Prediction Markets Bet on Kevin Hassett as Fed Chair, Signaling Softer Inflation Outlook

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

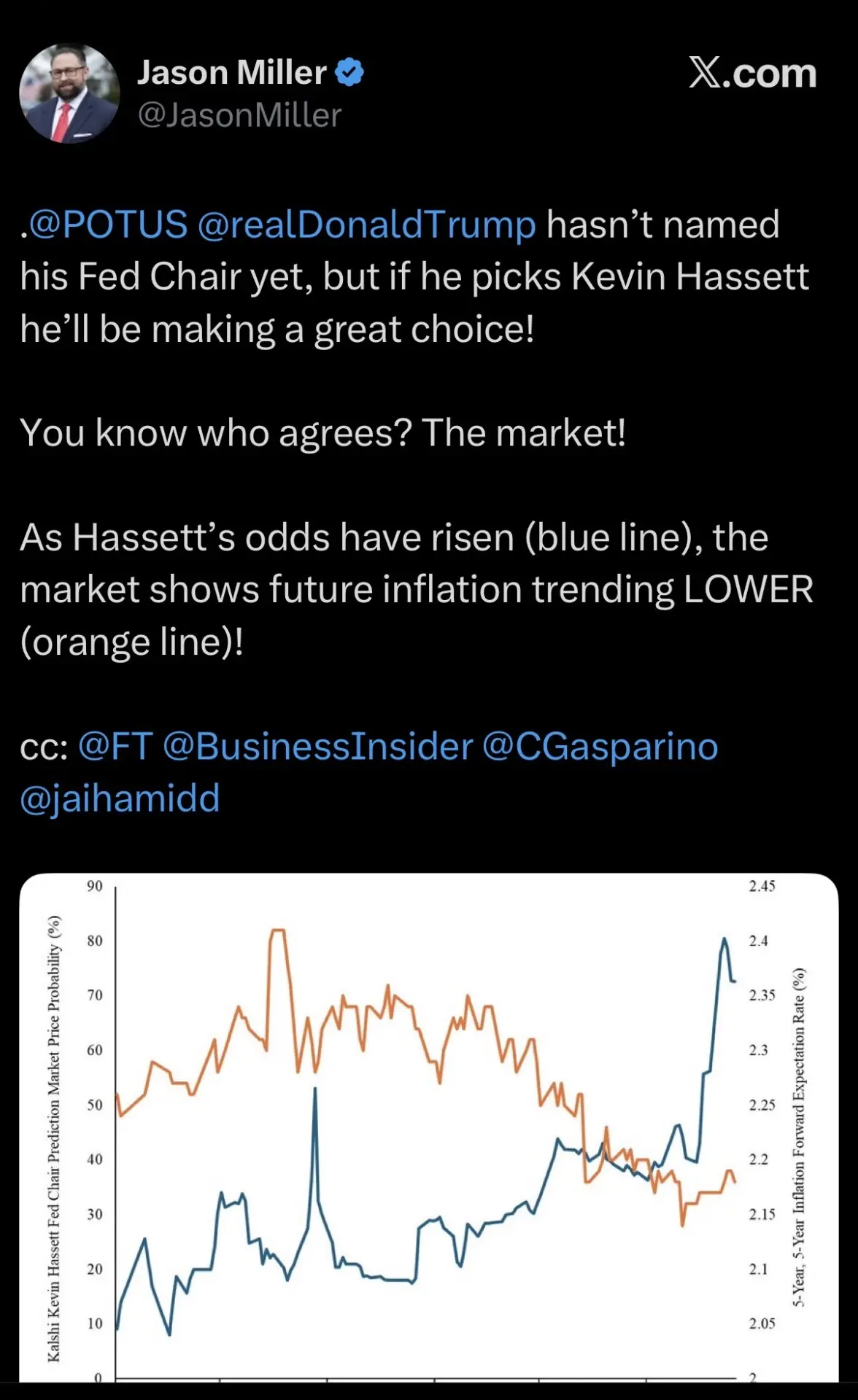

Kevin Hassett’s rising odds as Federal Reserve Chair candidate are boosting market expectations for lower inflation and potential rate cuts, with prediction markets showing 73% probability. This shift is influencing Treasury yields and the U.S. dollar, signaling broader economic impacts including on cryptocurrency valuations.

-

Prediction markets favor Hassett at 73% odds, up from 30% last month, per platforms like Polymarket and Kalshi.

-

Trump’s potential selection aligns with market bets on softer inflation and easier monetary policy.

-

Treasury yields rose 14 basis points, reflecting investor concerns over rapid rate cuts reigniting inflation; experts like Michael Brown at Pepperstone note this as a loyalty-driven signal to Trump’s agenda.

Kevin Hassett emerges as top Fed Chair contender amid prediction market surge and market reactions. Explore implications for inflation, crypto markets, and U.S. economy—stay informed on policy shifts.

What Are the Odds of Kevin Hassett Becoming the Next Federal Reserve Chair?

Kevin Hassett, current director of the National Economic Council, has surged to the forefront as a leading candidate for Federal Reserve Chair, with prediction markets placing his odds at 73% as of late December 2025. This rapid rise, from just 30% at the end of November on platforms like Polymarket, reflects growing investor confidence in his alignment with President Trump’s economic vision, particularly on aggressive rate cuts. While no official announcement has been made, market behaviors indicate traders are pricing in a shift toward looser monetary policy that could ease borrowing costs and stimulate growth.

How Is Kevin Hassett’s Candidacy Impacting Bond Markets and Inflation Expectations?

Kevin Hassett’s ascent has triggered notable movements in financial markets, particularly in Treasuries and currencies, as investors weigh the prospects of a Fed led by someone advocating for substantial interest rate reductions. Since reports from Bloomberg highlighted him as the frontrunner on December 17, 2025, the 10-year Treasury yield has climbed 14 basis points to around 4.3%, signaling caution that overly swift cuts could stoke inflation above the Fed’s 2% target. Michael Brown, senior research strategist at Pepperstone, attributes this volatility primarily to Hassett’s perceived loyalty to Trump, stating, “It is almost solely on the back of Hassett, given that we’ve had nothing really else to trade on this week.”

The U.S. Dollar Index dipped from 99 to 98 in response, defying the usual support from rising yields, as markets interpret Hassett’s potential role as favoring dovish policies that weaken the currency. Ryan Swift, chief bond strategist at BCA Research, recommends Treasury curve steepeners as a high-conviction trade into 2026, forecasting sustained increases in long-term yields due to persistent inflationary pressures. Art Hogan, chief market strategist at B. Riley Wealth Management, adds that investors view the broader economic picture as one where inflation lingers above target levels for an extended period, potentially complicating the Fed’s path.

In the cryptocurrency space, these dynamics are particularly relevant. Lower rates historically correlate with risk-on sentiment, boosting assets like Bitcoin and Ethereum by making yield-bearing alternatives less attractive. However, renewed inflation fears could introduce volatility, as seen in past cycles where hawkish surprises led to crypto sell-offs. Data from CoinMetrics shows Bitcoin’s price sensitivity to Fed announcements, with a 5-10% average swing following major policy signals. Hassett’s past advocacy for fiscal stimulus during economic downturns, as outlined in his work at the American Enterprise Institute, suggests a pro-growth stance that could indirectly support crypto adoption through enhanced liquidity.

Frequently Asked Questions

What Makes Kevin Hassett a Strong Candidate for Federal Reserve Chair?

Kevin Hassett’s extensive experience in economic policy, including his role in Trump’s first administration as Chair of the Council of Economic Advisers, positions him as a favored pick. His support for targeted rate cuts to spur recovery, combined with alignment to Trump’s agenda, has driven prediction market odds to 73%. This expertise ensures a focus on growth-oriented monetary decisions without venturing into uncharted speculation.

How Might Kevin Hassett’s Appointment Affect Cryptocurrency Prices?

If appointed, Kevin Hassett’s push for lower interest rates could benefit cryptocurrencies by encouraging investment in high-risk assets like Bitcoin, potentially driving prices higher amid increased liquidity. However, markets are also pricing in inflation risks from rapid easing, which might temper gains if yields rise further. Historical patterns indicate crypto often rallies 10-15% post-dovish Fed shifts, based on data from TradingView analyses.

Key Takeaways

- Prediction Markets Lead the Way: Platforms like Polymarket and Kalshi show Kevin Hassett at 73% odds, directly linking his candidacy to expectations of softer inflation and rate cuts, influencing trader sentiment across assets.

- Bond Market Signals Caution: The 14 basis point surge in 10-year Treasury yields reflects investor worries that Hassett’s dovish views could reignite inflation, as echoed by strategists at Pepperstone and BCA Research.

- Crypto Implications: Looser policy under Hassett may boost digital assets through risk-on flows, but persistent inflation above 2% could introduce volatility—monitor Fed votes for deeper insights.

Conclusion

As Kevin Hassett’s candidacy for Federal Reserve Chair gains momentum in prediction markets, the financial landscape is adjusting to prospects of lower inflation expectations and potential rate cuts, with ripple effects on bond yields, the U.S. dollar, and cryptocurrency markets. Experts from Pepperstone and B. Riley Wealth Management highlight the balance between growth stimulus and inflationary risks, underscoring the Fed’s committee dynamics that limit any single chair’s influence. Looking ahead, this development signals a pivotal moment for economic policy in 2026—investors in crypto and traditional assets alike should track official announcements for strategic positioning.

Source: Jason Miller/X

Source: Jason Miller/XComments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026