Maple Finance Accused of Breaching BTC Yield Exclusivity with Core Foundation

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Maple Finance faces accusations from Core Foundation of breaching a 24-month exclusivity agreement by launching a competing Bitcoin yield product, syrupBTC, after co-developing lstBTC with $150 million in BTC funding from lenders. The dispute has led to a restraining order against Maple, raising concerns over lender reimbursements in the growing BTCFi sector.

-

Core Foundation alleges Maple misused confidential data and violated contract terms.

-

Maple Finance denies wrongdoing and plans legal action against Core for harming lender interests.

-

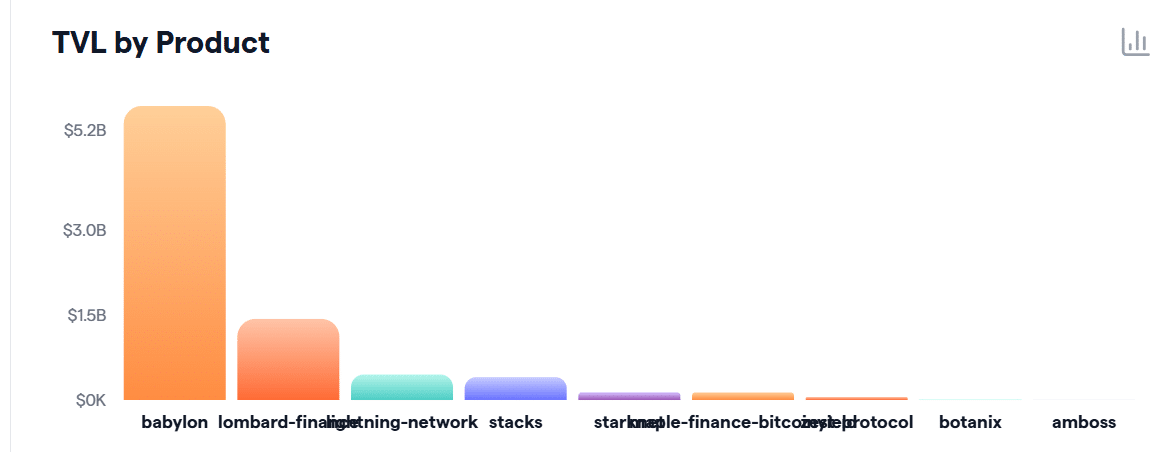

BTCFi market sees Babylon holding 66% share, with yields dropping from 3.19% to 3.0% amid broader market pressures, impacting tokens like SYRUP at $0.35.

Discover the Maple Finance Core Foundation dispute shaking BTCFi: breach claims, restraining orders, and lender risks. Stay informed on Bitcoin yield products and DeFi developments—explore impacts today.

What is the Maple Finance and Core Foundation Dispute?

The Maple Finance and Core Foundation dispute centers on allegations of contract breach in the development of Bitcoin yield products within the DeFi space. Core Foundation claims that Maple Finance violated a 24-month exclusivity agreement by preparing a rival product, syrupBTC, using shared confidential information from their joint lstBTC initiative. This conflict has escalated to legal measures, including a restraining order obtained by Core, highlighting tensions in institutional DeFi lending.

How Did the Bitcoin Yield Product Development Lead to This Conflict?

The partnership between Maple Finance and Core Foundation began in early 2025, focusing on creating lstBTC, an ERC-20 token designed to provide liquidity and yields for Bitcoin holders across DeFi platforms. Launched in April 2025, the product was funded by $150 million in BTC from institutional lenders, enabling seamless integration into various protocols while generating returns. However, Core asserts that Maple’s development of syrupBTC directly contravenes the exclusivity clause, potentially exposing lenders to losses as reimbursement remains uncertain. According to statements from Core Foundation, this breach not only misuses proprietary data but also undermines trust in collaborative DeFi projects. Market data from Bitcoin Yield platforms indicates that such innovations have driven BTCFi growth, yet this feud could deter future partnerships. Experts in DeFi, including analysts from institutional finance reports, emphasize the need for robust legal frameworks to protect intellectual property in blockchain ecosystems, with similar disputes noted in past tokenization efforts involving 20-30% of project delays due to contractual issues.

Institutional-focused DeFi lending firm Maple Finance has made headlines for allegedly breaching a contract and misappropriating its partner, Core Foundation’s Bitcoin yield product.

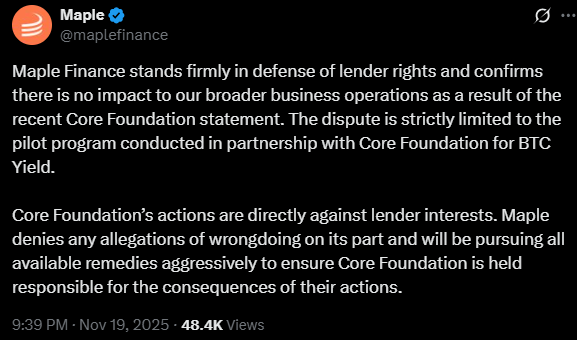

On X, Maple Finance distanced itself from the claims and blamed the Core Foundation for “directly going against lender interests.”

The firm added,

“Maple denies any allegations of wrongdoing on its part and will be pursuing all available remedies aggressively to ensure Core Foundation is held responsible for the consequences of their actions.”

Source: X

Frequently Asked Questions

What Are the Specific Claims in the Maple Finance Core Foundation Breach?

Core Foundation accuses Maple Finance of violating a 24-month exclusivity deal by developing syrupBTC, a product similar to their co-created lstBTC, and failing to return $150 million in BTC to lenders. This has prompted Core to secure a restraining order, citing misuse of confidential data and poor business practices that risk institutional funds in BTCFi.

Why Is the Maple Finance Dispute Important for Bitcoin DeFi Users?

This dispute underscores risks in Bitcoin DeFi, where yield products like lstBTC promise liquidity and returns but face contractual pitfalls. For users, it highlights the need to monitor lender protections and market shares, with BTCFi leaders like Babylon maintaining dominance at 66%, ensuring safer navigation of volatile yields around 3%.

Key Takeaways

- Exclusivity Breach Allegations: Core claims Maple violated a 24-month agreement by launching syrupBTC, using data from their joint lstBTC project funded by $150 million BTC.

- Lender Reimbursement Uncertainty: Questions persist over whether initial BTC contributors will recover funds, amid Maple’s denial and plans for legal recourse against Core.

- Market Impacts: SYRUP token fell 3% to $0.35, Core’s TVL dropped 2% to $50 million, while BTCFi yields slipped to 3.0% in a broader downturn.

Source: Bitcoin Yield

Bitcoin DeFi, or BTCFi, has gained significant momentum recently, led by protocols like Babylon and Lombard. Other Bitcoin Layer 2 solutions, including Core, have also entered the fray. As of now, Babylon commands a 66% market share.

However, yields have declined alongside the wider market correction, moving from 3.19% to 3.0% in the last week.

Meanwhile, SYRUP, Maple Finance’s native token, declined 3% to $0.35 after the news. The Core ecosystem saw its total value locked decrease by 2% to $50 million in the past day.

The resolution of this case remains uncertain, particularly regarding whether the original BTC lenders will be fully compensated.

Conclusion

The Maple Finance and Core Foundation dispute reveals critical vulnerabilities in Bitcoin yield product collaborations within the BTCFi landscape, from exclusivity breaches to lender fund uncertainties. As DeFi evolves with projects like lstBTC and syrupBTC driving innovation, stakeholders must prioritize transparent agreements to sustain growth. Looking ahead, this conflict could reshape institutional trust in Bitcoin Layer 2 ecosystems—monitor developments closely for opportunities in a maturing market.