Bitcoin Sell-Off Drives Liquidations Amid Thin Liquidity in Crypto Market

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

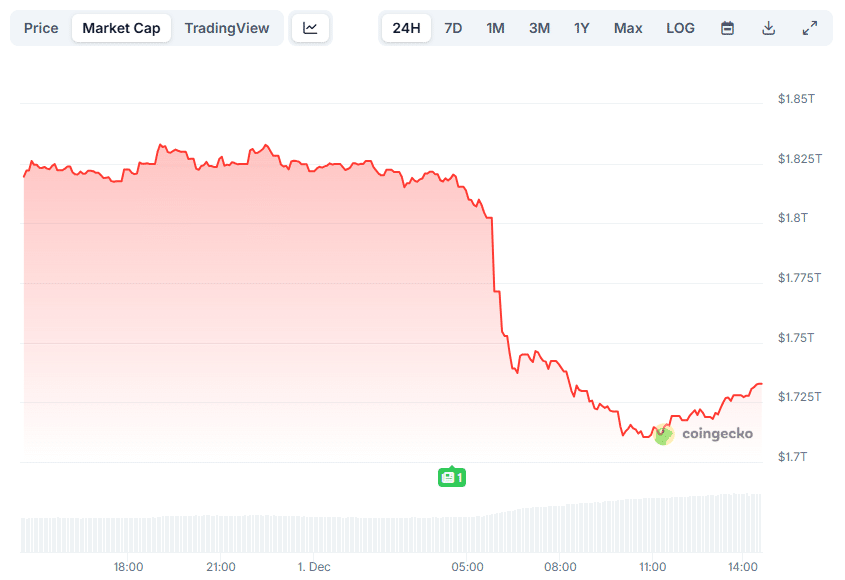

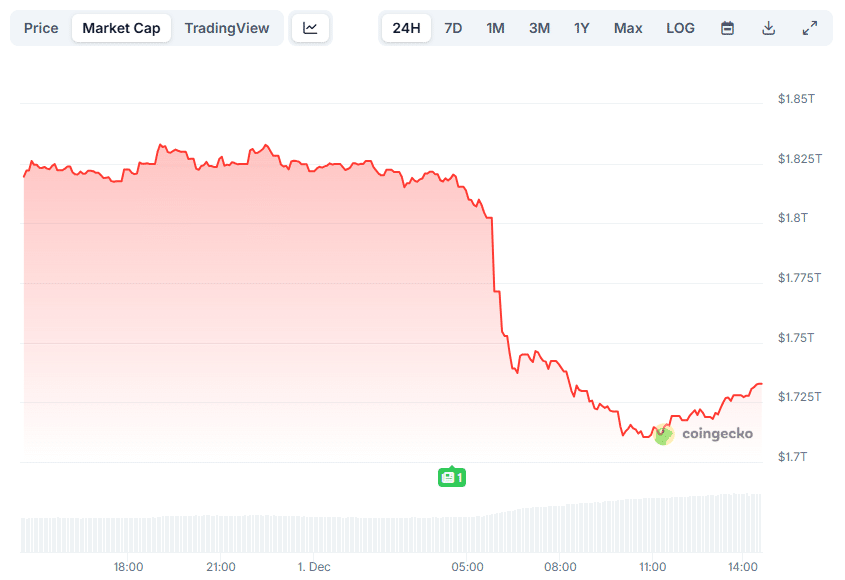

The recent Bitcoin sell-off in December 2025 saw BTC plummet over $4,000 in minutes, dragging the total crypto market cap down from $1.82 trillion to below $1.72 trillion. This rapid drop triggered massive liquidations exceeding $2.4 million, primarily affecting long positions in major assets like Ethereum and Solana.

-

Bitcoin’s sudden $4,000 decline sparked a chain reaction across the crypto market, wiping out billions in value overnight.

-

The sell-off highlighted ongoing liquidity issues, with thin order books amplifying volatility during low-volume weekend sessions.

-

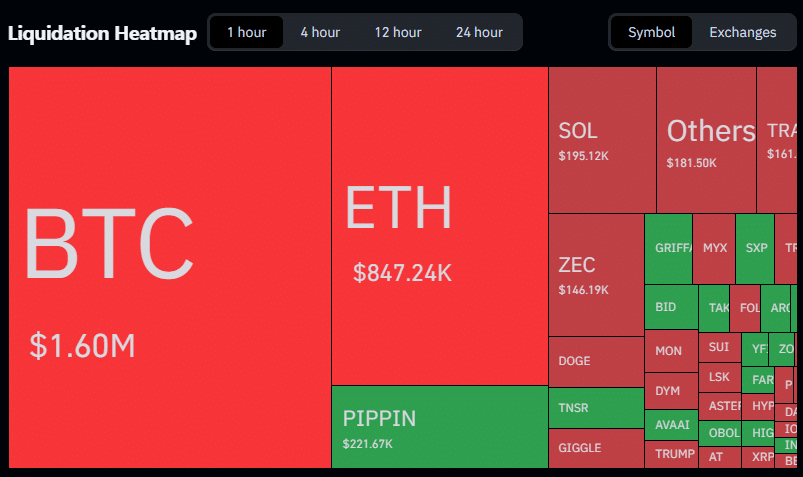

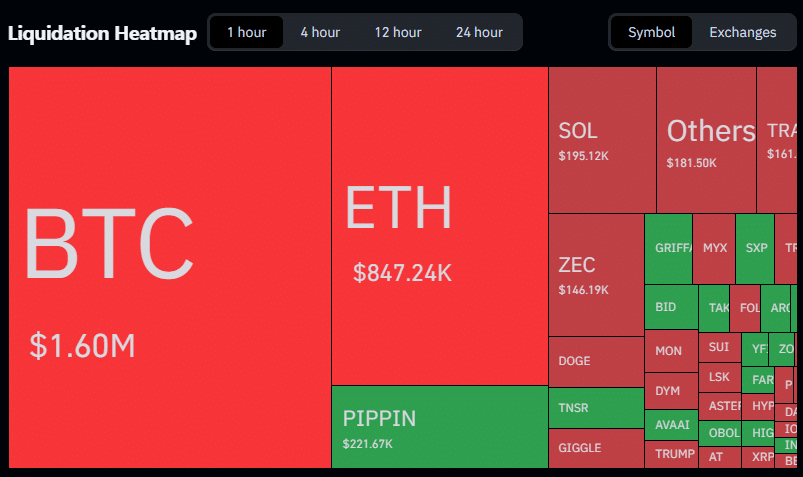

Liquidations surged to over $2.4 million in the final hour, with Bitcoin accounting for $1.6 million and Ethereum $847,000, per Coinglass data.

Discover the causes behind the December 2025 Bitcoin sell-off and its market impact. Stay informed on crypto volatility and protect your investments today.

What caused the Bitcoin sell-off in December 2025?

The Bitcoin sell-off in December 2025 was triggered by a sudden burst of selling pressure during a low-liquidity weekend session, causing BTC to drop over $4,000 in minutes from around $96,000. This rapid decline forced widespread liquidations in derivatives markets, exacerbating the downturn across the broader cryptocurrency ecosystem. Factors like high leverage and thin order books turned a modest sell signal into a full market rout.

How did the liquidations affect major cryptocurrencies?

The liquidations during the Bitcoin sell-off were particularly severe, with over $2.4 million in positions wiped out in the hour leading up to the event’s peak. According to data from Coinglass, Bitcoin bore the brunt at $1.6 million, while Ethereum followed closely with $847,000 in losses. Solana and other altcoins like ZCash saw significant long-position closures, as shown in liquidation heatmaps dominated by red zones indicating heavy downside pressure. Smaller tokens, such as Pippin, bucked the trend with minor gains amid the chaos, but the overall impact underscored the interconnected risks in leveraged trading. Market analysts from The Kobeissi Letter have noted that such weekend volatility has been a recurring pattern in 2025, driven by reduced trading volumes that allow small trades to snowball into major shifts. This event reinforces the need for traders to manage leverage carefully, as structural fragilities persist despite the market’s growth.

The impact was immediate on the broader market. Total crypto market cap slid from around $1.82 trillion to below $1.72 trillion, its lowest level in weeks.

Source: CoinGecko

The charts all show a fast, heavy dump followed by a small, uncertain recovery.

Liquidations spike as BTC leads the sell-off

The pressure hit derivatives traders hard.

Source: Coinglass

In the last hour alone, counting up to press time, Bitcoin accounted for more than $1.6 million in liquidations, with Ethereum following at $847,000. Most of the heatmap was red, so long positions were wiped out across major caps like Solana [SOL] and ZCash [ZEC]. The only pockets of green were in smaller tokens such as Pippin [PIPPIN], which saw modest gains as volatility spilled over.

Liquidity is thin, volatility runs abound

Weak liquidity drove the latest drop. The Kobeissi Letter noted that weekend sessions have repeatedly produced oversized moves this year, and this selloff fit the pattern. With order books thinning out and leverage sitting near record highs, even a small burst of selling quickly snowballed. BTC’s rapid $4,000 slide caused lots of forced liquidations, speeding the downturn across majors and mid-caps alike. Despite market maturity, structural fragility remains. Until liquidity improves, sudden moves will continue to dictate price action.

Frequently Asked Questions

What triggered the Bitcoin price drop in December 2025?

The Bitcoin price drop was initiated by unexpected selling pressure during a quiet weekend trading period, leading to a $4,000 plunge in minutes. High leverage in derivatives markets amplified the effect, resulting in over $2.4 million in total liquidations across major cryptocurrencies, as reported by market data platforms.

Is the crypto market recovering from the recent sell-off?

Following the Bitcoin-led sell-off, the crypto market has shown signs of a tentative recovery, with the total capitalization stabilizing above $1.75 trillion after dipping below $1.72 trillion. Traders should monitor liquidity indicators closely, as ongoing volatility could lead to further fluctuations in the coming sessions.

Key Takeaways

- Weekend volatility risks: Thin liquidity during off-peak hours can turn minor trades into major market events, as seen in the December 2025 Bitcoin sell-off.

- Leverage dangers: Record-high leverage levels contributed to $2.4 million in liquidations, emphasizing the need for risk management in derivatives trading.

- Market interconnectedness: The BTC drop impacted altcoins like Ethereum and Solana, highlighting how leaders influence the broader ecosystem—investors should diversify to mitigate such shocks.

Conclusion

The December 2025 Bitcoin sell-off, driven by liquidity shortages and high leverage, serves as a stark reminder of the crypto market’s inherent volatility. With liquidations spiking and market caps contracting sharply, participants must prioritize robust risk strategies. As liquidity conditions evolve, staying vigilant could position investors to capitalize on the next recovery phase in this dynamic landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC