility. Stay ahead—monitor ETF flows now (158 characters).

What should traders expect from Bitcoin price action?

Bitcoin price action in late 2025 shows a bearish internal structure amid the highest sell pressure in three years. Aggressive taker sell orders have fueled a downtrend since the October crash, compounded by persistent negative spot ETF flows that underscore waning demand and risk aversion toward year-end.

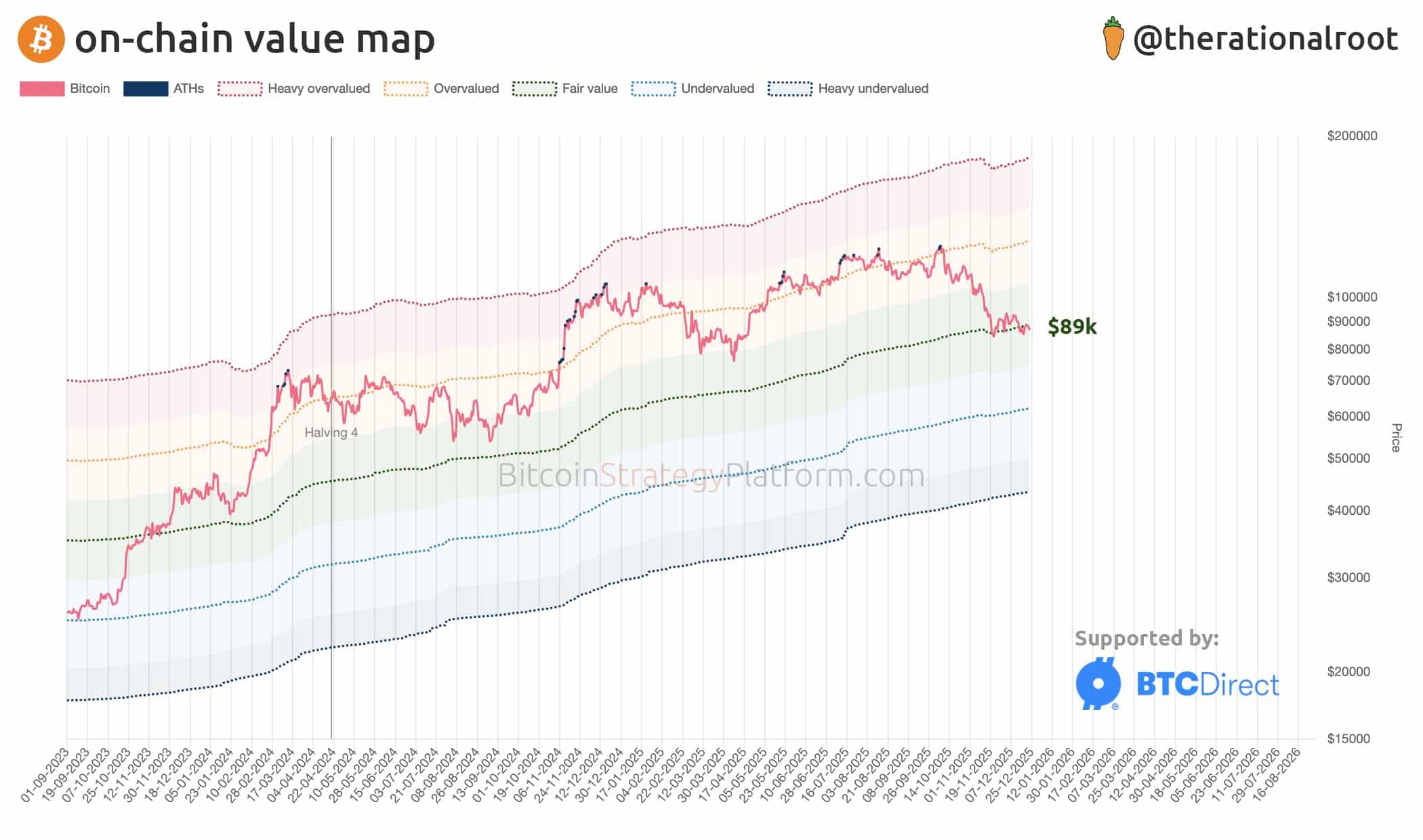

Source: Root on X

On-chain analyst Root noted on X that Bitcoin is now trading near its on-chain fair value, calculated using realized capitalization, coin days destroyed, and liquid supply. This metric indicated overvaluation since March 2024, peaking in late 2024. The recent correction has brought pricing back to fair value, but this alone does not signal an immediate reversal.

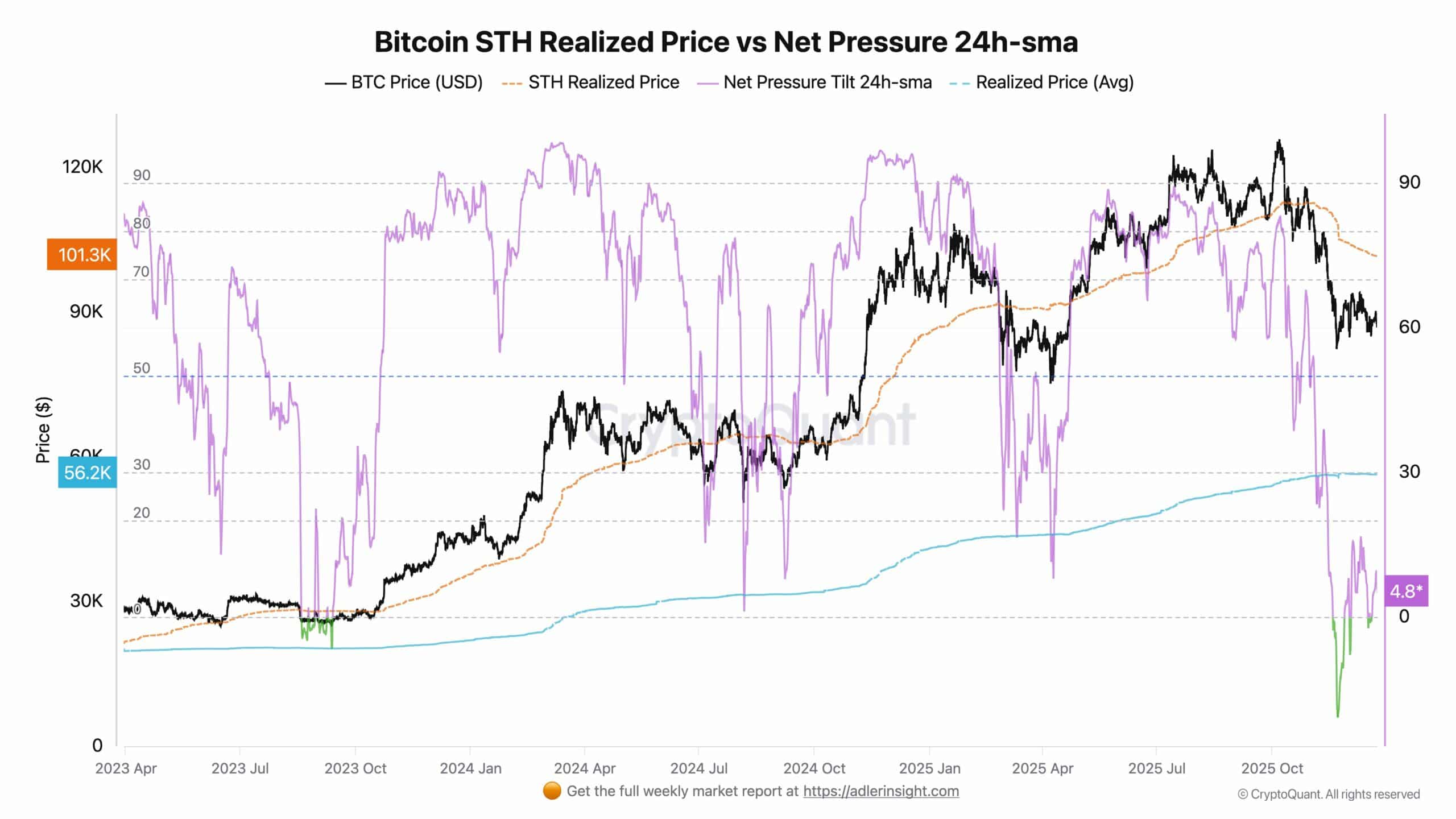

Source: Axel Adler Jr on X

Why has Bitcoin sell pressure reached three-year highs?

Bitcoin sell pressure has surged to its highest levels in three years, as detailed in recent COINOTAG analysis. This stems from aggressive taker sell activity post the October crash, alongside consistently negative spot ETF inflows. These factors reflect diminished risk appetite, particularly as markets brace for heightened volatility at year-end. Short-term holder realized price metrics hit a rare equilibrium in the bottom 5% of three-year historical data—occurring just 5.8% of the time—indicating balanced buying and selling forces as the market probes directional cues. Analyst Axel Adler Jr highlighted on X that this pressure balance among short-term holders does not guarantee a buying opportunity, urging caution amid the bearish structure.

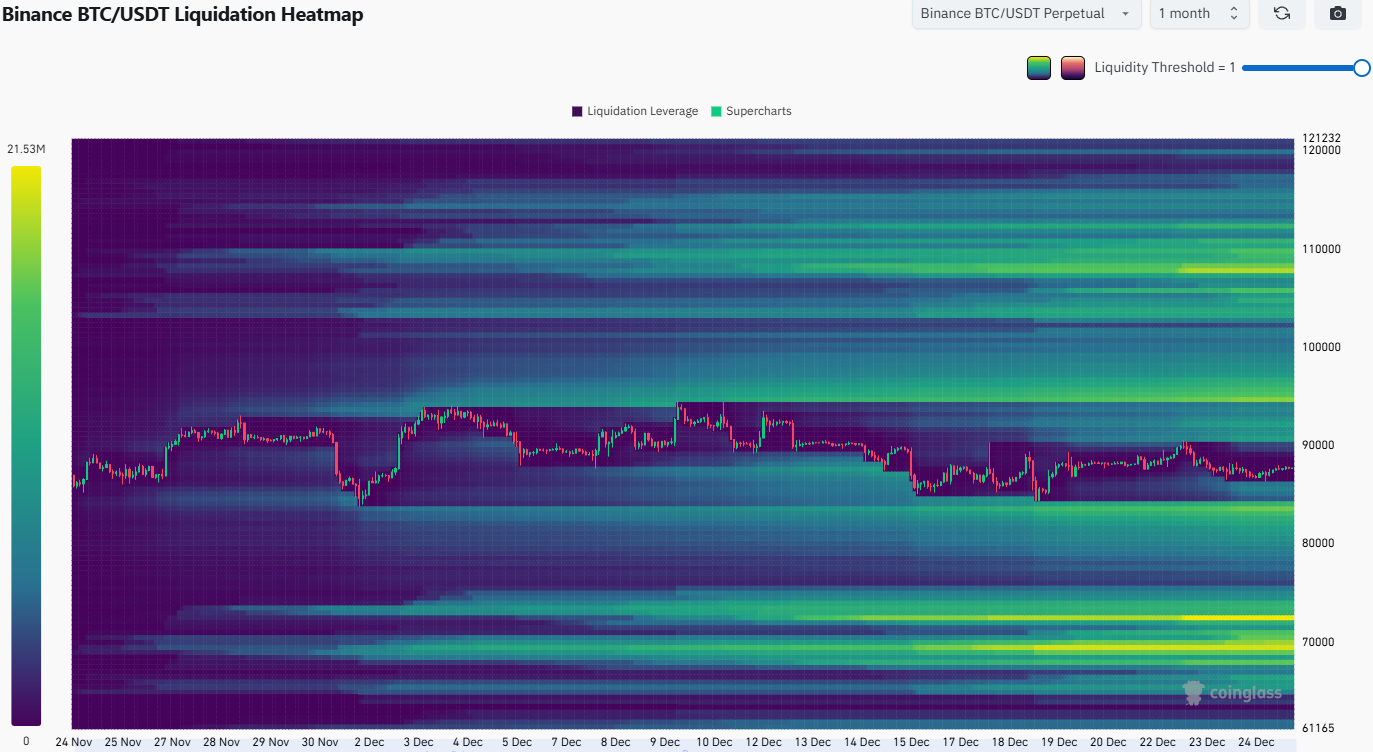

Source: CoinGlass

Liquidation heatmaps from CoinGlass pinpoint $83,500 and $94,700 as primary magnetic zones, with a liquidity cluster between $90,000 and $92,700 warranting attention. These levels could draw price action during bouts of volatility.

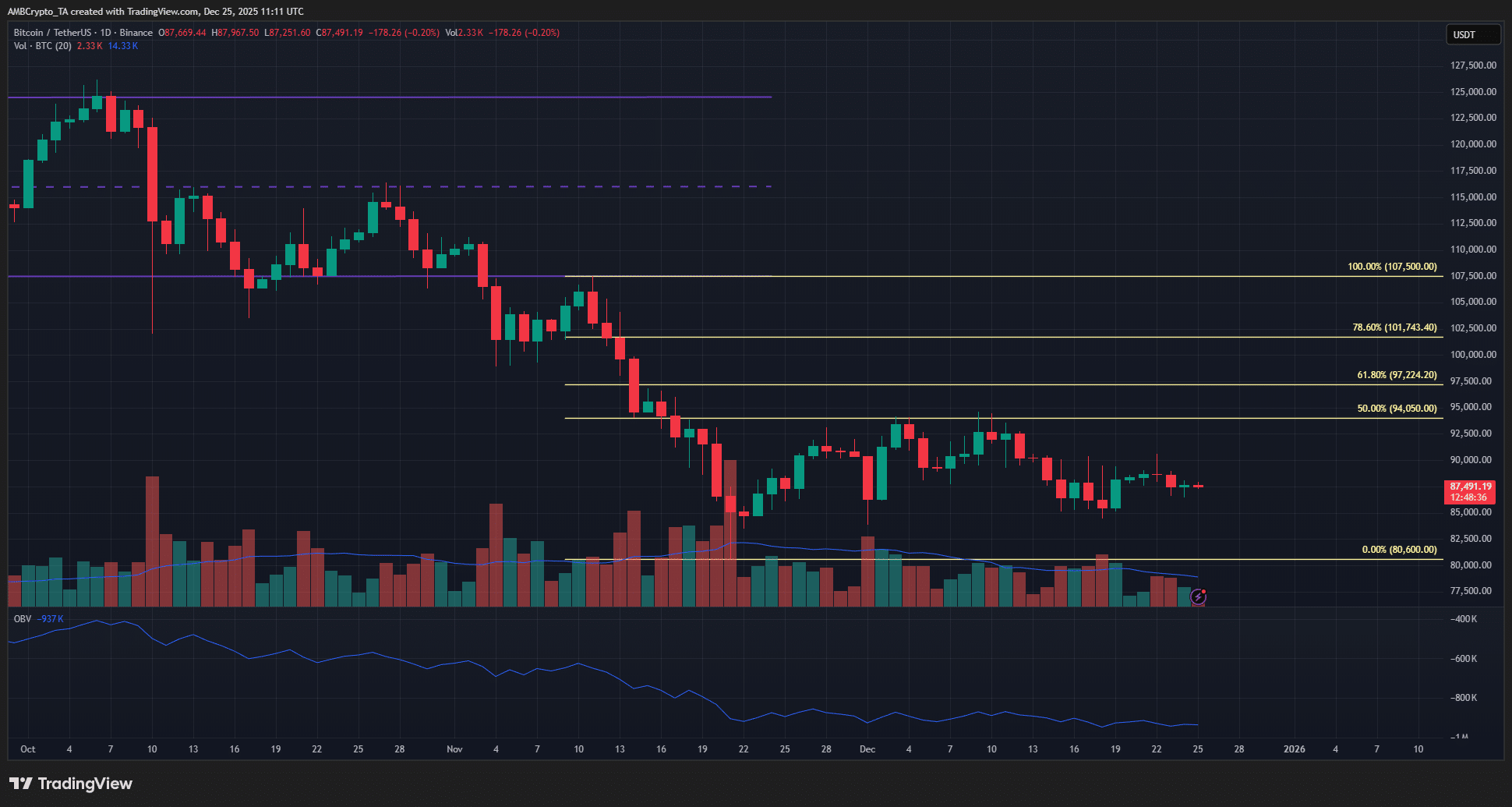

Source: BTC/USDT on TradingView

The one-day chart reveals no sustained trend in December, with a bearish internal structure persisting. A dip toward the $84,000 liquidity pocket appears probable. Fibonacci retracement analysis suggests bullish bias requires a break above $101,700 or $107,500. Near-term, Bitcoin price action may remain sideways, amplified by Friday’s major options expiry.

Frequently Asked Questions

Will Bitcoin price drop to $82,000 amid current sell pressure?

Yes, a drop to around $82,000 is anticipated in the short term due to elevated sell pressure, negative ETF flows, and bearish structure. This aligns with on-chain data and liquidation levels, though a subsequent bounce to $95,000 could follow options expiry.

What do on-chain fair value metrics indicate for Bitcoin today?

On-chain fair value metrics, incorporating realized cap and liquid supply, show Bitcoin at equilibrium after prolonged overvaluation. As shared by analyst Root, this neutral zone tempers enthusiasm but sets up potential stabilization if buying pressure builds.

Key Takeaways

- Highest sell pressure in three years: Driven by taker sells and ETF outflows, signaling caution.

- On-chain equilibrium: Short-term holders at rare balance, bottom 5% historically—no clear buy signal yet.

- Key levels to watch: Monitor $83.5K support and $94.7K resistance for directional clues.

Conclusion

Bitcoin price action remains under significant sell pressure, reverting to on-chain fair value amid negative ETF flows and market equilibrium among short-term holders. While a brief rebound is possible post-options expiry, traders should prepare for volatility around $82,000-$95,000. Stay vigilant on liquidity zones and structure shifts for informed positioning in this dynamic landscape.

Disclaimer: This information does not constitute financial, investment, or trading advice and reflects analysis only.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC