Bridge Receives Conditional Bank Approval from OCC: Stablecoin Move

ALT/USDT

$3,922,675.43

$0.008730 / $0.008350

Change: $0.000380 (4.55%)

+0.0031%

Longs pay

Contents

Bridge OCC Conditional Approval and Stablecoin Future

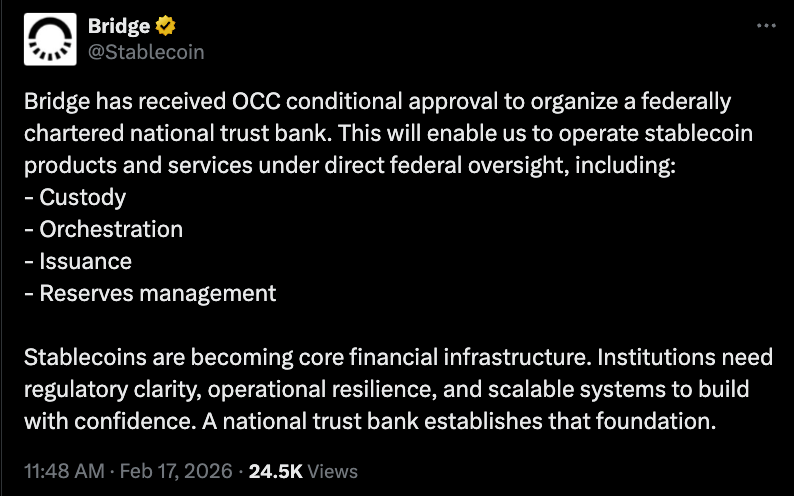

Stripe-owned stablecoin platform Bridge has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) for a federal national trust bank charter. This approval will enable it to operate stablecoin products and services directly under federal supervision after full approval. Bridge will be able to offer digital asset custody, stablecoin issuance, and reserve management services. The company stated that it has a compliance framework compliant with the GENIUS stablecoin law enacted in July 2025, and it will provide regulatory infrastructure for customers to build reliable, scalable stablecoins.

Source: Bridge

Sector Charter Race After the GENIUS Law

Bridge is one of the crypto-focused companies seeking a national trust bank charter from the OCC after the GENIUS Law. In December, conditional approvals were granted for BitGo, Fidelity Digital Assets, and Paxos to convert state trust companies, as well as for Circle and Ripple's charter applications. Bridge applied in October and received approval on February 12. Stripe acquired Bridge in a $1.1 billion deal in 2025. The American Bankers Association (ABA) called on the OCC to slow down charter approvals for crypto companies until GENIUS rules are clarified. These developments could strengthen the DeFi ecosystem as stablecoin regulations become clearer; for example, they could provide infrastructure support for detailed ALT analysis.

ALT Technical Outlook: Supports and Resistances

Stablecoin approvals can affect market sentiment. Current data for ALT:

- Price: $0.01 (24h: +1.63%)

- RSI: 40.86 | Trend: Downtrend | Supertrend: Bearish

- EMA 20: $0.0092

- Supports: S1 $0.0082 (Strong, -6.18%) | S2 $0.0069 (Strong, -21.05%)

- Resistances: R1 $0.0092 (Strong, +5.26%) | R2 $0.0113 (Medium, +29.29%)

For detailed charts, check ALT futures. ALT spot analysis is recommended.